Why Retirement Tax Planning Deserves a Fresh Look This Filing Season

Many people believe retirement is supposed to feel simpler. Fewer moving parts. Fewer decisions. More time spent enjoying what you’ve built. And in many ways, that’s true. As retirement approaches, the pace slows and the focus shifts away from accumulation and toward living well.

This is especially true during tax season, when many retirees expect the process to feel as routine as gathering the documents, filing the return, and moving on.

However, retirement also introduces a different kind of complexity. Income doesn’t disappear when work stops; it just changes form. And once that happens, the tax impact of each decision becomes more visible, more permanent, and harder to undo.

That’s why retirement tax planning deserves more attention than it typically gets. It’s not just about how much you withdraw, but where that income comes from, when it’s recognized, and how those choices help shape cash flow and flexibility over time.

And it all starts with a clear understanding of the income sources you’ll rely on in retirement, and how each one is treated once the paychecks stop.

How Retirement Income Is Taxed (And Why It’s More Layered Than Expected)

One of the most common surprises retirees encounter is how differently income is treated once it’s no longer coming from a paycheck.

When people ask, “How is retirement income taxed?” they’re often expecting a single answer with a clear marginal percentage. In reality, retirement income is taxed by source, not as one combined stream — and that distinction is important, as it shapes nearly every planning decision that follows.

Most retirees rely on a combination of income sources, each with its own tax characteristics:

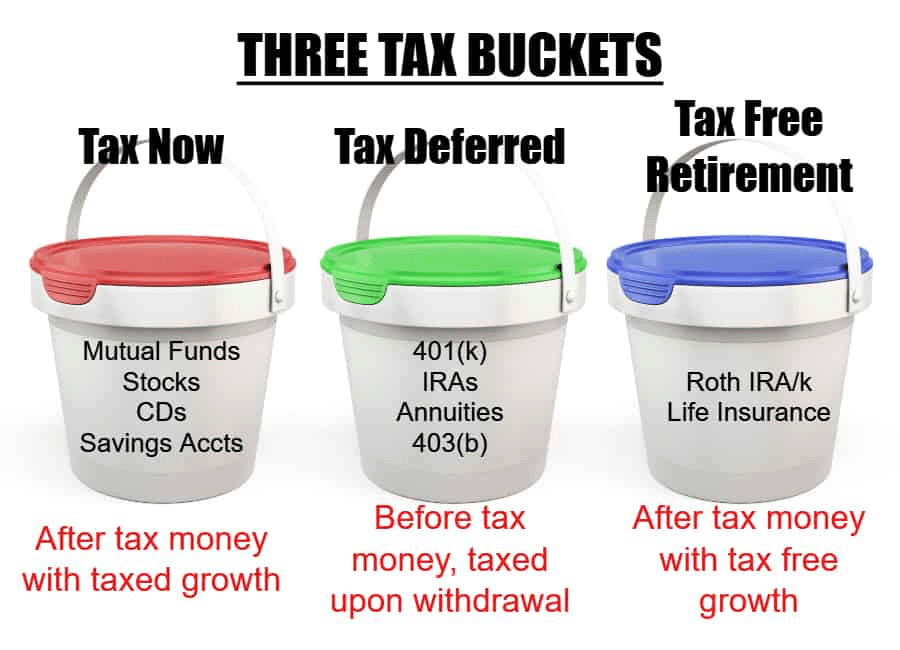

- Tax-deferred accounts, such as traditional IRAs and 401(k)s, where withdrawals are generally taxable as ordinary income.

- Tax-free accounts, like Roth IRAs, which can provide income without additional federal tax when structured properly.

- Taxable investment income, including interest, dividends, and realized gains, which may be taxed differently depending on how and when they occur.

