From Properties to Profits: Part One Mastering Taxes as a Real Estate Investing Pro!

AUTHOR: MEGAN M. MILLER, EA, Associate Wealth Advisor, Towerpoint Wealth

MEGAN M. MILLER, EA With a bachelor’s in Economics from UCLA, Megan began her career at Pricewaterhouse Coopers (PwC) in their individual tax group, primarily consulting and working with employees of Fortune 500 companies through their international work assignments. She then migrated from Los Angeles to Northern California, gathering experience and guiding Sacramento and Bay Area business owners, technology entrepreneurs, and venture capitalists at two Northern California firms.

In continuing to build and apply her wealth advisor experience and expertise, Megan is excited to leverage and apply her deep tax knowledge and economic proficiency to help Towerpoint Wealth clients properly coordinate all of their financial affairs in a fully comprehensive capacity. Working as a true fiduciary at a fully independent wealth management firm aligns well with her values, and she is excited to use her wisdom and skills to help guide TPW clients towards achieving their personal and economic goals, acting as a legal fiduciary and always putting their best interests first.

Transition from simply owning real estate to building true wealth by mastering the art of tax and retirement planning as a real estate professional. In this guide, we will explore advanced tax-saving strategies, retirement account options, and investment techniques that will help you more efficiently grow and protect your long-term wealth.

Are you just starting out in real estate investing and want to make sure you’re getting all the tax deductions allowed to you?

Or are you a real estate investing pro interested in reducing your current tax bill and planning for a financially secure future?

Regardless of your experience level, if you are a real estate investor, this guide was designed for YOU! Below you will find actionable strategies to help you minimize the income taxes you pay, and reduce your obligation to Uncle Sam in order to “get better gas mileage” as a real estate investor.

If you’re new to the game, our first suggestion is to JUST GET STARTED. We see many potential real estate investors get stuck in “analysis paralysis” regarding which type of business entity to create and how to structure their real estate investing business. However, if you don’t have many assets yet to protect or minimal investment income to strategize around, you’re likely better off starting off as a sole proprietor, which requires no formal entity organization.

This simply means establishing a separate business bank account (and credit card, if you’d like) and tracking your real estate investing expenses and income. Whether it be flipping, wholesaling, owning short-term or long-term rentals, contracting, lending, etc., once you have your business account setup to receive deposits and pay bills, use an expense tracking tool to keep your business organized. (An app like QuickBooks Self-Employed is an excellent choice.) JUST GET STARTED.

Move on to consider entity creation and business structure when you really need it – when you begin to accumulate assets or are receiving substantial income that warrants more complex (and often costly) tax planning.

PART ONE: MASTERING TAXES

Keep it in the family

How doing business with family could be a good thing for your wallet.

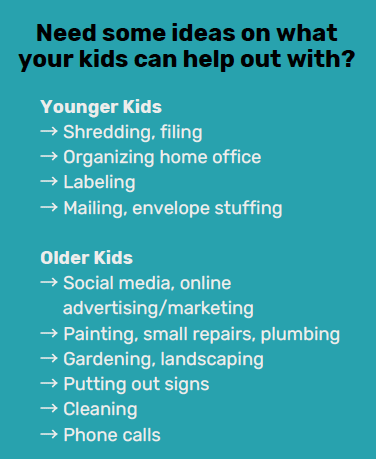

As a real estate investor, you are a business owner. If you have children, you have tax minimization opportunities! If your son or daughter is currently earning money from you, receiving a weekly or monthly allowance, or being given money for food, clothes, etc., the money you are already providing to your kids could be tax-deductible to you!

How? Hire your kids!

THE FAMILY EQUATION

1 high school child + 1 middle school child

Each working 10 hours/week for your business @ $15/hour

= $7,800 per child in wages annually x 2 children

= $15,600 tax deduction for your business

= $3,600 in annual tax savings for YOU*

*based on an estimated parental tax bracket of 32% and child tax bracket of 10%

Important note here: Be sure that you or your child are properly documenting time worked for the business, that your kids are being paid from your business account, and are on payroll — it’s worth it to minimize your taxes!

