When it comes to investing, many people focus on maximizing returns — finding the right investments, properly diversifying their portfolios, and shrugging off shorter-term market noise. But there’s one factor that can quietly eat away at those gains if not managed properly: TAXES.

Many investment decisions carry tax consequences. Whether it’s capital gains from selling investment positions, dividend payouts, interest income, or capital gain distributions from mutual funds, taxes can significantly impact your after-tax returns. And for high earners, the tax burden can be even greater.

This is where being conscious about tax-efficient investing comes in. A well-structured investment strategy isn’t just about growing your wealth — it’s about keeping more of what you earn.

In this article, we’ll break down the tax implications of investing, explore tax-efficient investing strategies, and discuss how investors — especially higher-net-worth individuals — can minimize that “tax drag” and better protect their portfolios.

Key Takeaways

- Not all investment income is taxed the same way. Understanding how capital gains, dividends, and interest are taxed can help you optimize your after-tax returns.

- Asset location matters. Placing tax-inefficient investments in tax-advantaged accounts, like IRAs and 401(k)s, can significantly reduce your tax burden.

- Tax-efficient strategies can boost longer-term growth. Techniques like tax-loss harvesting, Roth conversions, and the Backdoor Roth IRAs can help minimize taxes and maximize wealth.

- Choosing the right investments for your portfolio is crucial. Tax-efficient mutual funds and ETFs with low turnover can help reduce capital gains taxes.

- Working with your financial and tax advisors can enhance tax efficiency. A strategic, tax-sensitive investment plan ensures you keep more of what you earn.

Why Tax Efficiency Matters for Investors

Tax efficiency is oftentimes overlooked in investment planning, yet it plays a crucial role in longer-term wealth accumulation. While market performance and asset allocation are key factors in portfolio success, taxes can significantly impact your overall net returns.

Not only do you pay taxes on investments, but the way you invest — whether through taxable accounts, tax-advantaged accounts, or specific asset types — can dramatically affect how much you owe and how much of your returns you actually keep.

Without a tax-efficient strategy, investors may find themselves paying more to the IRS than necessary, ultimately reducing their net investment gains. By strategically managing taxes, investors can retain more of their wealth and enhance portfolio growth over time.

Here’s why tax efficiency is critical for investors looking to protect their wealth.

The Erosion of Returns Due to Taxes

Investment gains are not just about how much your portfolio grows but how much you actually keep after taxes.

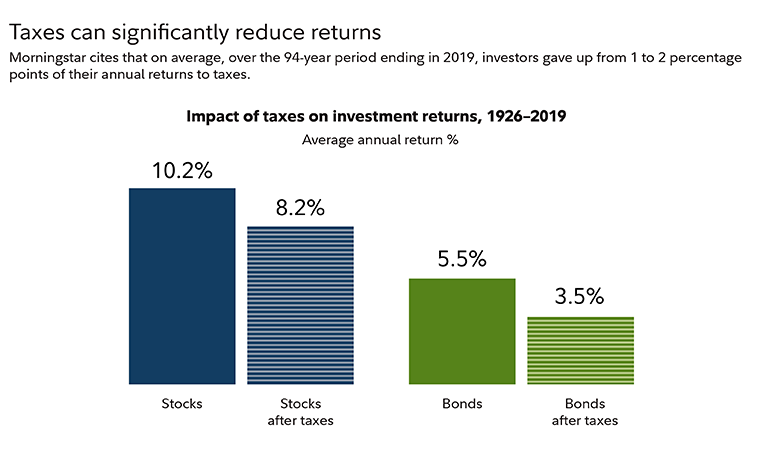

If you earn a 7% return but lose a significant portion of it to taxes, your real return may be much lower than anticipated. Taxes on capital gains, dividends, and interest income can take a sizable chunk out of investment earnings — especially for high-income individuals who may be subject to higher tax rates.

