Manage Costs and Investment Expenses

Investment costs and fees add up, but can be minimized

Utilize Tax Minimization Strategies

You can count on steady headwinds from investment costs and fees - and of course income tax bills from Uncle Sam. You’ll inevitably face these necessary evils as you work to build and protect your net worth, but with intelligent and proactive planning, you to have a degree of control over them. In other words, we can select our vessels, and, to finish the metaphor, we can control the sail.

The markets go up and down. The economy is uncontrollable and unpredictable. We can’t guess about the next political headline and how it will affect our bottom line, and above all, we can’t control them. There’s an old sailing metaphor that begins: We can’t control the wind.

What’s ultimately important for your financial peace of mind is not what you make but what you keep. Identifying and controlling these necessary evils is crucial for wealth management.

What can you do to minimize their impact as you grow net worth? How can you keep sailing in the right direction?

Manage Costs and Investment Expenses

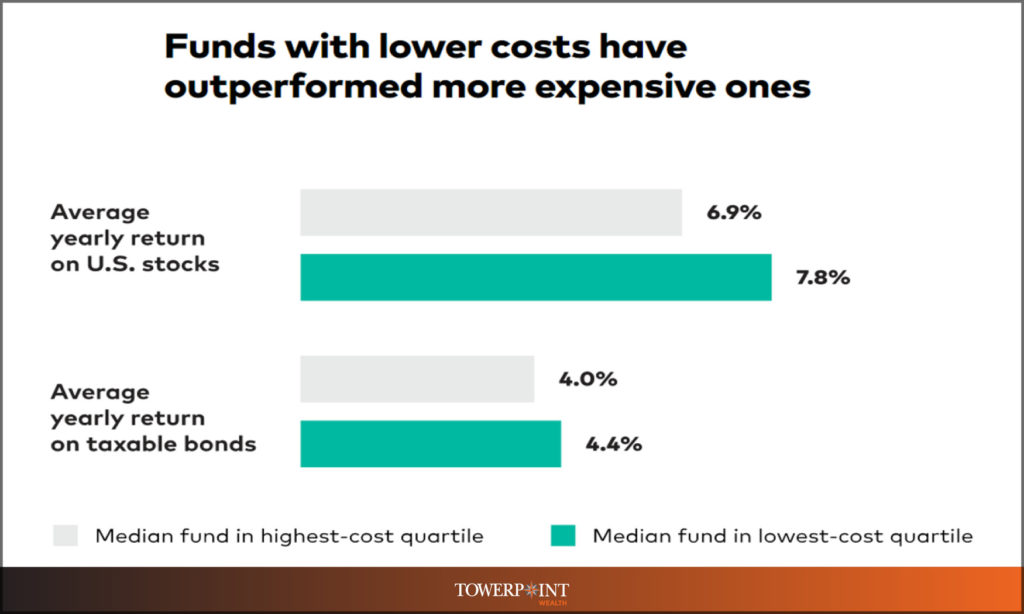

We consider costs and investment expenses to be one of the two things that impede the growth of a client’s net worth and portfolio. Studies have repeatedly shown that reducing costs can drastically increase the probability of success in one’s portfolio. At the same time, we believe that picking funds simply by lowest fee can sometimes be short-sighted. One must consider the expenses of an investment within the larger spectrum of its overall merit. You can get better “mileage” out of a portfolio by managing and reducing the drag of costs and expenses.

Investment costs and fees add up, but can be minimized

Because fund investors don’t receive a bill in the mail to physically write a check to pay the internal costs and expenses of their diversified investment funds—these are paid directly out its returns—a large number of investors don’t even know how much they are paying in fees and investment costs. This is money you earn but never see! Since one of the easiest ways to bolster your returns and to better grow and protect your net worth is through expense, fee, and cost reductions, it pays to be aware.

Consider expenses, control costs:

