Most people dream of a long, fulfilling retirement. But what if living longer, a gift in many ways, quietly puts your financial future at risk?

At Towerpoint Wealth, we believe effective retirement planning isn’t just about reaching the “retirement finish line;” it’s about making sure your plan carries you well beyond it. As life expectancy continues to rise, a growing number of retirees are facing a challenge that few see coming: longevity risk, or the risk of outliving your money.

This isn’t a theoretical problem. It’s a very real threat to retirement security, especially for high earners and successful professionals who may live well into their 90s or beyond. Without the right income planning for retirement and wealth coordination strategies in place, even a well-funded portfolio can become strained over time.

In this article, we’ll break down what longevity risk is, why it’s more relevant than ever, and how to build a resilient retirement plan that protects your wealth and your lifestyle through every phase of retirement. We’ll also share how we help clients prepare for a longer life, with a customized (and sustainable) retirement strategy built around clarity, tax efficiency, and peace of mind.

Key Takeaways

- Longevity risk is the risk of outliving your money, and it’s one of the biggest challenges in modern retirement planning.

- A written, goals-based financial plan for longevity helps ensure your savings align with your lifestyle, cash flow, and healthcare needs.

- Smart retirement income distribution planning includes layering guaranteed income, tax-efficient investment withdrawals, possible part-time work, and Social Security.

- Fiduciary retirement planning provides coordinated, unbiased advice to help you manage retirement risks like market volatility, inflation, and sequence risk.

- Living longer means planning smarter, not just to grow wealth, but to preserve and sustainably distribute it over time.

What is Longevity Risk, and Why Does It Matter?

The term “longevity risk” refers to the financial risk of living longer than expected and potentially outliving your retirement savings. While that may sound like a good problem to have, the reality is more complicated.

