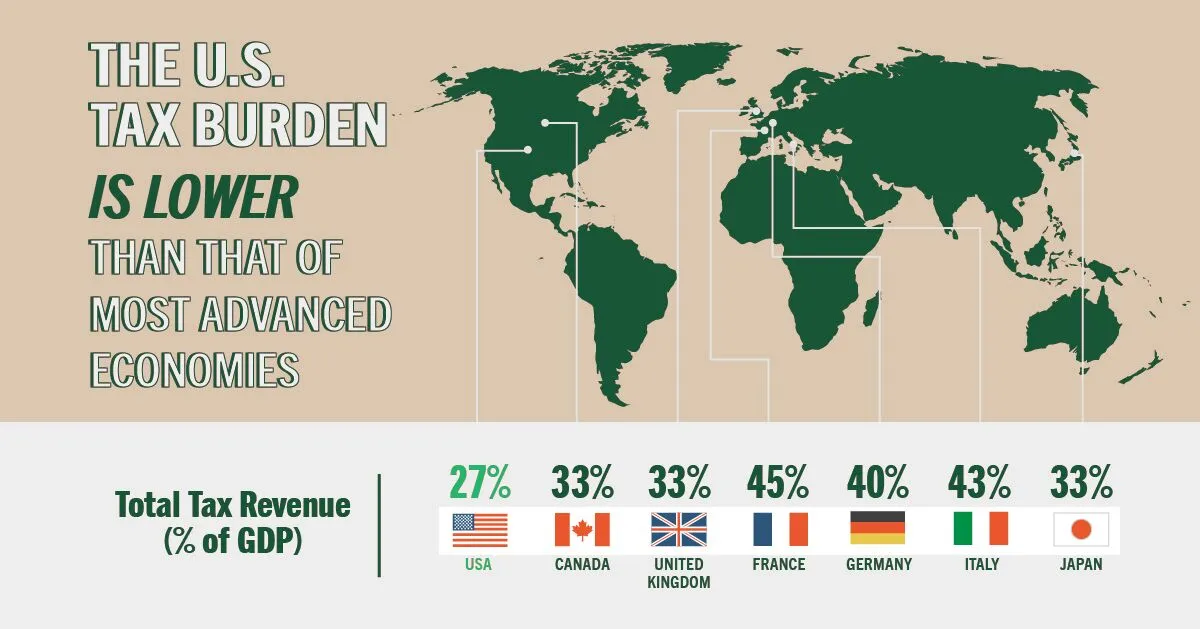

The comparative tax burdens between the United States and several other advanced economies. The central message highlights that the U.S. has a significantly lower tax burden, with total tax revenue constituting 27% of its Gross Domestic Product (GDP). This figure is notably lower than the tax revenue percentages of other major economies such as France (45%), Germany (40%), and Italy (43%).

The lower tax revenue as a percentage of GDP in the U.S. suggests a relatively lighter tax load on its economy compared to these nations. This can impact the level and scope of public services and infrastructure the government can provide. Countries with higher tax revenues often fund extensive social welfare programs, healthcare, and other public services, reflecting their socio-economic policy choices. In contrast, the U.S. tends to rely more on private and state-level initiatives for services that other countries might provide at a national level through higher taxation. This comparison underscores the diversity in economic policy approaches among advanced economies, each balancing taxation, public service provision, and economic growth differently.

If you are concerned about how your tax burden affects your financial future and wealth growth, it's essential to understand your options and plan strategically. Contact us today to set up an initial analysis. Our experts can help you assess your current tax situation, explore strategies to minimize your tax liabilities, and align your financial planning with your long-term goals. Don't let uncertainty about taxes hinder your financial growth—reach out now for tailored advice and proactive solutions.

Thank you to the Peter G. Peterson Foundation for this infographic.