Lots of talk. Lots of posturing. Lots of sound bites. But not a lot of action (so far, at least). A familiar refrain? It is, when it comes to our elected officials in Washington D.C.

In today's Trending Today newsletter, we are going to explore the $1.2 trillion bipartisan infrastructure bill, the $3.5 trillion infrastructure plan details, and, perhaps most importantly to investors, the potential federal income tax increases that may occur if and when either, or both, of these massive bills become law.

Legislators are taking a two-step approach in their efforts to pass President Biden's ambitious jobs and infrastructure program, some provisions being Republican-friendly, and some Democrat-friendly. This two-track plan to pass this legislation works as follows: Put the GOP-friendly items in a $1.2 trillion bipartisan infrastructure bill that could pass on a bipartisan basis, and then put the rest in a much larger $3.5 trillion infrastructure bill that would attempt to pass on a party-line vote, via what is known as budget reconciliation, which only requires a simple majority to pass it.

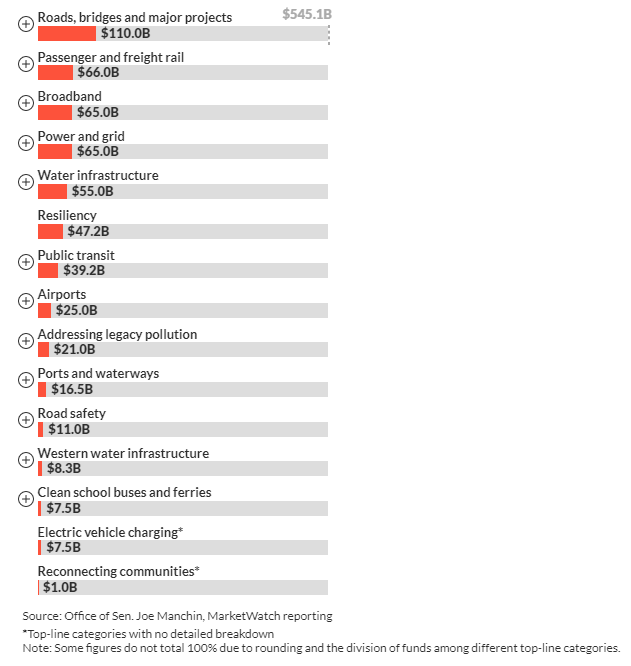

The $1.2 trillion bipartisan infrastructure bill, known as the Infrastructure Investment and Jobs Act, already passed the Senate by a vote of 69-30 on August 10. Many people have asked: "What is the bipartisan infrastructure bill, and what's in it?" Focusing on the traditional definition of infrastructure, the bill focuses on roads, bridges, rail, and water. It is truly a monumental measure, with an equally monumental 13 digit price tag!

What's in the bipartisan infrastructure bill?

However, the bipartisan infrastructure bill cannot become law until it also passes the House of Representatives, and that is where things begin to become tricky.

Speaker of the House Nancy Pelosi promised that the House would vote on the $1.2 trillion bipartisan infrastructure bill yesterday, but that vote was again delayed. The problem? Pelosi faces pressure from progressive Democrats, who say they will not support the "skinny" $1.2 trillion bipartisan infrastructure bill unless the much bigger $3.5 trillion infrastructure bill, focusing on human infrastructure and social spending such as climate change mitigation, increased child care funding, and health care expansions, also moves ahead.

We truly feel it is amazing that we live in a world where spending $1.2 trillion on a bipartisan infrastructure bill is considered "skinny," but it is when compared to the $3.5 trillion infrastructure bill!

Financing such social programs as universal pre-kindergarten, extended childcare, and expansion of health insurance coverage provided under Obamacare, the $3.5 trillion infrastructure bill, known as the American Families Plan (AFP), it represents the largest expansion of federal spending since the New Deal. And, with this enormous price tag comes the concurrent federal income tax increases to fund it. Here are the potential "highlights":

- Federal income tax increases - the AFP will restore the 39.6% pre-Trump, pre-Tax Cuts and Jobs Act marginal ordinary income tax rate. This current marginal rate is 37%.