BONUS PLANNING IDEA: Establish a tax-free Roth IRA account for your child, and have them fund it with their earnings. Contributions to Roth IRAs, while not tax deductible, grow and are withdrawn tax free. The earlier one starts investing, the more time that money has to compound.

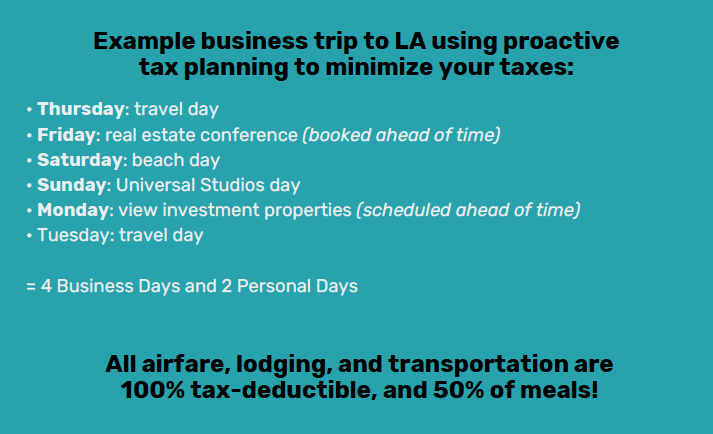

Travel Smart

Planning to take a trip? Make it a business trip and minimize your taxes by writing off your travel, airfare and transportation costs!

All travel, airfare, and transportation are fully tax-deductible, and meals are 50% tax-deductible, as long as the “primary” purpose of the trip is business.

“Primarily Business” = 50% or more of the trip days are business days (travel days count as business days!)

IMPORTANT NOTE: For full tax-deductibility, be sure you keep good records of your airfare, lodging, transportation, and meals, that they are not “lavish or extravagant,” and ensure you plan out and schedule your business activities in advance so it is clear that at least 50% of the trip is intended to conduct business.

The double dip

Why rental real estate income is so lightly taxed

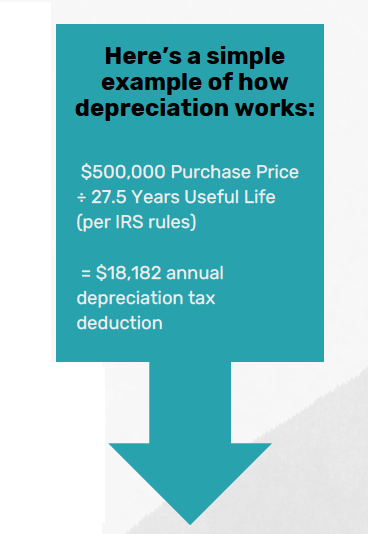

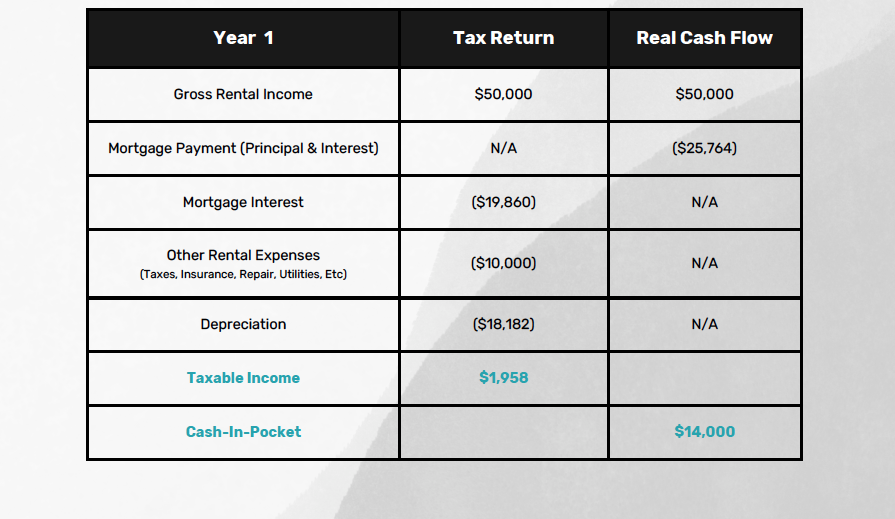

A key reason why real estate investing is so appealing from a tax minimization standpoint is because you’re paying taxes on far less income than you actually receive in your pocket. This is due primarily to the IRS-allowed depreciation expense.

