October might be the season for ghosts and goblins — but when it comes to your finances, the only thing scarier than Halloween decorations is heading into year-end unprepared.

Between tax surprises, investment decisions, and key retirement deadlines, small oversights now can turn into big financial frights later.

That’s why Q4 is the perfect time to slow down, take stock, and make sure your year-end financial checklist is complete. Proactive year-end tax planning and financial planning can help you minimize surprises, reduce your tax bill, and start the new year with clarity and confidence.

Whether it’s reviewing your budget, harvesting tax losses, checking your RMD (and being aware of RMD deadlines), or fine-tuning charitable giving strategies, a little planning and coordination now can make a big difference come 2026.

So, before you carve the pumpkins and close the books on 2025, let’s walk through the key items to review — and how working with a fiduciary financial advisor can help you avoid any financial frights before year-end.

Key Takeaways

- A proactive and coordinated year-end financial checklist helps you minimize taxes, align goals, and enter the new year with clarity and confidence.

- Reviewing your budget, cash flow, and investment allocation ensures your financial plan and investment strategy still reflect your current personal and financial goals, as well as market conditions.

- Smart tax and retirement moves before December 31 can strengthen your financial position and prevent costly surprises.

- Strategic charitable giving can support your legacy while enhancing longer-term tax efficiency.

- Partnering with a fiduciary financial advisor brings discipline and coordination, turning a potentially stressful year-end into a confident close and a strong start to 2026.

1 | Perform a Cash Flow and Budget Review

Before you finalize your year-end planning, take a hard and honest look at your cash flow. Think of it as “facing the numbers” before the calendar resets. A budget review isn’t just about tracking where your money went; it’s an opportunity for you to be mindful of how your spending and saving support your bigger, longer-term goals.

Start by comparing this year’s spending patterns to your expectations. Did certain expenses creep up — travel, dining, or subscriptions? Or did a windfall, bonus, or inheritance increase your cash on hand?

If you find excess cash sitting idle, consider redirecting it toward debt reduction, investment contributions, or charitable giving before the year’s end. Even small reallocations can have a meaningful compounding impact over time.

Looking ahead, you can also use this review to establish your 2026 baseline budget. If your circumstances have changed — a new job, a home purchase, or retirement — your spending and savings plan should reflect that.

Finally, we urge you to remember: a budget isn’t a constraint, it’s a control mechanism. One that helps you make intentional choices about your money instead of reactive ones. Reviewing it now can ensure that your year-end financial checklist sets the stage for a smoother, more confident financial year ahead.

2 | Conduct an Investment Review

Once you’ve reviewed your budget and cash flow, the next step on your year-end financial checklist is to assess your investments and portfolio.

Markets rarely move in a straight line, and over the course of a year, volatility and interest rate shifts can quietly distort even a well-diversified portfolio.

