For many investors, 2022 has been a challenging and frustrating year, as persistently high inflation has resulted in an environment of quickly rising interest rates, leading to a “double-whammy” of twin selloffs across both stocks and bonds this year. After increasing more than 31% in 2019, 18% in 2020, and 28% last year, the S&P 500 (an often-cited proxy for the stock market) has declined more than 16% this year. And to make matters worse, the bond market, as measured by the Bloomberg U.S. Aggregate Bond Index, has declined by more than 11%. Put differently, investing in conventional stock and bond asset classes has not worked very well so far in 2022.

Not surprisingly, these declines have led to an increase in demand for “supplemental” investment opportunities outside of these traditional areas, and have led some people to ask themselves “Why are there are no alternative investments in my portfolio?”

But what are alternative investments? What role might they play in a properly-allocated investment portfolio? And why would an investor want to add them to their current diversification strategy?

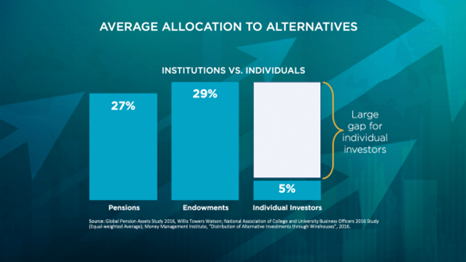

Put simply, an alternative investment is any financial asset that does not classify as a traditional stock, bond, or cash. While they can vary widely in their accessibility and structure, alternatives can provide an opportunity to 1.) boost returns, 2.) generate income, 3.) provide potential tax benefits, and 4.) reduce risk in a portfolio. Institutions like pension funds and endowments have been utilizing them for years, and today, more and more individual investors are questioning why they have no alternative investments, and whether they should change their plan to include them.

At Towerpoint Wealth, we selectively utilize alternatives for a number of clients and for a myriad of reasons; primarily, we find alternatives attractive due to the low correlation they have to traditional asset classes such as stocks and bonds. This means that the value and price of alternatives does not necessarily move in the same direction when market and economic conditions change, strongly enhancing portfolio diversification.

Here are eight types of alternative investments you should know about, in no particular order:

- Private equity – ownership in private businesses and non-publicly traded companies.

- Private credit – non-bank lending and ownership of privately negotiated loans and debt financing.

- Commodities – tangible goods that can be used as they are, or used to make other goods, including precious metals, wheat, oil, beef, coffee, etc.

- Collectibles – fine wine, art, coins, stamps, trading cards, comic books, or vintage cars.

- Cryptocurrency – any form of currency that exists digitally or virtually, and uses cryptography to secure transactions.

- Hedge funds – a limited partnership that pools investors’ money and invests it by making use of higher-risk and more complex trading methods.

- Venture capital – a subset of private equity, it is financing provided to startup companies and small businesses that are believed to have long-term growth potential.

- Real estate – a very long list – REITs, DSTs, QOZs, raw land, co-working spaces, farmland, manufactured homes, mobile home parks, and private real estate partnerships and syndicates.

In addition to these eight, other investments that can be classified as alternative include timberland, NFTs, crowdfunding, cannabis, tax liens, oil and gas, air rights, prop bets, and bankruptcy claims. Take a few minutes to read through this list of 150 types of unusual (alternative) investments, as there sure are some interesting, esoteric, and wild ones!

Of course, we would be remiss if we did not also highlight a number of the key risks and constraints that alternative investments inherently have:

- They oftentimes are unregulated by the U.S. Securities and Exchange Commission (SEC)

- They can be illiquid, and can be difficult to sell and turn into cash

- They can have high minimum investments and fewer opportunities for non-accredited investors

- They oftentimes have high (and sometimes hidden) fees and operating expenses

Is it bad if you have no alternative investments in your portfolio? Are you curious about “alts” and want to learn more? If you are an accredited investor, or serve accredited investors in a professional capacity, we welcome having you join us at Sacramento’s beautiful Sutter Club on September 21!

Click on the invitation below to RSVP!

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients build and protect their net worth.

Our President, Joseph Eschleman, recently connected with a very good and long-time client, Charlotte Strand, for a comprehensive semi-annual financial, investment, and retirement review meeting at her home.

You are in good hands, Charlotte - glad to see you are doing well, and that you feel confident that all of your financial affairs are properly coordinated!

While the Sacramento Republic unfortunately fell short in its dream-run pursuit of the US Open Cup on Wednesday night, it certainly wasn’t due to the lack of support from the greater Sacramento-area community.