What is depreciation? Depreciation helps you to minimize your taxes because it allows for an annual income tax deduction to “recover” the original cost, or purchase price, of your investment property. The IRS requires that depreciation to be amortized, or applied over the entire time you own the property, known as the “useful life” of the property. For residential rental property, the IRS has determined the maximum “useful life” to be 27.5 years.

As you can see in the example below, you receive $14,000 in your pocket in cash flow, but only about $2,000 of the $14,000 is subject to tax in the current year.

Essentially, because of how a mortgage payment is amortized (a majority of the mortgage payment in the early years of a mortgage consists of interest), and because the IRS usually allows a tax deduction for both depreciation AND mortgage interest, it feels like you are getting a double deduction or “double-dipping”, in the early years after the purchase of investment real estate.

The long game

Avoiding ordinary AND capital gains tax for flippers.

Typically, when an investment property is sold, or “flipped” for a gain, the gain on the sale is taxable at higher ordinary income tax rates — up to 37% at the federal level. Yikes!

What if you could completely avoid paying taxes on your flip? Here’s where focusing on the long game comes in by utilizing the IRS Section 121 Primary Residence Gain Exclusion rules. Here is how it works:

- Purchase the property you’d like to flip as your primary residence — you can often do this with a 5% down payment or less — another win!

- Live in the property for at least 2 years while completing your renovations.

- Sell the property after living in it as your primary residence for at least two years.

- Exclude up to $500,000 of gain from taxation* (this $500,000 capital gain exclusion applies to married filing joint taxpayers; the exclusion is $250,000 for single filers).

* Please consult your tax advisor or CPA regarding your specific circumstances

The teeny downpayment

Purchasing investment properties with as little as 3.5% down.

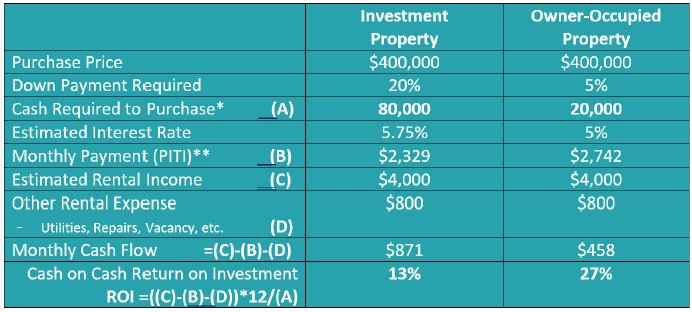

While not tax-specific, this is a favorite strategy for those who might not be flush with cash, but who still want to acquire a portfolio of rental real estate. Conventionally, purchasing an investment property as a rental that you do not intend to occupy requires a 20% or 25% down payment, BUT if you…

- Acquire the property as your primary residence AND

- Live in the home for at least 1 year

- THEN, move out and turn the property into a rental after 1 year…

You are typically able to purchase the property with far less down, as little as 0% on a VA loan or 3.5% with an FHA loan!

This greatly lowers barriers to entry, AND potentially increases your cash-on-cash return once the property is turned into a rental. ALSO, owner-occupied properties typically qualify for lower mortgage interest rates as compared to rental properties. If you don’t want to go the VA or FHA route, there are also conventional loans available starting at 5% down. Let’s run through an example:

*Not including lender and escrow closing costs

**PITI = principal, interest, taxes, property insurance + private mortgage insurance (PMI) required for < 20% down

Additionally, once the equity in your owner-occupied home increases to at least 20%, you can eliminate the monthly mortgage insurance payment of ~ $240 (PMI averages 0.2%-2% of the loan) and further increase your total monthly cashflow!

