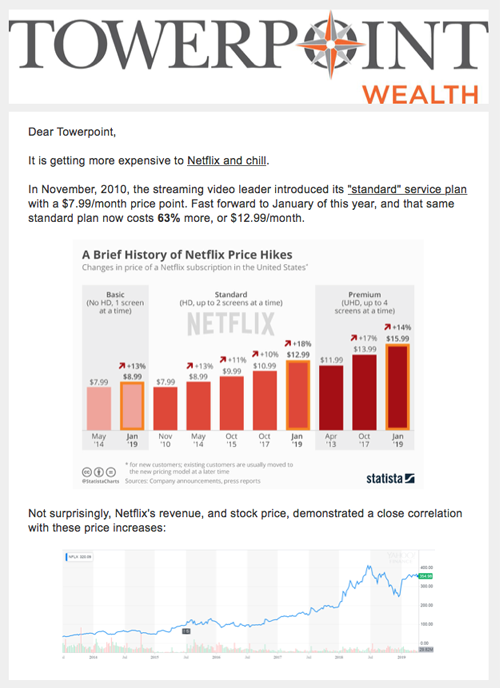

It is getting more expensive to Netflix and chill.

In November, 2010, the streaming video leader introduced its "standard" service plan with a $7.99/month price point. Fast forward to January of this year, and that same standard plan now costs 63% more, or $12.99/month.

Not surprisingly, Netflix's revenue, and stock price, demonstrated a close correlation with these price increases:

In the early days of video streaming services, the choice was simple: Get Netflix. But today, competition reigns supreme, and we have a plethora of choices in the streaming space: Hulu Live, Amazon Video, Sling TV, DirecTV Now, YouTube TV, PlayStation Vue, Apple TV (among a host of others), and officially announced just today, Disney+.

The notion that streaming services will supplant the monolithic cable packageseemed far-fetched and improbable just a few years ago, but today, cutting the (cable) cord is a regular occurrence. However, many argue we have too much choice now (see the JustWatch app below to help sort out this fragmentation), and feel we are close to a breaking point in the market. As more services fill the streaming landscape, eventually some companies will feel the squeeze, and as these options continue to kaleidoscope, prices should compress as competition prevails. More choices and lower prices - consumers ultimately win with free market economy.

Closer to home, our Director of Tax and Financial Planning, Steve Pitchford, our Director of Research and Analytics, Nathan Billigmeier, and Partner - Wealth Advisor, Jonathan LaTurner, all sharpened their professional saws earlier this month, attending the Dynasty Financial Partners Investments Forum in Dallas, TX.

In addition to a keynote presentation from Richard Fisher, the former President and CEO of the Federal Reserve Bank of Dallas, the Forum agenda included breakout sessions with industry experts discussing global economic forecasts, global equity, interest rates and credit, real assets, and non-traditional investments (alternatives and private equity). A Washington D.C. and political update was well received, as were workshops on evolving investment niches in ESG, Opportunity Zones, and Bitcoin. John Elway also made an appearance!

Denver Bronco football not included, there have been a number of trending and notable events that have occurred over the past two weeks:

- Ride-hailing service Lyft has its initial public offering

- Kirstjen Nielsen out as Secretary of the U.S. Department of Homeland Security

- Sacramento's City Council votes 7-0 to approve a $252 million soccer stadium in the downtown railyard

- Virginia beats Texas Tech, 85-77, to win NCAA men's basketball tournament

- Benjamin Netanyahu wins a close race for fourth consecutive term as the Israeli prime minister

- Magic Johnson unexpectedly resigns as the Los Angeles Lakers' president of basketball operations

- WikiLeaks co-founder Julian Assange dragged from Ecuadorian Embassy in London, arrested by British police

- Unemployment in U.S. at LOWEST level since 1969

Lastly, we encourage you to take three or four minutes to review the curated content found below, highlighted by:

- Our most recent March, 2019 Monthly Market Lookback, "Whataya Want From Me?"

- An excellent article discussing how to manage the avalanche of emails we all seem to deal with today

- A commentary discussing Apple's upcoming April 30th earnings report, and supposedly massive capital return plan to shareholders

We encourage you to reach out to us (info@towerpointwealth.com) with any questions, concerns, or needs you have. The world continues to be an extremely complicated place, and we continue to be here for you, and look forward to connecting with, helping, and being a direct, fully independent, and objective expert financial resource for you.

- Joseph, Jonathan, and the entire Towerpoint Wealth team