Building and Protecting Personal Net Worth

Emotional Awareness – Strike a Balance between Life Now and Planning for Later

Financial Advisor vs Financial Planner

Find a Financial Advisor Who Will Understand Your Specific Goals

The First Step – Ask Around!

The Second Step – Find a Legal Fiduciary to Work With

How Does a Financial Advisor Get Paid?

How Do I Know if a Financial Advisor is a Legal Fiduciary to Me?

What Can I Expect From a Good Financial Advisor?

What are the Qualifications for a Financial Advisor?

What Will the Best Financial Advisor Do for Me and My Family’s Assets?

When is the Best Time to Hire a Financial Advisor?

Building and Protecting Personal Net Worth

You're working hard and making money. But accumulating money doesn’t always lead directly to economic peace of mind. This money also has to be managed if it’s going to last through your lifetime. It takes time, expertise, and discipline to consistently manage a plan to protect and build your wealth. It’s common not to have the desire or patience to do this oneself. It’s important to establish and execute on a well-thought out plan, so your net worth will be enough to help you enjoy the rest of your life once you stop working.

Investing, coordinating, protecting, and managing your wealth and assets is a challenge that increases as your net worth does.

This leads to the inevitable question that many investors find themselves asking at some point in their net worth building journey – how and where can I partner with a trustworthy, qualified, and supportive financial advisor who can help me properly manage and coordinate much of this financial heavy lifting? Or in today’s parlance, asking their smartphones to respond to the directive: “Find a financial advisor near me!”

Emotional Awareness – Strike a Balance between Life Now and Planning for Later

Striking the appropriate balance between your career and your family life is challenging and stressful. Adding in the essential responsibility (some might argue “hassle”) of properly managing and coordinating all of your financial affairs creates additional stress and pressure. It is difficult to develop and execute on a well-thought-out and disciplined plan to grow and protect your personal wealth. It’s no wonder this responsibility often gets de-prioritized until you “aren’t so busy.” Additionally, the effort to grow net worth isn’t simply a task, but an ongoing process that requires constant attention and nurturing. The emotional ups and downs of managing one’s wealth are arguably more difficult to manage than the more data-driven aspects. It’s easier to worry about our net worth than it is to nurture it.

Unfortunately, for many of us, we’re looking forward to retirement as our time to be less busy. But the greatest investment planning opportunities, many critical economic decisions, and basic compounding benefits have already passed by the time we get there.

Whether you search for a financial planner vs financial advisor vs wealth manager, you want to know what qualifications for financial advisor matter. You want to find a partner you can trust.

Find a Financial Advisor Who Will Understand Your Specific Goals

Let’s face it, most of us shop for everything on line these days, and shopping for a financial advisor could look something like asking your device to “find a financial advisor near me.” While you could simply enter find a financial advisor near me (or for that matter, find a financial planner near me) in a browser search window and go with the first result, finding a financial advisor who will understand you and your specific needs tends to be the most challenging aspect of hiring one.

Partnering with a financial advisor is about finding one who you trust and feel comfortable with and confident about. They need to be smart, and established, yes, but more than that too. The idea is that you’ll be a partner with them, and be in charge of your own finances. You’re not turning over control. An important part of the wealth building journey is partnering with the right financial advisor. Like finding a trusted doctor, accountant, therapist, or even housekeeper, this may be easier said than done!

The First Step – Ask Around!

When working to find the right financial advisor, the first step to take is to ask friends and colleagues who have a financial advisor to share their experiences with you. What qualifications for financial advisor do they consider?

Finding the right financial advisor should have a lasting positive impact on your financial future, and it is essential you are hiring the right person to partner with. For instance, if you are compensated with restricted stock units or stock options, find out if your colleagues are working with an advisor who has this area of expertise.

Find out if the advisor can help you set up your RSU strategy regarding selling and taxation of restricted stock units.

Are you working towards retirement with 2 million dollars? Are you curious about Right Capital software for retirement planning?