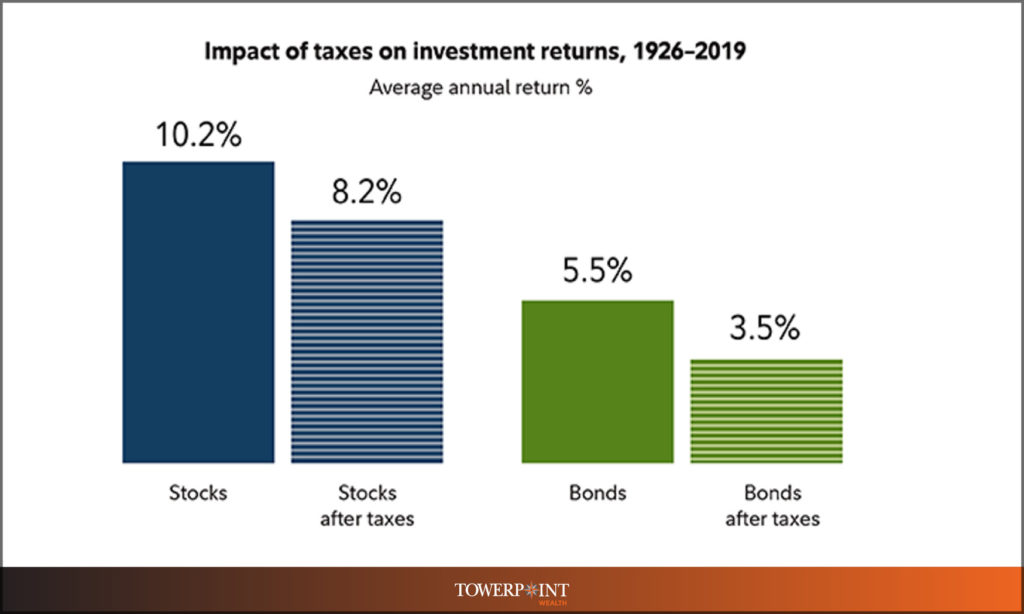

1. Low-cost index funds and ETFs have fewer fees and lower costs than actively managed funds. The more trades you execute, the more fees or commissions you might have to pay. Empirical data suggests that funds with lower costs have actually outperformed more expensive ones.

2. Account custodial fees and trading commissions/costs can be reduced and in some cases eliminated completely. Use a custodian or brokerage firm that doesn’t charge for these things. For example, Towerpoint Wealth partners with Charles Schwab as our custodian, and our clients do not pay any account custodial fees, nor any stock/ETF trading commissions.

3. Institutional funds and no-commission (no-load) funds are out there. Make sure your financial advisor recommends them to you over commission or high-load funds, assuming all else is equal.

4. Company-sponsored retirement plans may have hidden fees. You can ask to see the summary plan description, also known as the plan document. If your menu of investment choices is a limited selection of high-expense/high-fee funds, ask your plan administrator what lower-cost options are available to you.

5. Fiduciary financial advisors are legally responsible for putting their clients’ personal and financial interests before their own, and always acting in their clients’ best interests, 100% of the time. This means they won’t sell you something that is simply suitable for your needs and will pay them a large commission. A fiduciary financial advisor is compensated generally via an annual, asset-based fee that is computed based on a percentage of the client’s assets the advisor manages.

A financial advisor who is not a fiduciary can receive compensation via hidden compensation derived from products that can have higher fees and expenses. In fact, the White House Council on Economic Advisers has discovered that non-fiduciary advice leads investors to pay higher fees and expenses to the tune of $17 billion a year!

Utilize Tax Minimization Strategies

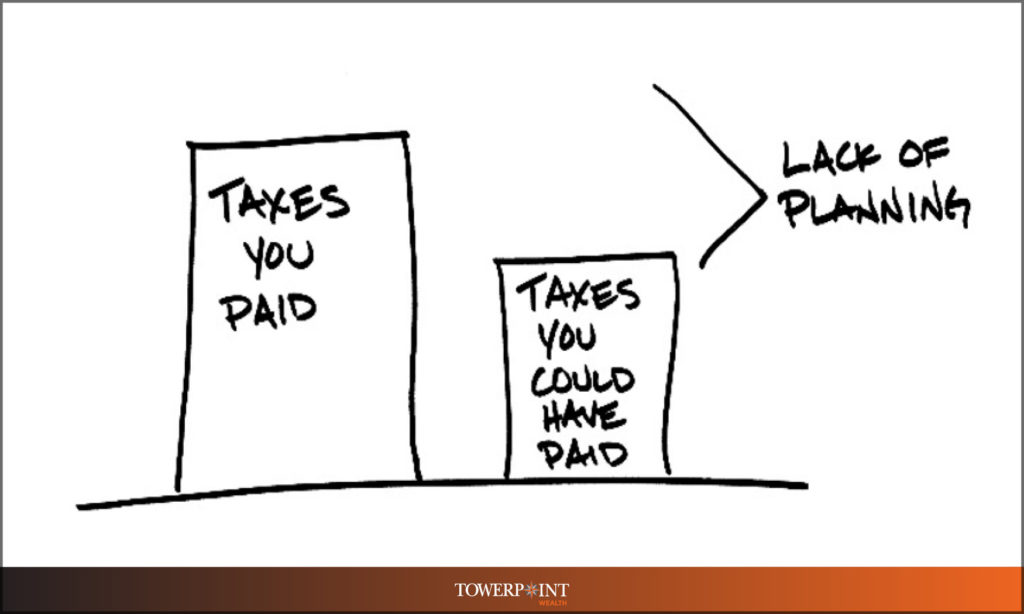

Taxes are the second of the two inevitable headwinds mentioned above, and can severely impact investment returns if not monitored and controlled. You want to keep the tax impact of investments and portfolios minimized, while not allowing tax implications to be the sole criterion. Utilizing careful fund screening, intentional asset location, and tax-loss harvesting decisions, through diligence it’s possible to minimize your obligation to Uncle Sam.

