Concerns about the future of Social Security seem to surface with every election cycle — and 2025 is no exception.

Headlines raise questions like “Will Social Security run out?” or “Could Donald Trump’s election as president affect Social Security’s future?” These worries are understandable, given that Social Security plays a crucial role in the financial stability of millions of Americans, especially retirees and those nearing retirement age.

However, while speculation is rampant, the reality is far less dire than many fear. Social Security is not on the brink of disappearing, and both current and past administrations — including Trump’s — have acknowledged the importance of maintaining the program’s longevity. Political discourse may highlight potential changes or reforms, but the notion of the program vanishing altogether is largely unfounded.

As we approach 2025, understanding the nuances behind Social Security’s funding, the implications of potential policy shifts, and how to plan for the future becomes even more important. Whether you’re concerned about benefit reductions, tax changes, or how a potential Trump presidency could influence Social Security, having the right information is key to making informed decisions.

In this article, we’ll discuss the realities behind the speculation, clarify how Social Security is funded, and examine proposed solutions to ensure the program’s sustainability. We’ll also address how political leadership — including President Donald Trump’s stance on Social Security — may affect the program moving forward, helping you prepare for the future with clarity and confidence.

Key Takeaways

- We believe that Social Security is not going away. Even if trust funds are depleted, payroll (FICA) taxes and other potential Congressional changes will continue to cover most benefits.

- President Trump has expressed support for preserving Social Security benefits, with no significant cuts expected during his second term.

- Funding challenges remain, but potential solutions include raising the payroll tax cap, adjusting benefits, and increasing the retirement age.

- Common fears about Social Security disappearing are often exaggerated.

- Proactive planning, including diversifying income, maximizing benefits, and staying informed, is essential to protect your retirement.

How Social Security Is Funded (and Why It’s Not Going to Disappear)

One of the most common fears among Americans is that Social Security will “run out” of money. While it’s true that the Social Security trust funds are projected to face funding challenges in the coming years, we believe the idea of the program vanishing altogether is a misconception.

How Does Social Security Funding Work?

Social Security is primarily funded through payroll taxes collected under the Federal Insurance Contributions Act (FICA). Workers and employers each contribute 6.2% of wages, while self-employed individuals pay the full 12.4% Social Security contribution. Social Security limits the amount of income subject to taxation. For 2025’s earnings, that limit is $176,100. This amount is also referred to as the “wage base limit” or the “taxable maximum.”

These taxes go into two trust funds:

- Old-Age and Survivors Insurance (OASI) Trust Fund: Pays retirement and survivor benefits.

- Disability Insurance (DI) Trust Fund: Pays disability benefits.

These funds are invested in U.S. Treasury securities, ensuring they earn interest over time. When you hear about the possibility of funds “running out,” it typically refers to the trust funds being depleted — not the entire program.

Even if reserves are exhausted, ongoing payroll taxes will still cover approximately 77-80% of scheduled benefits beyond the depletion date.

What’s the Timeline for Potential Depletion?

According to the latest projections from the Social Security Trustees, the OASI trust fund could be depleted by 2033 if no changes are made. This projection has fueled concerns and media headlines, often asking, “Will Social Security run out?” or suggesting impending cuts.

While these concerns are valid, depletion does not mean elimination; it means that benefits could be reduced unless Congress enacts changes to strengthen the system.

Political Influence on Social Security: What Trump and Other Leaders Have Said

New administrations often bring heightened anxiety about Social Security’s future. In particular, discussions surrounding Trump and Social Security have resurfaced as President Trump has stepped back into the Oval Office.

Trump’s Stance on Social Security

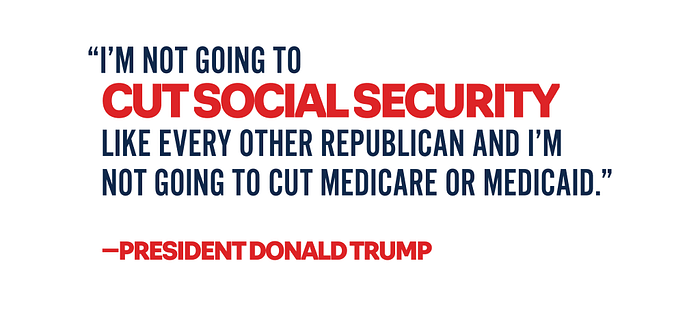

During his first term, President Donald Trump consistently stated that he would not cut Social Security benefits. In fact, he emphasized protecting the program for seniors while addressing broader fiscal issues. Critics, however, point to proposals during his administration that involved payroll tax deferrals, raising questions about long-term funding implications.

As we progress into Trump’s second term, discussions surrounding Trump on Social Security have centered around whether his policies would prioritize tax cuts over entitlement program sustainability. While Trump has reaffirmed his commitment to preserving benefits, the debate remains heated, especially with conflicting viewpoints in Congress.

What Does This Mean for Social Security’s Future?

