Are you terrified? If you’ve been paying attention to the world's economic landscape right now, you might be. With unprecedented inflation throughout the years, coupled with the political uncertainty surrounding the upcoming 2024 U.S. presidential election, it’s hard not to feel some paralysis when considering your financial decisions. If you are feeling more than a bit unsettled, you’re not alone. Inflation and the economy are at the top of voters’ minds, and it can feel like we’re all just waiting around for something to save us.

Aside from the dwindling effects on your hard-earned dollars, inflation is affecting the REAL return you’re getting on your investments. When general prices increase, the amount of growth you need on your investments to maintain your standard of living and to hopefully retire comfortably also increases. We call this the “hidden tax”, sticking its hands in our already shrinking pockets.

The bad news is that at Towerpoint Wealth, we believe inflation isn’t going anywhere, while understanding the inflation rate does vary over time. Inflation over the last 3 years is not necessarily a predictor of inflation over the next 3 years.

The good news is that, with some understanding of how inflation plays a role in your investment strategy and some strategic decision-making, you can learn to better manage this hidden tax, and increase the probability you can retire comfortably and live a happier life.

Inflation…what is the “hidden tax”?

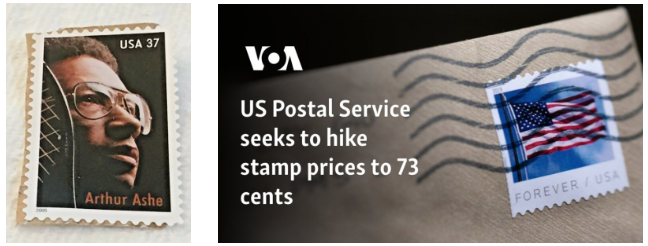

We all generally understand that inflation reflects the gradual increase in prices of goods and services over time. This is influenced by monetary policies, supply and demand, production costs, etc. As prices increase, the buying power of each dollar you have starts to diminish. Just think: A postage stamp cost $0.37 just 20 years ago, and today is virtually double the price ($0.73) for the same service!

We call inflation the “hidden tax” because it reduces your ability to spend. Unlike direct taxes, which are visibly deducted from your income or levied on your purchases, inflation subtly, but insidiously, reduces the value of your savings and investments over time.

When prices rise, the same amount of money buys less in goods and services, effectively reducing your standard of living. This loss of purchasing power acts as a “tax” on your financial resources, minimizing the real value of your income and savings.

Inflation doesn’t stop at driving up the price of the goods and services you pay for on a daily basis, as it can create a massive risk to investors if they don’t play their cards right.

So, how does inflation affect my investments?

While a moderate level of inflation is generally seen as a sign of a growing economy – the Federal Reserve aims to keep the inflation rate at a healthy 2% – too much inflation (or hyperinflation) can eat away at the current value of your investments. In other words, the money you’re pouring into your investment accounts has to work harder to maintain the same level of growth in buying power.

If your investment growth does not keep pace with the inflation rate, the real (or “nominal” value of those investments declines.

Say your investment portfolio grows by 4%, but the inflation rate is 5%. While the actual dollar amount of your investments went up, your money has less spending power, meaning the REAL value of your investments has actually decreased.

For investors, inflation’s hidden tax poses a unique challenge to navigate. At Towerpoint Wealth, we urge you to have strategies in place to ensure your investments work harder than inflation in the long run.

What can I do to protect my investments from inflation?

Don’t let your emotions dictate your decision-making.

It’s easy to get scared by painful (but almost always, temporary) declines in the value of your portfolio, and give in to the temptation to panic and sell. Jumping out of a sinking ship makes sense, doesn’t it? While the waves can and will get rough, at Towerpoint Wealth we believe that rough conditions like these, while oftentimes unpleasant, are almost always temporary, and that selling when prices are low, while your investments aren’t performing the way you want them to, is a poor recipe and philosophy, not to mention a sure way to realize the loss.

So, our first bit of advice is to breathe. Many investment strategies can help you in times of high inflation to ensure your investments are set up to protect you from financial distress. As Warren Buffett said:

Rebalance your portfolio

We recommend you be disciplined in systematically rebalancing your portfolio (preferably semi-annually). This allows you to maintain your portfolio diversification, capitalize on gains, and re-examine the valuation of assets that may be over or undervalued.

Treasury Inflation-Protected Securities

Investing in Treasury Inflation-Protected Securities (TIPS) is one of the most direct ways you can help protect your portfolio against the negative effects of inflation. TIPS are government bonds whose principal and interest payments are tied to the Consumer Price Index (CPI). This means that as inflation rises, the value of TIPS increase with it, helping to maintain your purchasing power over time.

Although TIPS tend to offer lower returns compared to other investments, their inflation-adjusted returns provide a reliable hedge against rising prices and inflation throughout the years.

