The COVID-19 crisis has challenged and changed us all in different ways, including what we think of as essential. The conversation over what qualifies as an "essential" versus "non-essential" business has impacted many companies that produce and sell items and services considered essential for everyday use. What do you think of as essential (?) - we encourage you to reply to this email and let us know.

Traditionally defined, consumer staple stocks are broken down into five main industries: beverages, food, household goods, personal and hygiene products, and tobacco - services and items that individuals are either unwilling or unable to eliminate from their budgets even in times of financial trouble. Recently, a more contemporary definition of a consumer staple has emerged from our pandemic-altered lifestyles, and consequently, the definition of a consumer staple stock has arguably changed. Introducing, the FAANG stocks:

Facebook (social media). Amazon (e-commerce). Apple (smartphones and tech hardware). Netflix (video streaming). Google (online search and services). All five companies are known for their dominance in their respective industries and sizable customer bases. Combined, they have a market capitalization of more than $4 trillion! Additionally, as a group (below, in purple), the stocks have collectively outperformed the overall stock market (as measured by the S&P 500, below, in yellow) by a healthy margin so far in 2020:

While many other companies have experienced major interruptions to business operations during the COVID-19 pandemic, revenue and earnings for the FAANG stocks have been excellent. Facebook doubled its first quarter profit from 2019; Amazon's first quarter revenue in 2020 increased 26.4% from the same period a year ago; Apple increased its dividend by another 6% on April 30; Netflix now has 182.9 million subscribers, more than doubling its own projections for new paying customers in Q1 of 2020; and Google's parent company, Alphabet, experienced year-over-year revenue growth of 13% (to $41.2 billion) in the first quarter of 2020. Clearly impressive numbers for these "essential" businesses.

Will companies like the FAANG stocks continue to dominate in the hazy and nebulous "new normal" we are all continuing to get used to, or will things revert and this outperformance be temporary? One thing is for certain - we should get used to life, as well as the financial markets, remaining unsettled and uncertain for the foreseeable future.

Pandemic Notes

- Did you know that COVID-19 is an acronym for coronavirus disease of 2019? The name was selected by the WHO, the World Organization for Animal Health, and the Food and Agriculture Organization of the United Nations, working in cooperation. Their joint guidelines required that the name and its abbreviation be easy to pronounce, related to the disease, and not refer to a specific geographic location, a specific animal, or a specific group of people.

