From ancient civilizations to modern society, humans have always had a fascination with gold. The yellow metal has been used as currency, as jewelry and incorporated within various other industrial applications. Gold also helped shape United States history when it was discovered in the Sacramento Valley in 1848 sparking the California Gold Rush. But does it belong in your investment portfolio? We will discuss some of the benefits and drawbacks below.

1) Store of Value

Famed financier J.P. Morgan once stated, “Gold is money, everything else is just credit”. This quote strikes at the core of the “gold as a store of value” argument. But what exactly is a store of value and what qualifies gold to be viewed as such?

By definition, a store of value is an asset that maintains its value without depreciating. Gold’s ability to maintain wealth by preserving purchasing power has been well documented. Civilizations throughout history have turned to gold as a means of exchange as well as a hedge against currency devaluation.

Gold’s finite supply also helps boost its appeal as a store of value. To date, all the gold mined throughout history would fit into two and a half Olympic-sized swimming pools. According to the US Geological Survey (USGS), approximately 187,000 metric tons of gold has been mined in total, with 57,000 metric tons remaining underground.

Critics of gold state that it is an antiquated means of exchange with little utility or industrial applications, outside of jewelry, and should therefore not be considered a store of value. Specific to utility, their argument could be viewed as valid. But what gold lacks in utility, it makes up for in investor psychology. Humans have long placed value in gold. While this value may very well be due to its historical reputation, until this connection is broken, gold will remain one of the primary assets used to preserve wealth.

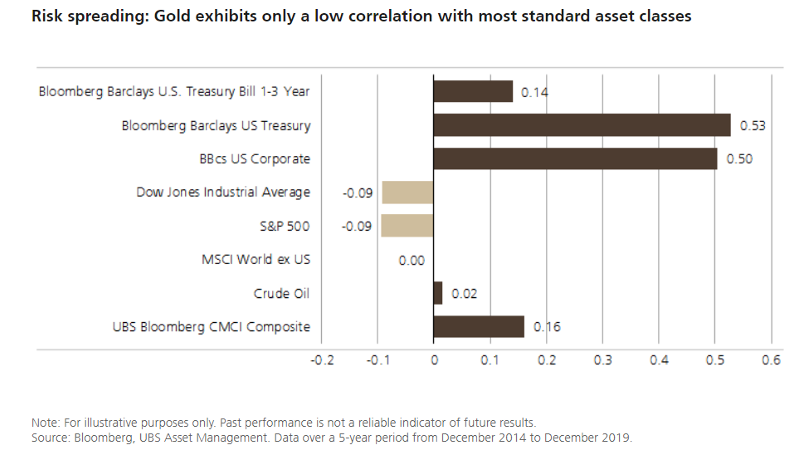

2) Low Correlation to Other Investments

One key aspect of a properly diversified portfolio is owning investments that have a low correlation to each other. What does this mean, and why is it important? Correlation is a numeric value from -1 to +1. The closer that two different investments are to having a +1 correlation, the higher the likelihood their respective market values will move in tandem with each another. Vice versa is true for investments with a -1 correlation. Investments with a correlation of 0 are completely unrelated, meaning the price movement of one has no relation to the price movement of the other.

For longer-term investors, it is important to work to have the correlation between the various asset classes (read: stocks, bonds, alternatives, cash, etc…) held in their portfolio be as close to zero as possible. This allows investors to better manage the risk of their portfolio, and increases the likelihood that the share price of investments held in differing asset classes will not move in the same direction in response to current economic and market trends.

Gold is a unique asset in that it has a low, or sometimes even negative correlation to the other primary asset classes typically included in a properly diversified portfolio. In fact, as you can see from the above graph, it tends to have a negative correlation to U.S. equities, hence sometimes being described as a “flight to safety” asset.

3) Portfolio Insurance

Just as you purchase home or auto insurance to protect your assets against unforeseen events, you should consider doing the same with your investment portfolio. As recent events have shown us, market and economic crises can and do happen.

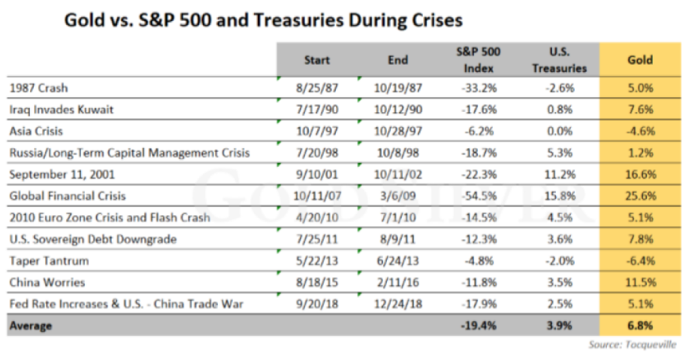

Given its negative correlation to U.S. equities, gold can provide needed insulation to your portfolio, helping it to better absorb these inevitable pullbacks. While it will not completely offset equity losses, gold can help reduce volatility and provide “downside insulation” to a portfolio.

