Whether you are skeptical, cautious, and apathetic, OR enraptured, excited and intrigued by it, crypto has exploded in global popularity over just the past year, and has, to one degree or another, captured the attention of most of the civilized world.

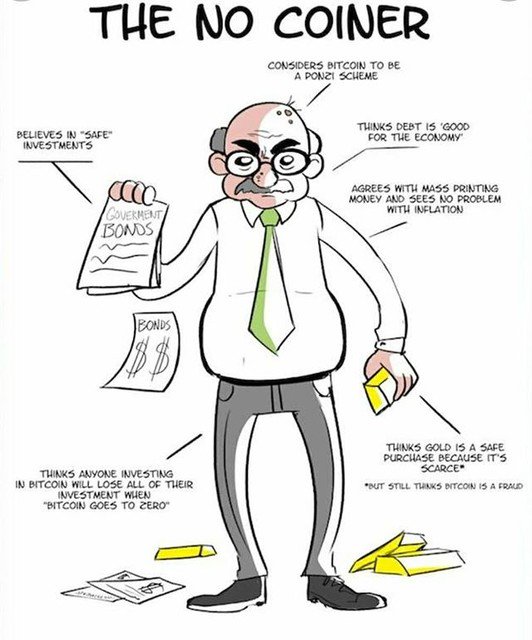

Bitcoin was released as the first decentralized cryptocurrency in 2009, and nine years later, in 2018, the Merriam-Webster Dictionary approved "cryptocurrency" as an official word. While many (ourselves here at Towerpoint Wealth included) believe that crypto is here to stay, there are still plenty of "no-coiners" who feel otherwise:

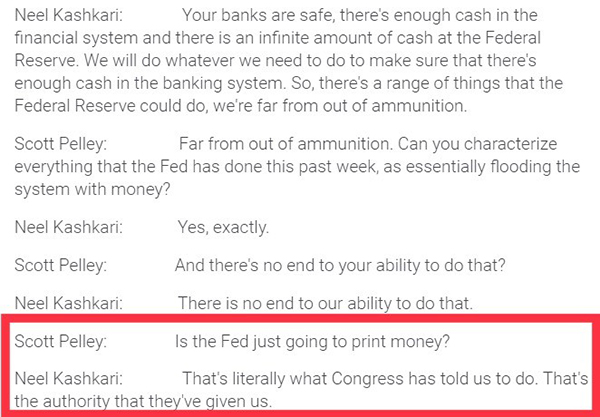

Many Westerners find it difficult to understand how a 12-year-old digital currency could be safer to hold than the US dollar, which has long been recognized as the reserve currency of the world. However, once you understand that the Federal Reserve, America's central bank, has inflated the money supply to achieve its macroeconomic goals, it becomes a bit clearer. Note the "infamous" comment made by Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, in a March 22, 2020 interview on CBS' 60 Minutes:

Do we have your attention now?

Rather than opine on the intrinsic details and inner-workings of crypto, it is important for most investors to note three main takeaways:

- Cryptocurrency is a digital, or virtual, asset. Many cryptocurrencies are decentralized and aspire to be a form of money and a medium of exchange

- Unlike fiat currencies, most cryptocurrencies operate without government oversight or intervention

- Most cryptocurrencies are managed by a large group of network participants, and are secured by advanced cryptography. Explaining the Crypto in Cryptocurrency does an excellent job of explaining cryptography further

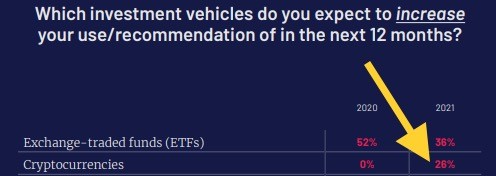

Concurrently, the shift to embrace crypto as an investment vehicle is certainly on the rise. According to the Financial Planning Association's 2021 Trends in Investing Survey, conducted by the Journal of Financial Planning:

- More than a quarter (26%, to be exact) of financial advisors plan to increase their use or recommendation of cryptocurrencies over the next 12 months

- Almost half (49%, to be exact) of advisors indicated that clients had asked them about investing in cryptocurrencies over the past six months

Do these two facts alone make crypto "good" or "appropriate" for integration into one's investment portfolio? Certainly not, but it does speak to the inflection (some may say tipping) point where we find ourselves. El Salvador is pushing to become the first country to adopt bitcoin as legal tender. This feels more like a movement than a trend.

