It’s no secret — these are unsettled times.

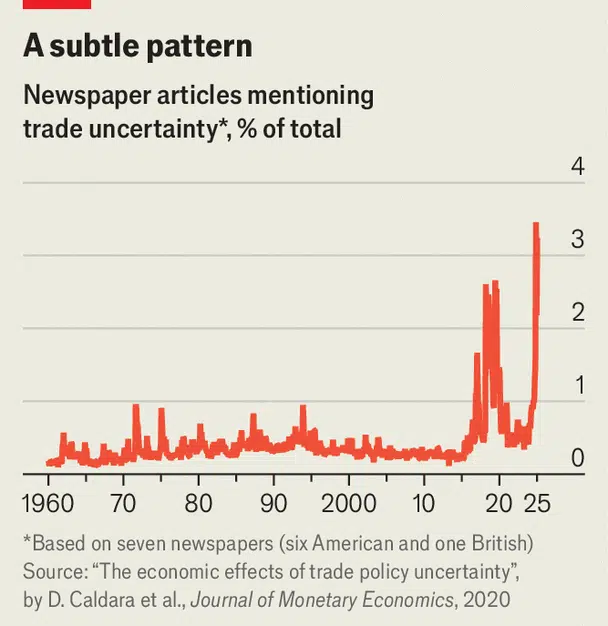

As we move deeper into 2025, the U.S. economy is sending mixed signals. Real estate values have cooled from their post-pandemic highs. Inflation remains stubborn, driving up the cost of essentials like groceries, gas, and housing. Tariffs and trade wars are creating doubt. And the stock market, while resilient in some areas, continues to feel the effects of global tension, rising interest rates, and cooling corporate earnings.

Naturally, investors are asking themselves some important, and difficult, questions: Are we already in a recession? If not, is one on the horizon? And, importantly, what should I be doing now to protect my portfolio?

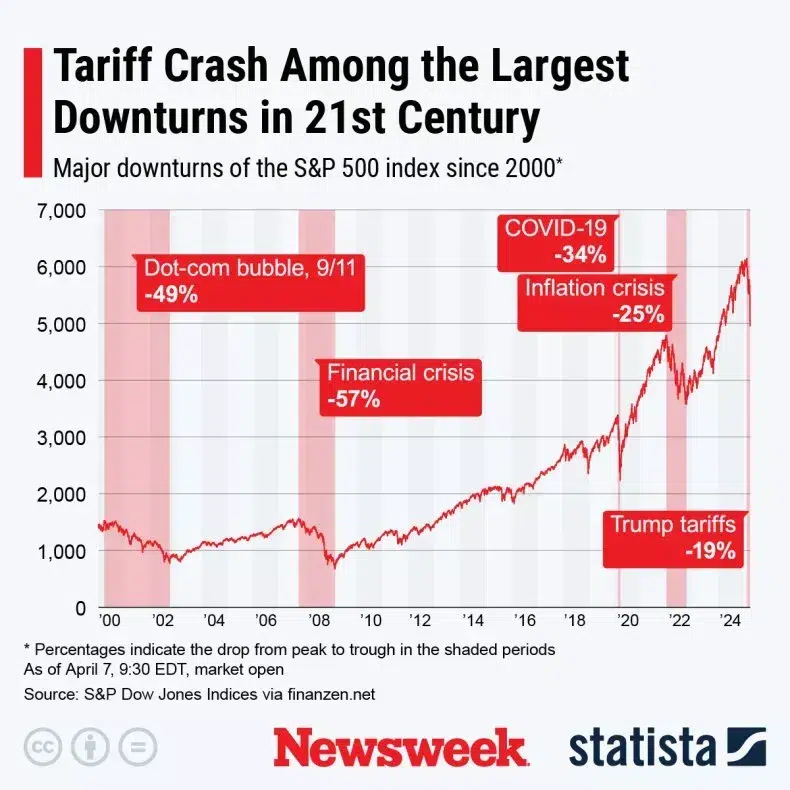

At Towerpoint Wealth, we believe that market downturns and economic pullbacks, while uncomfortable, are a normal and inevitable part of investing, and should even be expected. They’ve happened before, and they will happen again.

But history has also shown, and as evidenced by the above graph, that those who are disciplined, and prepare — not panic — are the ones who come out ahead.

In this article, we’ll walk you through five proven strategies to help recession-proof your portfolio. Whether you’re already worrying about the impact of today’s economy or simply want to be proactive, these strategies are designed to help you manage risk, stay focused, and uncover opportunity — even when headlines say otherwise.

Let’s dive in.

Key Takeaways

- Recessions are a normal part of the economic cycle, and while uncomfortable, they’ve historically been temporary.