As the chart below shows, with the exception of two instances, the 1997 Asian financial crisis and 2013’s “Taper Tantrum,” gold has achieved positive returns during times of equity unrest. It also has a tendency to outperform U.S. Treasuries during these downturns, which many view as another safe haven asset.

4) But What About Income…?

Gold is not without its faults. One of the main arguments against gold ownership is the lack of a dividend or interest payment and the fact it has little to no industrial production value.

One of the most famous investors in the world, Warren Buffet, is an outspoken critic of gold ownership for these very reasons. He has been quoted as saying,

“Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

…and Mr. Buffett would be correct. Gold has little to no real economic utility, does not generate sustainable cash flow, and does not pay a dividend.

What it does offer is relative stability and the potential for price appreciation. During turbulent economic times when company cash flows decline and dividends are cut or reduced, gold tends to shine, as investors try to preserve capital and fear the inevitable stimulus measures taken by central banks and/or government could stoke inflation and decrease the purchasing power of their currency.

More recently, financial markets have also been grappling with historically low interest rates, with some countries even experimenting with negative interest rates (i.e. investors paying the government interest, instead of receiving it, when owning government-issued bonds). This has significantly lowered the opportunity cost of owning gold (which pays no interest) versus owning government-issued bonds (which pay interest) as investors look for safety during times of market unease. Gold has been a direct beneficiary as the declining interest rate trend has gained steam, particularly in countries issuing bonds with negative interest rates. Why would an investor choose to pay interest to own a government bond when they could own gold instead, achieving the similar end goal of capital preservation?

4) What happened to gold with the COVID-19 pandemic and the March 2020 decline?

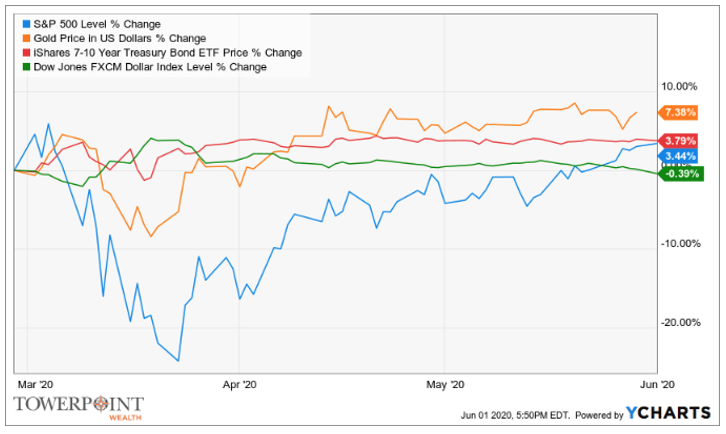

During the depths of the COVID-19 market pullback in March of 2020, gold suffered sizable declines along with equities. In fact, it suffered its largest weekly decline since 1983 while equities dipped into bear market territory in a record-shattering 20 days. Doesn’t this fly in the face of all the previous arguments for owning gold?

It depends on what you believe. Some have argued that the declines in the price of gold, at the exact same time equities were dropping precipitously, debunks the theory that gold should be viewed as a safe haven asset during times of market turmoil. Especially coupled with the fact that US Treasury bonds and the U.S. dollar remained strong throughout the collapse in equity prices.

Proponents of gold have argued that the price decline the metal suffered in March, 2020 was due to the rapid shock the U.S. economy experienced as virtually all of us entered lockdown. This forced many investors to raise cash as rapidly as possible, and gold, being a very liquid asset, provided easy access to needed cash. These proponents would challenge that the price of gold acted similarly during the 2008/2009 financial crisis before ultimately touching all-time highs, not too different to what has happened over the last three months. By analyzing the above chart, we are able to see that initially gold did maintain its strength as equities began to move lower. As the equity losses accelerated gold prices declined before beginning its steady march higher prior to the March 23 low in equity prices. This does lend credence to the claim by gold “bulls” that the metal was used as a source of cash by investors during the selloff, and in doing so, helped them limit their losses.

In Summary While critics may remain unconvinced, it is hard to deny that gold has maintained its luster throughout history as a go to asset during times of uncertainty. Its ability to provide ballast to a portfolio allows your longer-term financial goals to remain upright and on course. We are by no means advocating that investors transition 100% of their assets into gold. However, we feel that a modest allocation of 3-7% in gold does have a place in a properly diversified investment portfolio.

How Can We Help?

Towerpoint Wealth is a fee-only certified financial planner near Roseville, Rocklin, Granite Bay, Folsom, Gold River, El Dorado Hills, East Sacramento, Curtis Park, Land Park, Elk Grove, and Rancho Murietta. At Towerpoint Wealth, we are a fiduciary to you, and embrace the legal obligation we have to work 100% in your best interests. We are here to serve you and will work with you to formulate a comprehensive and tax-efficient retirement strategy.

We serve clients primarily in the Northern California region. Glad you’re here! Please contact us with any questions you have about our wealth management process.

Nathan P. Billigmeier, Director of Research and Analytics | (916) 405-9170