When it comes to investing, the goal is simple: buy low, sell high.

But as any experienced investor knows, the reality can be far more complicated.

Despite having access to more financial data, information, and knowledge than ever before, translating that into true wisdom can be difficult for many investors. Oftentimes, we can fall into the same trap, buying into assets when they are “hot,” and prices are high, and then selling them when they’re “not,” and prices are low. It’s not a matter of logic. It’s a matter of human psychology.

In fact, research shows that emotion-driven decisions are one of the biggest threats to longer-term financial and investment success. Market euphoria can tempt investors to chase performance, while fear and uncertainty can lead to panic selling at exactly the wrong time.

At Towerpoint Wealth, we believe understanding these emotional tendencies and investment psychology is essential to sound financial planning and investing. Building lasting wealth isn’t just about selecting the right investments. It’s about maintaining perspective, discipline, objectivity, and a plan that helps you stay the course, even when emotions run high.

In this article, we’ll explore why investors so often make decisions that go against their best interests, and more importantly, what YOU can do to avoid those pitfalls. Because while market cycles may be out of your control, how you respond to them is not.

Key Takeaways

- Emotional biases like fear, greed, and FOMO often drive investors to buy high and sell low, hurting long-term returns.

- Market volatility is normal; reacting impulsively to it is not a strategy.

- A written, goals-based wealth management plan can help anchor decision-making during market swings.

- Rebalancing, diversification, expense reduction, and tax-aware planning are practical tools to stay disciplined.

- Working with a fiduciary financial advisor provides the guidance and perspective needed to avoid costly emotional mistakes.

Understanding Market Cycles

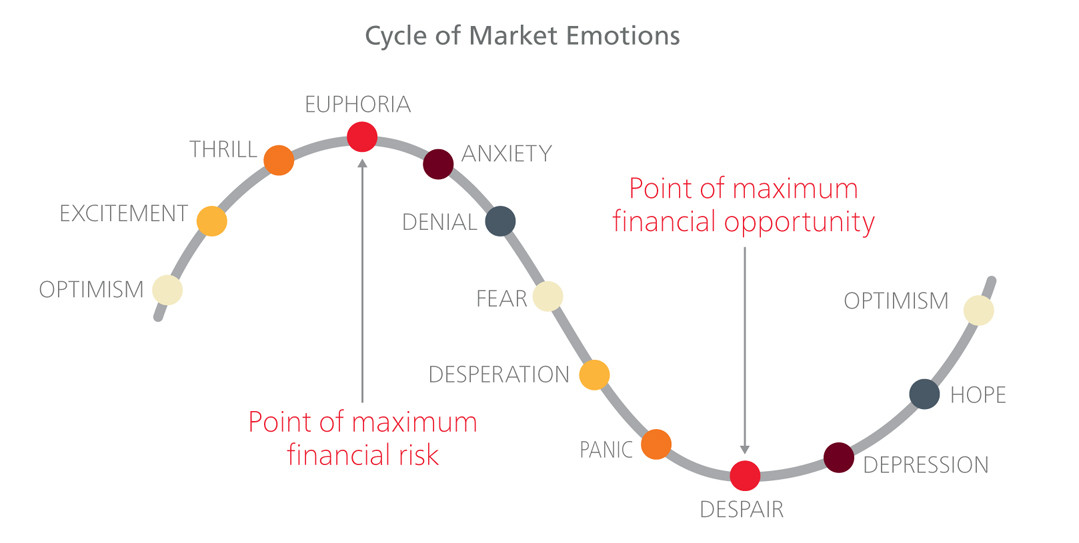

Markets move in cycles, periods of expansion followed by contraction, growth followed by pullbacks. While every cycle is unique in its timing and causes, the emotional patterns investors experience during them tend to follow a predictable rhythm.

Let’s look at the typical market cycle through a psychological lens:

Optimism → Excitement → Euphoria

During the early and mid-stage of a bull market, optimism builds as economic indicators improve and markets trend upward. As the rally continues, excitement takes hold, followed by a feeling of euphoria when returns begin to feel “guaranteed.”

At this stage, many investors begin to pile in. Unfortunately, this is also when asset prices are often at or near their peak. Buying high may feel like a smart move when everyone else is doing the same.

