Helping you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement.

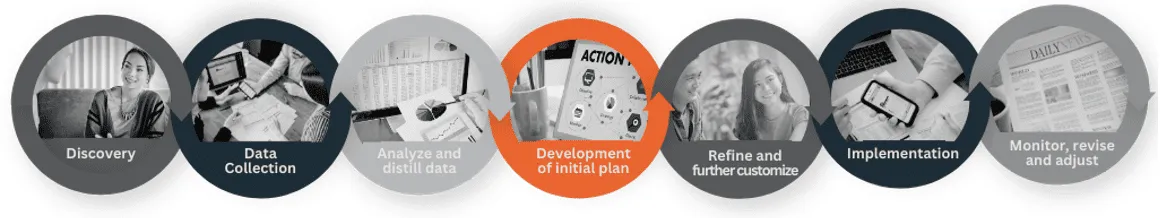

Wealth Management Process

At Towerpoint Wealth, we understand that successful wealth management is about more than just investments. It’s about creating a clear, structured financial plan that evolves with you.

Our process is designed to build trust, provide clarity, and proactively guide you through each stage of your financial journey. With a focus on personalized, fiduciary-driven advice, we take the time to understand your unique situation before crafting a plan tailored to your long-term success.

Every great financial plan starts with a conversation. In our Discovery Meeting, we take a deep dive into your: Personal and financial aspirations Concerns and challenges Time horizons and liquidity needs Risk tolerance and investment preferences This allows us to not only gather financial data, but to understand your values, priorities, and long-term vision so we can create a strategy that aligns with your life.

With a full understanding of your financial picture, we develop a customized wealth management plan using advanced financial planning software. In this meeting, we: Present a comprehensive, data-driven financial strategy Align your plan with your goals, risk tolerance, and investment timeline Discuss actionable steps to optimize wealth growth, preservation, and tax efficiency This interactive session ensures that your plan is tailored, adaptable, and built to evolve with you.

Once your financial plan is refined, we meet to solidify our partnership and begin implementation. This meeting allows us to: Address any final questions before moving forward Coordinate with your CPA, attorney, or other professionals for seamless execution Ensure you are fully comfortable with the strategies we are implementing This is where your financial plan moves from strategy to action.

Transitioning into a new financial relationship can feel overwhelming. That’s why we schedule a 45-day check-in to help: Organize new financial documents and ensure you have everything you need Reaffirm the initial strategies and answer any lingering questions Ensure you feel confident and comfortable with your financial plan We want this process to feel streamlined, simple, and empowering—not overwhelming.

Financial planning isn’t a one-time event — it’s an ongoing process. We schedule regular progress meetings, typically semi-annually, to: Adjust your financial plan as life changes Reevaluate investments based on market conditions and opportunities Address any new financial concerns or priorities that arise Through proactive engagement and ongoing communication, we ensure your financial plan stays aligned with your evolving goals and priorities.

A Process Built for Your Success

We are committed to making wealth management clear, structured, and aligned with your life. By following a disciplined, proactive approach, we help you:

- Gain confidence in your financial future

- Reduce the stress of wealth management decisions

- Focus on what matters most — your life, family, and long-term goals

Let’s Start the Conversation

Ready to build a financial plan that works for you? Schedule a consultation today to see how our structured process can help you achieve financial clarity and long-term success.