- Blue-chip stocks, alternative diversifiers, and international equities can provide stability and opportunity during downturns.

- Holding cash and maintaining portfolio flexibility helps investors stay positioned to act, not react.

- Diversification and disciplined portfolio rebalancing are essential tools for reducing risk and avoiding emotional decision-making.

- Working with a fiduciary financial advisor can help you stay focused on your longer-term goals and uncover opportunities, even in uncertain times.

What is a Recession?

Before we dive into how to recession-proof your portfolio, let’s take a moment to clarify what a recession actually is — and why it matters to investors.

A recession, by general definition, is a significant decline in economic activity that lasts for an extended period, typically recognized after two consecutive quarters of negative GDP growth.

However, the recession definition goes beyond just GDP. The National Bureau of Economic Research (NBER), the organization responsible for officially declaring a recession in the US, also considers other factors like rising unemployment, declining consumer confidence, reduced corporate earnings, and sluggish industrial production.

While technical definitions vary, what most agree on is this: when the economy is in recession, businesses slow down, job growth stalls or reverses, and consumer spending declines — all of which can have a meaningful impact on your portfolio.

So whether you’re asking, “What is a recession?” or trying to determine if a recession in the US is coming, understanding the basics can help you make smarter investment decisions.

Now that we’ve covered the fundamentals, let’s look at where we are today — and whether or not the signs are pointing toward a full-fledged recession.

Are We in a Recession?

If it feels like the economy is slowing down, you’re not alone, and you’re not imagining things.

Recent headlines have been filled with warnings about stagflation, a potential economic slowdown, and widespread consumer unease.

In fact, according to a March 2025 survey from Deutsche Bank, nearly half of institutional investors believe a U.S. recession is likely within the year. Meanwhile, consumer confidence has dropped to its lowest level in over four years, reflecting real concerns about inflation, rising interest rates, and tariffs.

So, are we in a recession?

No — at least not yet. The National Bureau of Economic Research (NBER) has not made that call. Additionally, the labor market remains on very solid footing, adding 228,000 jobs in March, exceeding economist expectations.

But that doesn’t mean we aren’t feeling the effects of a slowing economy, or the prospect of slowing earnings due to tariff uncertainty.

Even if we’re not officially in a recession today, the risk of entering one is real.

At Towerpoint Wealth, we believe in focusing less on labels and more on planning and preparation – after all, none of us have any control over the economy or the market’s reaction to it. Whether or not a recession is declared this year, the signs of economic softening are enough to warrant a thoughtful review of your investment strategy.

Trying to time the market or guess when a recession will begin or end is a losing game, as nobody has the ability to accurately predict the future. But preparing for one? That’s just smart investing. Rather than fearing what may come next, our philosophy is to build portfolios designed to weather uncertainty — and, when possible, capitalize on it.

In this article, we’re going to share our five concrete, actionable strategies that investors can use to protect their portfolios and position themselves for longer-term success.

Five Key Strategies to Recession-Proof Your Portfolio

If you’re wondering how to what to invest in during a recession — or how to take advantage of opportunities that often emerge during uncertain times — you’re not alone.

These five strategies can help investors stay grounded and confident when markets become unpredictable.

1. Own and Maintain Exposure to Blue-Chip Stocks

When uncertainty strikes, blue-chip companies tend to be the anchor in a portfolio. These are large, financially stable businesses with strong balance sheets, reliable revenue streams, and often, a track record of paying consistent dividends.

In periods of economic contraction, blue-chip stocks tend to outperform riskier, more speculative companies. They offer more predictable earnings, global market presence, and tend to operate in essential industries.

Think companies in sectors like healthcare, consumer staples, or utilities — industries that people rely on regardless of the broader economy.

Dividends are also a valuable driver of portfolio growth during a recession. Not only do they offer income while you wait for markets to recover, but reinvesting dividends during down markets can help you COMPOUND, and accumulate more shares at lower prices. Many blue-chip stocks (and blue-chip stock mutual funds and ETFs) offer consistent dividends, making them an attractive option for investors during uncertain times.

At Towerpoint Wealth, we believe in the power of blue-chip equities to provide both resilience and longer-term growth, especially when paired with a disciplined asset allocation strategy.

2. Harness the Power of Low-Correlation and Alternative Investments

Diversification is a cornerstone of any sound investment strategy — but during a recession, it’s not just about owning many different investments. It’s about owning investments that behave differently when market conditions change.

Low-correlation assets — such as real estate, commodities, private equity, or even collectibles and fine art — tend to move independently of traditional stocks and bonds. Having exposure to these types of “alternatives” can help smooth out returns during periods of volatility, and provide exposure to different sources of return.