[RM1]Link to https://towerpointwealth.com/5-steps-to-retiring-with-2-million-dollars/

[RM2]Link to https://towerpointwealth.com/sacramento-financial-planning-philosophy-strategy/right-capital-financial-planning-process-retirement-planning-calculator/

To increase your odds of longer-term success, your financial advisor will need to know and understand your financial life and oftentimes many aspects of your personal life as well. Providing the most appropriate and customized advice and counsel can only happen when you are as honest and open with your advisor as you expect your advisor to be with you. When an advisor has a legal responsibility to act in your best interests 100% of the time, he or she is known as a fiduciary.

The Second Step – Find a Legal Fiduciary to work with!

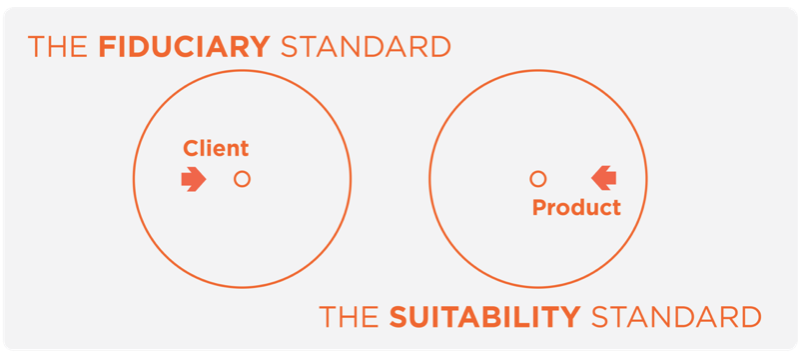

An extremely important step when searching for a financial advisor is to ensure they are professionally bound by the legal fiduciary standard. With the designated duty of fiduciary, a financial advisor is regulated by the Securities and Exchange Commission (SEC), and is legally held to the fiduciary standard: the highest standard in the industry. A fiduciary advisor is required to discharge their planning, counsel, and advice solely in the best interests of the client, even if it means placing the client’s interests ahead of their own.

The suitability standard is in stark contrast to the fiduciary standard. A financial advisor working with the suitability standard is required to make recommendations that are simply “suitable” for a client. Importantly, the suitability standard does not legally require an advisor to act solely in a client’s best interests.

Another significant distinction between these two very different professional standards is how an advisor is compensated.

How Does a Financial Advisor Get Paid?

A fiduciary financial advisor is compensated generally via an annual, asset-based fee that is computed based on a percentage of the client’s assets the advisor manages. A financial advisor who is not a fiduciary can receive compensation via commissions, and hidden compensation derived from products that can have higher fees and expenses. In fact, the White House Council on Economic Advisers has discovered that non-fiduciary advice leads investors to pay higher fees and expenses to the tune of $17 billion a year! Proving something Ben Franklin said in his aforementioned essay:

“You will discover how…small, trifling expenses mount up to large sums, and will discern what might have been…saved.”

How Do I Know if a Financial Advisor is a Legal Fiduciary to Me?

The possibility for conflicts of interest always exists. However, a financial advisor who is a fiduciary is obligated to disclose them to you, and a financial advisor who works under the suitability standard has a much greater possibility for conflicts of interest to occur. Look elsewhere if a prospective advisor is not 100% transparent about answering the following two questions:

- “How exactly do you get paid?”

- “Are you a legal fiduciary to me?”

What Can I Expect From a Good Financial Advisor?

There is no distinguishing set of variables that define a financial advisor vs financial planner or a wealth manager. Because every individual has unique personal and financial circumstances, a crucial first step in working with any financial professional is to jointly discuss your personal and financial goals. While this may seem straightforward, it doesn’t take long for things to become complex and nuanced, especially when you seriously consider responses to the following questions:

- What financial concerns keep you up at night?

- How would you like me to work with you so you can rest soundly?

- What are you working towards in your life?

- What decline in your overall investment portfolio, in hard dollars, would cause you great personal discomfort such as lack of sleep, anxiety, worry, or even despair?

- Why do you think you need financial help and guidance?

