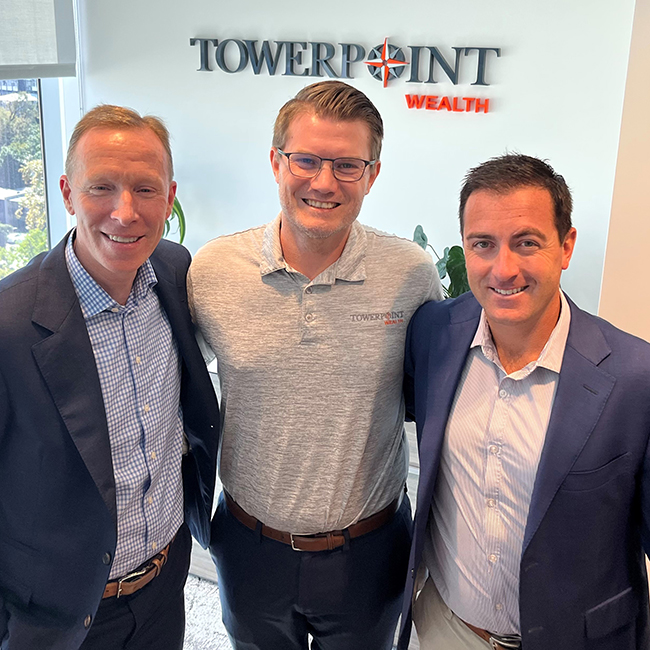

Our Director of Research and Analytics and TPW Investment Committee member, Nathan Billigmeier, spent an productive hour-long meeting yesterday with Lance Oman, CFA and Chris Murphy, CIMA® of T. Rowe Price, discussing specific ideas and strategies to help Towerpoint Wealth help our clients: 1. Lessen the impact of rampant inflation and rising interest rates on our model client investment portfolios.2. Reduce the income tax drag on our model portfolios.3. Minimize …

Monthly Archives: September 2022

With Inflation and Rates Sky High, Should You Consider Bonds to Buy? 09.23.2022

2022 is well on its way to being one of the worst years in modern history for bond (also known as fixed income) investors, ushering in the worst bond market returns since 1973. This begs the question: Are there any decent bonds to buy? Since 1976, bonds have provided a positive annual return in 42 of 46 …

Continue reading “With Inflation and Rates Sky High, Should You Consider Bonds to Buy? 09.23.2022“

Cryptocurrency future | Why Crypto is Here to Stay and Not Going Away 09.23.2022

In this video, Towerpoint Wealth’s president and Sacramento wealth manager Joseph Eschleman addresses the following: Common concerns about the cryptocurrency future, and why we believe that crypto is here to stay and not going away. What decentralized finance, or DeFi, is, and how cryptocurrency is shaping its future (look out, banks!). Mainstream crypto adoption trends and the Great …

Continue reading “Cryptocurrency future | Why Crypto is Here to Stay and Not Going Away 09.23.2022“

Webinar on alternative investments 09.23.2022

For virtually all investors, 2022 has been a challenging and frustrating year. Persistently high inflation has resulted in an environment of quickly rising interest rates, leading to a “double-whammy” of twin selloffs across both stocks and bonds. After increasing more than 31% in 2019, 18% in 2020, and 28% last year, the S&P 500, an often-cited …

Continue reading “Webinar on alternative investments 09.23.2022”

Hold On… You Have No Alternative Investments In Your Portfolio? 09.09.2022

For many investors, 2022 has been a challenging and frustrating year, as persistently high inflation has resulted in an environment of quickly rising interest rates, leading to a “double-whammy” of twin selloffs across both stocks and bonds this year. After increasing more than 31% in 2019, 18% in 2020, and 28% last year, the S&P 500 (an …

Continue reading “Hold On… You Have No Alternative Investments In Your Portfolio? 09.09.2022“