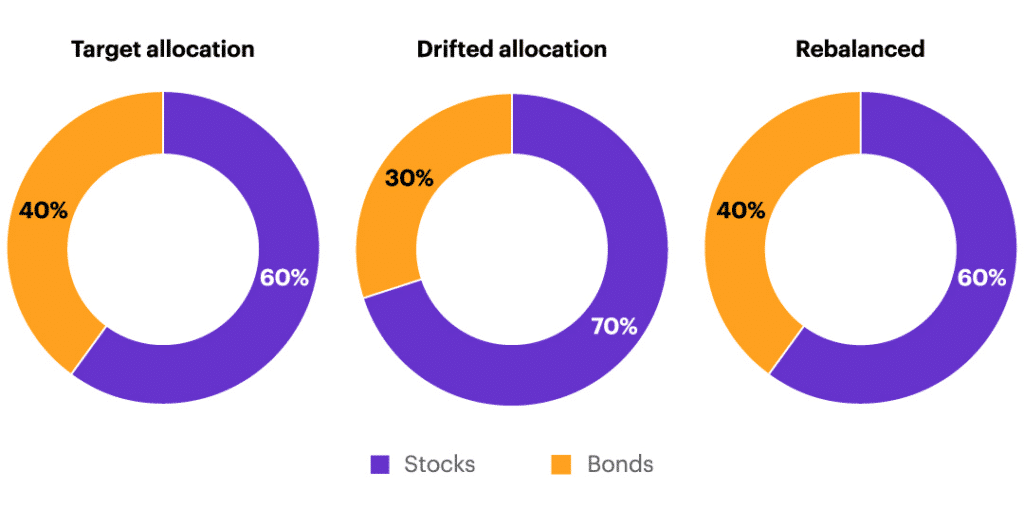

Start by reviewing your asset allocation — how your investments are diversified among stocks, bonds, cash, and alternatives — and ask: does your current mix still reflect your goals and comfort with risk? A strong year in equities or a pullback in bonds may have tilted your portfolio’s balance more than you realize.

If that’s the case, it might be time to rebalance. Strategic rebalancing helps bring your portfolio back in line with your intended strategy, ensuring you’re not unintentionally taking on more or less risk than you planned.

It’s also worth examining performance relative to meaningful benchmarks; not headlines or friends’ portfolios, but your personal goals and time horizon.

Finally, take a close look at how diversified your holdings truly are. Effective diversification means having a mix of assets that behave differently in various market environments, so that when one area dips, others can help steady your returns. It’s one of the most reliable ways to pursue growth while keeping risk in check.

At Towerpoint Wealth, we help clients analyze where their portfolios stand, how they are correlated, what adjustments make sense, and how to stay disciplined through changing markets. The key is to review, not simply react. A well-structured investment and portfolio review can keep your longer-term strategy on track — no matter what the markets do next.

3 | Year-End Tax Planning Moves

As the year winds down, October through December is prime time for smart tax positioning. The window for meaningful year-end tax planning is short, but the potential impact can be long-lasting.

Thoughtful adjustments now can help minimize taxes, maximize deductions, and set you up for a smoother April and a stronger start to the new year.

Tax-Loss Harvesting Strategies

One of the most powerful tools to consider is tax-loss harvesting. For investors, this strategy means selling investments that have declined in value to offset gains elsewhere in your portfolio. It’s not about timing the market, but about using temporary losses to reduce your overall tax bill.

Tax-loss harvesting strategies can also help rebalance your portfolio and reinvest in similar (but not identical) securities to maintain proper market exposure without triggering wash-sale rules.

Strategies for Charitable Giving

Another area to review is charitable giving. Making use of sound financial strategies for charitable giving can make a real difference for investors, both personally and financially.

Options like donor-advised funds (DAFs) allow you to make a large charitable contribution before year-end, potentially claim the tax deduction now, and distribute grants to charities over time. For retirees taking Required Minimum Distributions (RMDs), Qualified Charitable Distributions (QCDs) offer another powerful strategy — allowing up to $100,000 per year from your IRA to be directed directly to a qualified charity, tax-free.

Even if you’re not itemizing, “bunching” charitable gifts into a single year can help you exceed the standard deduction and unlock greater tax benefits.

Finally, remember that effective year-end tax planning isn’t just about isolated moves — it’s about coordination. At Towerpoint Wealth, we work closely with clients’ CPAs to ensure tax strategies complement your broader financial plan, balancing your personal and investment goals, cash flow needs, and longer-term wealth preservation.

Smart, proactive planning now can mean fewer financial frights when tax season arrives.

4 | Don’t Miss Key Retirement Deadlines

As the year-end approaches, it’s also time to double-check your retirement-related deadlines — because missing them can be costly.

Required Minimum Distributions (RMD Deadlines)

For those age 73 or older, Required Minimum Distributions (RMDs) must be taken from traditional IRAs and most employer retirement plans before December 31 each year. These withdrawals are mandated by the IRS to ensure that retirement savings are eventually taxed.

Missing your RMD deadlines can trigger a steep penalty (up to 50% of the amount that should have been withdrawn), though recent changes allow for some flexibility if corrected quickly. Still, it’s a mistake best avoided through proactive planning.

For retirees with charitable intentions, there’s a smart alternative: Qualified Charitable Distributions (QCDs).

As we’ve discussed, these allow you to transfer up to $100,000 per year directly from your IRA to a qualified charity. The amount counts toward your RMD but isn’t included in your taxable income, making this a powerful way to give back while reducing your tax bill.