Anxiety → Denial → Fear

When growth begins to slow or volatility picks up, anxiety sets in. Investors may convince themselves the dip is temporary, but as the market continues to fall, fear takes hold.

It’s here that many begin to question their strategy… or abandon it entirely. They may reduce their exposure, sell at a loss, or sit on the sidelines “until things feel more stable.”

In other words, they sell low.

Panic → Despair → Depression

The deepest point of the cycle is when panic selling occurs. Prices fall sharply, and pessimism dominates headlines. It’s often the moment of maximum financial opportunity and maximum emotional pain.

Many investors sell here, hoping to stop the bleeding, locking in losses that may take years to recover.

Hope → Optimism

Eventually, markets stabilize. Slowly, confidence returns. Those who remained invested begin to see their portfolios recover, while those who exited may re-enter later, having missed the rebound.

And so, the cycle begins again.

At Towerpoint Wealth, we believe that understanding this cycle (and your own emotional responses to it) is one of the most powerful tools for building, protecting, and sustaining longer-term wealth.

While the data behind market cycles is rational, investor behavior often isn’t, and that’s where market psychology comes into play.

Why Investors Buy High and Sell Low

Even seasoned investors can fall into emotional traps that sabotage their financial plans. While it’s easy to say “buy low and sell high,” investment psychology often leads us to do the exact opposite, especially when markets are volatile or headlines are loud.

Let’s unpack the key emotional and cognitive biases that contribute to this behavior.

Herd Mentality: The FOMO Trap

When markets are soaring and everyone seems to be making money, it’s easy to feel like you’re missing out. That’s the emotional pull of herd mentality, the tendency to follow the crowd, even when it goes against logic or strategy.

We’ve seen this during every major bull market: investors flood into hot stocks, trending cryptocurrencies, or speculative assets, not because of fundamentals, but because others are doing it.

The fear of missing out (FOMO) becomes stronger than the discipline to follow a long-term plan, often leading to euphoric buying near market tops.