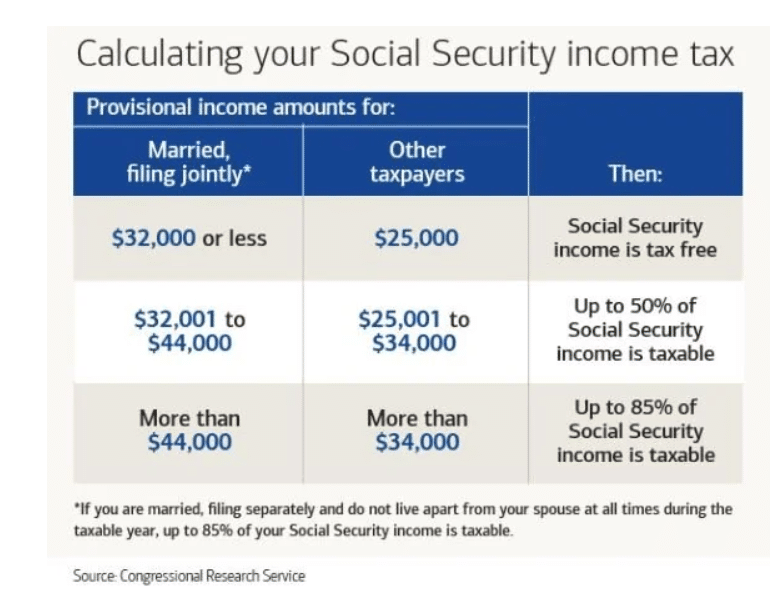

- Social Security benefits, which can become partially taxable depending on how much other income is present.

- Required distributions, which introduce timing considerations and can affect the taxation of other income sources.

- Systematic withdrawals taken from “regular” investment accounts, which are independent of any of the above income sources, and can be tax-free depending on their structure.

- Real estate income, both residential and commercial, which oftentimes can be taxable but may also offer deductions, depreciation, and other tax strategies that can reduce the effective tax burden on the income.

Individually, each category is straightforward. Together, they create layers that require more attention.

That’s where planning retirement income becomes more nuanced. The tax impact isn’t driven by any single account, but by how these sources interact in a given year. Adding income from one place can change how another is taxed. Timing matters. Order matters. And small shifts can have outsized effects on your net income and overall flexibility.

This is why retirement tax planning is less about isolated decisions and more about coordination across all of them. Understanding how each income source is treated sets the foundation for evaluating withdrawals, managing future tax exposure, and maintaining control over how income shows up over time.

With that framework in place, the conversation can naturally shift from what you have to how those pieces work together.

Planning Retirement Income With Taxes in Mind, Not After the Fact

Once you understand how retirement income is taxed by source, the next step is recognizing why planning retirement income works best when taxes are considered before decisions are made — not after returns are filed.

In retirement, income choices tend to be interconnected (when strategized properly). Withdrawals from tax-deferred accounts can influence how much of Social Security becomes taxable. Realizing investment gains (and losses) in a taxable account can affect overall income levels for the year. Required distributions can create ripple effects that extend beyond the account they come from.

None of these decisions exists in isolation.

This is where sequencing and coordination matter. The order in which income sources are used, the timing of distributions, and the interaction between different accounts all shape tax outcomes. What feels like a small adjustment in one year can meaningfully alter flexibility in the years that follow.

That’s why an effective retirement tax strategy looks beyond a single filing season. Decisions made today don’t just affect this year’s tax bill — they influence future options, future income control, and the ability to adapt as circumstances change.

