- 500 Capitol Mall, Suite 2060 Sacramento, CA 95814

- info@towerpointwealth.com

Helping you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement.

- 500 Capitol Mall, Suite 2060 Sacramento, CA 95814

- (916) 405-9140

- info@towerpointwealth.com

- https://towerpointwealth.com/

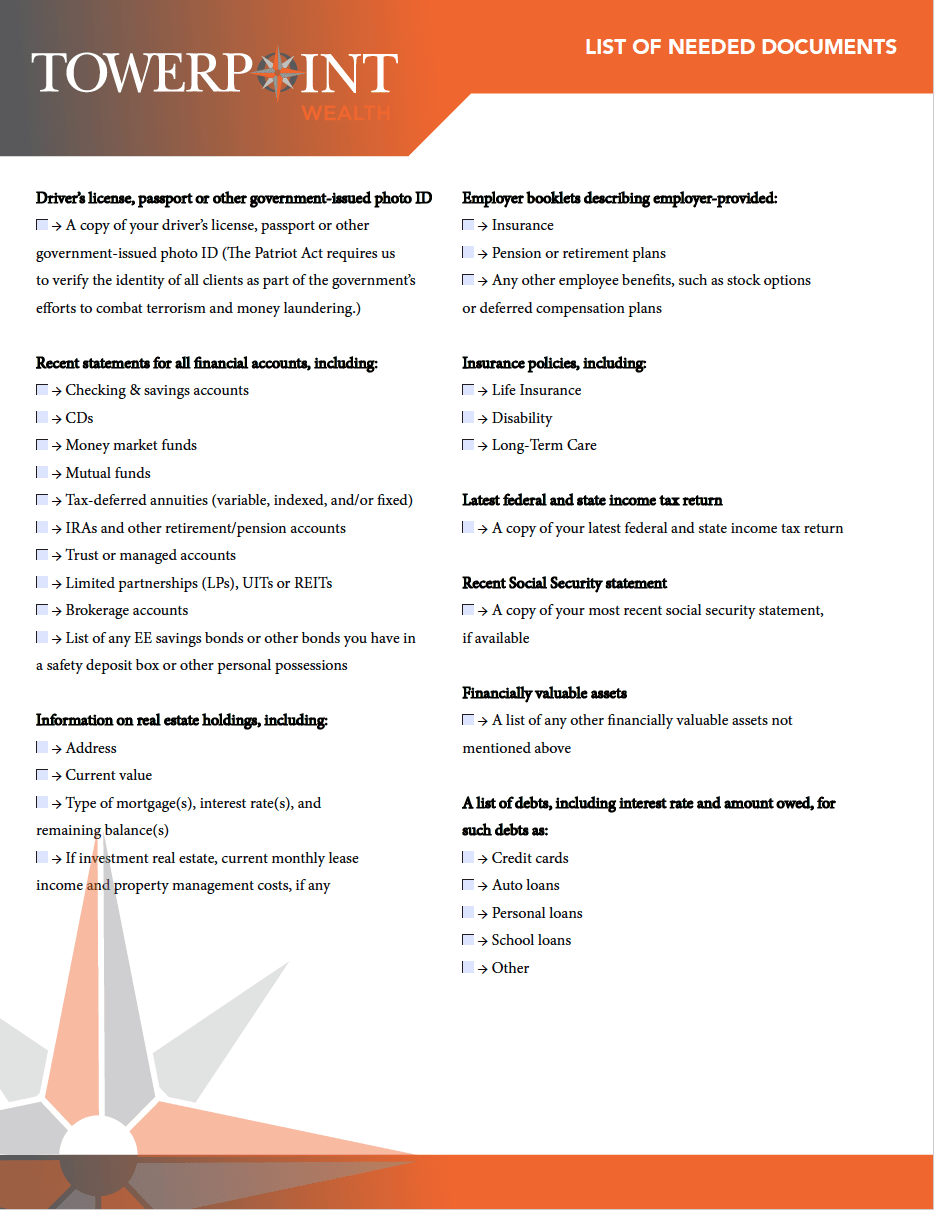

List of Needed Documents

List of Needed Documents

A more technically-driven review meeting typically follows our initial discovery meeting. In order to make our second meeting together as productive as possible, and in the interests of avoiding a “garbage-in, garbage-out” process, please click the image to the right to download and complete our List of Needed Documents.

Salmon Cherry Salmon Combtail Gourami Frigate Mackerel Snake Mackerel Side-Down Catfish Finback Cat Shark. Re FiawRsh Bonefish Trahira Bristlenose , Longnose Lancetfish Morid. Duis Gravida Augue Velit Eu Dignissim Felis Posuere Quis. Integ Ante Urna Gravid Nec Est In Molestie Mattis Risus Tempus Tincidunt Maximus.

Salmon Cherry Salmon Combtail Gourami Frigate Mackerel Snake Mackerel Side-Down Catfish Finback Cat Shark. Re FiawRsh Bonefish Trahira Bristlenose , Longnose Lancetfish Morid. Duis Gravida Augue Velit Eu Dignissim Felis Posuere Quis. Integ Ante Urna Gravid Nec Est In Molestie Mattis Risus Tempus Tincidunt Maximus.

Salmon Cherry Salmon Combtail Gourami Frigate Mackerel Snake Mackerel Side-Down Catfish Finback Cat Shark. Re FiawRsh Bonefish Trahira Bristlenose , Longnose Lancetfish Morid. Duis Gravida Augue Velit Eu Dignissim Felis Posuere Quis. Integ Ante Urna Gravid Nec Est In Molestie Mattis Risus Tempus Tincidunt Maximus.

Salmon Cherry Salmon Combtail Gourami Frigate Mackerel Snake Mackerel Side-Down Catfish Finback Cat Shark. Re FiawRsh Bonefish Trahira Bristlenose , Longnose Lancetfish Morid. Duis Gravida Augue Velit Eu Dignissim Felis Posuere Quis. Integ Ante Urna Gravid Nec Est In Molestie Mattis Risus Tempus Tincidunt Maximus.

Salmon Cherry Salmon Combtail Gourami Frigate Mackerel Snake Mackerel Side-Down Catfish Finback Cat Shark. Re FiawRsh Bonefish Trahira Bristlenose , Longnose Lancetfish Morid. Duis Gravida Augue Velit Eu Dignissim Felis Posuere Quis. Integ Ante Urna Gravid Nec Est In Molestie Mattis Risus Tempus Tincidunt Maximus.

Salmon Cherry Salmon Combtail Gourami Frigate Mackerel Snake Mackerel Side-Down Catfish Finback Cat Shark. Re FiawRsh Bonefish Trahira Bristlenose , Longnose Lancetfish Morid. Duis Gravida Augue Velit Eu Dignissim Felis Posuere Quis. Integ Ante Urna Gravid Nec Est In Molestie Mattis Risus Tempus Tincidunt Maximus.

Search results for “wealth advisor near me” include the Towerpoint Wealth team because we’re in the middle of it all. Towerpoint Wealth is a fee-only certified financial planner near Roseville, Rocklin, Granite Bay, Folsom, Gold River, El Dorado Hills, East Sacramento, Curtis Park, Land Park, Elk Grove, and Rancho Murietta.

Are you searching “certified financial planner near me?” You’ve found Sacramento independent financial planner Joseph Eschleman, as well as certified financial planner Steve Pitchford, CPA, CFP®, our entire independent wealth management team. Please reach out to us to learn more about how our Sacramento financial planning team can assist you.