- Putting aside the unexpected, what life changes do you expect to occur in the future?

- How do you picture your ideal life three years from now? Five? Ten?

- How would you describe your feelings and experiences about money growing up?

This is a small sample of initial questions a financial advisor may ask you during your initial getting-to-know-you conversations (also known as the discovery process). And the questions should continue, as the right financial advisor will have a sincere interest in you. Separate from the questions to ask when hiring a financial advisor, the questions they ask you should illustrate the depth of your partnership. In addition to asking, listening to, and considering your answers to thoughtful questions such as these, any good advisor will dedicate time and energy to you to develop rapport, and ultimately, trust.

What are the Qualifications for a Financial Advisor?

According to the Bureau of Labor Statistics, there are more than 200,000 people in the US who hold themselves out as financial advisors. Financial planner vs financial advisor vs investment advisor, the actual job title matters much less than the qualifications and experience a prospective financial advisor brings to the table. Qualifications for financial advisors go way beyond whether they have an office near you.

Trust

Regardless of whether you are working with a financial advisor vs. financial planner, do you trust them with not only the intimate details of your financial life, but also with the intimate details of your personal life? The two clearly go hand-in-hand, as a quality financial advisor will help bring alignment between your money and the rest of your life.

Fiduciary Standard of Care

Are they legally bound to serve in your best interests? The opposite of a fiduciary financial advisor is any advisor employed by and first beholden to the company that employs them. Ask any financial advisor at any major Wall Street firm or bank if they are a legal fiduciary, and wait for their response. They are not.

Experience

Has the advisor been around the block, and experienced both good markets and bad? Recessions as well as economic expansions? A quality financial advisor should have a history with many successful and happy clients who are willing to step forward and attest to the advisor’s professionalism and knowledge. In other words, when you search for “financial planner near me,” you should be able to learn a little bit about their qualifications for financial advisor.

In addition to this experience, what kind of training have they had? Are they a Certified Investment Management Analyst or Certified Financial Planner? Do they pursue opportunities for continuing education and growth?

Financial Emotional Awareness

Why do investors feel smarter and more confident when the markets are rising, and dumber and less confident when the markets are declining? One word: emotions. At Towerpoint Wealth, we believe that one of the central qualities of a skilled financial advisor is the ability to help their clients remain objective, avoid overconfidence, or, on the flip side, hopelessness. Managing emotions and remaining objective when making financial decisions is an essential component of longer-term success in building net worth.

What Will the Best Financial Advisor Do for Me and My Family’s Assets?

A quality financial planner will leverage a broad-based array of resources to provide you solutions and advice, much of which you may never have been aware of, thought about, or had access to.

Resources such as Right Capital, which allows us to help our clients position themselves to retire comfortably and confidently.

With the best financial advisor, you will have someone at your side who will help you make smart financial decisions. Want to retire early? Not sure what to do with your RSUs? Not sure if you need an estate plan? You will manage your own money with the guidance of a well-educated, responsive, focused and diligent partner.

At, Towerpoint Wealth, Sacramento wealth management firm, we will learn about your unique history, and help and challenge you to clarify your distinct goals, values, and dreams, rather than simply inquiring about your balance sheet. We seek personal insight into your life in order to understand the role money plays for you. By adding our professional financial planning and wealth management expertise and wisdom, we will coach you towards your personal goals and financial peace of mind.

When is the Best Time to Hire a Financial Advisor?

Now is the best time to hire a financial advisor. Developing a customized financial and wealth management plan now will help you advance towards your personal and financial goals, grow net worth, and ultimately help you retire on your schedule. Time is money. Partnering with an advisor that understands you means you may spend less time worrying about this aspect of your life.

Are you ready to speak with an independent financial advisor? You’ve found Sacramento independent financial planner Joseph Eschleman, as well as certified financial planner Steve Pitchford, CPA, CFP®, and our entire independent wealth management team.

We serve clients primarily in the Northern California region. Glad you’re here! Please contact us with any questions you have about our wealth management process.

Update on July, 08, 2024