Invest in the right equities

Investing in stocks, or equities, provides the potential for the growth your portfolio assuredly needs over the longer term. However, you have to remember that not all equity investments are created equal, especially in an inflationary environment.

Income-generating stocks

Equities that provide income, in the form of dividends, can be a good hedge against inflation and hyperinflation. Dividend stocks tend to perform better than other types of stocks in times of high inflation; however, dividends are never guaranteed.

You might want to consider stocks of companies that have been successful in prioritizing dividends over long periods of time, as they are usually financially stable, have strong cash flows, and sustainable business models to maintain growth of the dividends being paid.

Dividend income is typically paid in cash, which ensures a tangible return regardless of market conditions, helping to create a natural inflation hedge. Additionally, dividend-paying stocks can still appreciate in value like other stocks, as companies that consistently increase dividends attract investors seeking stable income, which can drive up stock prices.

Price makers, not price takers?

Other equities that may be good options for investors in times of high inflation are companies that are able to pass on price increases to their customers without dramatically affecting the demand for their products. These tend to be companies that have a long-standing history of high performance.

Companies that can increase their prices along with inflation have the ability to maintain their margins and profits, and increase real value for shareholders.

You may want to consider the stocks of larger companies, since they can demonstrate an ability to weather the storm in different economic conditions, including inflation throughout the years. They have the resources to absorb higher input and financing costs, and the ability to pass some of these higher costs onto their customers, making them a generally more stable investment.

Diversify, diversify, diversify

To help preserve the real value of your investments during inflation, we recommend building a diversified portfolio that includes a mix of major asset classes such as equities, bonds, real estate, alternatives, and even commodities.

Diversification helps protect you from having all of your eggs (or assets) in one basket when a huge problem or market pullback arises. It helps spread risk across different investment asset classes, reducing the impact of any one of them underperforming. And it helps to smooth out the curve when looking at the returns of your portfolio.

Real assets like commodities and real estate often perform well during inflationary periods. Commodities, in particular, have historically been a reliable hedge against inflation because they are directly tied to the prices of goods and services. By incorporating these into your portfolio, you can better position yourself to withstand the impact of rising prices.

Don’t discount bonds!

As mentioned above, when you think of a well-diversified portfolio, it includes many different types of assets like bonds, stocks, real estate, etc.

Fixed-income securities, or bonds such as corporate, municipal, and government bonds, and even CDs, provide you with a set percentage of interest income over a stated period of time. The rate at which your bond pays this interest stays the same for the life of the investment, so that rate will not go up or down when the rate of inflation increases (excluding TIPS, as mentioned above!).

For this reason, many people avoid investing in bonds altogether when there is high inflation; however, with strategic thinking and planning involved, bonds can still be a great part of your investment strategy when inflation is high.

Although recent increases in interest rates can lead to lower bond prices, you also have the ability to reinvest matured bonds at a higher interest rate and potentially generate more income. It’s important that you don’t rule out bonds in an inflationary environment, as the relative stability, and consistent interest income, are important parts of any properly-diversified investment portfolio.

Work with your trusted financial professional

There is no such thing as a “one-size-fits-all” strategy when developing, implementing, and managing a well-structured and properly diversified portfolio, as everyone has unique personal and financial needs, goals, and circumstances. Here at Towerpoint Wealth, we believe that working with a financial advisor who is a fiduciary, and who understands you and your “unique story,” is the best way to get the coordinated results you’re looking for in the long term.

When it comes to managing your investment portfolio in times of high inflation, you want to meet with your advisor to avoid making emotional decisions, come up with a solid strategy, decide on your asset allocation, and create a plan for your retirement and withdrawal strategy. You also want to have regular comprehensive review meetings to see when things need adjustment so you can monitor and rebalance when necessary.

Working with someone who takes the time to understand your values and create a personalized plan that is built to weather storms in the long term is paramount. You want to have someone with the expertise to help you make informed decisions and protect your assets no matter what the economic conditions are.

We at Towerpoint Wealth, a Sacramento Investment Advisor Firm, work with clients to create a disciplined plan and strategy in times of stability, to ensure we remain disciplined during times of instability.

The bottom line is…

Navigating the complexities of high inflation, or hyperinflation, can be a daunting task. You don’t want to lose all of your buying power over time, but may feel fearful about pouring your money into the market during unsettled times. We get it, and we’re here to provide you with the right strategies and advice to help you safeguard your assets and maintain financial stability, no matter what lies ahead.

To learn more about inflation and its effects on your investments, check out our YouTube channel!

For more financial advice, check out our blog “Retiring with 2 Million Dollars“ to learn about strategies you can implement to prepare for retirement.

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity. We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on YouTube

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on X

Click HERE to follow TPW Podcast : A Wealth of Knowledge