Our experienced and knowledgeable team at Towerpoint Wealth uses facts and logic rather than emotion to guide our clients through investment decisions. Too often, we see investors that do not work with a financial advisory or wealth management firm fall prey to mental biases that lead to poor investment decisions.

Indeed, these mental biases impact our everyday life without most of us even realizing it. Unfortunately, these biases can be particularly costly to an individual’s investment portfolio, and ultimately their financial success, if not managed and monitored properly.

While it’s impossible to completely eliminate mental biases - we are human after all - we help our clients identify and minimize common investment biases to put them in the best position to succeed.

What are the most common biases in investing?

Behavioral psychologists Daniel Kahneman and Amos Tversky first explained the biases that inhibit investors’ ability to make rational economic decisions. There are two main categories of investing biases: cognitive and emotional.

Cognitive investing biases involve information processing or memory errors, whereas emotional investing biases involve taking actions based on feelings rather than on facts. Let’s take a look at the five most common investment biases, along with remedies we use to minimize their impact on our clients. As you will see, these investment biases are certainly not exclusive. Several investment biases can, and often do, work together to compound poor financial decisions.

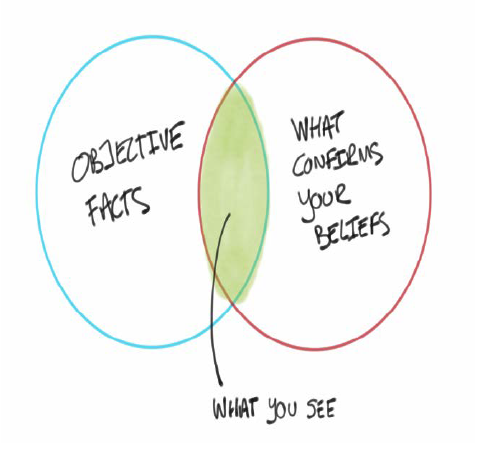

1. Confirmation Bias Confirmation bias is the natural tendency for individuals to be drawn to information that supports their existing views and opinions. This bias often leads investors to attach more emphasis to financial information that supports the outcome they desire. This can cause investors to experience a myriad of self-induced investing mistakes. For example, an investor may be prone to the hazardous strategy of stock picking by filtering through data and research to find those facts that make them sure the stock is a “winner.”

1. Confirmation Bias Confirmation bias is the natural tendency for individuals to be drawn to information that supports their existing views and opinions. This bias often leads investors to attach more emphasis to financial information that supports the outcome they desire. This can cause investors to experience a myriad of self-induced investing mistakes. For example, an investor may be prone to the hazardous strategy of stock picking by filtering through data and research to find those facts that make them sure the stock is a “winner.”

How We Help Minimize the Effects: We provide our clients with up-to-date information gathered from a variety of reputable sources. Our investors are fully informed of the pros and cons of their desired investments, giving a more balanced view that leads to better decisions.

2. Overconfidence Bias A common behavioral bias in investing is overconfidence, which causes investors to overestimate their judgement or the quality of their information. This can lead to “doubling down” on a losing investment instead of knowing when to cut losses, or under-reacting to important information about changing market conditions.

How We Help Minimize the Effects: We guide our clients by developing a customized and detailed investment plan based on sound financial fundamentals and not emotion. We do not pretend to be able to predict the direction of the market, and diversify our clients across many asset classes instead. Diversification maximizes the probability that our clients experience long-term investment success.

3. Recency Bias

3. Recency Bias

Investors who suffer from recency bias have a tendency to overvalue the most recent information over historical trends. For example, recency biases can threaten an investors’ financial well-being by spurring them into increased risk-taking after experiencing a favorable gain in their portfolio. It can also occur when the investor experiences an isolated loss and decides not to make any portfolio adjustments for fear of further loss. One recent example of recency bias is the large number of investors that completely exited the stock market during the Great Recession. Had an investor understood the historical trends of the stock market rather than focusing on the loss in value of their current investment portfolio, they would have stayed the course and ultimately experienced the significant investment gains of the bull market after the Great Recession.

How We Help Minimize the Effects: We help our clients focus on the long-term performance of their portfolios, by reviewing both historical and current performance.

4. Loss Aversion Bias Research has shown that humans feel the pain of a loss approximately twice as much as they feel the pleasure of a similarly sized gain. This can lead investors to focus on their investment declines more than gains and can lead to inaction that stagnates the growth of their portfolios.

How We Help Minimize the Effects: We help our clients accept that losing money is an inevitable part of investing. However, we do not ignore the importance of the loss aversion bias and because of this, we recommend that our clients invest in diversified portfolios that offer downside protection. We believe erring on the side of being more conservative rather than aggressive is important to mitigate this bias.

5. Anchoring Bias

Anchoring bias is the tendency to “anchor” on the first piece of information received rather than evaluating the market as new information develops. For example, many investors buy an investment when its value rapidly drops. These investors anchor on the recent high price of the investment and predict the investment will recover to this price.

How We Help Minimize the Effects: We help our clients to assess investments based on current market value and utilize the first piece of information on an investment only within the broader picture of all data and research gathered.

We Are Here To Help

Investing biases can lead people into making poor investment decisions that can significantly hamper their long-term financial success. That’s why we believe one of our main responsibilities at Towerpoint Wealth is to help our clients avoid the cognitive and emotional biases that can lead to faulty investment decisions.

If you’re interested in learning more about how we can help you manage cognitive biases, please call (916-405-9140) or email us (info@towerpointwealth.com) for a complementary consultation.

Disclosures: Towerpoint Wealth is a Registered Investment Advisor. This platform is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Towerpoint Wealth and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Towerpoint Wealth unless a client service agreement is in place. No portion of any content within this commentary is to be interpreted as a testimonial or endorsement of Towerpoint Wealth investment advisory services and it is not known whether any clients referenced herein approve of Towerpoint Wealth or its services; nor should it be assumed that any references to our clients are representative of all our clients’ experiences.

Sources:

Parker, Tim. (2018, May 3). Behavioral Bias: Cognitive Versus Emotional Bias in Investing [Blog post] Retrieved from https://www.investopedia.com/articles/investing/051613/behavioral-bias-cognitive-vs-emotional-bias-investing.asp

Farnam Street. (2018). Confirmation Bias And the Power of Disconfirming Evidence [Infographic].

McKenna, Greg. (2014, Nov. 20) Trading Insider: 5 Cognitive Biases That Can Hold Traders Back [Blog post]

Lazaroff, Peter (2016, April 1) 5 Biases that Hurt Investor Returns [Blogpost] Retrieved from https://www.forbes.com/sites/peterlazaroff/2016/04/01/5-biases-that-hurt-investor-returns/

Towerpoint Wealth Phone: 1.916.405.9140 500 Capitol Mall, Suite 2350 Email: info@towerpointwealth.com Sacramento, CA 95814 Twitter: @twrpointwealth Page | 4

DesignHacks.co (2017, August). Cognitive Bias Codex [Infographic].

Dr. Pipslow (2018, May). What is “Recency Bias” and How Can You Avoid It? [Infographic]. Retrieved from https://www.babypips.com/trading/forex-recency-bias-20180518