In the Northern Hemisphere, September (the harvest month) marks the beginning of meteorological autumn, and in many countries, the beginning of the academic year.

In her short poem about the month of September, the Canadian author Lucy Maud Montgomery (best known for her classic children's novel, Anne of Green Gables) offers a cheerful tribute to the 'late delight' of the month:

Lo! a ripe sheaf of many golden days

Gleaned by the year in autumn's harvest ways

With here and there, blood-tinted as an ember,

Some crimson poppy of a late delight

Atoning in its splendor for the flight

Of summer blooms and joys

This is September

She could be saluting 2021's cheerfully buoyant year-to-date stock market returns, with the S&P 500 up +20.35% as of Thursday, September 16th.

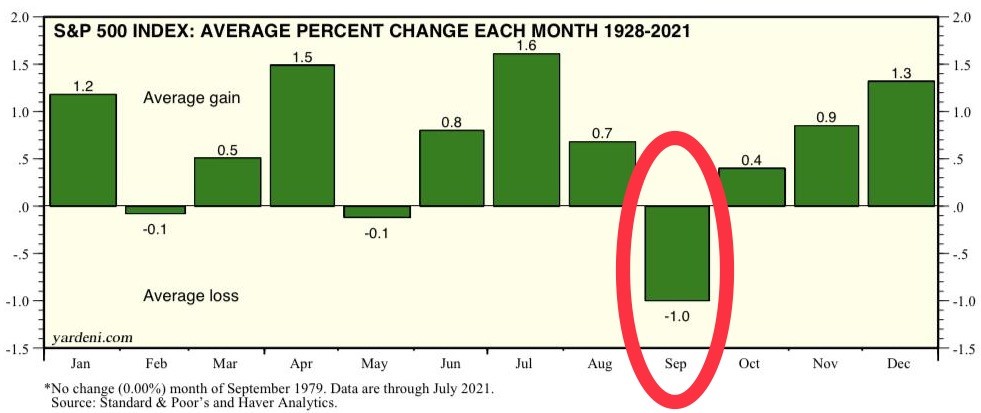

However, September has historically been a volatile month for stocks, and in the past has ranked as the least promising month of the year, on average, for the S&P 500 index over the 1928-2021 time frame:

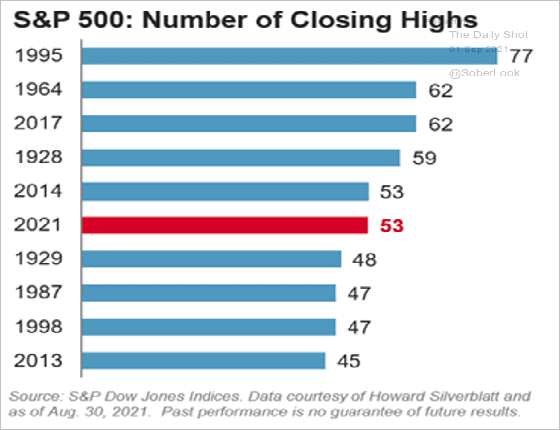

Additionally, through September 1st of this year and as depicted by the chart below, the S&P 500 has reached a total of 53 (!) new record closing highs, the fifth highest figure in the past 93 years:

The $64,000 question: Is it reasonable to expect this growth and momentum continue? Here are both sides of the story:

Positive Economic Developments

- Improving jobs market: After a rolling sequence of shortages in 2021 (including lumber, used cars, ocean shipping capacity, and semiconductors), labor also continues to be in short supply for many companies. This is reflected in the Bureau of Labor Statistics (BLS) report of an increase to 10.1 million job openings (!) as of the last business day in June, the highest EVER figure since job openings began to be tracked in December of 2000.

- "Goldilocks" labor recovery: While the labor market is improving, it does not appear to be improving at such a rapid extent that the Federal Reserve feels compelled to becomes more aggressive in reducing (or "tapering") its current level of asset purchases (currently $120 million per month)

- Services and manufacturing sector expansion: On September 3rd, the Institute for Supply Management (ISM) reported its services index grew for a 15th consecutive month, registering a 61.7 in August after a hitting a record high of 64.1 in July. On September 1, the ISM reported its manufacturing index also grew for 15 consecutive months, with a very good reading of 59.9.

- Rising home prices: Spurred by extremely low interest rates, an increased ability to work remotely, and low inventories of homes for sale, the median sales price for single-family existing homes was higher year-over-year in 2Q, 2021 for 182 of the 183 metropolitan areas tracked by the National Association of Realtors (NAR). In fact, in 94% of those metropolitan areas, median prices rose by *more than* 10% from a year earlier!

- Potential for scaled back tax increases: In a September 2 Wall Street Journal op-ed, West Virginia Senator Joe Manchin indicated that he would not support a social infrastructure spending bill anywhere near $3.5 trillion, thus reducing the chances that such a large package would become law and lead to significantly higher taxes

- Significant individual and institutional investor liquidity: The Investment Company Institute (ICI) reports that as of 9/15, total assets of retail money market funds amounted to $1.43 trillion (!), and total assets of institutional money market funds reached $3.03 trillion. This almost $4.5 trillion of CASH currently sitting on the sidelines represents significant buying power for financial assets

- Significant corporate liquidity: According to Dow Jones Market Data, cash holdings among S&P 500 companies reached $1.98 trillion on August 9, a more than 30% increase from two years ago at the end of 3Q, 2019 When combined with significant available credit that remains unused, S&P estimates a total of $6.8 trillion of unused cash liquidity is available to the corporate sector as a whole. This liquidity can be used to buy back stock, increase dividends, and pursue strategic capital investments

Please bear in mind, while this is an impressive and robust list, there are also risks and concerns to worry about: Uninspiring retail sales, weakening commodity prices, slower 3rd quarter GDP growth estimates, and declining consumer confidence, to name a few.

