Successful Long Term Investing Strategies for Successful Long Term

Investors

Are you really a long term investor? Or do you just say you are a long term investor but behave more like a trader or a gambler, and fail to apply long term investment strategies to your portfolio? Watch our President, Joseph F. Eschleman, CIMA®, discuss exactly what it takes to truly act and behave like a long term investor, and what specific long term investing strategies and philosophies need to be developed and internalized to be a successful long term investor. Trying to successfully build, and protect, your wealth and “nest egg?” Watch this video to listen to Joseph outline seven key long term investing strategies and philosophies, as well as the exact emotional and behavioral characteristics needed to be a successful long term investor.

In this video, you can expect me to outline three key ingredients that, here at Towerpoint Wealth, we believe are *crucial* to being a SUCCESSFUL long term investor, and seven specific KEY long term investing strategies and principals that we believe NEED to be followed to successfully build, and protect, your wealth. You do want to successfully build and protect your wealth, don’t you?? Well then let’s get started!

SAYING you are a long term investor is easy; however, BEHAVING like a long-term investor is much more difficult. Throughout history, human behavior (specifically, fear and greed) has regularly gotten in the way of CONSISTENTLY following the long term investing strategies I am about to outline.

Or, put differently, as the great boxer Mike Tyson said, “Everybody has a plan until they get punched in the face.”

When the markets, economy, and politics are relatively “normal,” investing seems easy. However, when things get crazy, volatile, unbelievable, explosive, unpredictable, turbulent, harrowing, or unsettling, it becomes much more difficult to tolerate, endure, and absorb a major body blow to your “nest egg.”

Watching your money SHRINK can be a very emotional and traumatizing experience. And while there is no perfect recipe for becoming a successful long term investor, at Towerpoint Wealth we believe doing so all starts with three basic ingredients:

- Consistent objectivity

- Measured behavior

- Disciplined thinking and execution

In addition to the inherently emotional nature of money, there are a myriad of uncontrollable variables populating the external environment we live in that makes it quite difficult to enjoy the benefits of being long term investor: The movements of the stock market. The vicissitudes of the US and global economy. The fickle nature of the political winds. Increases and declines in interest rates, income taxes, and inflation. These are just a few examples from a very lengthy list of items that are OUT OF OUR CONTROL. And while it is human nature for us to think (even to outright believe) that we have some control over many of these things, the truth is, if we want to truly be a successful long term investor, we must recognize and accept the things we do not control.

At Towerpoint Wealth, we believe that the most successful long-term investors and wealth-creators have a somewhat-unique capability, a skill, that allows them to maintain appropriate perspective, to exhibit a high degree of humility, and to be laser-focused on the bigger picture. Fortunately, this IS a skill that can be coached, cultivated, and learned, and is something that we have a relatively high degree of control over.

But let’s pause, make this more tangible, and highlight seven key long term investing strategies and principles that, at Towerpoint Wealth, we believe are necessary to be a successful long erm investor:

- Be humble, be aware of, and accept, things that are out of your control

- Keep your emotions in check, and be acutely self-aware of the fear and greed that we may feel when considering our finances and investments, especially during periods of extremes

- Plan to live a LONG life, which we actually do have some control over!

- Einstein was right: The power of compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.

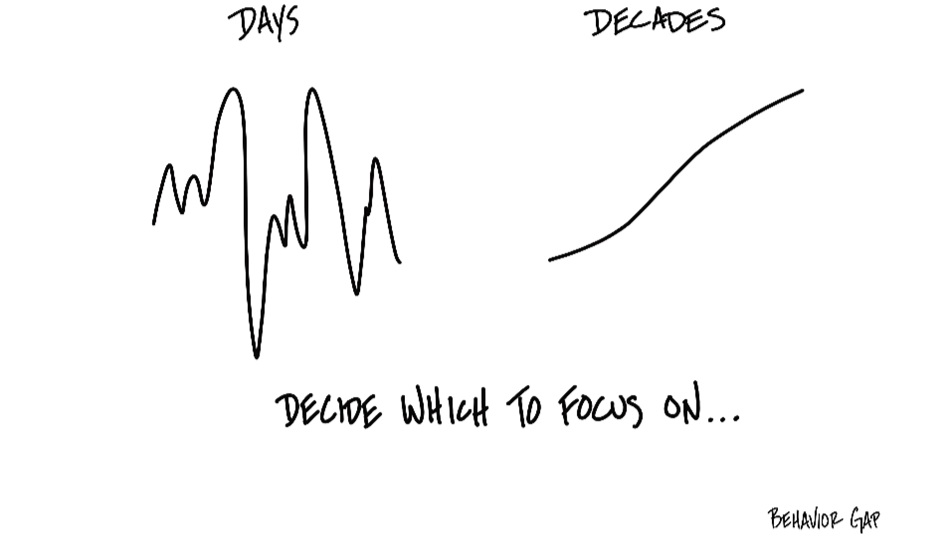

- Volatility should be expected, embraced, and taken advantage of, not feared nor averted

- Unless you have the unique ability to consistently AND accurately predict the future, stay properly invested and diversified, REGARDLESS of what you believe may happen in the market and in the economy

- Have a plan and a strategy, and be disciplined in sticking to it, regardless of the things you have no control over

In opining about what we believe it takes to be a successful long-term investor, we would be remiss if we did not directly integrate Warren Buffett’s (aka the “Oracle of Omaha”) wisdom on this subject into this video. Warren said it best:

Someone is sitting in the shade today because someone planted a tree a long time ago.

Do you have a plan to properly manage and coordinate all of your financial affairs, and a strategy to be a successful long term investor by growing and protecting your wealth and investment portfolio, even during turbulent times?

If so, are you being disciplined in consistently following it? If you have concerns, or simply would like to discuss how you can apply the long-term investment principles discussed above, we welcome having a conversation with you. Click HERE to message us, as we regularly have no-strings-attached conversations about these issues, and are happy to be an objective resource for you as you begin to consider your personal and financial circumstances further.

At Towerpoint Wealth, and UNLIIKE advisors at the major Wall Street firms, we are a fiduciary to YOU, and have a legal obligation to act in your best interests 100% of the time. If you have concerns, or simply would like to discuss how you can apply the long term investing strategies and philosophies I’ve discussed today, we welcome beginning to get to know you, and to have you get to know us. [SMILE} So let’s talk! Message us in the comments section, call us at 916-405-9150, or email us at info@towerpointwealth.com, to discuss your circumstances further.