As the holidays approach, many of us naturally start thinking about gratitude, family, and the causes we care most about.

For some, that means volunteering, supporting a favorite nonprofit, or writing a year-end check to a charity. For others, it’s a desire to leave a lasting legacy or to teach children and grandchildren what generosity looks like.

What we see at Towerpoint Wealth is that charitable giving is most powerful when it’s both intentional and strategic. In other words, when your giving reflects your values and takes advantage of the tax benefits of charitable contributions available under current tax law.

In this Thanksgiving edition of Trending Today, we’ll walk through a number of charitable giving strategies that can help you make a bigger impact, potentially reduce your tax bill, and integrate generosity AND tax efficiency into your broader financial and retirement plan.

Now, this is not about finding loopholes or “gaming” the system. It’s about understanding the rules, so you can give in ways that are tax-efficient, impactful, and aligned with what matters most to you.

Why People Give: Values, Legacy, and Impact

Most clients don’t start their charitable intentions with the tax code; they start with their values. They give because they:

- Want to support a cause that has touched or is important to their family.

- Feel a responsibility to give back to their community.

- Hope to leave a legacy that extends beyond their lifetime.

- Want younger generations to see money as a tool for meaning, not just consumption.

At the same time, fewer people realize that charitable contributions for taxes can be structured in ways that enhance both their impact and their overall financial picture. Thoughtful planning can help you give more, not less, by aligning charitable giving tax benefits with your income, investments, and longer-term goals.

At Towerpoint, we see charitable planning as an ongoing conversation, asking questions like:

- What do you care about?

- What are you trying to solve for or support?

- How can your financial plan help you do that in a way that’s sustainable and tax-efficient?

The Foundation of Tax-Efficient Charitable Giving

Effective, tax-efficient charitable giving starts with understanding how contributions are treated under the current tax code.

Itemized vs. Standard Deduction

To claim a charitable giving tax deduction, you generally need to itemize deductions on your tax return. Many households now take the standard deduction, which means traditional write-a-check giving may not produce additional tax benefits on its own.

However — and this is important — you can still give strategically even if you don’t itemize.

Non-itemizers can often benefit from approaches like:

- Qualified Charitable Distributions (QCDs), which reduce taxable income directly.

- Donor-Advised Funds, which allow you to “bunch” multiple years into one itemizing year.

- Gifting appreciated securities, which avoids capital gains taxes, regardless of whether you itemize.

So while the standard deduction limits the benefit of simple cash gifts, it doesn’t limit your ability to give in tax-efficient, high-impact ways. That’s one reason planning matters: the more you understand your overall tax picture, the easier it is to determine how and when to give.

Charitable Giving Tax Deduction Limit

The IRS also places limits on how much you can deduct in a given year, often expressed as a percentage of your Adjusted Gross Income (AGI). These charitable giving tax deduction limits depend on:

- The type of asset you’re donating (cash vs. appreciated securities).

- The type of organization you’re giving to.

When your gifts exceed those limits, excess contributions can often be carried forward to the next year.

It’s important to note that none of this is meant to be a DIY tax guide. The key takeaway is that there is a framework, and when you understand it, you can align your generosity with your financial plan in a way that is both impactful and tax-efficient.

Strategy #1: Qualified Charitable Distributions (QCDs)

For retirees with IRAs, Qualified Charitable Distributions can be one of the most powerful charitable tools available.

What Is a QCD?

A Qualified Charitable Distribution is a direct transfer from your IRA to a qualified charity, available once you reach age 70 ½. Instead of taking a taxable distribution and then making a donation, you instruct your IRA custodian to send funds directly to the charity.

Under current rules, you can typically distribute up to a specified annual limit each year as a QCD. These distributions:

- Can count toward your Required Minimum Distribution (RMD)

- Are excluded from your taxable income, unlike a normal IRA withdrawal

Because of this, QCDs can help reduce your taxable income, the impact on Medicare premium brackets (IRMAA), and the taxation of your Social Security benefits.

Key QCD Rules

To receive the full tax benefits of charitable contributions via QCDs, it’s important to follow the QCD rules:

- You must be at least 70½ when the distribution is made.

- The funds must transfer directly from your IRA to a qualified charity.

