BAD NEWS. There is never a shortage of it. And unfortunately, a crisis control mindset is essential when it comes to managing your portfolio through periods of great uncertainty, like today. This is by no means easy, but we argue is essential to the longer-term health of your portfolio and financial well-being. Supporting this idea, and in his classic unique, direct, and contrarian style, Warren Buffett makes a paradoxical yet excellent point about how an investor should synthesize bad news.

Put differently, bad news creates temporary declines in the financial markets, and prudent investors welcome opportunities to buy low.

Between the 2020 coronavirus crash, the Russian invasion of Ukraine in February of 2022, hyperinflation that reached 9.1% in June of last year, extremely aggressive interest rate increases, the ongoing US debt ceiling mess, and now the Israel-Hamas war, there has been no shortage of crisis events over just the past few years for investors to navigate and consider. How is an investor supposed to feel comfortable in an environment like this one?

To be direct, at Towerpoint Wealth, we know that exercising your crisis control muscles early and often makes for stronger positions in times of uncertainty and volatility. As the American businessman and investor Rob Arnott said:

In investing, what is comfortable is rarely profitable.

The scenes of terrorism and war out of Israel and Gaza continue to be horrific. And while we pray we are wrong, we do not expect this deep-seated conflict to end any time soon, nor become any less polarizing. However, and unfortunately, in the ever-evolving landscape of global finance, at Towerpoint Wealth we continue to believe that the unyielding influence of crisis events like this on the financial markets will always been a painful constant. All of which begs the question many investors are currently asking themselves: “What should I do now?” and “What should I be doing differently?”