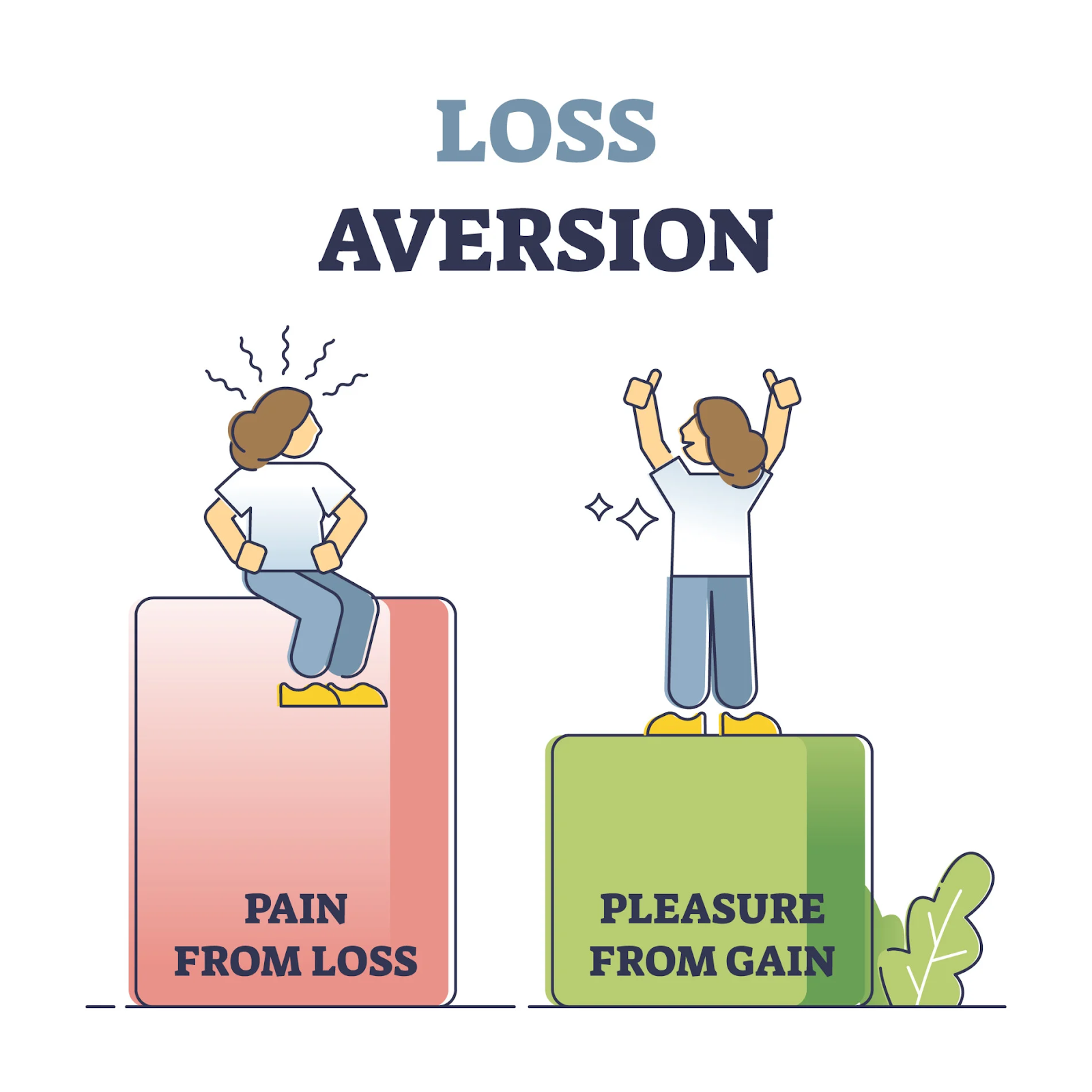

Loss Aversion: Fear Over Fundamentals

On the flip side, loss aversion causes investors to overreact to downturns.

Research shows that people feel the pain of a loss more intensely than the pleasure of a comparable gain, in some cases, by a factor of two.

So when the market drops, even temporarily, panic selling can kick in. Investors might offload assets during a correction, not because the long-term fundamentals have changed, but because they want to “stop the bleeding.” Unfortunately, this emotional reaction often locks in losses and misses the eventual recovery.

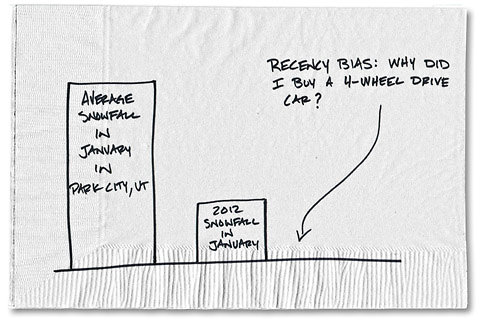

Recency Bias: Mistaking Now for Always

Recency bias is a behavioral finance bias that leads investors to assume that what’s happening now or in the recent past will continue into the future.

When markets rise for an extended period, it can feel like they’ll never fall again, encouraging riskier behavior and aggressive bets.

The reverse is true in bear markets. After a prolonged decline, pessimism takes over. Investors may feel like things will never recover, even when history strongly suggests otherwise. This can result in abandoning strategies at the worst possible time.