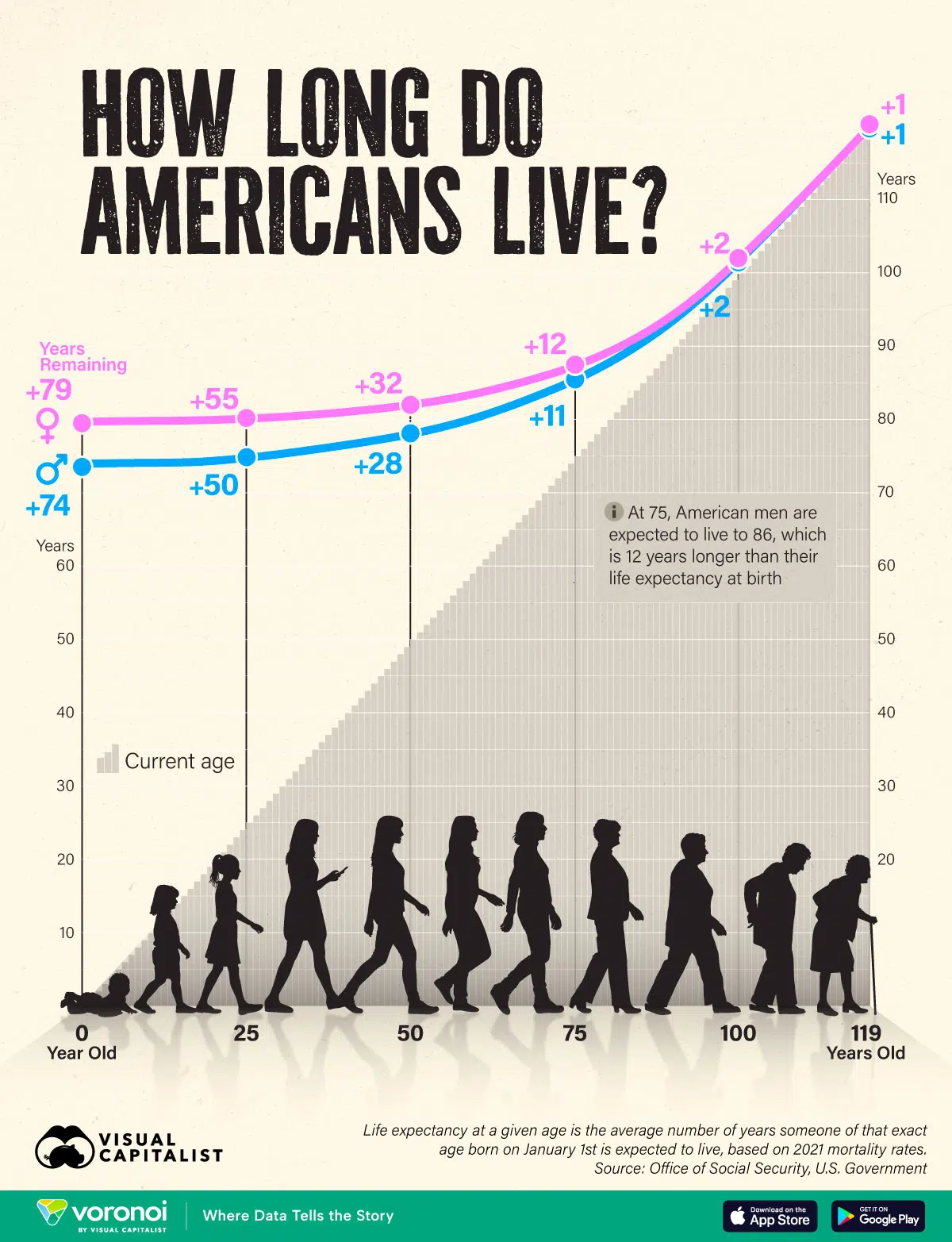

A longer life requires a longer stream of consistent income. That means your retirement plan needs to support not just 20 or 25 years, but possibly 30 or even 40 years of spending, healthcare costs, market volatility, and inflation.

If your plan isn’t designed with that time horizon in mind, you may find yourself making difficult trade-offs in your 80s or 90s… just when your financial flexibility is lowest.

For high-income earners and successful professionals, this risk can be especially deceptive. A strong portfolio today may create a false sense of security. But without a clear strategy for retirement income distribution, tax efficiency, and sustainable withdrawal rates, even substantial wealth can erode over time.

According to CDC data, a 65-year-old couple today has a nearly 50% chance that at least one spouse will live past age 90. That makes longevity not just a possibility, but a probability, and one that needs to be accounted for.

At Towerpoint Wealth, we view longevity risk as a critical component of retirement planning. It’s not just about how much you’ve saved. It’s about how you structure, protect, and draw from those savings over time. Planning for longevity means building a strategy that supports the life you want to live, and for as long as you live it.

The Domino Effect: How Longevity Risk Impacts Retirement Planning

A longer life can be something to celebrate, but it also sets off a series of financial dominoes that many retirement plans aren’t prepared for.

The first and most obvious impact? You need your money to last longer.

That means a greater risk of depleting your portfolio if you withdraw too much, too soon, or without a coordinated strategy. But longevity risk doesn’t stop at the headline. It has ripple effects across nearly every aspect of financial planning.

Healthcare costs rise with age. Even with Medicare, out-of-pocket expenses, including premiums, co-pays, prescriptions, and potential long-term care, can add up quickly. In fact, the average 65-year-old couple retiring today can expect to spend more than $300,000 on healthcare during retirement. Living well into your 80s or 90s only increases that number.

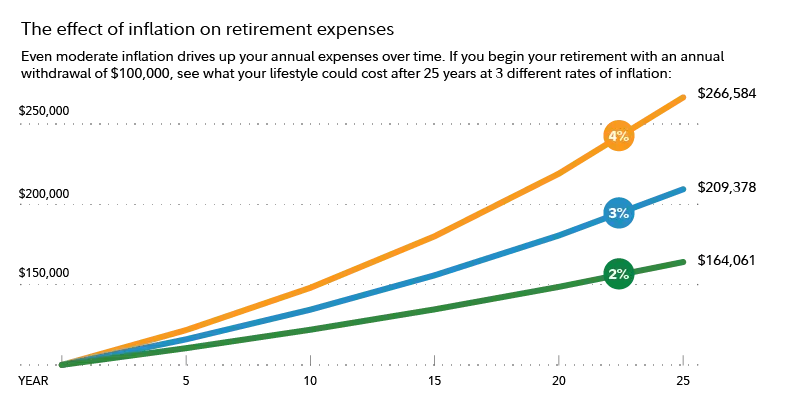

Inflation becomes a greater threat. Over the course of a 30- to 40-year retirement, even moderate inflation can erode purchasing power. The cost of a comfortable lifestyle at age 65 may not cover the costs of a similar lifestyle at age 85. A longer retirement timeline demands a portfolio that not only preserves wealth but also grows it in a tax-efficient and inflation-protected way.