- Multimillionaire excise tax - the AFP places a 3% excise tax on income in excess of $5 million

- Higher corporate tax rates - the corporate tax rate is set to increase form 21% to 26.5%, with a new minimum tax of 16.5% on offshore earnings

- Higher capital gains tax rates - the federal marginal capital gains tax rate for those with incomes higher than $400,000 will increase from 20% to 25%, and will be retroactive to September 13, 2021

And the less-likely but still possible proposals:

- Elimination of the step-up in cost basis upon death

- Limitations on popular tax planning vehicles such as Section 1031 "like-kind" tax-free exchanges and IDC (intangible drilling cost) deductions

Additionally, the following indirect federal income tax increases are in the crosshairs:

- Elimination of Roth IRA conversions for taxpayers filing jointly with incomes over $450,000, and for single taxpayers with incomes over $400,000

- Elimination of "Backdoor" Roth IRA contributions, banned for ALL income levels

- Mandatory taxable drawdowns of large IRAs - contributions to IRAs that have a total value of $10 million or more would be prohibited, IRAs and 401(k)s in excess of $10 million will have required minimum distributions of half of the amount over $10MM, and for retirement accounts over $20 million, everything over $20MM must be distributed immediately

Federal Income Tax Increases Explained

Still confused? Have more questions? Hungry for clear answers? Found below is a simple educational video we just produced, designed to break down the complicated topic of the $1.2 trillion bipartisan infrastructure bill, the $3.5 trillion infrastructure plan details, and the concurrent federal income tax increases that may occur, all specifically arranged in a digestible and easy-to-understand format.

Click HERE to watch the video!

Be sure to also click the SUBSCRIBE button to follow

Towerpoint Wealth on YouTube!

Importantly, and regardless of how things shake out, at Towerpoint Wealth we sincerely believe three things:

- Taxes will be higher over the next few years, perhaps as early as January of 2022, and perhaps significantly for higher income earners

- It is very reasonable to assume that this infrastructure legislation, in one way, shape, or form, will become law, and that trillions of dollars will soon be spent by our Federal government

- The next three months represent the most important tax planning months in recent years, as potential federal income tax increases mentioned above could be effective as soon as 1/1/2022

These tax planning opportunities include:

- Accelerate income into THIS YEAR, and defer tax deductions into future tax years, to leverage today's low income tax rates and minimize tomorrow's potential Federal income tax increases

- Utilize a partial, or even full, Roth IRA conversion in 2021, for the same reason mentioned directly above

- Evaluate gifting strategies, such as the utilization of a donor advised fund (DAF), to accelerate (or "bunch") your charitable contributions to hurdle the standard deduction in 2021

Have a plan, and if you don't, we encourage you to click HERE to message us and begin to discuss your circumstances further. With the high probability of federal income tax increases occurring in the near future, time is of the essence!

What’s Happening at TPW?

Our always-photogenic Director of Research and Analytics, Nathan Billigmeier, and his beautiful wife Jessica, post together prior to heading into the brand new Safe Credit Union Performing Arts Center in downtown Sacramento to see a stellar performance of Hamilton!

Most of the Towerpoint Wealth family (and extended family!) had a fun day of golf two Monday's ago, directly supporting the Rotary Club of Arden-Arcade and the Rotary Club of Granite Bay to raise resources and money for homelessness, at-risk youth, and local schools and parks.

It was quite the "Around the World" golf tournament, specifically the craft beer, jello shots, and marshmallow drive on the TPW-hosted 7th hole!

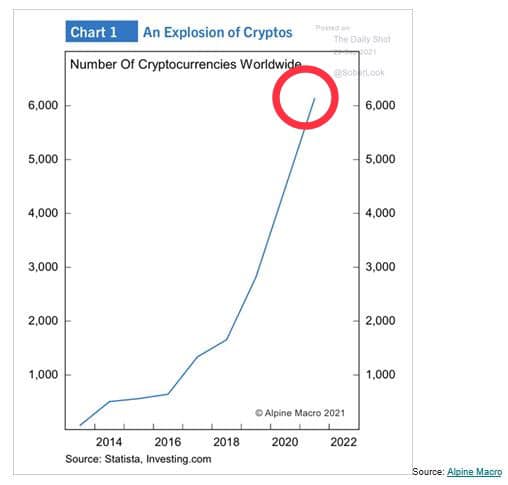

Graph of the Week

Are you a nocoiner, or do you HODL?

A compelling chart below suggests that cryptocurrency does not appear to be going away any time soon!

What do you think is going to happen with crypto? Click HERE to message us and let us know your thoughts!

Trending Today

As the 24/7 news cycle churns, twists, and turns, a number of trending and notable events have occurred over the past few weeks:

- Secret Joe Manchin 'agreement' with Chuck Schumer leaves Democrats scrambling

- The US Treasury says that the US and Qatar have issued sanctions against a Hezbollah financing network in the Arabian Peninsula

- Tesla's "full self-driving" may be says away from sharing the roadways

- The historic Giants/Dodgers 2021 NL West race may be the best of all time

- The Dixie Fire, the largest wildfire in the United States, is now 94% contained

- Joint Chiefs of Staff Chairman General Mark Milley and Defense Secretary Lloyd Austin III testify about US failures in Afghanistan during a Senate Armed Services Committee hearing

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.