Save, Spend, Donate

OK. So Henry and Josephine now have the forum to earn, which logically then leads to the transition into the next lesson: what to do with it. This is a lesson many of us are still working to learn, and why Megan and I feel it is important to cultivate these skills early in life. We are trying a simple four-“bucket” program to instill in Henry and Josephine the main goals that having money helps them to meet:

Save

Save- Special Save

- Donate

- Spend

Subsequent to getting paid on Monday mornings, both kids then decide for themselves (with very slight coaching from Dad) how they want to allocate their hard-earned cash. They can choose to put more or less in each of their two banks (save, donate) and wallet (spend) as they wish, predicated by the rule that SAVING COMES FIRST.

Ask either of them “What do we first do with our money?” and their answer will invariably be “Save it.”

Intermittently, we tally how much they are saving and keep a running number. Cultivating a personal net-worth-building attitude and habits early in life – huge!

“Special Save” is a rudimentary 401(k)-type matching program. Special save is meant to help each kid tuck money away for a specific longer-term item or goal that is important to them. For Henry, it is a new mini-Cooper Lego set; for Josephine, it is a new flat-screen TV for her bedroom. Whatever funds the kids decide to allocate to Special Save, “the house” matches dollar-for-dollar. It has been enjoyable to witness Josephine’s flat screen TV research, as she is close to making a buying decision, and the exercise in weighing features, costs, and benefits has been a good one.

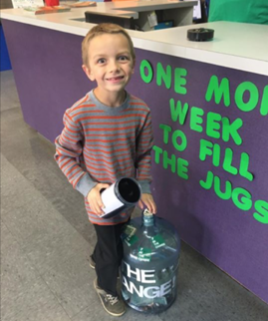

Donate. Instilling in Henry and Josephine the importance of giving and of helping others less fortunate is paramount for Megan and me. Intermittently, we take a field trip to whatever charity they have chosen and donate the funds directly on-site. The impact these trips have had on them has been tremendous, not to mention the sincere “thank-yous” and gratitude expressed verbally, and in written form, by the various “qualifying” charities Henry and Josephine have selected over the years.

And finally, the fun part – spending! Henry and Josephine get to do whatever they want with their spending money, no strings attached. Candy, Pokémon cards, slime, dart guns, whatever. If they have the money, they can buy it. Because after all, Henry buying a pack of Pokémon cards is no different than me buying an $8 bottle of Panic IPA, and Josephine’s slime purchase might as well be Megan’s latest new pair of shoes. What fun is life if we only prepare for the future, and don’t get to live in the present as well? Plus, having spending money of their own, that they earned themselves, hopefully helps both kids equate the money they have to the hard work they did to earn it, and also gives them the financial freedom of knowing that their spending money is theirs to do with what they please. Even if it means going Dutch with your Dad at Gunther’s Ice Cream.