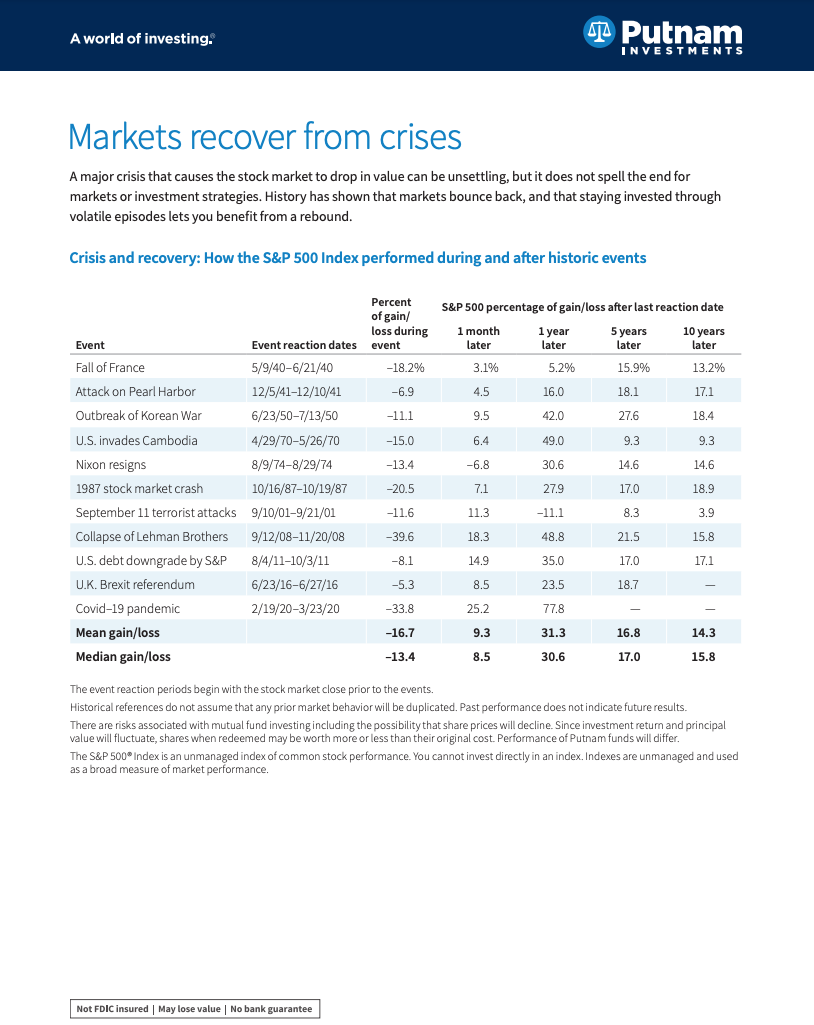

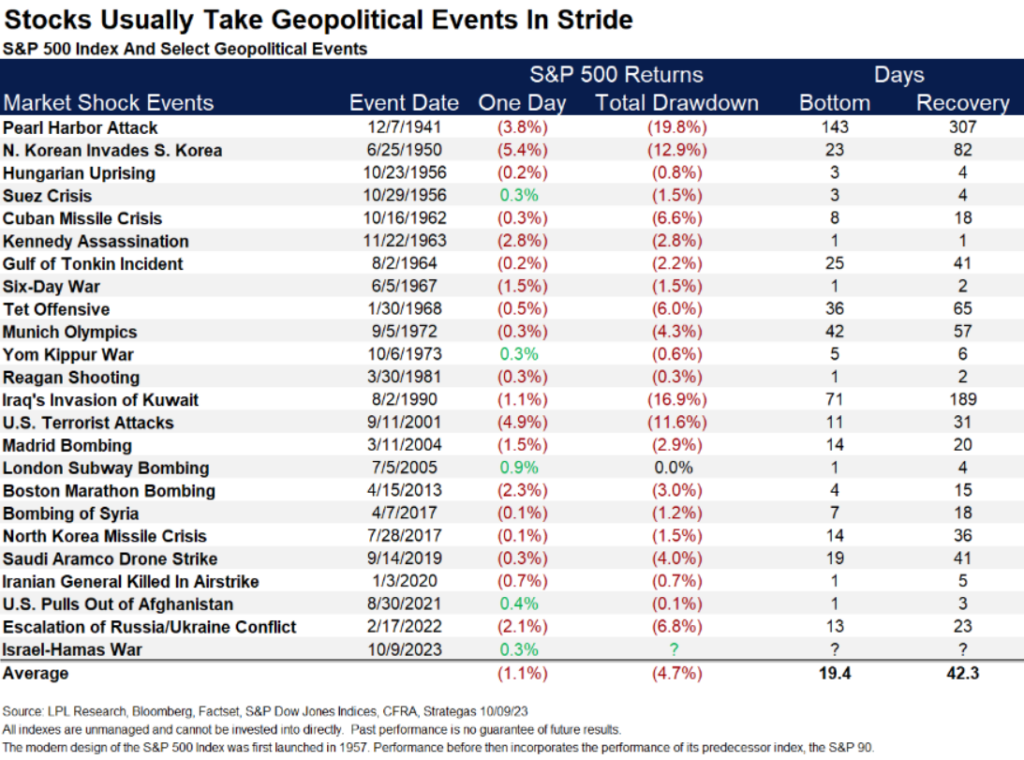

For starters, click the image below to review an excellent two-page fact sheet from Putnam Investments, exploring how the markets have historically reacted to crisis events, and why any initial negative reaction has always ended up being temporary.

Continue reading for a small-scale historical analysis of key crises, how financial markets typically react to crisis events, and most importantly, the psychology of fear and overreaction, and how to exhibit “crisis control.”

Historical Analysis of Crisis Events and the Markets

Financial markets have exhibited a range of reactions during times of crisis, reflecting the complex interplay of economic, psychological, and geopolitical factors. During some crises, such as the Great Depression of the 1930s or the 2008 financial crisis, stock markets experienced sharp, prolonged, and yet temporary declines. Investors, gripped by emotion and fear, often engaged in widespread selling, causing significant, but temporary, value erosion across various investment categories.

Conversely, other crises, like the aftermath of the 9/11 attacks or the initial stages of the COVID-19 pandemic, saw sharp initial market declines but relatively swift recoveries. Government intervention, stimulus measures, and monetary policy adjustments played a crucial role in stabilizing markets and restoring confidence. In these instances, investors who remained patient and focused on their long-term objectives were often rewarded as markets rebounded, illustrating the resiliency of financial markets in the face of adversity.

Based on the chart above illustrating prior geopolitical/crisis events, we have the following:

- The average total drawdown was -4.7%.

- The average time to reach market bottom was 19 days.