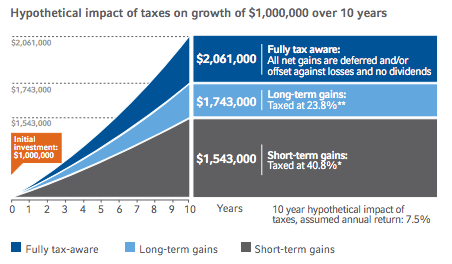

Consider two investors with identical portfolios, one employing tax-efficient strategies and the other ignoring tax implications. Over time, the tax-conscious investor retains more of their earnings, leading to greater compounding and a higher final portfolio value.

What does this mean? The more tax-efficient your investments, the more money you may end up keeping.

The Impact of Tax Drag on Investment Growth

“Tax drag” refers to the reduction in an investment’s growth due to taxes on interest, dividends, and capital gains.

Mutual funds, for example, often distribute taxable capital gains, forcing investors to pay taxes even if they haven’t sold any shares. This tax drag can slow portfolio growth significantly, particularly in taxable accounts.

By investing in tax-efficient vehicles such as ETFs, which generate fewer capital gains distributions, or holding higher-growth assets in tax-advantaged accounts, investors can reduce tax drag and keep more of their money working for them.

How Different Investments Are Taxed

A common question investors ask is: “Do you pay taxes on investments?”

The short answer? Yes — but how much you pay depends on what you invest in, where you hold your investments, and how you structure your portfolio.

Before diving into strategies, it’s important to understand how taxes on investment income work. Here’s a quick breakdown of what that can look like:

- Capital Gains Taxes

- Short-term capital gains (assets held less than one year) are taxed as ordinary income (up to 37% for high earners).

- Long-term capital gains (assets held more than one year) are taxed at lower rates (0%, 15%, or 20% depending on your income).

- Dividend Taxes

- Qualified dividends are taxed at lower long-term capital gains rates.

- Nonqualified dividends are taxed at higher ordinary income levels.

- Interest Income Taxes

- Interest from corporate bonds, bank savings accounts, REITs, and CDs is taxed at ordinary income rates.

- Interest from municipal bonds is federally tax-free and usually state tax-free, making them a potentially great option for high earners.

- Taxes on Mutual Funds

- Many mutual funds generate capital gains distributions, which investors must pay taxes on — even if they didn’t sell any shares.

Different types of investments have different tax treatments, so it’s important to have strategies in place that help make the most out of every dollar you contribute to your nest egg.

Key Strategies for Tax-Efficient Investing

Minimizing taxes on investment income is a crucial part of maximizing long-term portfolio growth. Without a proactive tax-efficient investment strategy, unnecessary taxes can erode your returns, reducing the effectiveness of even the most well-planned investment strategy.

Tax-efficient investing involves selecting the right accounts, structuring your portfolio to minimize taxable distributions, and using strategic withdrawal plans to keep your tax burden as low as possible.

Whether you’re a high-earner looking to protect your wealth or an investor focused on optimizing returns, these key strategies can help you keep more of your money working for you.

From asset location and tax-loss harvesting to strategies like Roth conversions and backdoor Roth IRAs, let’s discuss how you can implement tax-efficient investment strategies to enhance your portfolio’s long-term success.

1. Use Tax-Advantaged Accounts Strategically

One of the simplest ways to reduce taxes on your investments is by using tax-advantaged accounts effectively. These accounts allow your investments to grow tax-deferred or even tax-free, depending on the structure.

Tax-deferred accounts, such as Traditional IRAs, 401(k)s, 403(b)s, and 457s, let you contribute pre-tax dollars, reducing your current taxable income. Investments within these accounts grow tax-deferred, meaning you won’t pay taxes on capital gains or dividends until you withdraw the funds in retirement, at which point withdrawals are taxed as ordinary income.

Tax-free accounts, like Roth IRAs and Roth 401(k)s, are funded with after-tax dollars, but they allow for tax-free growth and withdrawals in retirement. These accounts can be particularly beneficial for high earners who expect to be in a higher tax bracket later in life.