- QCDs can’t be made to donor-advised funds, private foundations, or certain other entities.

- QCDs can only come from IRAs, not from 401(k)s or 403(b)s (though rollovers may be an option).

For retirees who are charitably inclined, QCDs can turn what would have been a fully taxable RMD into a tax-efficient charitable giving strategy that benefits both you and the organizations you support.

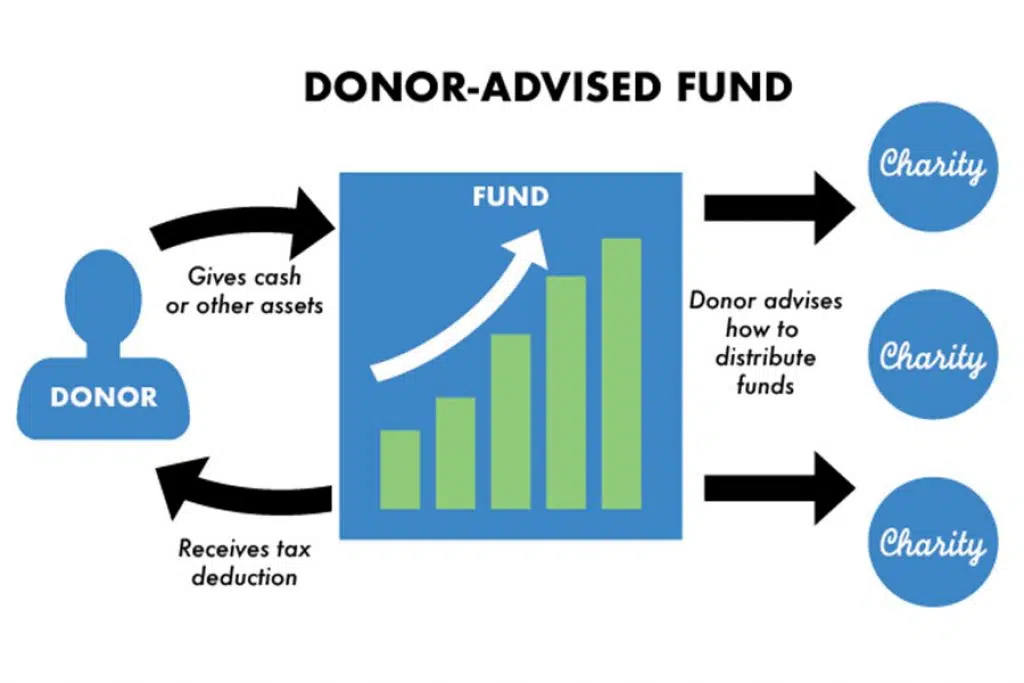

Strategy #2: Donor-Advised Funds

Donor-Advised Funds (DAFs) have become increasingly popular among families who want to be generous in a more structured, longer-term way.

How Donor-Advised Funds Work

A Donor-Advised Fund is, in essence, a charitable investment account, or a turnkey family foundation. You make an irrevocable contribution of cash or assets to the DAF, receive an immediate tax deduction (subject to AGI limits), and then recommend grants to charities over time.

This structure can be especially helpful for year-end charitable giving because it allows for time between when you give for tax purposes and when you direct the charity to receive the funds.

For example:

- You experience a high-income year from a business sale, stock vesting, or other event.

- You contribute to a DAF in that year to potentially offset some of that income.

- You then distribute those charitable dollars over multiple years to nonprofits you care about.

Benefits and Considerations

Donor-Advised Funds can:

- Allow you to “bunch” several years of giving into one for deduction purposes.

- Provide a platform for involving family members in strategic philanthropy.

- Offer a more organized way to track and manage your giving.

They may not be right for everyone, and there are fees and rules to consider. But for many households, DAFs can be a central part of their charitable giving strategies.

Strategy #3: Donating Appreciated Securities Instead of Cash

One often overlooked strategy involves the tax benefits of giving to charity by donating appreciated securities rather than cash.

Why Donating Appreciated Securities Can Be More Tax-Efficient

If you’ve held a stock, ETF, or mutual fund for more than a year and it has significantly appreciated, you normally pay capital gains tax when you sell it.