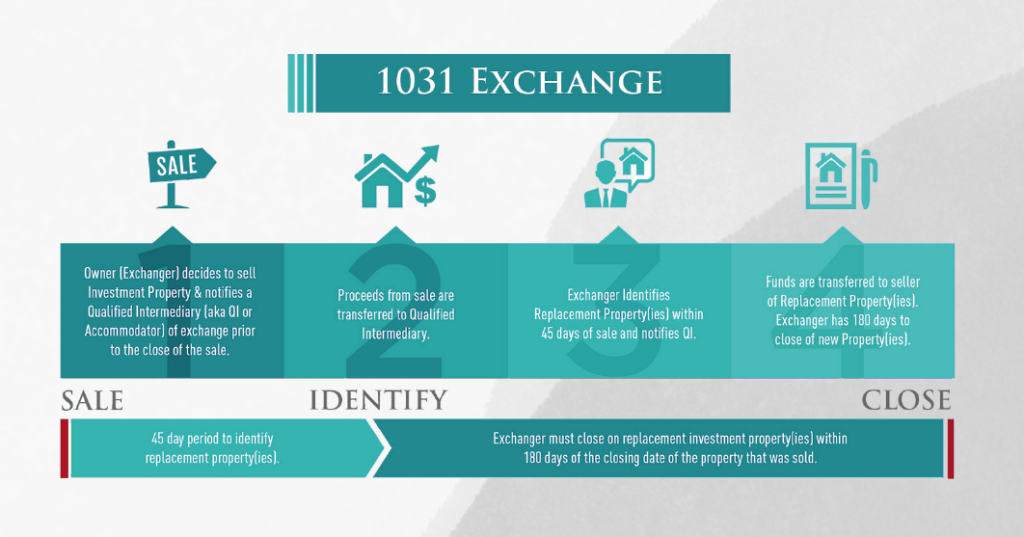

JUST “1031” IT

One of the Last Substantial Tax “Loopholes” – the Section 1031 Exchange.

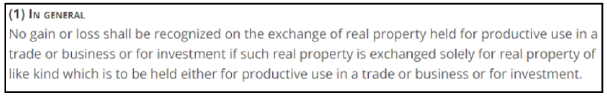

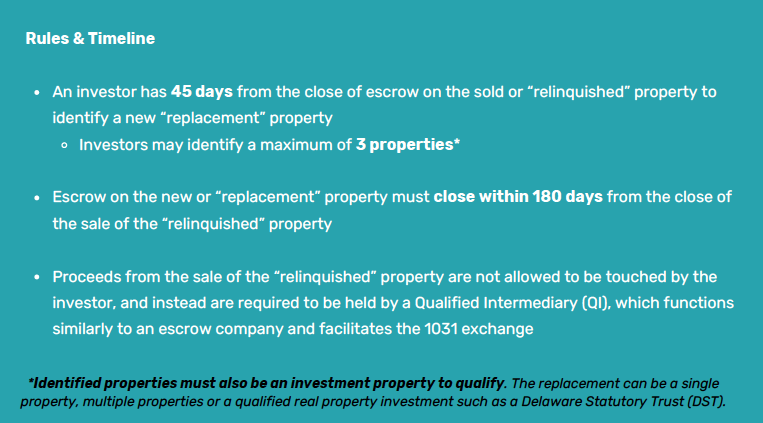

A section 1031 exchange is also known as a “like-kind” or tax-deferred exchange. Around since 1921, section 1031 exchanges are a common and well-known strategy that allows real estate investors to sell, or “relinquish,” an investment property, and defer any capital gains taxes on the profit by reinvesting the entire proceeds into a new “replacement” investment property of equal or greater value.

Officially, Section 1031 of the Internal Revenue Code says:

A 1031 exchange offers real estate investors the opportunity to defer paying taxes by reinvesting 100% of the proceeds and their equity into one or more investment properties. The money that would have been paid in taxes instead remains invested, generating more income and wealth.

Many real estate investors have accumulated significant wealth over their lifetimes by completing 1031 exchanges every time they sell, keeping more of their money at work, allowing for greater compounding of growth. Additionally, with proper estate planning, the taxes deferred through 1031 exchanges can be eliminated when properties are passed ultimately to an investor’s heirs if they so choose.

