For many families, providing financial help to adult children begins with the best of intentions. It starts as a temporary bridge. A moment of support during a transition. A way to help them get on their feet.

Over time, though, what starts as shorter-term assistance can quietly become an ongoing commitment — often without a clear plan, timeline, or shared expectations.

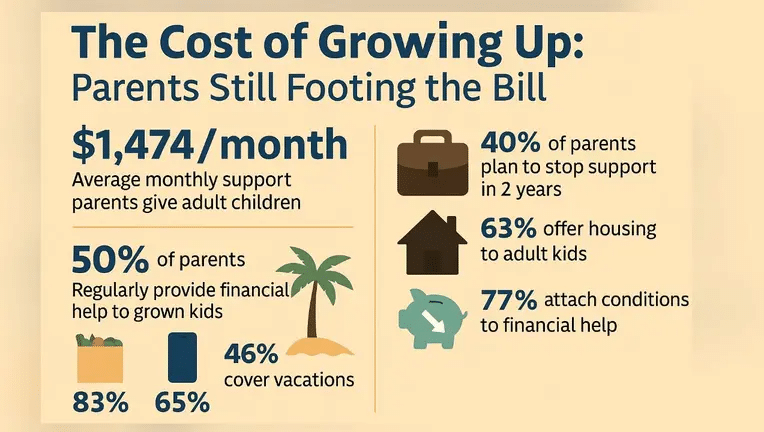

Graphic created by FOX 5 Atlanta

The question most parents wrestle with isn’t “should you financially support your adult children?” It’s how to offer support in a way that remains sustainable, aligned with their broader financial goals, and respectful of their own future.

This isn’t all about pulling back abruptly or rethinking generosity. It’s about restoring your own clarity, relying on your thoughtful planning, and making sure the way you support others doesn’t unintentionally limit your own flexibility, confidence, or longer-term security.

At Towerpoint Wealth, we believe good financial planning considers everyone who is important to you — and that, of course, includes you.

Why This Matters as Retirement Comes Into Focus

As retirement moves from a distant idea to a more tangible horizon, priorities tend to shift naturally. The focus turns toward protecting lifestyle flexibility, understanding which expenses are truly discretionary, and preserving options for how — and when — your work life transitions into the next chapter.

Ongoing financial support to adult children can intersect with these priorities in ways that aren’t always obvious.

Regular assistance may influence cash flow projections, extend retirement timelines, or add pressure during periods of market volatility. In many cases, these impacts aren’t intentional — they simply haven’t been fully modeled or revisited in the context of today’s goals.

What once felt manageable, or even negligible, can take on new weight as circumstances evolve. Not because helping was necessarily wrong in the first place, but because the broader financial picture has changed.

At this stage, the goal isn’t to rethink your generosity, but to reassess its alignment with your financial plan.

The Costs of Open-Ended Financial Support

Providing financial help to adult children is often rooted in care and good intentions, but when that support remains open-ended, it can introduce costs that aren’t always visible at first.

Cash Flow and Liquidity

Regular financial assistance, even in modest amounts, can reduce flexibility over time. There’s a meaningful difference between one-time help and recurring support — especially when expectations begin to form. What starts as “temporary” can become an assumed line item, limiting liquidity just when optionality matters most to your financial life.

Emotional and Relationship Strain

Ambiguity tends to create tension. Without clear parameters, financial help can blur roles and expectations, leading to frustration on both sides. Parents may feel pressure to continue support longer than intended, while adult children may struggle with mixed signals around independence.

Planning Blind Spots

In many cases, ongoing support isn’t fully reflected in retirement projections, tax strategies, or estate planning. Informal arrangements have a way of persisting — slowly extending well beyond their original purpose. When support isn’t modeled, it can distort longer-term planning in subtle but important ways.

None of this definitively means support should stop. It simply highlights why clarity and boundaries matter, especially when generosity intersects with longer-term financial decisions.

From “Support” to Independence

Financial help doesn’t have to create longer-term dependence. In many cases, the most meaningful support is the kind that helps adult children move toward greater stability and self-sufficiency — rather than continued reliance.

Many parents search for tips for financial independence, but what often makes the biggest difference isn’t hidden in a generic checklist. It’s the structure behind the support itself. Help that is tied to a clear purpose, a defined timeframe, and shared expectations tends to encourage forward progress instead of open-ended dependence.

When financial assistance is structured intentionally, it can reinforce responsibility, confidence, and forward momentum. It allows parents to remain supportive while also protecting their own financial flexibility and longer-term plans.

At Towerpoint, we see this as a mindset shift, not a hard stop. We work with clients to help thoughtfully navigate these situations, without sacrificing family relationships or financial planning in the process.

Common Ways Families Provide Support, and How to Think About Them

Financial help for young adults often shows up in familiar forms. The structure matters less than the reasoning behind it, and that’s where many families benefit from stepping back and reassessing.

Housing Assistance or Rent Support

Helping with housing can provide stability during transitions, especially early in a career or after a life change. Where it can drift is when temporary help quietly becomes permanent, without a shared understanding of how or when that support evolves. Clear parameters help keep housing assistance aligned with independence rather than replacing it.