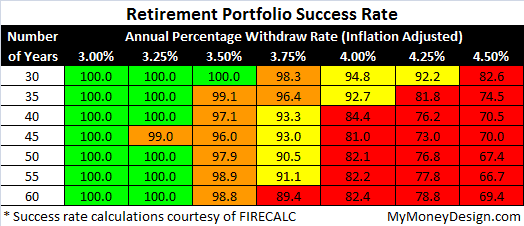

Your withdrawal strategy matters more. How, where, and when you take distributions from your accounts can significantly impact how long your money lasts. Tax inefficiency and mistimed withdrawals, especially during market downturns, can create a drag on your portfolio that’s hard to recover from.

Estate and legacy planning take on added complexity. A longer life means more time for goals, changes, and family needs to evolve. Ensuring your plan stays aligned with your wishes becomes an ongoing process, not a one-time event.

A longer retirement horizon introduces more variables and more opportunities for things to go off track. From rising medical bills to inflation pressure and evolving family dynamics, the financial demands of living longer require careful, ongoing attention.

Recognizing how each piece fits into the bigger picture is key to building a retirement plan that stands the test of time.

Our 5 Top Strategies for Financial Planning for Longevity

At Towerpoint Wealth, we believe a longer life should be a gift, not a financial liability. But the reality is that longevity risk touches nearly every corner of your financial plan. To build a retirement strategy that’s built to last, you need more than a pile of assets; you need a coordinated, goals-based financial plan that evolves with you.

Here are five key pillars we use to help our clients plan for a longer, more secure retirement.

1 | Start with a Written, Goals-Based Plan

A resilient retirement strategy starts with clarity. That’s why we work with each client to build a written plan rooted in their personal goals, values, and lifestyle vision.

Rather than focusing solely on account balances or investment performance, we design fiduciary retirement plans that prioritize what matters most: managing risk and ensuring your wealth supports the life you want to live, even far into the future.

This includes factoring in your cash flow needs, spending preferences, income tax considerations, charitable goals, and anticipated life milestones. When you anchor your strategy to specific outcomes, you’re better equipped to make decisions that serve your future, not just your fears.

2 | Build a Sustainable Income Distribution Plan

Living longer means your retirement savings need to stretch further. That’s why a thoughtful retirement income distribution plan is critical.

We help clients structure reliable income streams that blend guaranteed sources, like Social Security and pensions, with investment-based withdrawals. This layered approach helps reduce sequence risk (the danger of withdrawing during down markets) while aligning your income with your actual lifestyle needs.

The goal? To support your day-to-day expenses without prematurely eroding your longer-term assets.

3 | Incorporate Inflation Protection

Over time, inflation chips away at purchasing power, and the longer your retirement, the bigger the impact you’ll likely see.

Our approach integrates investment strategies designed to outpace inflation, along with cost-of-living-adjusted income sources where possible. Whether it’s owning equities with longer-term growth potential, selecting appropriate bond ladders, or ensuring your Social Security timing is optimized, protecting your future dollars is just as important as growing them today.

4 | Plan for Long-Term Care

Health care is one of the most significant wild cards in retirement, and longevity increases the odds you’ll need extended care.

We help clients evaluate long-term care planning options early, from standalone LTC policies and hybrid life insurance solutions to self-funding strategies. The goal is to ensure that the need for care doesn’t jeopardize the rest of your financial plan, or burden loved ones down the road.

5 | Revisit and Adjust Regularly

A retirement plan is not a once-and-done document. It’s a living strategy that needs to evolve as your life, family, and the world change.

That’s why ongoing planning is essential. We meet regularly with clients (usually semi-annually) to assess their plan’s health, stress test different scenarios, and make proactive adjustments, whether that means updating withdrawal strategies, adapting to tax law changes, or adjusting for market, economic, and lifestyle shifts.

The Role of a Fiduciary Financial Advisor in Navigating Longevity Risk

At Towerpoint Wealth, we often meet people who’ve done a good job accumulating wealth, but still feel uncertain about the future. Not because they haven’t saved enough, but because they’re missing something just as important: a coordinated, forward-thinking strategy.