IMPORTANT NOTE: Delaware Statutory Trusts (DST) can be an excellent “back-up” replacement property to identify as a part of your exchange. If your purchase escrow on a real replacement property were to fall through for any number of reasons, identifying a DST as a backup will ensure you do not lose your ability to continue on with your 1031 and defer the capital gains tax on the sale of the “relinquished” property. DSTs are also perfect for investors with “leftover” funds from purchasing other properties in a 1031 exchange. See more on DSTs below.

YOUR TRASH, TOILETS, AND TENANTS ALTERNATIVE — THE DST

Using Delaware Statutory Trusts (DSTs) as “replacement” property in a 1031 exchange.

It can be difficult to find a high-quality replacement property for a 1031 exchange in the IRS- imposed 45-day identification period, which creates anxiety, and can result in poor investment decisions. A solution to this constrained time period can be the DST, or Delaware Statutory Trust. A DST affords an individual investor a fractional ownership of a commercial grade, professionally managed real property (or properties), while also meeting the requirements of IRS Section 1031 to qualify as a “replacement” property for a tax-deferred exchange.

DSTs provide access to commercial real estate ownership that may otherwise be out of reach for individual investors, allowing for investment in an institutional-quality property that may otherwise be economically unattainable. DST opportunities open and close regularly, vary based on the sponsor, and typically hold 1-3 properties in a single class of investment real estate such as student housing, multi-family housing, self-storage, warehouse space, office buildings, hospitals, government buildings, etc. Many investors feel a sense of “graduation” into the world of commercial real estate ownership when considering fractional ownership of a Delaware Statutory Trust.

Advantages of DSTs:

- FAVORABLE TAX TREATMENT

- Deferral of federal and state capital gains taxes AND depreciation recapture taxes.

- Income distributed is taxable but offset with depreciation and other real estate expense deductions passed through to the investor typically on a form 1099 or 1098. - NO MANAGEMENT RESPONSIBILITIES

- DSTs are a truly passive strategy — step away from the Terrible Ts — tenants, trash & toilets.

- The DST sponsor manages and utilizes professional property management. - ACCESS TO INSTITUTIONAL QUALITY PROPERTY

- Invest in property typically not available to individual investors.

- DSTs own large institutional grade properties in a wide variety of markets. - LOWER PERSONAL LIABILITY

- No individual financial qualification — the DST is the borrower on any loan.

- Non-recourse financing to the individual investor. - CUSTOMIZABLE INVESTMENT AMOUNT

- If you need to invest a very specific amount of funds to fully exclude the gain on your 1031 sale, DSTs offer fully customizable investment amounts.

- DSTs come in a variety of loan to value options to meet your exact loan to value on the property relinquished to avoid having to add additional cash, take out a new loan or pay tax on the boot. Boot is the additional taxable gain if the replacement property price is less than the sales price of the relinquished property. - DIVERSIFICATION

- Can decrease overall risk in your real estate portfolio by offering additional geographic locations.

- Wide variety of property types (multi-family, student housing, senior housing, self-storage, industrial, etc.).

- Can divide proceeds amongst multiple DST investments.

Potential limitations of DSTs:

- ACCREDITED INVESTORS ONLY

- > $1M of net worth excluding primary residence, OR

- $200,000 of annual income for single investors and $300,000 with spouse or partner in the 2 years prior. - LIQUIDITY CONSIDERATIONS

Usually, there is an investment “lock-up” period, until the property is sold (called “going full- cycle”), which typically is between 4-8 years. - ADDITIONAL POTENTIAL STATE TAX RETURN FILINGS

Depending on the location of the investment(s) held inside of the DST, investment in a DST may required additional state income tax return filings. - VARIABLE QUALITY OF SPONSORS

Many companies offer DSTs, but not all have the same reputation, capitalization, and market recognition.

DSTs offer the potential for stable, long-term income without landlord duties, appreciation in property value, and fit almost any size exchange, as a DST investor owns a proportionate share of the property.

Additionally, the income that a DST generates is tax advantaged as an investor is able to deduct their proportionate share of mortgage interest and depreciation. But remember, it is always important to consider the limitations as well in considering whether a DST is right for you as a real estate investor.

