The art of negotiation and teaching kids financial responsibility.

Going Dutch - The Negotiation

Apparently, if you are a kid born around the Chrismukkah wintertime holidays, half-birthdays are important. Josephine, my ten and a half year old daughter, brought this to my attention just last week as she accompanied me on a father-daughter walk two blocks from home in Curtis Park down to Gunther’s Ice Cream to enjoy a double-scoop of vanilla. It is common knowledge that the overall quality of ice cream is measured by how good the vanilla is, and for most Sacramentans, it is common knowledge that Gunther’s vanilla unquestionably continues to set the bar for any vanilla we taste anywhere.

Me, at ice cream shop ABC in city XYZ: “Is it good?”

Josephine: “Yeah, but it isn’t Gunther’s good.”

We have made this two-block walk to Gunther’s dozens of times, but what made this specific trip different was the context of it. This was the first time Josephine was going to buy her own ice cream.

In working continually to teach my two children (my son Henry is seven, and is also in full agreement that Gunther’s vanilla is the gold-standard of all ice cream worldwide) the myriad of skills necessary to survive in this crazy world we live in, negotiation and finances both rank highly on the list. Being the children of a financial advisor, this should not come as a huge surprise, but what I continue to find amazing is that many kids seem to have no idea about either area. And when I say kids, I don’t just mean elementary school kids, I mean junior high, high school, and even college-age kids.

As most of us should or already do know, a negotiation can be deemed “successful” if both parties feel they obtained a benefit as a result. And it is common knowledge that you typically have to give something to get something. The fun is the art of the dance. However, win-win is not the definition of negotiation, it is only the goal. Fortunately, my walk down to Gunther’s with Josephine was a product of a successful negotiation, which as any parent can attest, is not always the outcome. Subsequent to being presented with her half-birthday data point, I was propositioned by Josephine to go to Gunther’s to celebrate. Leveraging this “fact” was a stretch, for sure, but I appreciated her spirit in asking and attempting to take advantage of her perceived half-birthday negotiating currency. One life rule both Eschleman children should know is to always ASK if you want something, and do not assume the answer is no, because you never know when you will catch someone in a good mood or at a moment of weakness.

I considered what she proposed for a moment and tried to remain unbiased in my response, which is difficult to do if you have had Gunther’s ice cream. Then, my response dawned on me, and I said with just a slight grin, “Sure, we can go to Gunther’s, but only if we go Dutch.”

The look on Josephine’s face did not let me down, as I was hopeful she had no clue what I was talking about. Pleased with myself for taking advantage of the situation to educate her on what “going Dutch” means, she pondered my counter-offer for only a few moments, as quick decision-making, for better or worse, is also an Eschleman personality trait – “OK Dad, let’s do it.”

Like most American households, the Eschlemans are regularly on the go with various activities and responsibilities, and while busy, try to lead satisfying and fulfilling and lives. However, one of the consequences of this busy schedule is having only limited time to attend to normal household responsibilities, or, as they are more commonly known, chores.

Having a desire to impart as much responsibility as we feel they deserve and are able to assume, my wife Megan and I have become diligent in ensuring that both Henry and Josephine fulfill their responsibilities as contributing members of our household. While “chores” has been rebranded to “jobs,” the goal remains the same – engendering a sense of accomplishment in both of them, as well as cultivating the importance of teamwork and affording them the opportunity to begin to see themselves as important contributors to the family.

We did not receive the parenting guidebook when either of them was born, so hopefully some of this is sticking. However, there is another major lesson with this “jobs” program I would like to instill and cultivate in both Henry and Josephine – fiscal savvy and responsibility.