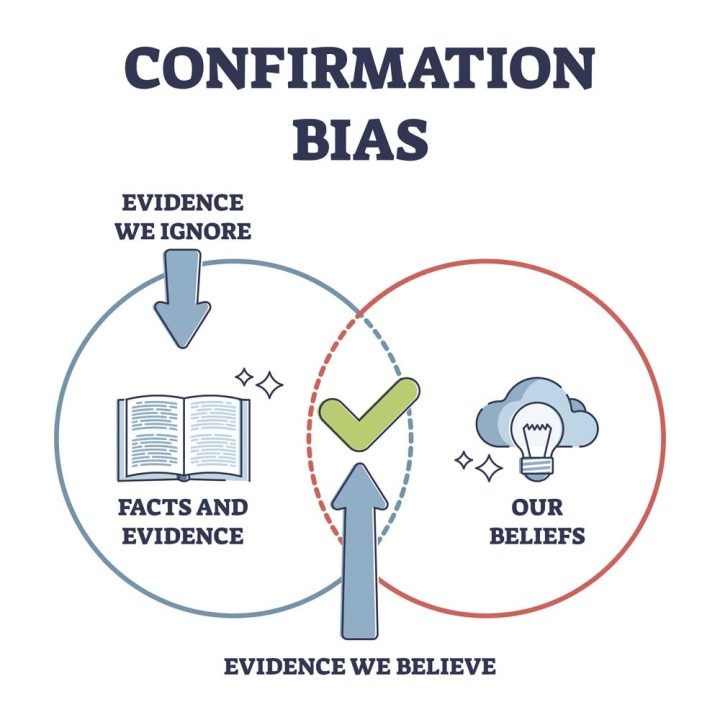

Confirmation Bias: Seeing What You Want to See

Confirmation bias causes us to seek out and believe information that supports our existing views, while ignoring data that contradicts them.

In investing, this might look like clinging to overly optimistic forecasts during a bubble (the part of you that says “This time it’s different!”), or doomscrolling bearish predictions during a downturn.

Either way, it reinforces emotional decision-making and reduces objectivity in your investment decisions.

Understanding these biases is the first step toward overcoming them. At Towerpoint Wealth, we help clients counteract emotion with compassion, education, structure, and perspective — guiding them to stay focused on longer-term outcomes rather than shorter-term noise.

The Real Cost of Emotional Investing

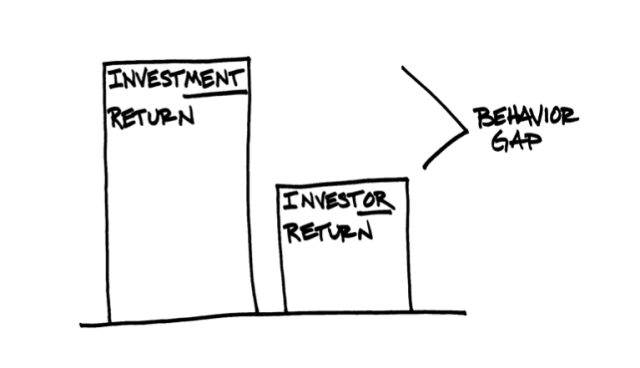

It’s one thing to talk about behavioral finance biases in theory, but the cost of emotional investing is more than a hypothetical. It’s measurable, and for many investors, substantial.

When market psychology turns from optimism to fear, even disciplined investors can get swept up in the emotional tide. According to the DALBAR Quantitative Analysis of Investor Behavior, the average equity fund investor dramatically underperforms the broader market over time. Why? Poor timing.

In 2024, the S&P 500 returned 25.02%, while the average investor earned just 16.54%. That gap of nearly 8.5% isn’t due to fees or bad luck; it’s primarily driven by buying high and selling low.

In other words, it’s not the market that sabotages returns; it’s investor behavior.

We saw this play out in real time during several recent market cycles:

- 2008 Financial Crisis: As fear overtook rationality, many investors bailed out near the bottom, only to miss the recovery that followed and one of the longest bull markets in history.

- COVID-19 Market Dip (March 2020): In just a few weeks, the market plunged more than 30%. Investors who sold in panic missed the near-immediate rebound, with the S&P 500 fully recovering by August of the same year.

- 2022 Selloff: As inflation surged and rates climbed, markets slid sharply. Many shifted to cash or “safer” assets — only to watch markets rebound in 2023, while they remained on the sidelines.

These aren’t isolated incidents; they’re reminders of how emotion, not economics, often drives costly decisions. At Towerpoint Wealth, we help clients avoid those missteps by anchoring their strategy in discipline, perspective, and longer-term thinking, not fear or hype.

Strategies to Stay Grounded and Rational When Investing

Market cycles are inevitable. Emotional reactions don’t have to be.

At Towerpoint Wealth, we believe successful investing isn’t about predicting the future — it’s about managing behavior in the present. Staying grounded during uncertainty begins with having a strategy built to weather it.

Here are five key strategies we encourage our clients to follow, especially when emotions run high:

1. Have a Written, Goals-Based Plan

When the market is volatile, a clear, customized financial plan becomes your anchor. A written plan reframes the conversation away from temporary market swings and toward your long-term goals.

Whether your objective is to retire comfortably, leave a legacy, or simply build security, your plan should reflect those goals and help guide your decisions, especially during turbulent times. Without that framework, short-term headlines can quickly lead to reactionary, and often costly, choices.