- The average time to fully recover losses was “only” 42 days.

In other words, exhibiting crisis control pays – equities have historically held up well during geopolitical shocks, including wars and other military conflicts going back decades. Even the market recovery from 9/11 took only 31 days.

Ned Davis Research (NDR) examined the effect on stocks of more than 50 crisis events since the turn of the 20th century—from the Panic of 1907 all the way to the COVID-19 crash of 2020—and found a crisis control pattern. After falling an average of 7% in the immediate aftermath of a crisis, the Dow Jones Industrial Average rose 4.2% over the next three weeks. Nine weeks later, the Dow had gained 6%, and after 18 weeks it was up an average of 9.6%, according to NDR.

Not every event followed the pattern precisely, and all were subject to larger economic forces. Yet the study shows a remarkable symmetry in market reaction.

These historical examples underscore the importance of understanding that market reactions during crises can vary widely, and that 1.) remaining disciplined and 2.) maintaining a longer-term perspective can be a valuable strategy to not only weather the storm, but also to capitalize on eventual recoveries.

The Psychology of Fear and Overreaction

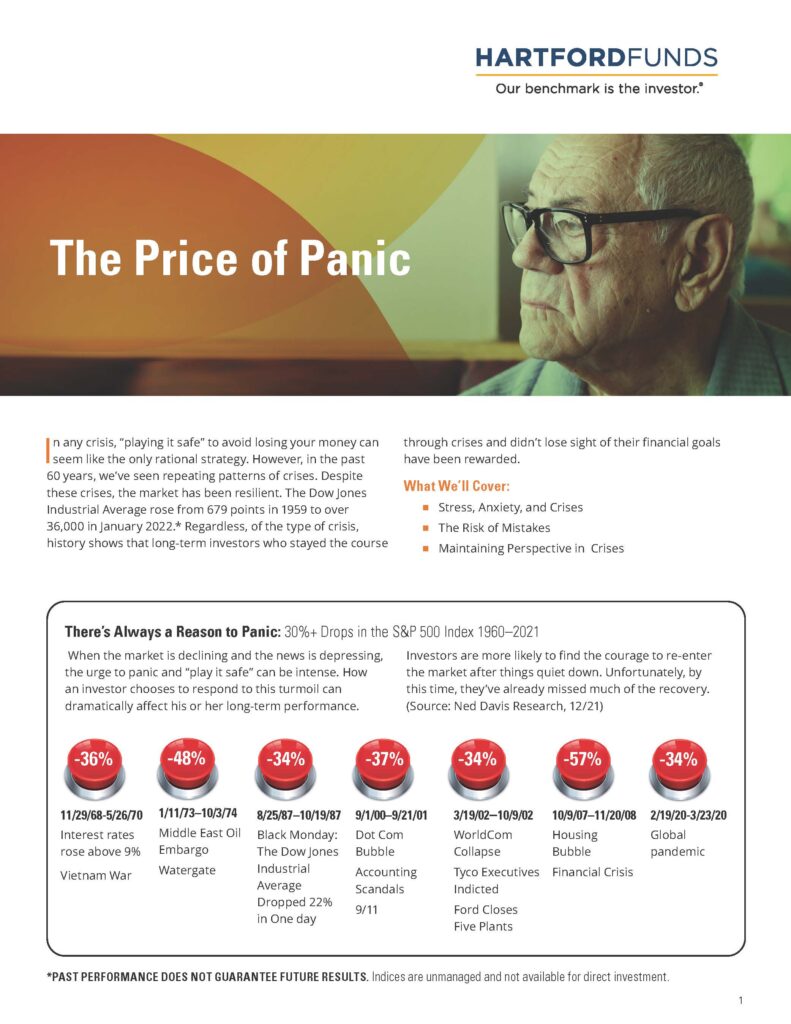

Fear and overreaction among investors are common behavioral responses when crisis events occur. The human psychology of fear often leads to hasty and emotionally-driven investment decisions during times of heightened uncertainty. Investors may become gripped by worry and panic, which leads to a “stop the bleeding” mentality and a desire to protect their assets, which can result in abrupt selling and a flight to safety in investing in perceived safe havens like cash, Treasuries, or gold. This collective emotional response can exacerbate market volatility, leading to rapid and steep declines in asset prices, sometimes far beyond what may be warranted by underlying economic fundamentals. Click below to read an excellent report from Hartford Funds about The Price of Panic.

