Investors are oftentimes their own worst enemy. Built-in psychological biases can lead to bad decision-making. At Towerpoint Wealth, we believe that being aware of these cognitive predispositions, and overcoming them, can be the single biggest driver to successfully building and protecting one's longer-term wealth and net worth.

As human beings, we are hard-wired to avoid pain and to pursue pleasure. Additionally, avoiding immediate pain is much more motivating than gaining immediate pleasure (see Loss Aversion in the list below), all of which is good when hunting, gathering, and surviving in the wild, but not so good when it comes to investing. Fortunately, there are many ways to stop doing foolish things with your money, and being mindful of and avoiding these behavioral obstacles is at the top of the list. Emotional decision-making and poor investor behavior have always been major impediments to successful investing. If we are able to recognize, and to some extent, control our emotions and cognitive biases, the probability of achieving the economic results we desire increases significantly.

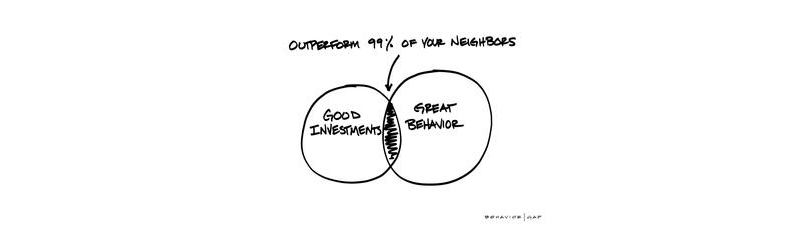

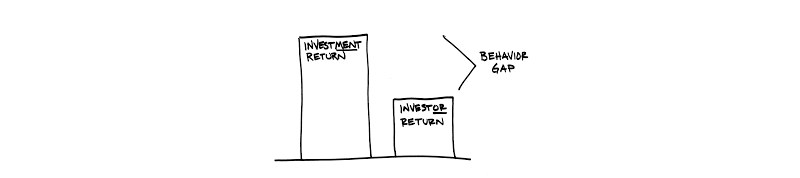

Author, artist, and financial advisor Carl Richards coined a phrase known as the Behavior Gap to describe the difference between the higher returns that investors might potentially earn and the lower returns that they actually do earn because of their own behavior. A classic empirical example of poor investor behavior and the Behavior Gap is that of the Fidelity Magellan fund.

From 1977-1990, the portfolio manager for the Magellan fund was Peter Lynch, considered by many to be the best mutual fund manager of all time. During the nine years the Magellan fund was open to the public (1981-1990), Magellan earned an annual return of 21.8%! However, Lynch himself pointed out a fly in the ointment - the average Magellan investor only earned an average annual return of 13.4% during the same time period. Money would flow out of the fund during setbacks (i.e. investors were selling low), and money would flow back into the fund during advances (i.e. investors were buying high).

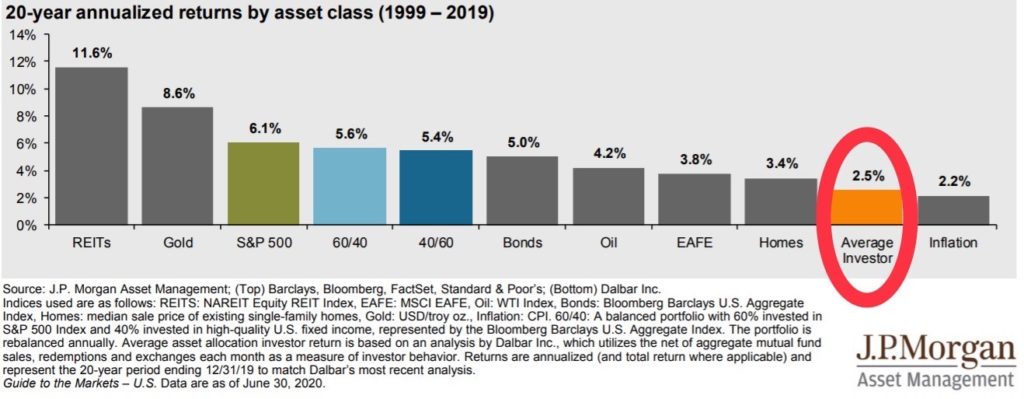

The Fidelity Magellan example and Richards' Behavior Gap concept provide additional evidence supporting the data found in J.P. Morgan's chart below:

So what are the behaviors and biases that investors need to consider and be mindful of? Below is a "Top Ten" list (in no particular order) of the most prevalent, and important, ones to consider:

- Loss aversion - the tendency to prefer avoiding losses to acquiring equivalent gains

- Overconfidence - the tendency for investors to overestimate what they know or are capable of; "I know better than everyone else"

- Mental accounting - taking undue risk in one area and avoiding rational risk in others; categorizing money and treating funds differently, depending on their origin

- Regret avoidance - not performing a necessary action due to the regret of a previous failure; refusing to admit a poor investment decision was made

- Herd behavior - copying behavior of others, even in the face of unfavorable outcomes, and whether or not those actions are rational

- Optimism - the tendency to believe that you are less likely to experience a negative event than someone else

- Anchoring - relying too heavily on familiar experiences, even when inappropriate; relying on the first piece of information to which we are exposed

- Framing - how we alter our decisions depending on how information is presented to us; we react a different way when the same choice is presented in the context of a loss or gain

- Hindsight bias - the misconception, after the fact, that one "always knew" they were right

- Recency bias - favoring a recent event over a historic one; giving greater importance to a more recent event

At Towerpoint Wealth, we embrace our responsibility to help you, our client, to recognize and overcome these behavioral biases. However, we also understand that our clients are human, and recognize that it is impossible to be completely devoid of the emotional biases that can lead to poor decision-making. We balance that by remaining disciplined and objective as your financial coach and quarterback, and helping you identify, be mindful of, and avoid having these behaviors cause negative impact on your plan, strategy, and decision-making. All of this is in the service of affording you complete economic peace of mind.

What's Happening at TPW?

The entire Towerpoint Wealth family enjoyed a fun night out together two weeks ago, connecting for cocktails at Zocalo's downtown location, and then for an amazing Spanish dinner at Aioli Bodega Espanola!

TPW Service Highlight

Unbeknownst to some of our clients, Towerpoint Wealth provides integrated counsel, planning, and expertise in a myriad of real estate-specific areas. Advice on buy or sell transactions and negotiations, mortgage, HELOC, and liability analysis, investment property cap rate and return-on-investment (ROI) planning, 1031 like-kind exchanges, Delaware Statutory Trust (DST) sourcing and due diligence, and real estate tax and estate planning are all areas we regularly help our clients directly manage and care for.

Click HERE to read an excellent Forbes article discussing the importance of combining real estate expertise and financial planning.

Towerpoint Wealth Original Content

Inflation may be on the rebound, and real interest rates are moving deeper into negative territory. Both have provided a big tailwind for the price of gold over the past few months.

Should you own this precious metal in a properly balanced investment portfolio? What are the benefits and drawbacks to owning gold? Click below to read our recently-published white paper, GOLD - 24 Karat Shine or Pyrite for Your Portfolio, discussing these, and other important consideration

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely complicated place, and we are here to help you properly plan for and make sense of it.

- Nathan, Raquel, Steve, Joseph, Lori, and Jonathan