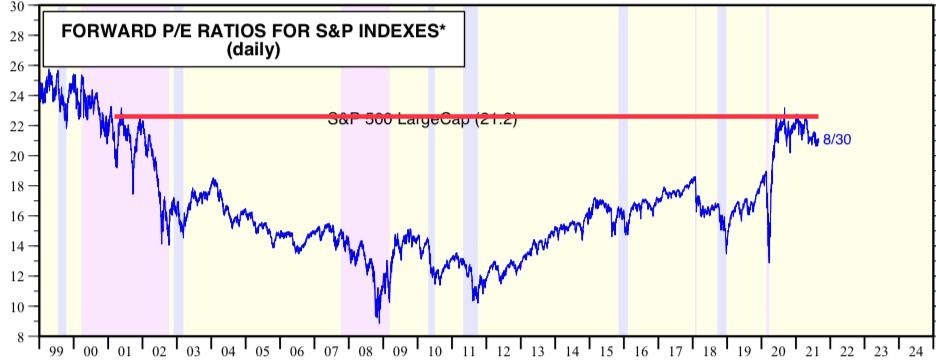

However, at Towerpoint Wealth, we believe the most concerning potential headwind comes in the form of high stock valuations, as the S&P 500's forward price-earnings (P/E) ratio of 21.2x is the highest it has been in two decades!

Although stretched valuations generally do not represent a causal trigger for a stock market correction, at elevated levels (as is presently), they nevertheless can serve investors well as a cautionary warning sign.

While we will always remain humble about our ability to consistently predict the future with accuracy, we do advise clients and friends to heed these high valuations, and to be vigilant in biasing high-quality, "all-weather" assets in their portfolios, especially in light of complacent stock market volatility readings and the long span of time without so much as a 5% market correction.

Confused? Worried? In need of discipline, direction, and/or a plan? Have questions or concerns? Click HERE to contact us for an objective, no-strings-attached conversation about you and your circumstances, as we fully support and echo Warren Buffet's philosophy:

What’s Happening at TPW?

Our Partner, Wealth Advisor, Jonathan LaTurner, wrapped up an amazing trip to Washington D.C. with his fiancée, Katie McDonald, stopping by 1600 Pennsylvania Avenue and also the Smithsonian's National Museum of Natural History.

Looks like an awesome tour of our nation's capital, Jon!

The San Francisco Giants are hot right now (!), and our Director of Tax and Financial Planning, Steve Pitchford, and his partner, Katie, took in an AMAZING extra-innings Giants 'W' versus the Dodgers two Fridays ago at Oracle Park! #BeatLA

Illustrations/Graphs of the Week

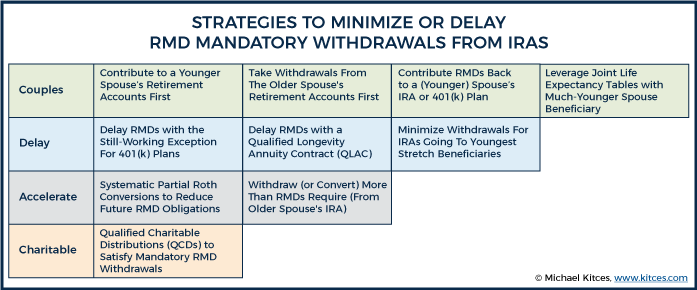

You cannot keep funds in a retirement account indefinitely, as the government wants their share! Required minimum distributions (RMDs) represent the minimum amount that you must withdraw from your IRA or employer-sponsored retirement plan account each year. With the exception of Roth IRAs and Roth 401(k)s, from which withdrawals occur tax-free and are not required until after the death of the owner, regular RMDs can be a "tax thorn" in the side of many investors who have accumulated wealth in any tax-deferred retirement account.

In addition to the two resources found in the news stories at the bottom of this newsletter (discussing RMDs and QCDs), the table directly below, courtesy of Michael Kitces from Kitces.com, does an excellent job of outlining the various strategies available to reduce, minimize, and delay these pesky mandatory, and taxable, retirement account withdrawals:

Confused? Have questions or concerns? Click HERE to contact us for an objective, no-strings-attached conversation about you and your retirement account circumstances.

Trending Today

As the 24/7 news cycle churns, twists, and turns, there have been a number of trending and notable events that have occurred over the past few weeks:

- Confused by the debate over President Biden's controversial COVID-19 vaccine booster plan? Click this helpful FactCheck.org explainer.

- Japan condemns North Korea's ballistic missile launch as "outrageous" and a "threat to the region."

- President Biden expresses confidence in the chairman of the Joint Chiefs of Staff, General Mark Milley, after calls for his resignation amid revelations that Milley twice called his Chinese counterpart to assure him the US was not going to attack China

- The US and Britain announce a defense deal with Australia, helping the country deploy nuclear-powered submarines to counter China's influence in the Pacific

- Fires are still burning in Northern California, and Sequoia National Park's giant trees are at risk

- The Zohra Orchestra, made up entirely of female musicians, has not been able to escape the Taliban's hostility in Afghanistan

- Police are eager to question fiancée of missing 'van life' woman, Gabrielle Petito

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph, Jonathan, Steve, Lori, Nathan, and Michelle