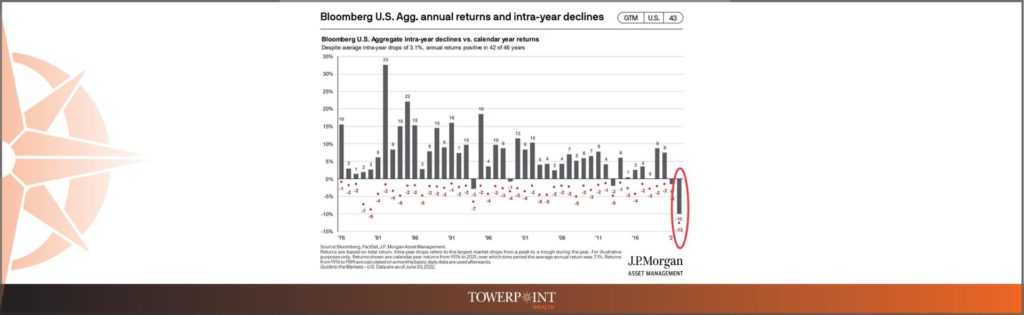

2022 is well on its way to being one of the worst years in modern history for bond (also known as fixed income) investors, ushering in the worst bond market returns since 1973.

This begs the question: Are there any decent bonds to buy? Since 1976, bonds have provided a positive annual return in 42 of 46 years. Unfortunately for bond investors, 2022 has been a huge anomaly.

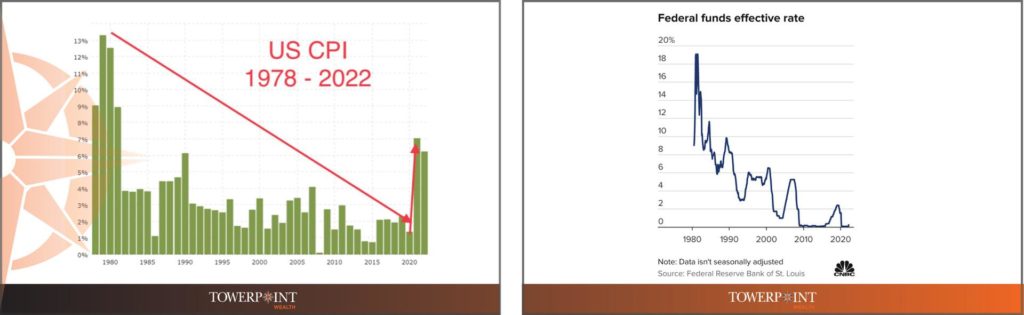

Prior to 2021, we experienced an unprecedented 30+ year period of low inflation and declining interest rates here in the United States.

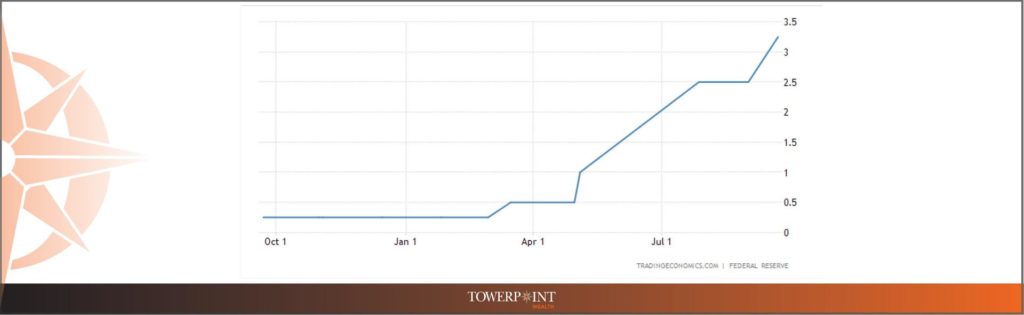

However, 2022 has been a stark reversal, as the worst inflation we have experienced in nearly 40 years has forced global central banks to aggressively increase interest rates in an attempt to combat rising prices and overheated economies. The United States Federal Reserve (“the Fed”) has been an active participant in this “tightening,” taking its benchmark federal funds rate from 0.25% at the beginning of the year to 3.25% today, after it boosted it again by 0.75% on Wednesday, the third straight ¾ point increase in 2022.

Greg McBride, chief financial analyst at Bankrate, said recently: "The Fed has been delivering a 'tough love' message that interest rates will be higher, and for longer, than expected. The Fed will continue to hike rates until it actually restrains the economy and intends to keep rates at those restrictive levels until inflation is unmistakably on its way to 2%."

