Helping you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement.

– Ruxton Adebiyi

The foundation of our investment strategy is the development and implementation of a strategic asset allocation, based on your unique personal and financial circumstances and tolerance for risk. We work with you to determine an optimal strategic asset allocation after determining the appropriate level of risk needed to take to help you achieve your intermediate and longer-term personal goals and concurrently, your financial independence. This is the “scientific” portion of our investment strategy.

We consider costs and investment expenses to be one of the two “necessary evils” that impede the growth of a client’s net worth and portfolio. Studies have repeatedly shown that reducing costs can drastically increase the probability of success in one’s portfolio. At the same time, we believe that picking funds simply by lowest fee can sometimes be short-sighted, and discretion is continually exercised when considering the expenses of an investment within the larger spectrum of its overall merit. A strict focus on helping a client to “get better gas mileage” out of their portfolio by managing and reducing the drag of costs and expenses is paramount.

Taxes are the second of the two “necessary evils” mentioned above, and can severely impact investment returns if not monitored and controlled. While we never let the “tax tail” completely wag the dog, we do maintain a specific focus on helping our clients keep the tax impact of their investments and portfolio absolutely minimized. Utilizing careful fund screening, intentional asset location, and tax-loss harvesting decisions, we are diligent to do everything possible to minimize clients’ obligation to Uncle Sam.

The centerpiece of our wealth management philosophy focuses on developing a foundational strategic asset allocation for you, then customizing and tailoring it based on your unique needs, goals, tax situation, and tolerance for inevitable market volatility. The Towerpoint Wealth Investment Committee has established a proprietary set of model portfolios, and we regularly scrutinize, adjust, argue about, and modify them on a consistent basis.

A “once size fits all” approach is inconsistent with our philosophy, understanding that all individuals and all portfolios are unique. While our model portfolios do form the basis for how we begin to construct your asset allocation plan, we regularly work with our clients to ensure that their investments are tailored to their unique personal and economic circumstances.

A “once size fits all” approach is inconsistent with our philosophy, understanding that all individuals and all portfolios are unique. While our model portfolios do form the basis for how we begin to construct your asset allocation plan, we regularly work with our clients to ensure that their investments are tailored to their unique personal and economic circumstances.

We are averse to speculation and active trading, and while we do make tactical decisions when we believe that a particular investment or asset class is grossly under- or over-valued, we rarely are reactive to the daily, weekly, and monthly gyrations of the economy and financial markets. Instead, we accept that these gyrations can and will occur, and seek to take advantage of them through disciplined portfolio rebalancing (see above).

We believe that consistently being disciplined in our financial decision-making and investment planning affords you the highest probability in achieving longer-term success in building and protecting your wealth, and believe that that identifying and resisting periods of fear and greed, both within the markets and within our clients, will lead to more predictable outcomes for our clients.

Put differently, we are disciplined in focusing our work, planning, and energy towards what we can control (risk, taxes, expenses, behavior), and not what we cannot (politics, markets, economic changes).

Our Investment Committee of five includes three of Towerpoint Wealth’s own, Joseph Eschleman, Nathan Billigmeier, and Steve Pitchford. The Committee also includes outstanding professional Kevin Cooper. We believe including outside professionals in our Investment Committee is crucial to finding the right balance for our committee and its ongoing mission to create optimal target portfolios that are consistent with our six core investing principles of our wealth management philosophy.

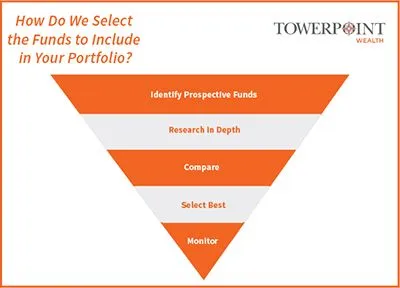

What steps does the Investment Committee take to accomplish this mission?

1. Define the objectives of our target portfolios

2. Design the mix of assets (bonds, stocks, and alternative investments) to be included in each target portfolio

3. Evaluate the individual investment fund options that are consistent with our core investing principles to be included in our target portfolios (please see Our Investment Selection Process below for more details)

4. Implement portfolio construction using these fund investment options

5. Monitor and analyze target portfolios

6. Consider modifications and tactical adjustments to the portfolios as the current market environment dictates

Search results for “certified financial planner near me” in El Dorado Hills, Auburn, Folsom, Rancho Murieta, Land Park, and Davis will all include Towerpoint Wealth, as we are conveniently located on Capitol Mall in downtown Sacramento.

Meet with us in person or virtually, as Sacramento financial advisor Joseph Eschleman, as well as certified financial planner Steve Pitchford, CPA, CFP®, and our entire Towerpoint Wealth team understand the financial concerns of those living in the greater Sacramento region.

We sent a 6-digit code to .

Trending Today Newsletter