Covering Recurring Expenses

Phone plans, insurance, subscriptions, or other monthly costs often feel small in isolation. Over time, though, these recurring expenses can create ongoing dependency and blur financial boundaries. The concern isn’t the dollar amount; it’s whether expectations are defined or assumed.

Student Loans or Education Costs

Education-related support is often rooted in longer-term opportunity and growth. It works best when it’s connected to a broader plan and timeline. Without clarity, it can linger well beyond the original intent, especially as careers take longer to stabilize than expected.

Business or Career “Bridge” Support

Helping during a career pivot, business launch, or period of uncertainty can be meaningful and constructive. These situations benefit most from clearly defined goals and timeframes, so support remains a bridge and not an open-ended backstop.

Across all of these scenarios, the common thread isn’t whether support is right or wrong, but whether the structure reflects intention, communication, and alignment — for both generations involved.

When expectations are clear, support can strengthen relationships and outcomes. When they’re not, even well-meant help can drift in ways no one planned for.

Questions Worth Asking Before Continuing (or Changing) Support

Before deciding whether to continue, adjust, or restructure financial support, it’s often helpful to pause and ask a few honest questions — not to force a decision, but to approach it with perspective.

- Is this support truly temporary, or has it become an ongoing part of the picture?

- Many arrangements begin with a shorter-term intention, but evolve over time. Recognizing where things stand today is often the first step toward clarity.

- Is this support reflected in your broader financial plan?

- If financial help isn’t modeled alongside retirement timelines, cash flow, and longer-term goals, it’s easy for blind spots to form, even in otherwise well-organized plans.

- What happens if markets are volatile or income changes?

- Support that feels comfortable in stable periods can feel very different when conditions shift. Considering flexibility ahead of time can reduce stress later.

- Are expectations clear on both sides?

- Unspoken assumptions often create more tension than the financial support itself. Clarity can strengthen the effectiveness of your support while preventing strains on familial relationships.

- Does this support encourage longer-term independence?

- The most sustainable arrangements tend to reinforce momentum for your adult child’s independence, rather than replace it.

Once these questions are on the table, the next step is simply to translate them into structure, so your support has a purpose, a plan, and a clear path forward.

How Thoughtful Planning Brings Confidence to Family Support Decisions

Family support decisions often carry a heavy emotional weight, which can make them harder to evaluate objectively. This is where thoughtful financial planning plays an important role.

A well-built plan creates a neutral framework — one that allows families to step back and see how support fits within the bigger picture. By modeling different scenarios, it becomes easier to understand the tradeoffs involved, the impact on longer-term goals, and where flexibility exists.

When cash flow, tax considerations, and longer-range projections are coordinated, uncertainty tends to soften. Conversations become clearer. Decisions feel more grounded. And support can be approached with intention rather than assumption.

From Towerpoint’s perspective, the goal of planning isn’t to dictate outcomes; simply to provide clarity so families can make thoughtful decisions that align with their values, their resources, and the life they’re working toward.

Protecting Your Freedom While Supporting Your Family

At its core, financial independence creates choice. It allows parents to decide how and when to help, without pressure, resentment, or second-guessing. When support is thoughtful and sustainable, it can play a meaningful role in encouraging financial independence for young adults, while still preserving the freedom parents worked hard to build over time.

When financial support to adult children is intentional and well understood, it tends to feel very different. It becomes something you offer from a position of strength rather than obligation. It fits into your broader financial life instead of competing with it in the background.

Boundaries often play a constructive role here.

When expectations are defined and the structure is understood, relationships are less likely to carry unspoken tension. Conversations become easier, decisions feel steadier, and family dynamics are less likely to be shaped by assumptions or uncertainty.

The strongest longer-term plans recognize that generosity and self-preservation are not opposing forces. They can coexist — when support is provided in a way that respects both the needs of the family and the sustainability of the parents’ own financial future.

That balance matters even more as priorities shift later in life. Protecting flexibility, maintaining control over choices, and preserving the ability to respond to life’s changes all become increasingly valuable.

Thoughtful planning helps ensure that family support enhances those outcomes rather than limiting them.

Bottom Line

There is no universal rulebook for how parents should support adult children. Every family’s circumstances, values, and resources are different. What tends to matter most is that the approach reflects intention, fits within the broader financial picture, and can be sustained over time — even if markets shift or priorities evolve.

Often, the most meaningful step isn’t changing anything right away. It’s simply taking the time to talk through how support fits into the bigger picture and what it means for the years ahead. A planning-led conversation can ease uncertainty, surface tradeoffs, and bring a sense of steadiness to decisions that otherwise feel emotionally charged.

At Towerpoint Wealth, these discussions are approached thoughtfully and without urgency. Our goal is to help families understand their options, see the longer-term implications, and move forward in a way that feels aligned with both their values and their future.

Sometimes, that perspective alone is enough to make the path forward feel lighter. If you’re looking for help managing the support of your adult child while prioritizing your own financial health, we’re here to help.

Book a complimentary 20-minute “Ask Anything” conversation with our team here.