“An Investment in Knowledge Pays the Best Interest” (Ben Franklin) A TOWERPOINT WEALTH SPECIAL MARKET UPDATE: MAY 22, 2019

Why does the back of our neck itch right now? The economy seems to be doing fine, the stock market is booming, earnings are solid, inflation is non-existent, interest rates remain low, and global central banks remain accommodative.

In our April Monthly Market Lookback, we opened with the following:

All of the “signals” we’ve been focusing on in the past several months remain solidly “in the green.” So why are we apprehensive? Perhaps we shouldn’t be, and simply are falling prey to our inner “Chicken Little” who always thinks the sky is falling. We’ve been guilty of that before.

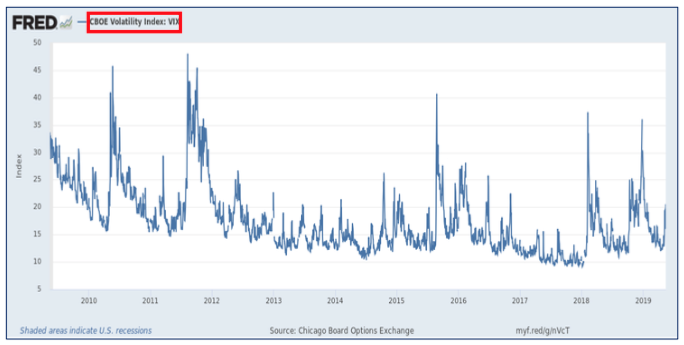

We think complacency is the root of our itch. Market volatility once again has become somnambulant, with the VIX trading below 15% since February (the historical norm is closer to 20%). The markets seemingly are ignoring geopolitical issues (trade tensions, Brexit, Italy, France, North Korea, etc.) and are trading in a very “Candide-ish” manner (“All is for the best in this the best of all possible worlds”). Nothing is moving the needle.

And that’s what’s bugging us. Nothing is moving the needle – the markets just keep trading higher. We hated the days when market movement revolved around Fed policy announcements – when bad news was good news because the Fed would ride to the rescue – but we seem to be back in that mode.

Well, at least for now, that complacency has evaporated. Consider the recent path of the VIX, a common measure of volatility. You notice two things right away: (1) the recent spike over the past two weeks, but also (2) how low volatility had been in the previous several months – essentially, since the beginning of the year (at least compared to historical averages):

In essence, the market had been pricing in no risk to the current market rally. We’ve been suggesting for months that investors focus on market signals – which to us means (1) Economic Growth, (2) Earnings, (3) Inflation, (4) Interest Rates, and (5) Central Bank Policy.

All of these signals suggest we remain in pretty good shape – perhaps decelerating with respect to economic growth and earnings, but still fairly solidly “in the green”.

We also have been suggesting that, unfortunately, many investors focus too much on market noise, which we define as transitory events that can disrupt markets in the short-term but generally do not have long- lasting effects.

We think that is where we are today – there is a lot of noise out there right now, including:

- The US / China trade negotiations

- Ongoing Brexit difficulties

- Changing political currents in Europe

- North Korea once again sending threatening nuclear signals, and

- Rising tension in the Middle East following the sabotaging of two Saudi Arabian oil tankers

Any of these issues individually might be “absorbed” by the market, but collectively they have re-introduced a certain amount of fear (and therefore increased volatility) into the global markets.

We believe the market had not been pricing in appropriately the possibility of protracted US/China trade negotiations, and certainly not the possibility of an all-out trade war. We also believe the market has been overly complacent about Brexit, which could end very badly indeed for the UK.

But some perspective is in order. The UK is a relatively small part (<3%) of global GDP, and the estimates we’ve read suggest that protracted trade negotiations or even a ramp up in tariffs between the US and China might shave roughly 0.5% off the US GDP growth rate in 2019 (which would still leave the expected growth rate above 2%).

The rising tensions in the Middle East are the newest development, and the risk of a subsequent spike in oil prices should not be ignored. But it is too early to evaluate the ultimate outcome.

We view all of these issues as “low probability, high consequence” (i.e., “fat tail”) events. If any or some combination of these issues should come to a negative outcome, it certainly would affect global growth and earnings (though, conversely, it would almost certainly keep interest rates low and central banks accommodative).

In particular, the US/China trade negotiations have the distinct possibility of getting worse before they get better (though we think they will get better), and the Middle East is almost always a potential source of geo- political turmoil.

So the market is correct to price in some degree of risk accordingly.

But keep in mind that the market had not been pricing in any measure of risk through the first four months of this year. In other words, we view the recent increase in volatility as healthy and, to some degree, a return to normalcy.

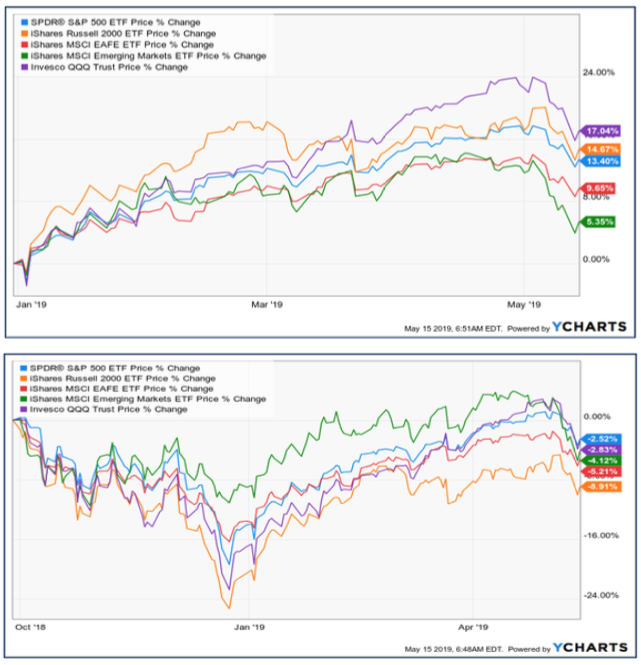

With respect to market performance, we again believe some perspective is in order. The following two charts show global stock market performance (1) Year-to-Date and then (2) since September 30, 2018 (roughly the high point of the markets in 2018):

What we see is that (a) despite the recent downturn, the markets remain solidly positive in 2019, and (b) the markets are down only slightly since the absolute high point of a phenomenal first three quarters of 2018 (ex-US Small Cap, which was hit hardest by both Q4 2018 and the recent downturn).

In many respects, we believe that the past few weeks have been a “mini-version” of what occurred in the fourth quarter of 2018. During that period, the broader market signals remained positive, but the market had become overly complacent and thus over-reacted to noise (primarily what was perceived to be overly- hawkish comments from Fed Chairman Jerome Powell).

In the current environment, we believe the market once again become overly complacent and so is reacting to noise. Perhaps it would be more accurate to suggest that the market is once again appropriately pricing risk back into the market.

We will close with how we closed our April Monthly Market Commentary, which we believe is still valid:

So, we find ourselves in a bit of a conundrum – most of the market signals remain “green”, and we generally are optimistic about the potential for risk assets over the remainder of 2019.

This is the consensus view and, frankly, that is what gives us pause. “When all the experts and forecasts agree — something else is going to happen”. We are not losing any sleep just yet, but we think there may be some sleepless nights ahead. Pay attention, stay diversified, and keep your investment horizon aligned with your financial plan.

Please do not hesitate to contact us with any questions at info@towerpointwealth.com.

Warm Regards,

Joseph F. Eschleman, CIMA® President

Towerpoint Wealth, LLC