Regardless of the political party in power, one thing remains clear: cutting Social Security entirely is highly unlikely. The program is often called the “third rail” of American politics — touching it is politically risky, given its popularity and importance to millions of voters.

In this second Trump term, the most likely scenario involves reform measures aimed at extending the program’s solvency, not eliminating it. Bipartisan solutions, while politically complex, are essential to address the looming shortfall without dismantling the system.

Proposed Solutions to Secure Social Security’s Longevity

If Social Security isn’t going away, what steps can lawmakers take to ensure its long-term stability?

Several proposals are on the table, each with varying degrees of political support:

- Increasing the Payroll Tax Cap: Currently, earnings above a certain threshold ($168,600 in 2024) aren’t subject to Social Security taxes. Raising or eliminating this cap could significantly boost the program’s funding without affecting lower and middle-income workers.

- Gradually Raising the Retirement Age: Another commonly discussed solution involves gradually increasing the full retirement age to reflect longer life expectancies. This change, however, is controversial, especially among workers in physically demanding jobs.

- Adjusting Benefit Formulas: Some proposals suggest recalculating benefits to slow growth for higher earners while preserving or enhancing payments for lower-income retirees.

- Modifying Payroll Tax Rates: A modest increase in the payroll tax rate could significantly extend Social Security’s solvency. For example, the combined rate could be gradually raised from 12.4% to around 14-15% to increase the contributions to the program.

- Diversifying Investment Options for Trust Funds: Though historically invested in government securities, some policymakers have proposed allowing trust funds to invest in other assets. This idea carries potential benefits but also increased risk and political opposition.

While no single solution is perfect, a combination of these approaches is likely necessary to secure the future of Social Security without drastically reducing benefits.

Debunking Common Myths and Fears About Social Security

Given the frequent headlines and 2024’s election-year rhetoric, it’s no surprise that many Americans are anxious about Social Security’s future.

Let’s address some common fears and set the record straight:

Myth 1: “Social Security Will Be Gone by the Time I Retire.”

Reality: Even in absolute worst-case scenarios where trust funds are depleted, the program will still collect payroll taxes to cover approximately 77-80% of scheduled benefits. While adjustments may be needed, a complete disappearance is highly unlikely.

Myth 2: “Trump’s Presidency Means My Benefits Will Be Cut.”

Reality: Despite political speculation, Trump and Social Security policies during his first term did not result in benefit cuts. While long-term funding solutions remain necessary, Trump has stated he supports maintaining benefits, particularly for current retirees.

Myth 3: “You Can’t Rely on Social Security for Retirement.”

Reality: While Social Security shouldn’t be your only source of retirement income, it’s designed to be a foundational safety net — particularly for middle and lower-income Americans. Planning for additional savings is crucial, but we believe dismissing the program’s role entirely is unnecessary.

What Can You Do to Prepare for Social Security Changes?

While it’s important to stay informed about potential policy changes, your best defense against uncertainty is proactive planning. At Towerpoint Wealth, we work with our clients to create a financial plan that allows them to retire with confidence.

Here are some of our top tips to help investors prepare for potential changes to Social Security and navigate external circumstances:

- Diversify Your Retirement Income: Relying solely on Social Security is risky. Incorporate retirement accounts (401(k)s, IRAs), taxable investment accounts, and other income sources to build a comprehensive financial plan.

- Maximize Social Security Benefits: Strategize your claiming age. While you can start benefits as early as age 62, waiting until your full retirement age — or even delaying until age 70 — can significantly increase monthly payments.

- Stay Informed About Policy Developments: Keep an eye on how policy discussions around Social Security in 2025 evolve. Changes to cost-of-living adjustments (COLAs), taxation of benefits, or eligibility criteria could affect your planning strategy.

- Consult a Fiduciary Financial Advisor: A fiduciary advisor can help you navigate complex decisions about when to claim benefits, how to manage taxes on Social Security, and how potential policy shifts may affect your retirement plan.

Planning Beyond the Headlines

Social Security’s future is a legitimate concern, especially with media speculation and political debates surrounding Trump on Social Security. However, despite dire headlines and campaign rhetoric, we believe the program is by no means disappearing. While reforms are necessary to maintain its long-term health, complete elimination doesn’t appear to be on the table.

Rather than focusing on fear-driven narratives, the best approach is to stay informed, advocate for thoughtful policy solutions, and work with a trusted financial advisor to align your retirement plan with potential changes. By doing so, you’ll be better prepared — no matter what political shifts or economic challenges lie ahead.

At Towerpoint Wealth, we help clients navigate uncertainty with comprehensive financial plans designed to withstand market fluctuations, policy changes, and economic shifts.

If you’re concerned about how potential Social Security reforms — including those under a possible Trump presidency — might affect your retirement, we invite you to schedule a 20-minute “Ask Anything” conversation today!

Social Security may be evolving, but with the right plan, your financial security doesn’t have to be left to chance. Let’s build a strategy that aligns with your goals — today, tomorrow, and beyond.