President Trump's tariff announcement on April 2, 2025 has rattled the financial markets. The index closed at 5,670.97 last Wednesday, and by Friday, it had dropped to 5,074.08, marking a decrease of approximately 10.5% over two days. Today, further declines are occurring, with the S&P 500 now approaching bear market territory. While higher tariffs were expected, the scale and scope caught many off guard.

The bottom line: Trump 2.0 has taken a hardline approach across the board—and trade policy is no exception.

- If there were any doubts about his commitment to using tariffs as a tool to rebalance the economy, those should be gone by now. This is a deeply held belief, not just a bargaining chip.

- While it’s reasonable to expect that some of these tariffs might eventually be softened, it’s unclear what—if anything—would trigger that pivot. For now, we have to assume they’re here to stay, at least for the next few quarters.

- If that’s the case, the economic impact could be meaningful: slower growth, possibly even a recession, and added pressure on inflation.

At the same time, don’t be surprised if Trump leans harder into tax cuts—the “dessert” after the tough tariff “vegetables.” Those cuts could be rolled out faster, and on a larger scale, as a way to offset market concerns and re-energize sentiment.

All of this is a lot to digest, and it’s a developing situation, as trade policy changes like this take time to play out. Also, none of this is a done deal, as the final shape and impact of these tariffs will likely be negotiated over months, not days.

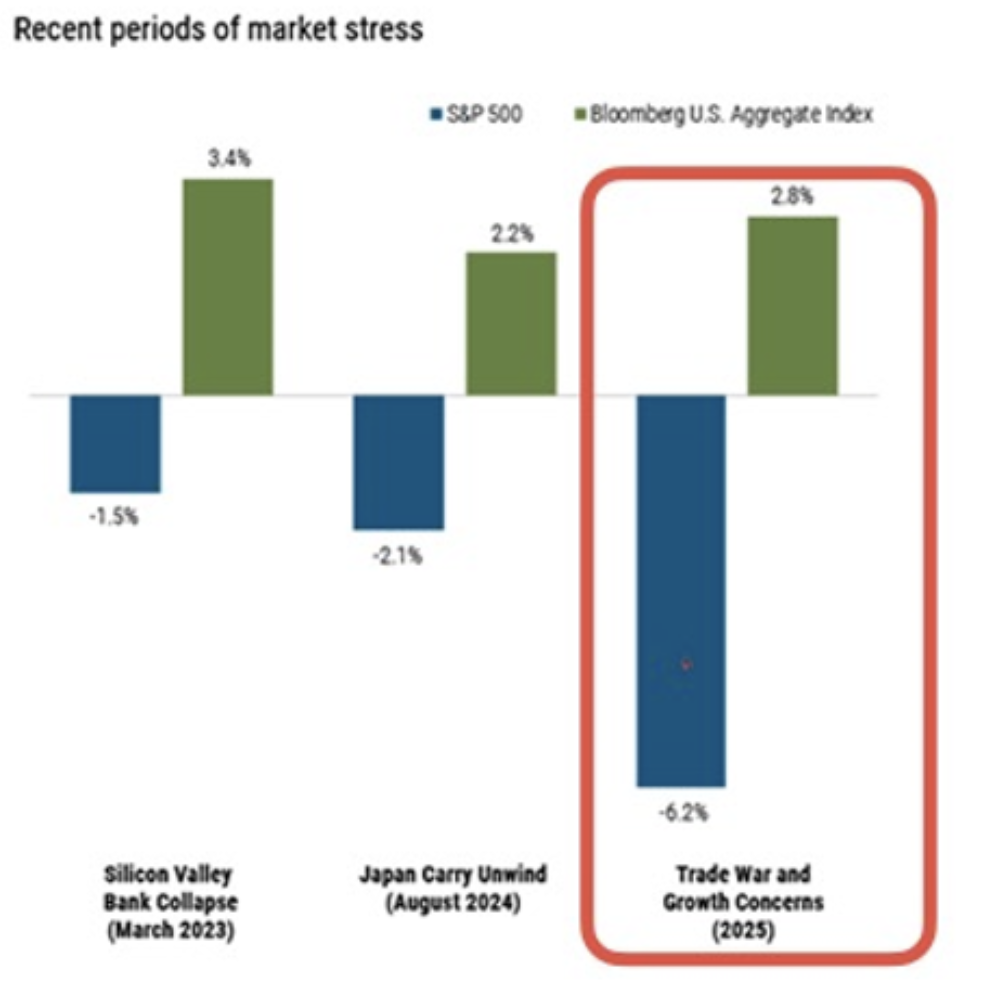

At Towerpoint Wealth, what we do know is this: uncertainty tends to push investors toward safety. And fortunately, if you are a client of the firm, you have a significant “dose” of defensive assets comprising your portfolio. Bonds in particular, have held up — and in many cases, helped — during past periods like this.

While stocks continue to temporarily sell off, high-quality fixed income (bonds) has stayed resilient, providing both ballast and liquidity. Bonds aren’t just about the income they pay — they’re about stability when it matters most.

We fully recognize that experiencing a temporary decline in the value of your portfolio is unsettling, as is today’s market, economic, and political environment. However, it’s worth remembering: markets do recover, and volatility is always a part of investing, even if an unpleasant one. As Warren Buffett said:

If you have thoughts or concerns that you would like to discuss, we encourage you to reach out to us. We are here for you, we will continue to stay grounded and disciplined in our philosophy, and we rest comfortably knowing that our clients being properly diversified, and strategically rebalancing their portfolios semi-annually, continues to be the smartest path forward.

Best regards,

Joseph F. Eschleman, CIMA®

President

Towerpoint Wealth