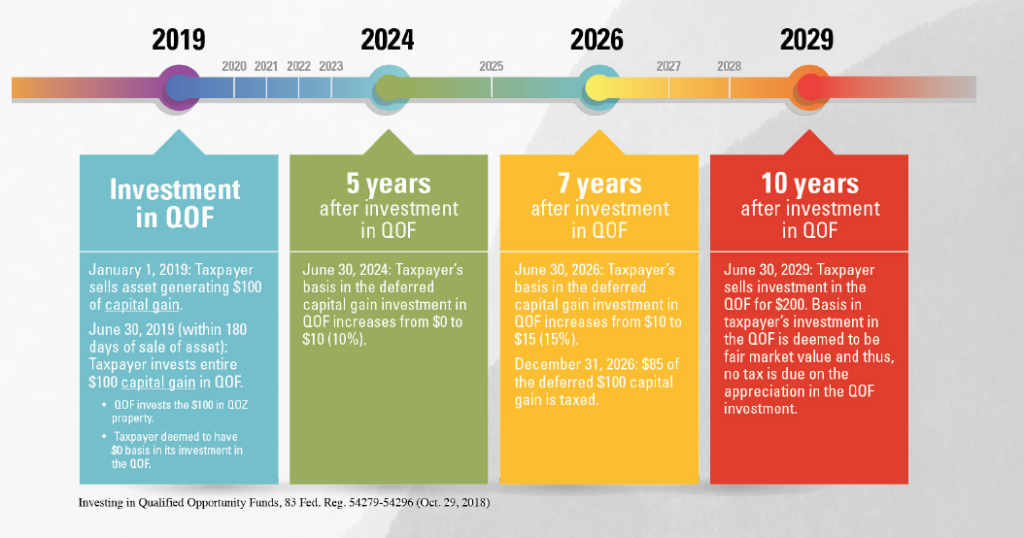

QUALIFIED OPPORTUNITY ZONE FUNDS

Do you have a capital gain in excess of the $500,000 primary residence sale exclusion? Or perhaps a large taxable stock sale?

A new addition to the IRS tax code that was introduced under the 2017 Tax Cuts and Jobs Act, Qualified Opportunity Zone Funds (“QOFs”) are an economic development tool that allow people to invest in distressed areas in the United States while taking advantage of major tax benefits. Capital gains that are generated from the sale of other assets can be invested into a QOF, and the recognition of either part of or all capital gains taxes associated with the sale will be deferred until December 31, 2026. This provides a number of powerful and unique financial planning opportunities:

- Ability to spread tax liability over multiple periods to reduce annual tax liability and marginal tax rate paid.

- Allow for time to engage in strategies like tax loss harvesting to offset capital gains. ADDITIONALLY, if the investor holds their interest in the fund for at least 10 years, their basis is stepped-up to fair market value and the growth of the investment upon exit is free of taxation! (assuming exit prior to 12/31/2047).

- Retroactive tax planning

- An investor has 180 days from the date of the sale that gave rise to the capital gain to invest the realized part of it into a QOF. - ANY appreciated asset qualifies including assets like a business, stocks, bonds, collectibles and primary residences that DO NOT otherwise qualify for 1031 exchanges.

How Can We Help?

At Towerpoint Wealth, we are a legal fiduciary to you, and embrace the responsibility we have to act in our clients’ best interests 100% of the time. We also understand that “talking taxes” can be intimidating, and that applying capital toward “retirement investing” instead of additional real estate investing might feel awkward and different from your “normal” wealth-building philosophy.

However, it is essential to educate yourself on the myriad of different and non-conventional planning opportunities as outlined in this white paper, as each of us will carve a unique path as we strive forward in our wealth building and wealth protecting journey.

Start on your plan today — call 916-405-8168 or email mmiller@towerpointwealth.com or schedule an appointment to get the ball rolling and open an objective dialogue.

Towerpoint Wealth, LLC is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Towerpoint Wealth, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Towerpoint Wealth, LLC unless a client service agreement is in place.