Taxes are inevitable, but controllable

Income taxes can drag down the real return of an investment. While financial, investment, or personal decisions should not be made entirely based on taxes, it’s wise to evaluate opportunities to reduce and minimize the income tax drag on your portfolio. You don’t want surprises when it comes time to retire.

Learn and consider ways to reduce taxes:

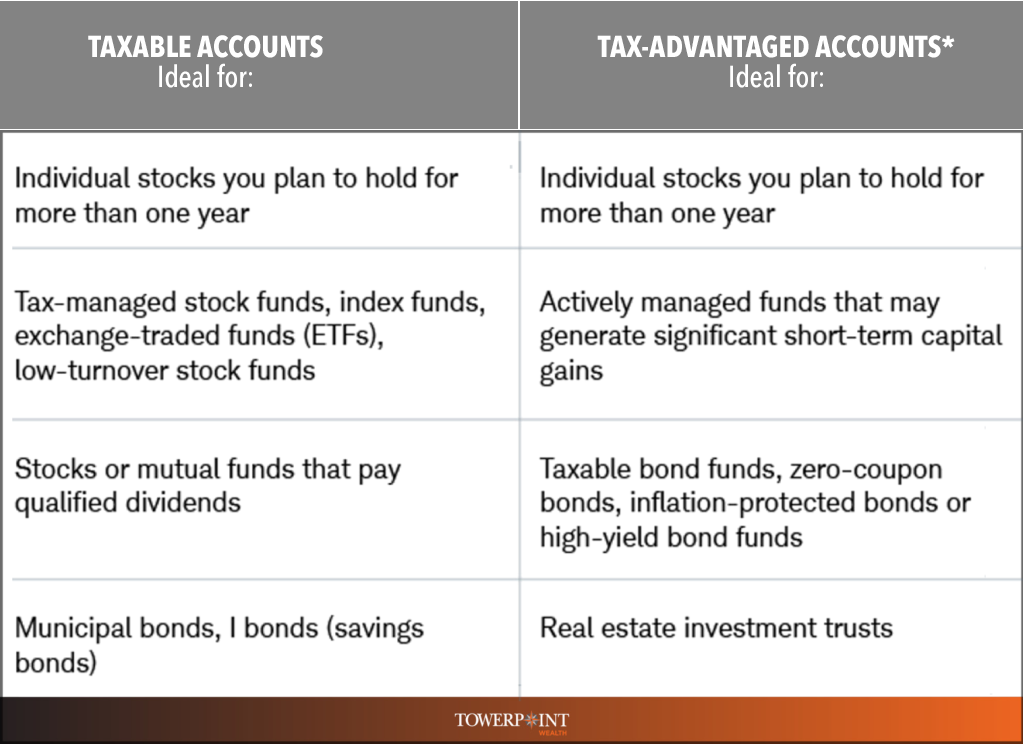

1. You may have a taxable account and also a tax-deferred retirement account. Knowing how to leverage, and what to hold, inside of IRA and 401(k) accounts can have a significant influence on your net, after-tax returns.

2. Speaking of retirement accounts, when setting up your 401(k) beneficiaries, you want to be aware of beneficiary distribution rules, as that will affect the taxes you and your beneficiaries may end up paying.

3. Should you buy and sell in your tax-deferred IRA or 401(k) account, or would it be better to take advantage of the long-term capital gain and/or return of principal opportunities that a “regular” taxable account offers?

4. Certain funds trade less and have lower turnover, tending to be inherently more tax efficient, as compared to funds that do a lot of active buying and selling, which can generate unwanted income and capital gain distributions. Exchange-traded funds, or ETFs, inherently trade less and almost always have a lower tax burden than do regular mutual funds.

5. Tax-loss harvesting and the strategic realization of capital gains can make a huge difference when reducing the overall tax drag of your portfolio. Short-term gains are taxed Federally at higher ordinary income rates, and long-term gains are usually taxed at the lower 15% Federal capital gains tax rate.

6. When taking money from your portfolio, be mindful of the type of account you decide to draw from matters, as does your personal income tax bracket at the time these withdrawals occur.

7. And while we’re on the subject of withdrawals, Required Minimum Distributions (RMD), which you must take after you retire, are also important to consider as you plan. Taxes on RMD will affect what you get to keep.

8. If you get Restricted Stock Units from your employer, consider your RSU selling strategy. Will you have to sell to cover taxes? The same goes for an employee stock purchase plan. ESPP taxation is a unique opportunity to look for tax planning and minimization.

9. Do you own or are you considering real estate or a short-term rental property? You know rentals are good tax return and deduction opportunities. But VRBO taxes and Airbnb taxes are a necessary part of the equation. Also, knowing the intricacies of section 1031 exchanges can help avoid a big tax hit when selling these properties.

10. Tax reduction strategies and modeling are important to look at periodically with a financial advisor and a tax advisor. Is a tax-optimized investment account liquidation, drawdown, and withdrawal analysis part of your wealth management process? A question to ask a financial advisor, for sure.