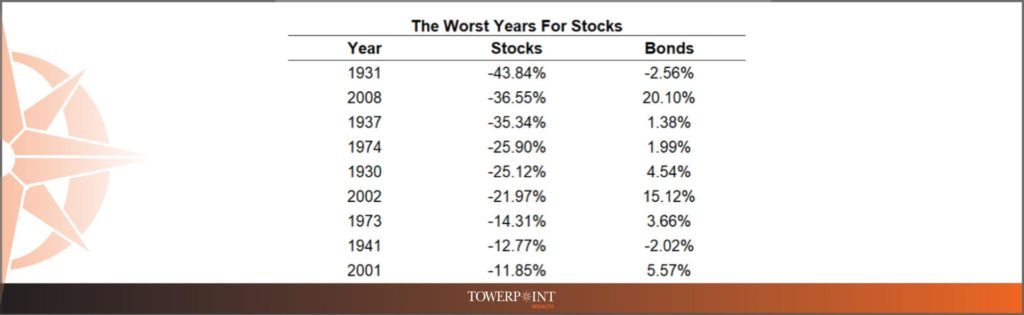

The result of this Fed “tightening” has been interest rate increases that have caused pain for many bond investors. Typically, bonds are thought of as a hedge against stock market volatility, providing a relatively steady return and a relatively steady income stream.

All of this begs the questions: Are there any decent bonds to buy? Is investing in bonds no longer an integral part of a well-diversified investment portfolio? 2022’s rising interest rate environment has been met by bond investors with as much enthusiasm as a root canal, and we have seen it lead folks to forget the reasons why they hold bonds in their portfolios. For some, it has even caused them to reconsider their long-term asset allocation and diversification choices.

This Too Shall Pass…

So why should investors consider remaining loyal, and look for bonds to invest in, even as rates rise?

Though recent interest rate hikes have led to lower bond prices this year, as bonds mature over time and are reinvested at higher interest rates, their ability to generate income can increase.

The raw interest paid by bonds can also be reinvested at higher rates. Because of this, if rates rise steadily and modestly over time, investors may be better off than if rates had remained at previously low levels.

We are confident that bonds will return to being a historical counterbalance against volatility in the equity markets, and that investors shouldn’t give up on looking for bonds to buy in building out a properly-diversified portfolio.

If you think diversification isn’t a compelling enough reason to consider owning an asset class, talk with investors who were “all in” on equities in 2002 or 2008, and discovered they were walking a high wire without a net as the winds of volatility started to gust!

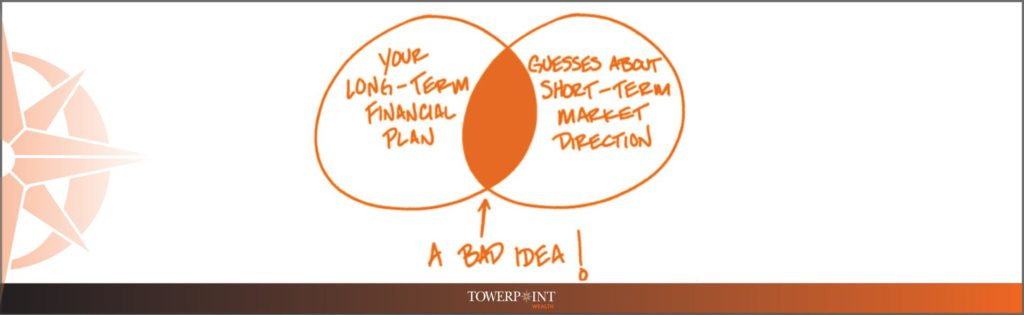

Investors looking to dump their fixed-income investments as rates rise may want to take a step back to avoid missing the forest for the trees. It’s important to remember that the shorter-term challenge of interest-rate increases generally doesn’t supersede the longer-term reasons for holding bonds in your portfolio.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients build and protect their net worth.

What are alternative investments? Is it important to have exposure to “alts” in your current portfolio?

Is it bad if you do not own any alternatives? What are the risks and benefits of adding alts to your investment strategy?

Do you have any of these questions? Well, we have some answers for you!

If you would like to learn more, click the thumbnail to watch our recently-produced webinar about alternative investments.

Here are some of our top trending moments at Towerpoint you might have missed on our social platforms.

So much of being a great team is trusting one another!

The whole Towerpoint Wealth team went to iFly Sacramento, and in this crazy vertical wind-tunnel, we took a trust fall and flew (with the help of an amazing flying coach)! If you aren’t familiar with the term, a trust fall is when a person allows themselves to fall, deliberately, trusting that someone will be there to catch them.

In addition to being a great team-building event, it reminded us how Towerpoint Wealth clients entrust us with their hard-earned money, and we are obligated (by our ethics as well as by law) to work in partnership with them to do everything in our control to help them build wealth and protect wealth so their futures are secure.

We all truly enjoyed this experience, and what a great reminder to surround yourself with people you trust!

What else is happening with the Towerpoint Wealth family?

At Towerpoint Wealth, we believe it may be time trust cryptocurrency.