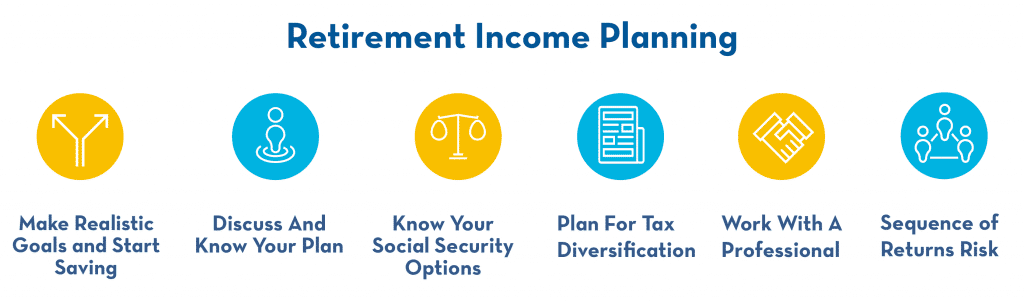

At Towerpoint, we view retirement income planning as a multi-year ongoing conversation. Our goal isn’t to optimize one moment in time, but to preserve choice over time. Planning works best when it looks forward — aligning income decisions with both current needs and longer-term considerations — rather than trying to unwind decisions after the fact.

This forward-looking perspective sets the stage for evaluating how different income sources can be coordinated in a way that supports flexibility throughout retirement.

Common Retirement Tax Considerations That Are Often Overlooked

Retirement introduces a different tax landscape — and with it, a set of benefits and considerations that don’t always receive much attention during working years.

These are not loopholes or tactics. They’re structural features of how retirement income is taxed, and understanding them helps inform better longer-term planning.

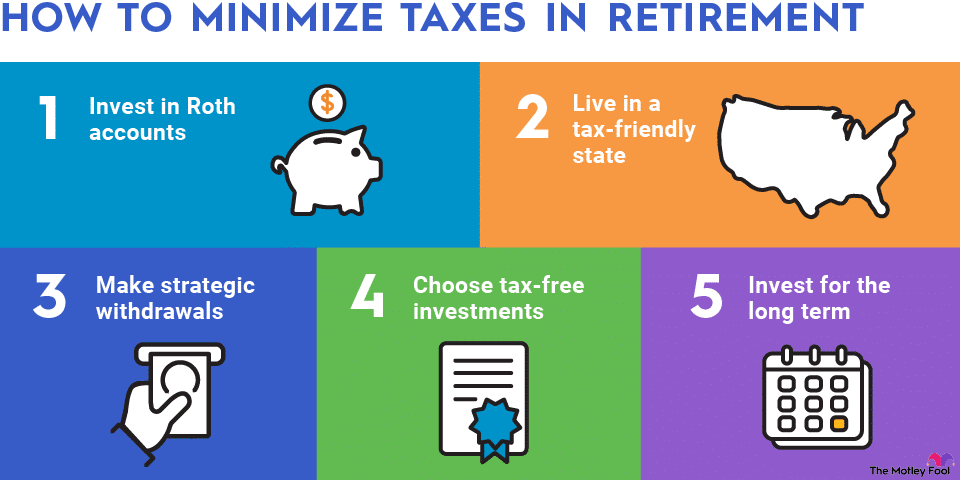

How different accounts are treated

As we’ve covered, not all retirement income is taxed the same way. Tax-deferred accounts, tax-free accounts, and taxable investments each carry different implications once withdrawals begin. The way these accounts interact can influence overall tax exposure from year to year, particularly when multiple income sources are involved.

Lower-income years and flexibility

Many retirees experience years where income is lower or more variable than it was during peak earning periods. These stretches can affect how income is taxed and how future distributions are treated.

While this isn’t something to “engineer,” it’s an important planning consideration that often goes unrecognized until after the fact.

Income levels and benefit taxation

Certain benefits, including Social Security, are taxed based on overall income rather than as standalone sources. That means the mix and timing of withdrawals from other accounts can influence how much of those benefits are subject to tax. This layering effect is one of the reasons retirement tax planning tends to be more interconnected than expected.

State and federal differences

Taxes don’t stop at the federal level. State rules around retirement income vary widely, and they can meaningfully shape net income in retirement — especially for households with flexibility around where they live or plan to spend time. These differences are often overlooked until they show up on a return.

When put together, these factors highlight why tax planning retirement strategies work best when they’re part of a broader conversation and not a year-end exercise. The goal shouldn’t be to chase benefits, but to understand how the system works so decisions are made with awareness, not surprise.

