As we head into 2026, it’s natural for investors to ask a familiar question: What does the market outlook look like from here? After several years of rapid shifts, elevated volatility, an unsettled economy, and no shortage of headlines, the desire for clarity is more than understandable.

But at Towerpoint Wealth, we believe the more productive question isn’t where markets go next month or next quarter. Instead, it’s how to make sound decisions in an environment where outcomes are uncertain and conditions continue to evolve.

Our 2026 financial outlook isn’t about predicting short-term market moves. It’s about understanding the landscape we’re operating in — how volatility shows up, why it persists, and how disciplined decision-making matters far more than any single forecast.

Markets don’t move in straight lines – they never have. They move in ranges, often unevenly, and rarely on a clean timeline. That’s why planning has always mattered more than prediction. Rather than guessing what comes next, we focus on our philosophy of building client-customized strategies designed to hold up across a wide range of outcomes.

In this edition of Trending Today, we’ll go over the current stock market outlook, key market dynamics, and the secular themes influencing 2026, including artificial intelligence and policy considerations. We’ll also cover some of the primary risks investors should be aware of and explain what disciplined investors tend to focus on when conditions are uncertain.

Our goal is to provide a grounded framework for thinking about markets — so decisions remain thoughtful, measured, and aligned with longer-term plans.

Economic Landscape: Growth With a Wide Range of Outcomes

As we look ahead to 2026, the prevailing economic view among major institutions points to the possibility of continued global expansion.

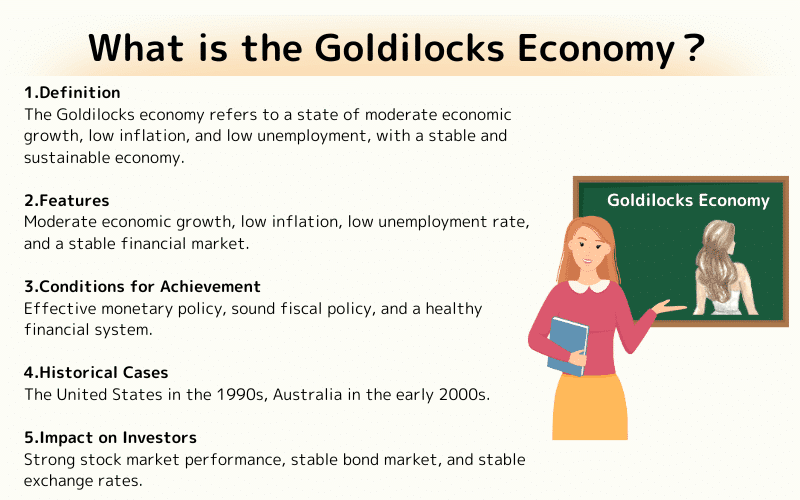

Consumption remains relatively resilient, capital investment is still supporting growth, and inflation pressures have moderated compared to recent peaks. Taken together, those factors suggest a constructive backdrop — but not a guaranteed one.

The nuance matters. Growth is uneven, and outcomes are likely to vary by region, sector, and household. Some areas of the economy continue to show strength, while others face tighter conditions.

Labor markets, in particular, are sending mixed signals. Corporate balance sheets remain generally healthy, yet employment trends may soften at the margins as businesses adjust to changing costs and demand.

From our perspective, this is not an environment defined by a single economic narrative. It’s one characterized by ranges rather than straight lines, where multiple outcomes remain plausible. For investors, that means weighing both risks and opportunities — and staying prepared for variability rather than relying on any one expected path forward.

Market Outlook: Momentum Meets Complexity

From a market standpoint, momentum has carried forward, supported by earnings growth and a policy backdrop that remains broadly economically constructive. Those forces have helped sustain equity markets even as conditions continue to shift.

At the same time, the market outlook is more complex than headline performance alone might suggest. Leadership beneath the surface has been relatively narrow (but widening), with returns unevenly distributed across sectors and styles. Valuations in certain areas are elevated, which can increase sensitivity to disappointment if expectations are not met.

This dynamic often shows up through increased sector rotation, uneven participation, and periods of volatility — even while the broader market trends higher. In other words, a constructive outlook does not imply a smooth or comfortable path.

From Towerpoint’s perspective, this is neither a bearish nor euphoric environment. It’s a realistic one. Markets can continue to make progress while still testing patience along the way, reinforcing the importance of balance, discipline, and perspective as conditions evolve. Some may view this as a “goldilocks” economy.

Structural and Secular Drivers Shaping 2026

Beyond shorter-term market movements, several structural forces continue to shape the investment landscape heading into 2026. These themes matter not because they offer clear predictions, but because they influence how markets behave over time — and why outcomes can vary widely.

Artificial Intelligence and Capital Investment

Artificial intelligence remains one of the most significant structural themes in today’s economy.

Large-scale capital investment by corporations continues, driven by expectations around productivity gains, efficiency, and longer-term growth. At the same time, there is an active debate around how much of that potential is already reflected in stock market valuations.

The important distinction is that structural change does not translate into linear returns. Innovation often creates both opportunity and volatility, as markets work to price in the longer-term benefits amid uncertainty around timing, adoption, and profitability. From our lens, AI is best viewed as a powerful force shaping the landscape — not a guarantee of smooth or immediate outcomes.