As a brief crypto aside/FYI, the term HODL (hold on for dear life) was coined (yes, pun intended) by a user in an internet bitcoin forum who misspelled "hold," and now refers to a devout buy-and-hold crypto philosophy. Now you know!

Perhaps next month, Trending Today (TT) should pivot from cryptocurrency and cover NFTs (non-fungible tokens)? Is your head spinning and ready to explode yet? While we are joking about NFTs being the next TT topic, we cite them in light of our dialogue above about cryptocurrency, as NFTs are just another specific example of how quickly our world (both inside and outside the world of finance and investing) is changing. Are these immature assets with room for development? We would argue yes. However, we also argue for (read: encourage) you to be careful about dismissing new technologies too quickly, and to be scrutinous yet open-minded about the speed at which our society is evolving.

Crypto - Join Us for Our Cryptocurrency Webinar!

Bitcoin and Ethereum are two of the most popular of the more than 4,000 different cryptocurrencies in existence as of January 2021. Crypto has exploded in popularity over the past year, and has emerged not only as a new asset class, but also as an alternative store of value - some call it "digital gold."

Click below to RSVP for this 45-minute educational Zoom webinar, in which Christopher King, CEO and Founder of Eaglebrook Advisors, will discuss the question: "Bitcoin - what is it?" as well as how cryptocurrencies and digital currencies can play an important complementary role within a properly diversified investment portfolio.

What’s Happening at TPW?

As a work family, part of the Towerpoint Wealth culture is to regularly volunteer and find opportunities to give back to our community. Earlier this week, in conjunction with the Cathedral of the Blessed Sacrament and with the help of Marilynn Fairgood, the Cathedral's Brown Bag Lunch program coordinator, we had an opportunity to assemble, and then distribute, sack lunches and other supplies to assist Sacramento's homeless community.

Unquestionably this was a fulfilling experience for everyone involved, as the sincere gratitude and appreciation we received was both heartwarming and priceless.

Click HERE for an excellent article from KHOU-11 for additional information on how to help and volunteer for the Brown Bag Lunch program.

Chart of the Week - Crypto, Bitcoin

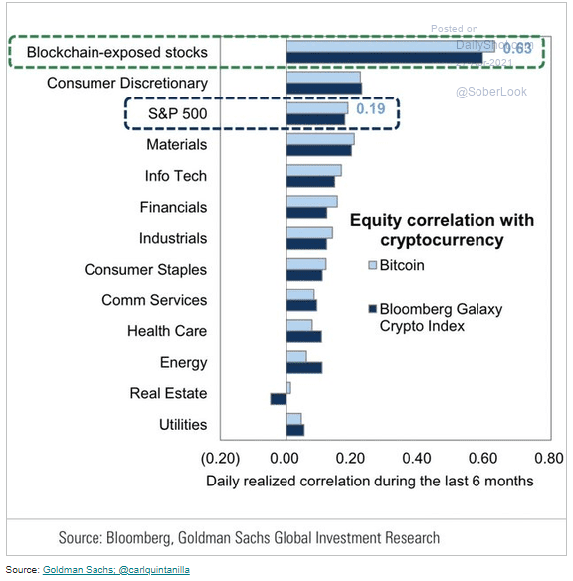

In our opinion, the most effective way to reduce and manage the risk of a properly diversified portfolio is to own various assets and investments with low correlations to each other. Understanding that no one can accurately predict the future performance of any investment, owning low (or even negatively) correlated assets can help mitigate damage during any particular market cycle.

Below is a simple chart (specifically, the darker blue dotted rectangle) that delineates the correlation between Bitcoin and the S&P 500 - at 0.19, this is an attractively low correlation. Put differently, Bitcoin oftentimes zigs when the stock market zags.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph, Jonathan, Steve, Lori, Nathan, and Michelle