Why Tax Planning Becomes More Complex at Higher Income Levels

As income sources expand, so does the complexity of tax planning in retirement. This isn’t a reflection of heightened risk or poor decisions, but simply the reality of managing multiple, overlapping parts of a financial life that has grown more layered over time.

Households with significant assets often receive income from several directions at once.

Retirement account withdrawals may coincide with taxable investment income, required distributions, or ongoing compensation and business-related cash flow. When these streams intersect, the tax impact of one decision can quietly influence others, sometimes in unexpected ways.

Investment income also tends to play a larger role. Interest, dividends, and realized gains don’t operate in isolation; they affect overall income levels, which in turn can shape how other sources are taxed. As required distributions enter the picture, timing and coordination become even more important, since those withdrawals follow fixed rules regardless of market conditions or personal spending needs.

In many cases, retirement income planning also runs alongside estate and gifting considerations. These decisions are often made with longer-term family goals in mind, but they still interact with annual tax outcomes and cash flow realities.

Without coordination, it’s easy for well-intentioned strategies to work at cross purposes.

This is where a thoughtful retirement tax strategy becomes less about individual moves and more about how everything fits together. High-net-worth tax strategies aren’t inherently more aggressive, but they are more interconnected.

When advice is fragmented across silos, important context can be missed. When planning is coordinated, decisions tend to feel more deliberate, measured, and aligned over time.

Reviewing Your Retirement Tax Strategy During Filing Season

As tax season begins, many retirees are now seeing the full picture of how their income showed up over the past year.

For some, the outcome aligns closely with expectations. For others, filing brings small surprises — not because anything was done “wrong,” but because retirement tax planning tends to reveal its effects only after the year is complete.

This is why tax season can be a valuable moment for reflection. Looking at how income was actually sourced — compared to how it was originally planned — often highlights areas that deserve a closer look.

Withdrawals, distributions, and investment income don’t occur in isolation, and their combined impact can become clearer once everything is viewed together.

Filing season also tends to surface questions about timing. The order in which income was taken, the months when distributions occurred, and how those choices interacted with market conditions or spending needs can all influence outcomes.

Life changes over the past year — whether shifts in spending, family needs, or personal priorities — may also affect how well last year’s approach fits going forward.

It’s important to bear in mind that reviewing retirement tax planning during tax season isn’t about revisiting decisions with regret. It’s an opportunity to understand how those decisions played out, and how that experience can inform planning for the years ahead.

A thoughtful review keeps tax planning for retirement forward-looking, even while grounded in what just happened.

Final Thoughts

Retirement tax planning is most effective when it’s part of a broader strategy, not something revisited only when a return is being filed.

The way retirement income is taxed influences more than just one year’s bill. It affects:

- Ongoing cash flow

- Investment strategy and flexibility

- How long assets can support your lifestyle

- How different planning decisions interact over time

When these elements are viewed together, patterns become much clearer — both what’s working well and where additional coordination may be helpful.

Taxes Are an Input, Not the Strategy

At Towerpoint Wealth, we don’t view taxes as something to “solve” in isolation. Thoughtful tax planning retirement strategies are integrated with how income is generated, how portfolios are structured, and how longer-term goals are supported.

That perspective helps avoid shorter-term decisions that limit future flexibility. It also shifts the focus away from trying to get everything exactly right in a single year — and toward maintaining optionality across many years.

Strong retirement planning doesn’t rely on perfection. It relies on awareness, coordination, and an understanding of how today’s choices shape tomorrow’s options. Often, a simple review of how retirement income is flowing — and how it’s being taxed — can provide reassurance, even when no immediate changes are needed.

If you’d like help reviewing how your retirement income, tax planning, and overall strategy fit together, we invite you to schedule a complimentary 20-minute “Ask Anything” conversation with our team.

It’s our way of offering support as we walk through your questions and ensure your plan continues to support the life you’re building… both now and for years to come.