Monetary and Fiscal Policy

Policy also remains a key influence on markets as we move into 2026. Expectations around potential monetary easing, continued fiscal support, and shifting regulatory priorities all contribute to the backdrop investors are navigating. The mid-term election cycle adds another layer of uncertainty, increasing noise rather than clarity.

Policy, however, is not a forecasting tool. It’s a source of variability. Planning must account for the reality that policy conditions can change, sometimes quickly, rather than rely on any single expected path. This reinforces the importance of flexibility and preparedness in an environment shaped by ongoing policy evolution.

Risks and Uncertainties: What Could Disrupt the Narrative

Every market outlook carries assumptions. What matters isn’t trying to eliminate risk, but to manage it, and understand where pressure points may exist and how they could show up.

Valuations and Market Concentration

Some areas of the market are entering 2026 with elevated valuations, which can increase sensitivity to disappointment. When expectations are high, even modest changes in earnings, interest rates, or policy can lead to outsized reactions.

Market concentration also plays a role. Narrower leadership means returns can become more dependent on a smaller group of companies or sectors, which can amplify volatility when sentiment shifts.

Policy and Macro Uncertainty

Policy remains a meaningful source of variability. Trade dynamics, tariffs, elections, and regulatory changes all have the potential to influence markets in uneven ways. These factors don’t move markets in straight lines — and they rarely arrive on a predictable schedule.

Rather than offering clarity, policy tends to introduce complexity, reinforcing why flexibility matters more than precise forecasts.

Less Visible Risks Beneath the Surface

Some risks are harder to see in real time. Areas like credit stress, private markets, or pockets of leverage may not always be fully reflected in public pricing until conditions change. These aren’t signals of immediate trouble, but they are reminders that not all risk is visible on the surface.

Towerpoint’s Perspective:

Acknowledging uncertainty is a necessary part of practical planning. A thoughtful outlook respects the range of possible outcomes, without assuming the worst or ignoring the best.

Understanding where risks may exist allows investors to focus on preparation rather than prediction.

What This Environment Calls For: Principles Over Predictions

When markets offer a wider range of outcomes, the most important decisions aren’t about forecasting what comes next, but about how investors behave when clarity is limited and conditions change.

This is where disciplined planning matters most.

Discipline Over Reaction

Periods of uneven growth, shifting leadership, and persistent volatility tend to reward investors who stay anchored to a repeatable process. Reacting to headlines or short-term narratives often creates more risk than it avoids.

A disciplined approach focuses on staying invested in line with longer-term goals, even when the path forward feels less predictable.

Diversification Over Concentration

When leadership rotates, and participation broadens or narrows, diversification becomes much more than a theoretical concept. A thoughtful diversification strategy helps reduce reliance on any single outcome, sector, or theme — especially in markets where winners change more frequently.

Risk Management Over Market Timing

Volatility is a feature of the investing environment, not a signal that something is broken. Effective portfolio risk management is less about avoiding volatility and more about understanding (and expecting!) it so that shorter-term fluctuations don’t derail longer-term plans.

That includes aligning risk with time horizon, liquidity needs, and personal goals rather than trying to sidestep every market move.

Goals Over Narratives

Market narratives shift quickly. Financial goals don’t. Investors who maintain confidence through uncertainty tend to keep decisions grounded in what their plan is designed to support, rather than what the market happens to be focused on in the moment.

Towerpoint Wealth’s take: These principles aren’t strategies for 2026 specifically. They’re responses to uncertainty in any market environment. When outcomes vary, discipline matters. When leadership shifts, diversification matters. And when volatility persists, emotional control matters most.

How We Think About Planning in a Complex Market

At Towerpoint Wealth, planning doesn’t start with a forecast.

Markets are too dynamic, and outcomes too varied, for any single projection to serve as a reliable foundation. Instead, our planning process is built around preparation — so clients aren’t dependent on being “right” about predicting what comes next.

That means evaluating a range of possible scenarios rather than anchoring to one expected outcome. Portfolios are stress-tested across different market environments, not just favorable ones. Investment decisions are coordinated with tax strategy, cash flow needs, and longer-term planning goals, so each piece of the plan works together and not in isolation.

Our objective isn’t to eliminate uncertainty. It’s to design plans that can adapt to it.

In complex markets, resilience comes from structure. Adaptability comes from foresight. And clarity comes from knowing decisions are grounded in a thoughtful process, not market noise.

Confidence Comes From Preparation, Not Precision

Looking ahead to 2026, investors are unlikely to be given simple answers.

Markets may continue to reward patience… and test it at the same time. Periods of progress may arrive alongside volatility, rotation, and uncertainty. It’s important to remember that this is not a flaw in the system. It’s how markets work.

Our goal isn’t to be exactly right about the market’s next move, but rather, to be prepared for a range of outcomes, with a plan designed to support longer-term objectives regardless of a current snapshot of conditions.

At Towerpoint, confidence comes from preparation, not precision. From discipline, not prediction. And from a planning process built to endure, not react.

That perspective remains the foundation of how we help clients navigate markets, through 2026 and beyond. If you want to feel more confident as we enter the new year, we invite you to schedule a complimentary 20-minute “Ask Anything” conversation with our team.