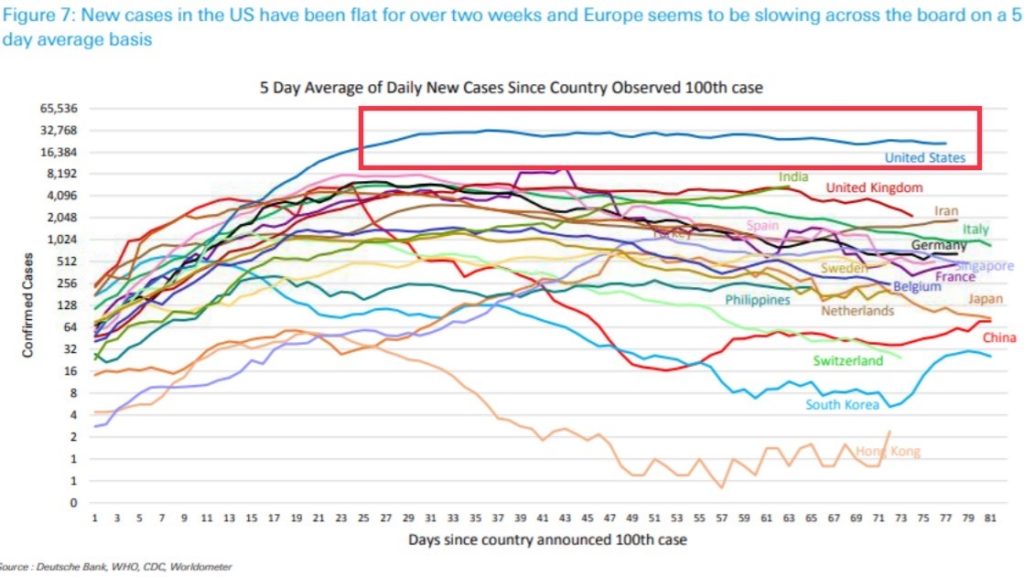

- Good news heading into the weekend: While one additional coronavirus diagnosis is too many, the curve is flattening, as new COVID-19 cases in the United States have been stable for over two weeks now, according to Deutsche Bank, the World Health Organization, the CDC, and Worldometer:

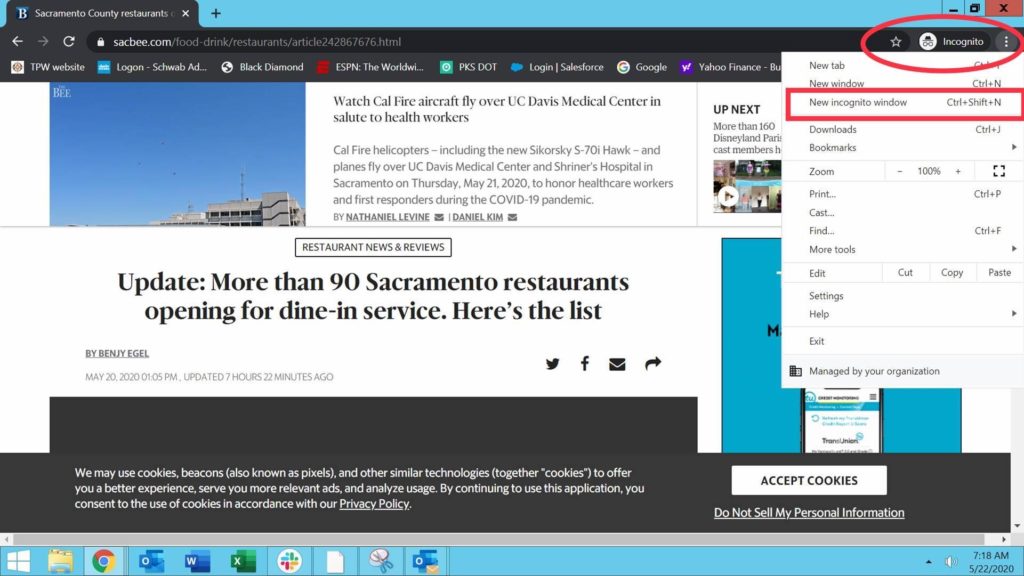

- More than 90 Sacramento restaurants are re-opening for dine-in service this weekend. To see the full list within the Sacramento Bee article, create a free account with the SacBee, or click HERE, and then cut and paste the URL into a web browser opened in "incognito mode" (a nifty little trick):

In addition to our dependence on the aforementioned technology behemoths and our desire to dine out again, a number of trending and notable events occurred over the past few weeks:

- Two dams failed after heavy rains in Michigan, leading to large evacuations

- Major League Baseball issues detailed safety proposal in an ambitious return-to-play plan for 2020

- Fred Willard, comic actor best known for his scene-stealing roles in "Best of Show" and "Anchorman," and on sitcoms "Laverne and Shirley" and "Everybody Loves Raymond," dead at age 86

- Jerry Stiller, actor and comedian known for his role as Frank Costanza in "Seinfeld" and Arthur Spooner in "The King of Queens," dead at age 92

- Monday is Memorial Day. The Chief of Staff of the U.S. Army posted a YouTube video with a message reminding us to remember our fallen soldiers

We are seeing early signs that these times of separation are beginning to pass, and opportunities to be back together in person with those we have been missing, are beginning to grow. And as always, whether in person or via a Zoom teleconference, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have - the world continues to be an extremely complicated place, and we are here for you.

- Nathan, Raquel, Steve, Joseph, Lori, and Jonathan