Maximize Your Contributions

If you’re still in the saving phase, year-end is the perfect time to maximize contributions.

401(k) contributions must be made by December 31, while IRA and HSA contributions can continue until April 15 of the following year. These contributions not only lower taxable income (for traditional accounts) but also strengthen your longer-term retirement strategy.

Finally, review your overall retirement income plan in light of this year’s market performance, inflation trends, and tax bracket changes. Even small adjustments to withdrawal timing or account sequencing can lead to meaningful tax savings and more sustainable and tax-optimized income in retirement.

At Towerpoint Wealth, we help clients stay ahead of these deadlines — not just to avoid penalties, but to ensure every decision supports their broader retirement and wealth goals.

5 | Charitable Giving and Legacy Planning

As the year draws to a close, it’s a great time to review your charitable giving strategies; not just as a way to reduce your tax bill, but as a chance to create lasting impact.

Thoughtful giving serves two purposes: it supports the causes you care about and helps manage your taxable income.

For some, that might mean contributing to a donor-advised fund to streamline giving across future years. For others, it may involve gifting appreciated investments, which can reduce capital gains while maximizing impact.

Looking ahead, there’s a new opportunity worth noting for 2026: the reinstatement of above-the-line charitable deductions for non-itemizers. This provision allows individuals who take the standard deduction — rather than itemizing — to still deduct cash donations to qualifying public charities, up to $1,000 for single filers or $2,000 for married couples filing jointly.

While donations to donor-advised funds or private non-operating foundations don’t qualify, this change encourages broader participation in charitable giving by allowing more taxpayers to benefit directly from their generosity.

These strategies are most effective when they fit seamlessly within your broader financial and estate plan as part of a coordinated approach to purpose-driven wealth.

Legacy planning goes hand in hand with giving. It’s about defining how your financial success can create a longer-term impact — for your family, your community, and the values you stand for. Reviewing your estate documents and ensuring your charitable intentions are clearly outlined can help avoid confusion later and make sure your legacy reflects both generosity and foresight.

At Towerpoint Wealth, we help clients integrate charitable giving into their comprehensive wealth strategy — ensuring your giving is intentional, sustainable, and deeply personal.

6 | Prepare for the Year Ahead

With your year-end checklist nearly complete, the final step is preparing for what’s next.

A new year brings new opportunities, and sometimes new financial challenges. Reviewing your overall plan now helps ensure you’re ready to move confidently into 2026.

Start with the essentials: insurance coverage, estate documents, and beneficiary designations. Life changes such as marriage, divorce, new children or grandchildren, or the purchase of property can all affect these areas. Outdated designations or missing documents are among the most common — and easily preventable — financial oversights.

Next, review your progress toward key savings and retirement milestones. Are you on track to meet your 401(k) or IRA goals? Has your cash reserve or emergency fund kept pace with rising expenses? A quick financial “health check” now can prevent larger adjustments later.

This is also the time to adjust your investment or tax strategy for any expected shifts in 2026, whether policy changes, income variations, or retirement transitions. Small refinements today can lead to significant benefits down the road.

At Towerpoint Wealth, we believe financial success isn’t about trying to accurately predict the future; it’s about planning for it. Before the year closes, take the opportunity to meet with your fiduciary financial advisor for a coordinated review of your entire financial picture.

Final Thoughts

At Towerpoint Wealth, we strongly believe financial confidence isn’t built overnight; it’s built through preparation and coordination.

The final months of the year are your opportunity to take control: to review, refine, and realign your financial plan so you enter the new year with clarity and confidence.

Proactive, fiduciary financial planning means more than just checking boxes on this year-end financial checklist. It’s about coordinating every part of your financial life — investments, taxes, retirement, estate, and charitable giving — so they all work together toward your longer-term goals.

Our team helps clients approach year-end planning with purpose. We review portfolios for opportunities, verify deadlines are met, and identify strategies that can reduce taxes while strengthening your financial foundation for the year ahead.

If you’d like to ensure your plan is ready for the close of the year — and positioned for success in 2026 — we invite you to schedule a 20-minute “Ask Anything” conversation with our team. It’s a simple, no-pressure way to confirm your strategy, gain peace of mind, and finish the year strong.