Precious metals like gold have historically been seen as safe havens, particularly when inflation is high or confidence in fiat currencies is low. Commercial real estate, depending on the region and sector, can also provide stable income and act as a hedge against rising prices.

While not appropriate for every investor, carefully selected alternatives can provide a meaningful layer of protection during market drawdowns. A fiduciary financial advisor can help you assess whether (and how) these investments may fit within your broader plan.

3. Increase Your Exposure to Non-U.S. Equities

While it might seem counterintuitive to look overseas during a domestic downturn, international equities offer potentially powerful diversification benefits — especially when the U.S. economy is under pressure.

Foreign markets often behave differently than U.S. markets due to varying monetary policies, economic cycles, and geopolitical factors. And in some cases, international stocks may offer better valuations or growth prospects than their U.S. counterparts.

Additionally, investing globally introduces currency diversification. When the U.S. dollar weakens, returns from foreign investments can be amplified when converted back into dollars. This can help offset domestic losses and offer potential upside.

Of course, investing internationally comes with risks — currency fluctuations, political instability, and differing regulatory environments, to name a few. But when thoughtfully integrated into a diversified portfolio, global exposure can be a powerful way to hedge against U.S.-specific recessions and economic slowdowns.

4. Don’t Forget: Cash is Still King

In an era where investors are focused on growth and yield, cash may feel like an afterthought — but it plays an essential role in a recession-ready portfolio.

Cash provides flexibility. It cushions against drawdowns. And, perhaps most importantly, it gives you the ability to act when opportunity strikes.

Recessions often bring discounted prices on quality assets. Having cash on hand allows you to be opportunistic, rather than reactive, when markets pull back. It also gives you breathing room so you’re less likely to sell investments at a loss to meet shorter-term expenses.

While you shouldn’t overweight cash at the expense of longer-term growth, maintaining a healthy allocation — especially in uncertain times — can be a prudent move.

5. Be Humble: Diversify and Rebalance with Discipline

It’s impossible to predict exactly when a recession will hit, how long it will last, or which part of the market will be most affected. That’s why humility — combined with discipline — is a core part of building a resilient portfolio.

Diversification across asset classes, sectors, and geographies ensures you’re not putting all your eggs in one basket. But equally important is rebalancing — the practice of periodically realigning your portfolio to match your original targets.

During volatile markets, it’s easy for certain assets to become overweight or underweight. Without rebalancing, your portfolio could end up riskier than intended. Rebalancing encourages you to buy low and sell high — trimming assets that have grown beyond their target allocation and adding to those that have lagged.

At Towerpoint Wealth, we generally rebalance client portfolios on a semi-annual basis, ensuring they stay aligned with both risk tolerance and longer-term objectives. Rebalancing isn’t flashy, but over time, it can improve returns, lower volatility, and reduce emotional decision-making during stressful market environments.

What NOT to Do When Recession Fears Rise

When recession fears start making headlines, the instinct to “do something” can be powerful — but not always productive. One of the most damaging things an investor can do during periods of economic uncertainty is react emotionally.

Here are some tips on what not to do if there is a recession in the USA.

- Don’t panic sell. Locking in losses due to panic-selling can derail years of progress and make it harder to recover when markets rebound — which, history shows, they always do.

- Don’t overreact to headlines. Financial media is built for attention, not nuance. A single data point or soundbite rarely tells the full story.

- Don’t make fear-based decisions. Instead, lean on your financial plan. If your portfolio was built to weather both ups and downs, trust the process.

- And don’t go through it alone. Partnering with a fiduciary advisor can help you process uncertainty, avoid costly mistakes, and make sound decisions aligned with your longer-term goals — especially when the markets feel anything but calm.

Final Thoughts

Recessions are an inevitable part of the economic cycle, and while they can be unsettling, they don’t have to derail your longer-term financial plan.

At Towerpoint Wealth, we believe successful investing isn’t about avoiding downturns entirely. It’s about building a resilient, diversified portfolio that can endure them. By focusing on fundamentals like blue-chip equities, diversification, asset location, and disciplined rebalancing, you can position your portfolio to weather volatility (and even uncover opportunity in the uncertainty).

Remember, the headlines may change, but your longer-term goals likely haven’t. Staying focused on what you can control — your risk exposure, your strategy, and your mindset — is what leads to lasting financial success. The best investment during a recession is one that furthers your longer-term goals, not one that simply eases temporary anxiety.

If you’re feeling uncertain about how your portfolio is positioned or want to develop a plan that accounts for both the risks and opportunities ahead, we invite you to schedule a 20-minute “Ask Anything” conversation with our team today. Let’s make sure your financial future is built to thrive in any environment.