Many investors don’t actually have a retirement plan. They have a collection of accounts.

That’s where a fiduciary financial advisor comes in.

Unlike brokers or sales-based advisors, a fiduciary is legally and ethically obligated to act in your best interest, 100% of the time. That means the advice you receive is not tied to products, commissions, or corporate agendas or profitability goals. It’s tailored to your goals, your lifestyle, and your longer-term economic security.

Fiduciary retirement planning takes your planning a step further. It’s not just about choosing investments, it’s about building a cohesive, coordinated, and personalized roadmap that protects against risks like inflation, market volatility, healthcare costs, and longevity.

When it comes to longevity risk, this kind of objective, comprehensive planning matters.

A fiduciary financial advisor can help you answer critical questions like:

- How long will my retirement savings last?

- How do I ensure my income keeps pace with inflation?

- What is a sustainable withdrawal rate from my portfolio?

- What happens if I live longer than expected, or need care I didn’t plan for?

At Towerpoint Wealth, we build integrated retirement plans designed to grow with you. We project your retirement income and we stress-test it. We look at your investment and asset allocation mix, and align it with your income needs, tax picture, and life goals.

The result is a strategy that isn’t just built for today, but built to last, no matter how long retirement lasts.

Common Retirement Risks And How to Mitigate Them

Effective retirement planning is about strategically building wealth and protecting it against a range of real-world risks. Here are five key risks every retiree faces, and how a proactive, fiduciary retirement planning approach helps address them:

Market Risk

Markets will rise and fall, and timing them perfectly is nearly impossible. A diversified portfolio tailored to your risk tolerance and income needs can help smooth the ride and reduce exposure to volatility.

Inflation Risk

Even moderate inflation can erode purchasing power over time. Investments with growth potential, cost-of-living adjustments, and smart asset allocation help protect your standard of living.

Sequence of Returns Risk

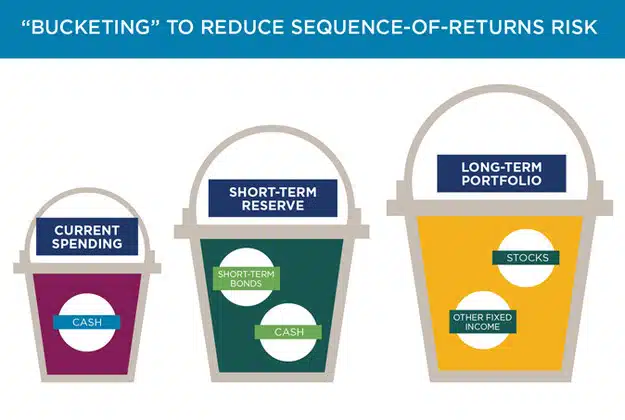

The order in which returns occur, especially early in retirement, can dramatically impact your portfolio’s longevity. Withdrawal strategies and income “bucketing” help reduce the risk of selling assets during market downturns.

Withdrawal Rate Risk

Taking too much, too soon, can deplete even a well-funded portfolio. A fiduciary plan ensures withdrawals are coordinated with income sources, taxes, and market performance to extend portfolio life.

Healthcare and Longevity Risk

Living longer means higher healthcare costs and more years of spending. Planning for long-term care and using protective strategies ensures your finances support your lifestyle, not the other way around.

We believe integrated, forward-looking planning is the key to navigating these risks successfully.

Planning for a Longer, Smarter Retirement

At Towerpoint Wealth, we believe longer life expectancy isn’t something to fear; it’s something to plan for.

Yes, living longer introduces new risks: rising healthcare costs, market uncertainty, inflation, and the very real possibility of outliving your savings. But with the right strategy, those risks become manageable. Even navigable.

That’s where fiduciary retirement planning comes in.

We don’t believe in guesswork, emotional decisions, or one-size-fits-all advice. We believe in data, discipline, and designing a plan around your real life, one that evolves as you do.

Whether you’re five years from retirement or already in it, now is the time to ask:

How long will my retirement savings last… and how do I make sure it’s enough?

If you’re ready for a strategy built to support your longer, more fulfilling retirement, we invite you to schedule a 20-minute “Ask Anything” conversation. It’s a no-pressure way to explore where you stand and how we can help you move forward with clarity and confidence.