The danger of overreaction becomes evident when investors make impulsive, fear-driven decisions, such as selling off a portfolio entirely, or drastically altering sound longer-term investment strategies. In many instances, such actions can lead to losses that are locked in, missing out on potential recoveries, and impairing long-term financial goals. Remember, if you sell everything to “stop the bleeding,” you have to be right twice with your predictions:

- That the financial markets continue to move down after you initially sell.

- To ensure you do not miss out on the inevitable recovery, you then buy everything back close to the bottom of the market (when things seem even darker and more ominous).

If you feel you can accurately predict when to exit, and then when to re-enter, we tip our cap and say “good luck to you!”

To combat overreaction, it is critical for investors to maintain a disciplined approach grounded in a well-thought-out investment plan that accounts for the inevitability of market downturns. Additionally, understanding behavioral biases, such as recency bias (placing excessive importance on recent events) or loss aversion (the tendency to feel the pain of losses more strongly than the pleasure of gains), can help investors make more rational and level-headed decisions during times of crisis. Put differently, exhibit crisis control, have a plan, be disciplined in the face of geopolitical events, and reach out to us with any questions or concerns you might have about your portfolio or overall financial situation.

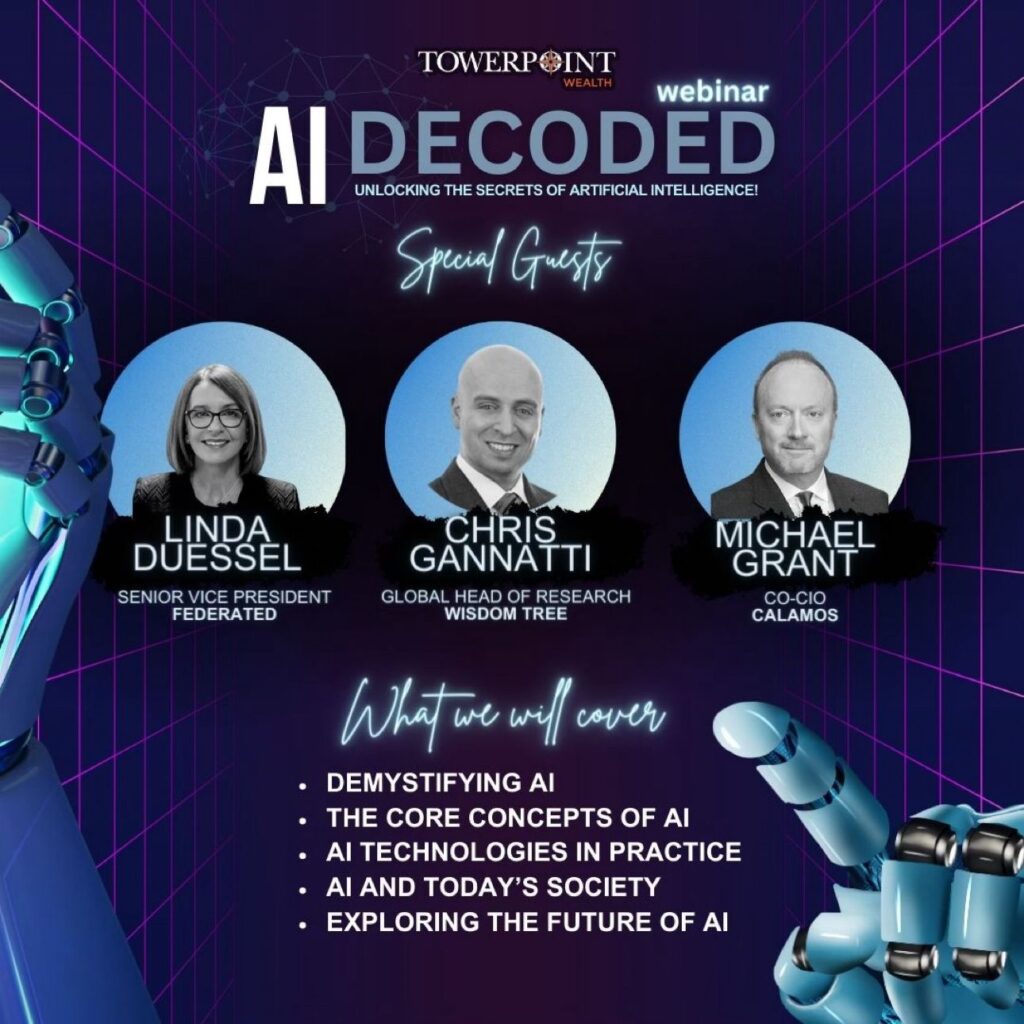

Curious about AI? Wonder what artificial intelligence (AI) is all about?

JOIN US!

Our upcoming 10/31 webinar promises to be an enlightening exploration into the world of AI, designed to demystify its intricacies and empower you with valuable insights. Join to listen what our three AI experts have to say:

- Linda Duessel, Senior Equity Strategist, Federated Hermes

- Chris Gannatti, Global Head of Research, WisdomTree Asset Management

- Michael Grant, co-CIO, Calamos Investments

Click HERE or the image below to RSVP!

Click the images below to get caught up on some of our most recent trending moments at Towerpoint Wealth you might have missed!

Four Reasons to Choose T-Bills Over CDs!

Click below to watch our most recently produced educational video, as we delve into the comparison between Treasury bills (T-Bills) and Certificates of Deposit (CDs). Discover why T-Bills might be the superior choice for conservative investors. Learn about T-Bill security features, tax benefits, liquidity, and more.

If you find this video helpful, give it a thumbs up, and hit the notification bell to subscribe to the Towerpoint Wealth YouTube channel for more insightful financial content!

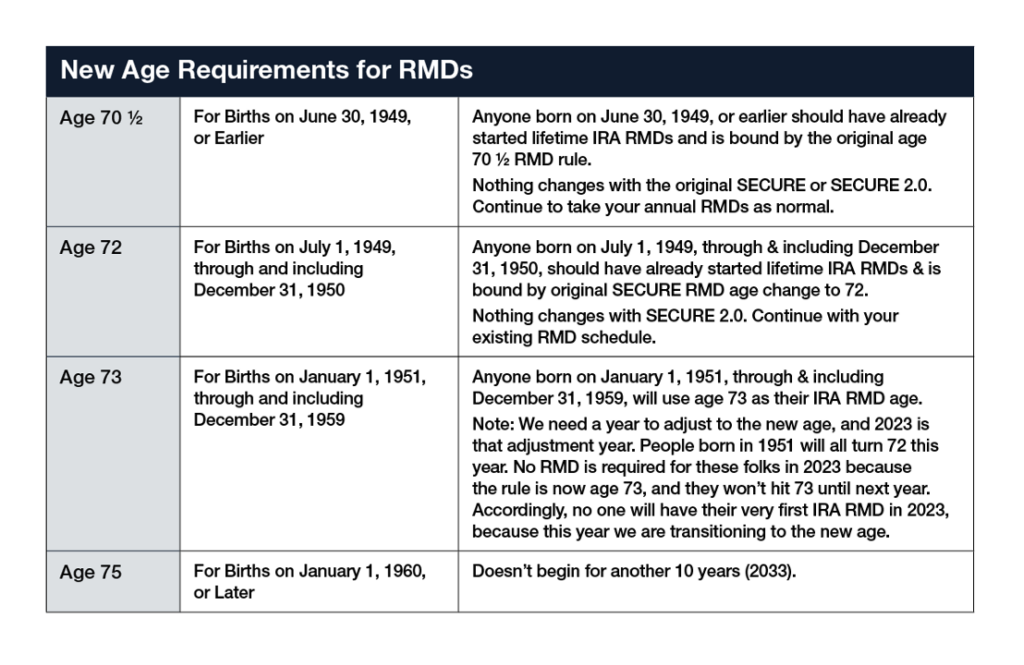

Changes to Retirement Account RMDs

Below you will find a summary of how the rules regarding required minimum distributions (RMDs) are evolving under the recently passed Secure Act 2.0 legislation, signed into law by President Biden on December 29, 2022.

