Any concerns about the economic carnage seen in the rear view mirror were overshadowed again this morning by the hope and optimism of the economic recovery that is seen when looking out the front windshield.

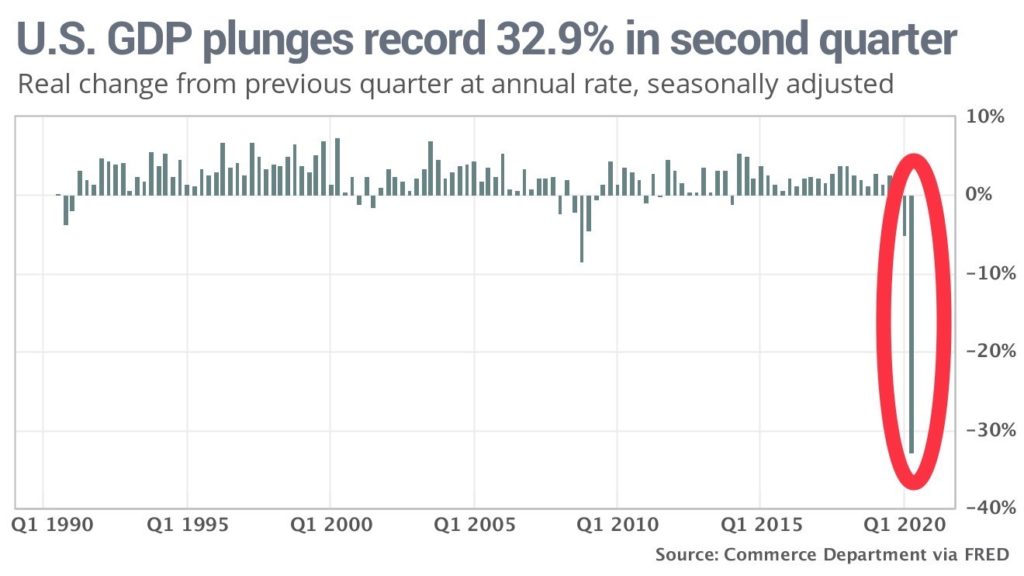

Yesterday, we were not surprised to receive confirmation from the U.S. Department of Commerce that an economic contraction of historic proportions occurred in the second quarter of this year, as the coronavirus-induced shutdowns battered the United States economy:

Yes, the U.S. economy shrank by one third just in the second quarter alone. Here is a graphical depiction of this GDP plunge:

With a headline number this horrific, one might expect the financial markets to immediately tank, and panic to ensue, exacerbating the depth and darkness of the hole that our economy cratered into between April and June of this year. However, chaos, fear, and a huge selloff were anything but the case.

Three reasons why the economy tanked but the financial markets have recovered:

- We are coming out of the crater, not driving into it (front windshield, not rear view mirror)

- Demand for technology companies, and tech stocks, continues to explode

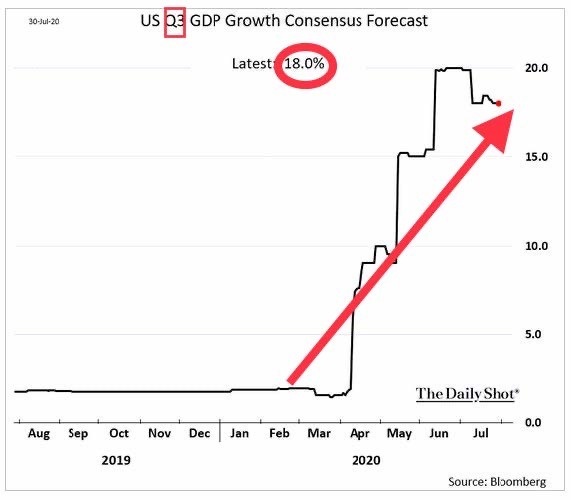

- A large economic/GDP bounce back is expected in the third quarter:

Facebook, Amazon, Apple, and Google (Alphabet) all reported their quarterly earnings results yesterday afternoon, and all four companies beat already-high expectations. Facebook posted 11% revenue growth and issued stronger-than-expected sales guidance for the current quarter. Amazon's sales soared, and operating income nearly doubled compared with the big drop that analysts had expected. Apple easily exceeded sales and profit estimates, and announced a 4-for-1 stock split. And Alphabet investors, while tolerating the company's first year-over-year decline in advertising revenue, had sales from its cloud-computing segment come in well above expectations.

Through yesterday, Amazon is up 61% and Apple is up 31% for the year (and both stocks appear set for additional gains based on trading so far today), while Facebook and Alphabet have both gained 14% so far in 2020. Truly a historic run for these tech behemoths.

We believe this outperformance should not come as a huge surprise, given the work-from-home trend the pandemic has advanced, further accelerating technology's leadership position; however, the pace, and scope, of this outperformance has certainly been noteworthy.