However, if you donate those shares directly to a qualified charity or to a Donor-Advised Fund, you can generally deduct the full fair market value of the security (subject to AGI limits). In turn, you avoid paying capital gains tax on the appreciation.

The result: the charity receives the full value of the asset, and you may receive a larger tax benefit than if you had sold the asset and donated the after-tax proceeds.

This can be particularly useful for:

- Concentrated positions in a single stock or other investment.

- Low-basis securities held for many years.

- Investors looking to rebalance portfolios in a tax-savvy way.

When thoughtfully executed, donating appreciated stock can be one of the most powerful tax-efficient charitable giving strategies available.

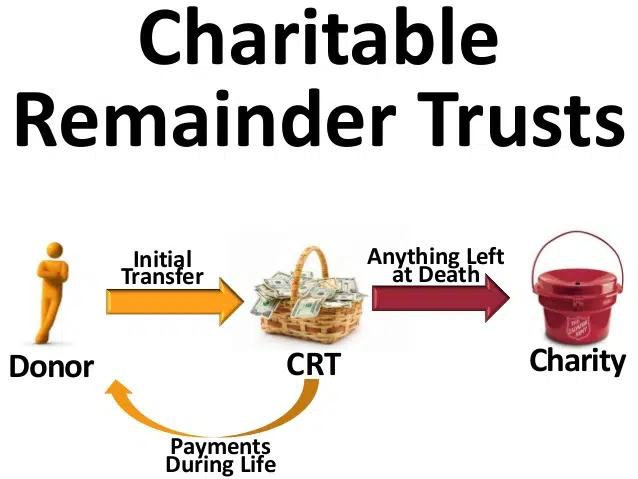

Strategy #4: Advanced Charitable Planning and Legacy

For some clients, charitable intent is intertwined with estate planning and multi-generational wealth conversations. In those cases, more advanced strategies — such as charitable trusts — may be appropriate.

These tools can help you to provide income to you or your heirs for a period of time, leave a remainder interest to charity, and potentially reduce estate taxes or manage concentrated positions.

These strategies are highly individualized and require coordination with estate attorneys and tax professionals. Our role at Towerpoint is to help you evaluate whether these options align with your goals, values, and broader financial plan.

Making Sure Your Gift Has Real Impact

Financial efficiency is important, but so is mission alignment. Before making significant gifts, we encourage clients to:

- Clarify the causes and outcomes they want to support.

- Review the financial health and transparency of the organization (for example, through independent charity evaluators like Charity Watch or Charity Navigator).

- Understand how donations are used — program spending vs. overhead, local vs. global impact, and so on.

In other words, the tax benefits of charitable contributions are meaningful, but the ultimate goal is to ensure your gift is doing the work you intend it to do.

Building a Year-Round, Tax-Efficient Charitable Giving Plan

While it’s natural to think about generosity around the holidays, the most effective plans treat giving as a year-round, integrated part of your financial life.

A thoughtful plan may include:

- Setting an annual charitable budget.

- Deciding which strategies to use — QCDs, Donor-Advised Funds, donating appreciated stock, or a combination.

- Aligning gifts with major income events, such as business sales or RMDs.

- Coordinating giving with your tax, retirement, and estate plans.

- Involving family members in the process to model generosity and shared values.

When you approach giving with intention, you create a framework that supports your personal sense of purpose, your financial objectives, and the needs of the organizations you care about.

Turning Generosity Into Lasting Impact

Thanksgiving is a natural time to reflect on what we’re grateful for and the kind of impact we want to have — on our families, our communities, and the causes that matter most to us.

At Towerpoint Wealth, we believe that charitable giving should be both heartfelt and well-planned. The right strategy can help you support organizations you care deeply about, potentially lower your tax burden, and align your financial resources with your life’s priorities.

Our role is to help you move from writing a year-end check to having a clear, tax-efficient charitable giving strategy that works in tandem with the rest of your financial plan.

If you’re considering charitable gifts before year-end — or want to explore which combination of Qualified Charitable Distributions, Donor-Advised Funds, and donating appreciated stock may be most appropriate for you — we invite you to start the conversation by scheduling a complimentary 20-minute “Ask Anything” conversation with our team.

A thoughtful plan today can help ensure that your generosity creates the greatest possible good, for both the causes you support and the people you love.