SECURE 2.0 is a comprehensive piece of legislation aimed at broadening retirement plan coverage, promoting increased retirement savings, highlighting the significance of Roth accounts, and making significant adjustments to RMD regulations. It builds upon the framework established by the SECURE Act of 2019. SECURE 2.0 introduces notable changes concerning RMDs:

- One prominent adjustment allows specific retirement account holders to further postpone their taxable RMDs. While the SECURE Act of 2019 raised the RMD age from 70 ½ to 72, SECURE 2.0 extends it even further, to age 73 and potentially as late as age 75.

- Participants in Roth employer plans, such as 401(k)s, are no longer required to take lifetime RMDs from these accounts.

- Additionally, the legislation reduces the penalty tax associated with failing to take or taking less than the required RMD for the year.

Certain provisions in the law simplify the statute of limitation rules for specific errors related to your Individual Retirement Account (IRA). These changes represent significant updates aimed at enhancing retirement planning and financial flexibility.

Click the image below to complete our short form and download Towerpoint Wealth’s 2023 Tax Reference Guide, an excellent resource and tax “cheat sheet” that was designed to help you take advantage of the many tax deductions and opportunities there are to help shave to help shave money off of your tax bill!

Have questions about your upcoming 2023 tax return?

Would you like to review an old tax return for missed opportunities?

Click the banner below to message Steve Pitchford, Steve Pitchford, Certified Financial Planner.

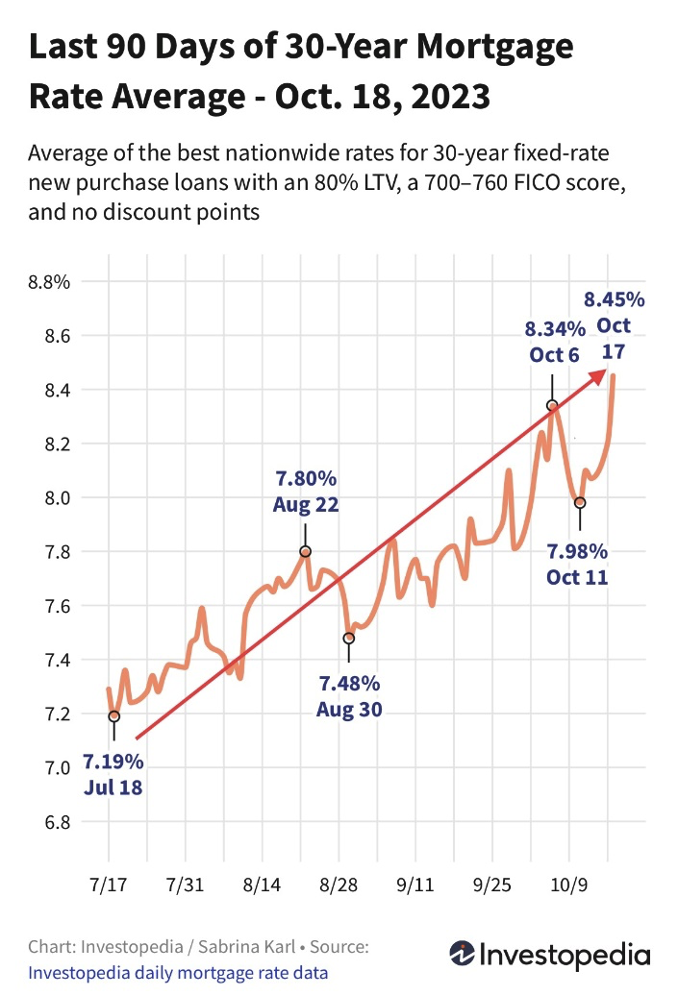

Mortgage rates are surging higher since mid-July and are now at their highest point since August, 2000, reducing affordability and home sales.

Thanks to Investopedia for the graph.

In light of how unsettled the economy and markets are, are you concerned or worried about the bonds in your portfolio, and/or the overall level of risk you are taking in your portfolio? Message us to discuss your circumstances.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity. We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on YouTube

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on X

Click HERE to follow TPW Podcast : A Wealth of Knowledge