In the newly-produced educational video found below, our President, Joseph Eschleman, CIMA®, addresses a number of common concerns about the cryptocurrency future, discusses mainstream crypto adoption trends, and also defines what DeFi —decentralized finance—is.

Joseph also discusses why cryptocurrency can be a very good alternative investment to diversify your portfolio, understanding that more than 220 million people owned digital assets as of June of 2021. We believe all of this bodes well for the cryptocurrency future.

Click the video to watch Joseph’s video on YouTube!

When you reach age 72, you are required to take annual required minimum distributions (RMDs) from your non-Roth retirement accounts. If you do not take them by December 31, you will owe a 50% (!) penalty of the RMD amount!

It does not matter if you take your RMD via a one-time, lump sum withdrawal, or a series of systematic distributions, as long as the minimum amount is distributed by 12/31.

While using an RMD calculator to help you determine your 2022 required minimum distribution is usually a straightforward activity, properly accounting and planning for this increase in taxable income is a more nuanced and strategic exercise.

While RMDs can be an unwanted by-product of contributing to and investing in retirement accounts such as 401(k)s, IRAs, 403(b)s, etc., there are impactful and proactive tax planning strategies that can materially lessen the tax sting of an RMD.

What are RMDs, and how should an individual plan for them within the context of a tax-efficient retirement strategy? Click the image below to learn more about RMDs, and specifically, three actionable RMD strategies worth evaluating to better keep Uncle Sam at bay.

Are you unclear about what your RMD will be in 2022,

or how to best take it before the end of the year?

1. I Wish I Was a Little Bit Taller

GQ – 9.15.2022

A growing number of men are undergoing a radical and expensive surgery to grow anywhere from three to six inches. The catch: It requires having both your femurs broken. GQ goes inside the booming world of leg lengthening.

2. Gavin Newsom is ‘Unequivocally’ Running for President in 2024 if Biden Doesn’t

TheWrap – 9.19.2022

The California governor, who’s already running ads in other states, is poised to challenge Vice President Kamala Harris.

1. The Rise of Mobile Gambling is Leaving People Ruined and Unable to Quit

Vice – 9.6.2022

Financial catastrophe is now only a few clicks away, a problem that is showing quiet signs of becoming a crisis. "I can't just get rid of my phone," one problem gambler says.

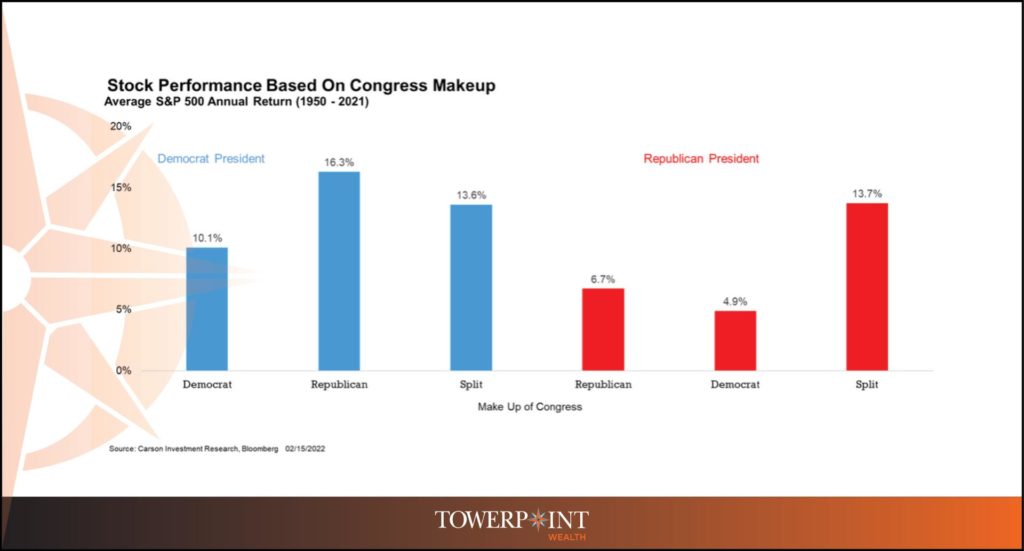

What do the upcoming 2022 midterm elections mean for investors?

Republicans need only to recapture five seats to regain control of the House, which has a 71% likelihood of occurring, according to FiveThirtyEight. The Senate is more of a tossup, with Democrats being favored by 71% to win the Senate. The chart below shows the very best scenario for stocks (based on historical precedent) is a Democratic President and a Republican controlled Congress. Should the Democrats retain control of the Senate, the scenario of a Democratic President and split Congress is quite strong for stocks as well.

Concerned about the upcoming midterm elections? At Towerpoint Wealth, we can help you - let’s talk about it!

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Joseph Eschleman, Jonathan, Steve, Lori, Nathan, Michelle, and Luis

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity.

We will happily donate $10 to it!