"The stock market is too high..." - a fairly typical response offered up by shorter-term traders and/or novice investors.

The S&P 500 hit a historic peak on Friday, touching an intraday record high of 2,964.15 subsequent to the U.S. Federal Reserve seemingly telegraphing an "easy-money" posture last week, with many experts believing that an interest rate cut may be forthcoming.

Independent of what the Fed may or may not do for the rest of 2019, the phrase "It's too high" has been one that has been uttered for decades. Noting that the Dow Jones Industrial Average (or simply "The Dow") is oftentimes the more favored or recognized index by retail investors, institutional investors perceive the S&P 500 as more representative of the U.S. stock market because it comprises more stocks across all sectors - 500 companies, versus only 30 for the Dow.

The S&P 500 opened on January 1, 1950 at 16.88. By January 1, 1955, it had more than doubled to 35.60. Less than ten years later, it more than doubled again, to 76.45 on January 1, 1964. And so on, and so on, and so on:

- January 1, 1973: 118.40

- January 1, 1984: 166.40

- January 1, 1988: 250.50

- January 1, 1992: 416.08

- January 1, 1998: 963.36

- January 1, 2002: 1,140.21

- January 1, 2007: 1,424.16

- January 1, 2015: 2,028.18

- January 1, 2018: 2,789.80

Click HERE for source.

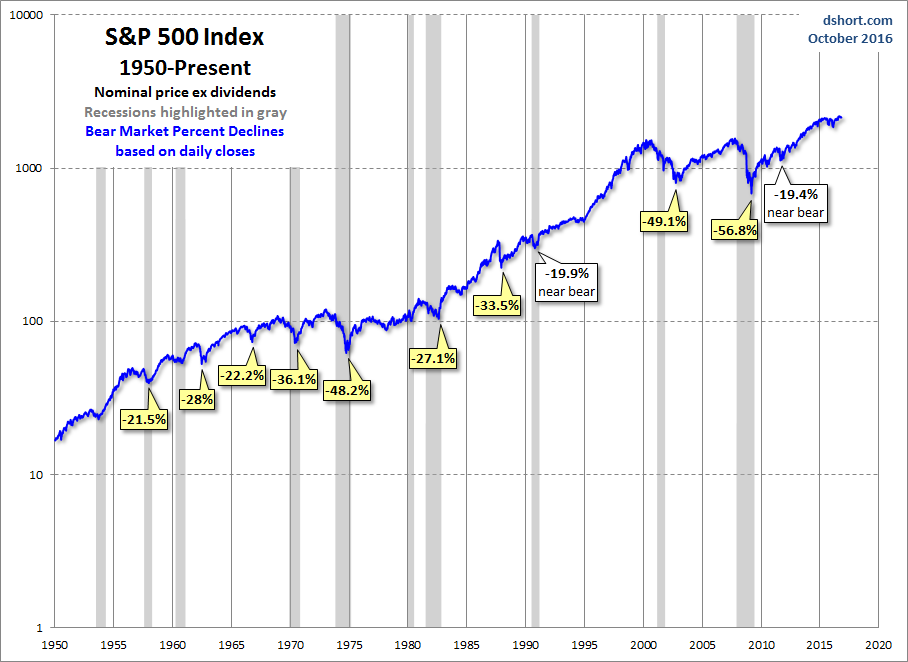

Notice a trend? While it is important, if not essential, to note that there have been extended periods of time when the stock market (as measured by the S&P 500) has been in decline, what is clear is that if you have a ten year window, the probability of generating positive returns is extremely high:

In summary, we feel very comfortable that as long as you have this discipline to follow a well-assembled and objective plan and strategy that ensures you: Don't Panic during pullbacks, speed-bumps, and recessions (which can last for years), that the probability is quite high you will enjoy the continued growth of this:

Billigmeier Sits for CFA® Level 2 Exam

Locally, our Director of Research and Analytics, Nathan Billigmeier, sat for his Chartered Financial Analyst (CFA®) Level 2 exam last Saturday at the Sacramento Convention Center in downtown Sacramento. With pass rates below 50% for each Level, the CFA series of tests is one of the most difficult sets of financial certifications, with a minimum of 300 hours (!) of study recommended for each exam.

A globally-recognized professional designation, and arguably the highest distinction in the investment management profession, the CFA® gives a strong understanding of advanced investment analysis and real-world portfolio management skills. Measuring and certifying the competence and integrity of financial analysts, candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management, and security analysis.

From 1963 to 2018, 1,696,451 candidates have sat for the Level 1 exam, with only 246,654 ultimately going on to pass the Level 3 exam. That represents a weighted average completion rate of only 14.5%.

We are very proud of all of the energy and time Nate has already invested in his CFA® curriculum, and are confident it is not "if" but "when" he ultimately earns the certification. In the meantime, after his grueling Level 2 exam, he definitely earned a few days earlier this week to decompress, during which time he enjoyed a round of golf on Tuesday (while representing TPW) at Old Greenwood in Truckee.

Putting aside stock market gyrations and cramming for exams, a number of trending and notable events have occurred over the past two weeks:

- NBA Finals 2019: Amidst key injuries, the Golden State Warriors lose to the - Toronto Raptors in six games

- Trump, Biden trade barbs amid dueling Iowa campaign visits

- Fashion icon Gloria Vanderbilt, dead at 95

- Happy Father's Day 2019

- The U.S. women's soccer team ends group stages of 2019 World Cup with a third shutout victory

- Juneteenth celebrated on June 19, commemorating the end of slavery in the United States

- Escalating hostilities between President Trump and Iran heighten war worries

- Phenom Zion Williamson selected first at the 2019 NBA draft

- Solstice 2019 - summer officially arrives today in the Northern Hemisphere

Lastly, please take three or four minutes to review the curated content found below, highlighted by:

- Our most recent May-June 2019 Monthly Market Lookback publication, "Danger Zone"

- Additional details about the CFA® program and curriculum

- Information on the GasBuddy app, which helps you find where the nearest gas stations are, and identify which are the cheapest today

We encourage you to reach out to us (info@towerpointwealth.com) with any questions, concerns, or needs you have. The world continues to be an extremely complicated place. We are here for you, and look forward to connecting with, helping, and being a direct, fully independent, and objective expert financial resource for you.