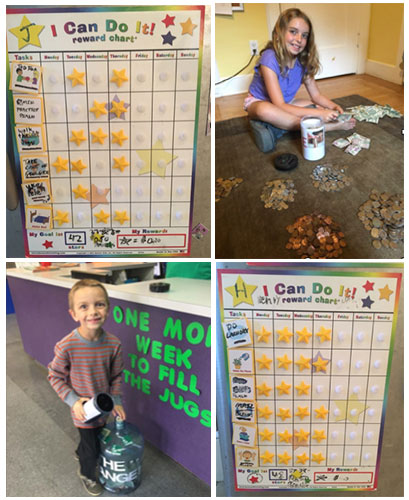

On the fridge in the kitchen, Henry and Josephine each have their “job chart” – nothing fancy, just six rows of jobs, and seven columns for each day of the week. The goal is to have each of them receive a star for completing each of their six jobs on a daily basis (42 total possible stars every week). Yes, for Megan and me it can be a job in and of itself just helping the kids stay on task to complete as many of their jobs as possible.

As is true with all of our schedules, life can and will get in the way of our jobs regularly enough, and it is rare (but not completely unprecedented) for Henry and Josephine to have a perfect week, but that is always the goal. And, to help them equate working harder with getting paid more, the scoring system (or compensation agreement, depending on how you look at it) works as follows:

- Each star (job) is worth in cents your age. Josephine is ten, so she gets $0.10 per star (job completed). “Tenure” in the Eschleman household is rewarded, and the jobs also get more difficult and time-consuming as you get older.

- If you accumulate a minimum of 27 stars in any one particular week, you earn a $0.50 bonus. This 27 star threshold is completely arbitrary.

- If you have a perfect week, you receive a $5.00 bonus!

For example, last week Henry completed 35 jobs (a darn good week), and earned $2.95 (35 x $0.07, plus $0.50 bonus for 27 star benchmark). Payday is on Monday mornings.

We try to vary and switch-up the jobs every so often to keep things fresh, and we entertain Henry and Josephine’s input on the jobs as well.

OK. So Henry and Josephine now have the forum to earn, which logically then leads to the transition into the next lesson: what to do with it. This is a lesson many of us are still working to learn, and why Megan and I feel it is important to cultivate these skills early in life. We are trying a simple four-“bucket” program to instill in Henry and Josephine the main goals that having money helps them to meet:

Save

Save- Special Save

- Donate

- Spend

Subsequent to getting paid on Monday mornings, both kids then decide for themselves (with very slight coaching from Dad) how they want to allocate their hard-earned cash. They can choose to put more or less in each of their two banks (save, donate) and wallet (spend) as they wish, predicated by the rule that SAVING COMES FIRST.

Ask either of them “What do we first do with our money?” and their answer will invariably be “Save it.”

Intermittently, we tally how much they are saving and keep a running number. Cultivating a personal net-worth-building attitude and habits early in life – huge!

“Special Save” is a rudimentary 401(k)-type matching program. Special save is meant to help each kid tuck money away for a specific longer-term item or goal that is important to them. For Henry, it is a new mini-Cooper Lego set; for Josephine, it is a new flat-screen TV for her bedroom. Whatever funds the kids decide to allocate to Special Save, “the house” matches dollar-for-dollar. It has been enjoyable to witness Josephine’s flat screen TV research, as she is close to making a buying decision, and the exercise in weighing features, costs, and benefits has been a good one.

Donate. Instilling in Henry and Josephine the importance of giving and of helping others less fortunate is paramount for Megan and me. Intermittently, we take a field trip to whatever charity they have chosen and donate the funds directly on-site. The impact these trips have had on them has been tremendous, not to mention the sincere “thank-yous” and gratitude expressed verbally, and in written form, by the various “qualifying” charities Henry and Josephine have selected over the years.

And finally, the fun part – spending! Henry and Josephine get to do whatever they want with their spending money, no strings attached. Candy, Pokémon cards, slime, dart guns, whatever. If they have the money, they can buy it. Because after all, Henry buying a pack of Pokémon cards is no different than me buying an $8 bottle of Panic IPA, and Josephine’s slime purchase might as well be Megan’s latest new pair of shoes. What fun is life if we only prepare for the future, and don’t get to live in the present as well? Plus, having spending money of their own, that they earned themselves, hopefully helps both kids equate the money they have to the hard work they did to earn it, and also gives them the financial freedom of knowing that their spending money is theirs to do with what they please. Even if it means going Dutch with your Dad at Gunther’s Ice Cream.