For investors with both tax-deferred and taxable accounts, a strategic approach to asset location — placing tax-heavy investments in tax-advantaged accounts and tax-efficient investments in taxable accounts — can help you to further optimize your portfolio’s tax efficiency.

At Towerpoint Wealth, we regularly work with our clients to make tax-efficient investment decisions. Want to know if your investments are being held in the right accounts? We welcome opening a dialogue with you.

2. Asset Location: Optimizing Where You Hold Investments

Asset location is a powerful but often overlooked strategy for reducing tax drag. Instead of focusing only on what to invest in, tax-savvy investors pay close attention to where (what accounts) they hold their investments.

Taxable accounts may best be suited for tax-efficient investments, such as individual stocks, ETFs, and municipal bonds, which generate minimal taxable distributions. Since long-term capital gains and qualified dividends are taxed at lower rates, these investments can help investors minimize annual tax liabilities.

Tax-advantaged accounts should hold tax-heavy investments, such as bonds, REITs, and actively managed mutual funds, which generally produce high levels of taxable investment income. By keeping these investments in tax-deferred accounts, investors can defer taxes on interest and dividends, allowing their portfolios to grow more efficiently over time.

3. Tax-Loss Harvesting: Turning Losses Into Tax Savings

Tax-loss harvesting is a strategy that allows investors to sell underperforming assets at a loss to offset taxable gains elsewhere in their portfolio.

For example, if an investor sells a stock at a $10,000 loss, they can use that loss to offset $10,000 in capital gains, reducing their overall tax bill. If your losses exceed all of your capital gains, you can also deduct up to $3,000 off of ordinary income per year, and carry forward any excess losses to future years.

This strategy is particularly valuable for high earners, as it can significantly reduce taxable income and maximize after-tax returns. However, investors must be aware of the wash sale rule, which prevents them from repurchasing the same security within 30 days of selling it for a loss.

4. Tax-Efficient Withdrawal Strategies for Retirement

Importantly, for retirees, how and when you withdraw funds from different accounts can have a major impact on your tax liability. A strategic withdrawal strategy helps minimize lifetime taxes and maximize retirement savings.

A common best practice is to withdraw from taxable accounts first, allowing tax-advantaged accounts to continue compounding tax-free for as long as possible. Since taxable accounts benefit from lower long-term capital gains rates, prioritizing these withdrawals can reduce your immediate tax burden.

Next, investors should withdraw from tax-deferred accounts like 401(k)s and IRAs, keeping an eye on Required Minimum Distributions (RMDs), which begin at age 73. Finally, Roth IRA withdrawals should generally be saved for last, as they grow tax-free indefinitely.

For high earners, Roth conversions, or doing a Backdoor Roth IRA strategy (moving funds from a Traditional IRA to a Roth IRA), can also be a valuable tax strategy, especially in years where income is lower than usual.

5. Minimizing Taxes on Mutual Funds and Alternative Investments

Investors holding actively managed mutual funds must be cautious of capital gains distributions, which are taxable even if they don’t sell any shares.

To minimize this tax burden, investors can:

- Choose tax-managed mutual funds that focus on reducing taxable distributions.

- Consider investing in ETFs, which are generally more tax-efficient than traditional mutual funds due to their structure.

Alternative investments, such as real estate, private equity, and hedge funds, often have complex tax implications. Working with a tax-aware financial advisor can help investors structure these investments to maximize after-tax returns.

Making Tax Efficiency a Core Part of Your Investment Plan

The bottom line: Taxes should not be the sole driver of your investment decisions, but should also never be an afterthought.

Taxes should be an integral part of how you structure and manage your investment strategy. Investors who ignore taxes risk losing significant capital over time due to unnecessary tax drag.

By working with a fiduciary financial advisor to implement tax-efficient investing strategies, investors can reduce capital gains taxes, minimize tax drag, and optimize their portfolios for long-term growth.

At Towerpoint Wealth, we specialize in helping investors build tax-efficient portfolios that align with their financial goals. If you’re ready to take better control of your investment tax strategy, we invite you to schedule a 20-minute “Ask Anything” conversation with our team today.