2. Rebalance with Discipline

Rebalancing is one of the simplest ways to counteract emotional investing, yet it’s often overlooked. The idea is straightforward: periodically sell assets that have appreciated beyond your target allocation, and buy those that have lagged.

This disciplined process provides a structured counterweight to the psychology of market cycles, nudging investors to act rationally when their emotions might suggest otherwise, and keeps their portfolios aligned with their original strategy.

At Towerpoint, we view rebalancing as a strategic opportunity to make thoughtful, tax-efficient adjustments that support your broader goals.

3. Work with a Fiduciary Financial Advisor

Even the most seasoned investors benefit from an objective voice, someone who isn’t emotionally tied to your portfolio but who deeply understands your financial picture.

That’s where a fiduciary financial advisor plays a critical role.

A fiduciary financial advisor is legally and ethically obligated to act in your best interests, 100% of the time. Their advice is not based on commissions, corporate mandates, or product sales, but on you. This means helping you stay focused on your goals, not the noise, and offering steady, objective advice when emotions are running high.

At Towerpoint Wealth, we serve not only as planners and investment professionals, but also as a support system. In moments of uncertainty, we help clients zoom out, stay focused, and make decisions aligned with long-term success, not short-term noise.

4. Control What You Can Control

No one can control the direction of the market.

But investors do have control over several high-impact variables, such as how much you save, how your portfolio is diversified, where assets are held (asset location), and how you manage expenses and taxes along the way.

Focusing on these controllable elements creates a sense of progress and stability, even when markets feel chaotic.

5. Tune Out the Noise

Financial media thrives on drama. Market pullbacks are called crashes. Slowdowns become crises. And conflicting predictions tend to dominate the headlines.

While staying informed is important, reacting to every twist and turn is not. One of the most valuable habits an investor can build is the ability to distinguish signal from noise. Put differently, avoid being a pinball!

At Towerpoint, we help clients filter through the static, identifying what actually matters to their plan and what doesn’t.

Market Cycles Are Normal… and Investable

Market volatility often feels like a threat. But in reality, it’s a feature, not a flaw, of investing.

Just like the seasons, market cycles are part of a natural rhythm. Periods of expansion are followed by contraction. Bull markets give way to corrections. Bear markets, while uncomfortable, have never been permanent.

In fact, every bear market in modern history has eventually been followed by a full recovery, and often, by new market highs. What separates successful investors from the rest is not the ability to predict these cycles, but the discipline to stay invested through them.

Trying to time the market, jumping in and out based on headlines, is rarely successful. But having a plan that accounts for volatility and sticking to it can be a powerful tool for longer-term wealth building.

We encourage our clients to see volatility not as a danger to be avoided, but as a reality to be expected and planned for.

Rational Strategies Over Reactive Decisions

Investing is as much a psychological endeavor as it is a financial one. That’s why our philosophy at Towerpoint Wealth is built on clarity, not emotion.

We believe in rational strategies over reactive decisions. In education and planning over predictions and guesswork. And in serving as a steady fiduciary partner who helps you stay focused, not just on returns, but on your greater goals.

We don’t chase trends. We don’t overreact to noise. And we don’t believe success comes from trying to outsmart the market.

Instead, we work closely with clients to build resilient, goals-based plans that help weather the inevitable ups and downs of the market with confidence, perspective, and intention.

Bottom Line

Market cycles will come and go, just as they always have. But investor behavior remains one of the most consistent determinants of longer-term investment outcomes. Buying high and selling low isn’t a flaw in the market; it’s a consequence of emotional decision-making. Fortunately, that’s something investors can be aware of and change.

With a well-constructed plan, a clear understanding of your goals, and the right behavioral guardrails in place, it’s possible to stay invested through uncertainty and emerge stronger (and wealthier!) on the other side.

At Towerpoint Wealth, we help clients navigate volatility with discipline, not panic or emotion. We build plans designed to endure full market cycles, not just favorable conditions. And we remain focused on what matters most: helping you make rational decisions in pursuit of your financial goals.

If you’re unsure whether your current investment strategy is built to withstand the next downturn, or even the next euphoric rally, let’s talk.

We invite you to schedule a 20-minute “Ask Anything” call to evaluate whether your approach aligns with both your long-term objectives and your emotional tolerance for risk.