All is certainly not well for the U.S. economy - far from it. And while a full economic recovery is still a long way off (we do not expect an unemployment rate below 4% until at least 2023 or 2024), the economy is at least generally headed in a better direction. And, while assuming the recovery will be anything but a smooth ride, we are confident that we are driving away from the worst of it, and looking at a better road ahead.

What's Happening at TPW?

For many people, spending time in Mother Nature has been a welcome respite during the COVID-19 lockdowns, and this has held true true for several of us here at Towerpoint Wealth.

Our Partner, Wealth Manager, Jonathan LaTurner, in the throes of enjoying a large dose of the great outdoors in Mammoth Lakes, hiking and fly fishing on the San Joaquin River with his partner, Katie McDonald.

Our Director of Tax and Financial Planning, Steve Pitchford, on an eight mile hike on the Salmon Falls Bridge / Darrington Trail in El Dorado Hills.

TPW Service Highlight

Are you eligible for a 401(k), 403(b), 457, TSP, profit sharing plan, or an employer-funded defined benefit (pension) plan through your employer? Do you have a Roth option available within your defined contribution retirement plan? Have you qualified for a single or multiple grants of restricted stock units (RSUs) or non-qualified stock options? Do you have an employee stock purchase plan (ESPP) available to you, perhaps offering a discount on shares of your employer's stock? Is employer-sponsored (group) life insurance and long-term care insurance part of your benefits offering?

We welcome working side-by-side with you to conduct a thorough deep-dive and audit of all of the various perks and benefits your employer offers. Analyzing, leveraging, and maximizing your employee benefits package could be one of the most impactful decisions you make in the service of your longer-term economic health, and we stand by ready to offer our counsel, expertise, and experience in this multi-faceted and oftentimes confusing area.

Graph of the Week

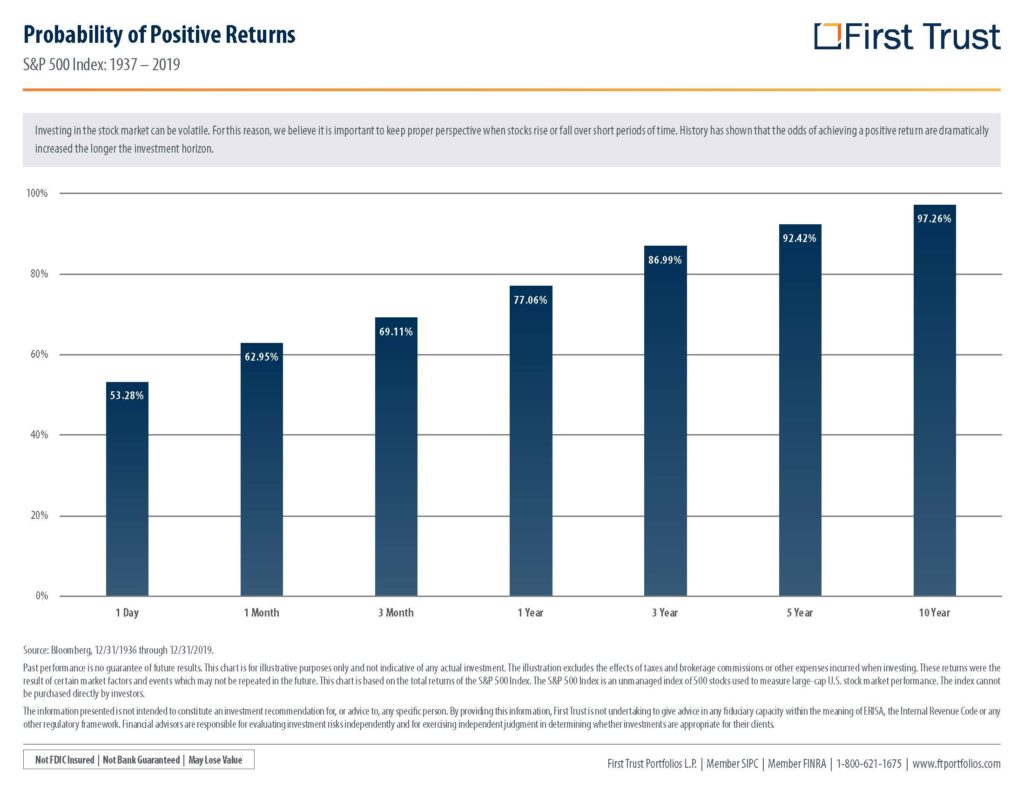

Investing in the stock market can be volatile. For this reason, we believe it is important to keep proper perspective when stocks rise or fall over shorter periods of time. History has shown that the odds of achieving a positive return are dramaticallyincreased the longer the investment time horizon.

We think First Trust's illustration below does an excellent job of conveying this ideal.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely complicated place, and we are here to help you properly plan for and make sense of it.

- Nathan, Raquel, Steve, Joseph, Lori, and Jonathan