Beat the Fire and Ash with Towerpoint’s Cash

With a heavy heart almost three years ago, we recognized the vicious wildfires tearing through both Napa and Santa Rosa. Today, with massive wildfires burning throughout Napa, Sonoma, Lake, Solano, and Yolo counties, we feel compelled to do so again.

As we mentioned in that newsletter, fortunately tough times do not last, but tough people do. And as dedicated and tireless relief and rescue crews work to contain and extinguish these devastating fires, we look to a rare bright spot during this time of destruction, symbolizing resilience, literally from the ground up as it rises from the ashes – the California fire poppy.

All of this begs the question – what can we do to help? The answer – stand with us and please give if you are able.

Towerpoint Wealth is committed to directly helping those in need during these fires, and we are pleased to offer a 100% match, up to a total of $15,000, of any charitable donations made by you to any of the following three fire-relief organizations:

- California Wildfire Relief Fund

- Solano Disaster Relief Fund

- 2020 Napa County Wildfires Fund

Please simply email us your donation receipt at info@towerpointwealth.com, and we will promptly email you our matching donation receipt within 48 hours.

* IMPORTANT NOTE: Please also remember that the recently-passed CARES Act created a one-year tax-deductible charitable deduction of $300 for the 90% of taxpayers who claim the standard deduction in 2020!

A New Addition to the Towerpoint Wealth Family

We are pleased and excited to welcome Matt Regan, CPA, MBT, to the Towerpoint Wealth family!

Armed with his Masters of Business Taxation from USC and eight years of experience as Tax Manager at Richardson Kontogouris Emerson LLP, Matt comes to us from KLS Professional Advisors (a division of Boston Private), where he was practicing as an Associate Director and Wealth Advisor to a diverse set of higher net worth individuals and families.

Matt specializes in working with attorneys, helping them manage the unique aspects of proper coordination all of their financial affairs. We look forward to having him utilize his tax consulting and wealth management skills and experience to help his own and other clients of Towerpoint Wealth save money on their income taxes, manage the downside risk of their portfolios, and properly plan for a comfortable retirement.

Please click HERE to read more about Matt, and please reach out (916-405-9164) to say hello, congratulate him, and help us with a warm “welcome aboard!”

TPW Service Highlight – Customized Responsible ESG Investing

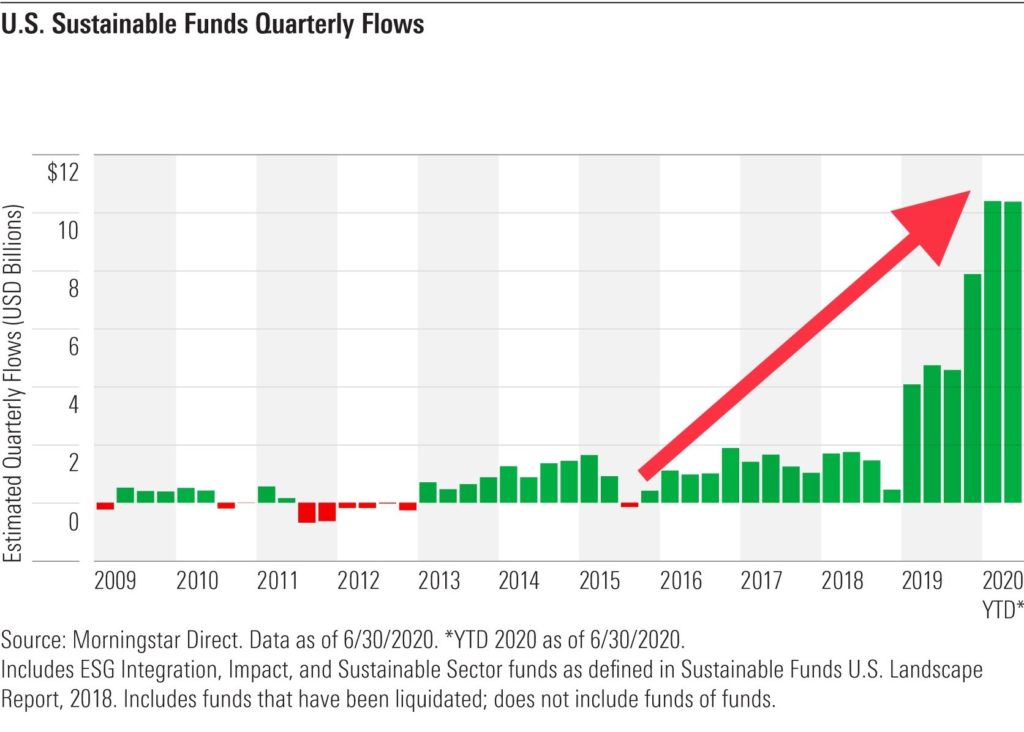

Are you aware you are able to align your portfolio with your personal values, without compromising your ability to have a diversified portfolio positioned to earn competitive returns? Many investors are not. Responsible investing, also known as ESG investing (Environmental, Social, and Governance) has exploded in popularity and importance over the past ten years (see the Graph of the Week below), and has quickly become an area of specialization at Towerpoint Wealth.

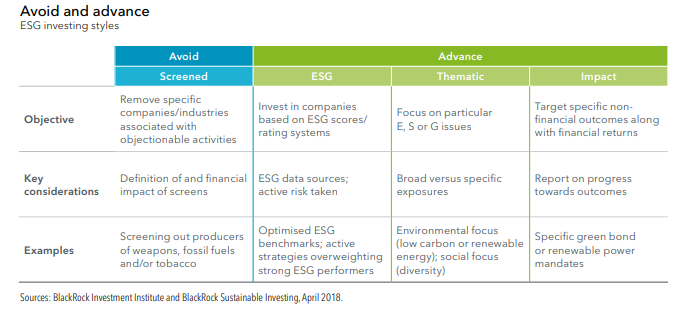

Screening to either avoid or advance ownership of specific companies, based on a myriad of different sustainability issues and criteria, is a central objective of ESG investing:

Environmental issues range from climate change, clean water, animal welfare, and deforestation. Social issues can include racial justice, education, poverty, democracy, and women’s rights. Governance issues encompass worker treatment, corporate ethics, and corporate diversity and inclusion. Click the Ethic Sustainability Pillars story found below for a deeper understanding of the various ESG issues that Towerpoint Wealth can specifically screen for, to help you avoid or advance your investment in equities consistent with these issues.

Time to do an ESG “healthcheck” on your portfolio? We welcome an invitation to sit side-by-side with you to conduct a deep-dive sustainability analysis of your portfolio, where we will x-ray your investments to evaluate what is considered “clean,” what is considered “dirty,” and how to make intelligent and tax-efficient ESG improvements. Click HERE to find out more, or click on our What’s In a Name? A Guide to Responsible Investing educational white paper found below.

Graph of the Week

As discussed above, responsible / ESG investing is no longer just a trend, but a full-blown movement. According to Pensions & Investments, the value of global assets applying environmental, social, and governance data to drive investment decisions has almost doubled over four years, and more than tripled over eight years, to $40.5 trillion (!) in 2020. Sustainable fund flows just in the U.S. have been extremely strong as well:

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely complicated place, and we are here to help you properly plan for and make sense of it.

– Nathan, Raquel, Steve, Joseph, Lori, Jonathan, and Matt