Click below for a funny and creative video produced by our Marketing Specialist, Luis Barrera, highlighting the Towerpoint Wealth crew taking full advantage of Mayor Steinberg’s “doctor’s note” authorizing us to leave the office and watch the game!

What else is happening with the Towerpoint Wealth family?

While more than 40 million Americans could see their student loan debt cut or eliminated under President Joe Biden’s plan, his student loan debt forgiveness plan has raised many questions: How much will it actually cost? Who will it benefit the most? How will it contribute to inflation? Does the President even have the legal authority to implement this forgiveness?

Another very important question: Whether or not residents of certain states will owe up to several hundred additional state tax dollars on their forgiven loans. While borrowers will not owe federal taxes on student debt relief, they should unquestionably check how this debt cancellation is treated at the state tax level. While it is an evolving issue, and many states have yet to decide, Arkansas, California, Indiana, Minnesota, Mississippi, North Carolina, and Wisconsin all appear to be on track to tax forgiven student loan amounts, according to the Tax Foundation, an independent tax policy 501(c)(3) nonprofit.

The official White House fact sheet on President Biden’s student loan relief contains additional details.

Are you confused about certain aspects of completing your tax return?

Useful and interesting content we’ve read over the past two weeks:

1. Women Are So Fired Up to Vote, I’ve Never Seen Anything Like It – NY Times – 9.3.2022

Once the Dobbs decision came down, everything changed. For many Americans, confronting the loss of abortion rights was different from anticipating it. In my 28 years of analyzing elections, I had never seen anything like what’s happened in the past two months in American politics: Women are registering to vote in numbers I never witnessed before.

I’ve run out of superlatives to describe how different this moment is, especially in light of the cycles of tragedy and eventual resignation of recent years. This is a moment to throw old political assumptions out the window and to consider that Democrats could buck historic trends this cycle.

2. Republicans Have Unlikely Allies in their Fight to Restrict Abortion at the State Level: Democrats – CNN – 9.6.2022

A CNN analysis of legislative records and reported party affiliations shows that the Republicans passing increasingly strict abortion bans around the country have been joined by scores of unlikely allies: Democrats.

More than 140 Democrats from eight of the roughly dozen states with the most restrictive abortion laws voted in favor of the bans, and the vast majority of these state lawmakers were men.

3. Americans Have ‘Tip Fatigue‘ – CNBC – 9.1.2022

Tipping 20% at a sit-down restaurant is still the standard however, consumers are less inclined to give as much for a carry-out coffee or take-away snack.

“Part of it is tip fatigue,” says Eric Plam, founder and CEO of Uptip. “Since everything got more expensive, we’ve seen a decline in tipping.”

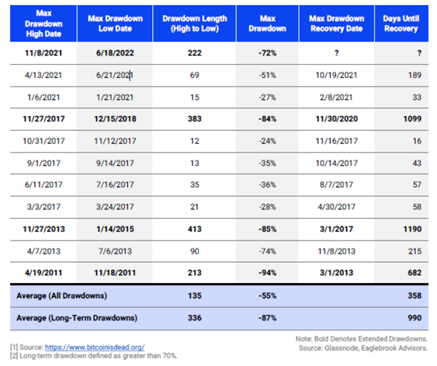

Below is a simple overview of prior drawdowns and recoveries over Bitcoin’s 13-year history. Bitcoin has had drawdowns of greater than 70% on four different occasions, including this current period.

Quoting https://www.bitcoinisdead.org/, Bitcoin's story cannot be told without the inclusion of both its strongest believers and disbelievers. Healthy skepticism of revolutionary technology is vital because it speeds up development and adoption.

Are you curious about cryptocurrency, and/or wonder if it should be part of your diversified investment portfolio? Let’s talk about it.

Queen Elizabeth II

April 21, 1926 – September 8, 2022

Rest in Peace

If you speak with someone who is concerned or unsettled

about their investments or advisor, we welcome talking with them.

As the 24/7 news cycle churns, twists, and turns, a number of trending and notable events have occurred over the past few weeks:

- Historic, unforgiving Western heat wave is peaking and crushing records

- Here’s everything Apple just announced at its iPhone14 event

- The new British Prime Minister Liz Truss has appointed Kwasi Kwarteng as Britain's first Black finance minister, as part of a cabinet where for the first time a white man will not hold one of the country's four most important ministerial positions

- NASA’s moon rocket was grounded by a leak, and the next try is weeks away

- United Airlines threatens to stop all JFK service if feds don’t OK more flights

- Lea Michele’s ‘Funny Girl’ leaves audience in tears

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Joseph Eschleman, Jonathan, Steve, Lori, Nathan, Michelle, and Luis

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity.

We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on Twitter