Estate planning documents specify how you want your assets distributed upon incapacity or death. The collection of these documents together is called an Estate Plan. Some people don’t believe they have an “estate,” and therefore, don’t need to create a plan. They see estate planning and wills as things reserved for the wealthy. In fact, no matter your net worth, once you die, everything you own is considered part of the estate you leave behind.

Many other individuals recognize that everyone needs some kind of estate plan, but avoid establishing one. Perhaps estate planning and wills evoke uncomfortable thoughts of incapacity or death, and this is simply too much to contemplate. Or maybe it’s because the legal jargon incorporated into estate planning documents can be difficult to understand.

However, to be clear, if you have a financial plan, you have an estate. Establishing and then maintaining a proper estate plan is an essential aspect of a cohesive, well-thought-out financial plan. Preparing estate planning documents is not just about distributing assets. It is about ensuring that your wishes are respected, your loved ones are taken care of, uncertainty is removed, and potential conflicts are avoided. By assembling the proper estate planning documents, you can minimize the burden on your family during an already difficult time, and provide them with a clear roadmap for how to properly handle your financial affairs.

Why is estate planning important for everyone? There are six primary reasons, including the fact that probate is a nightmare and expensive, you and your children need more protection than just a will—although a will is one of the most important estate planning documents—and you probably would like to reduce and minimize your taxes. You can find a link to an article on the topic of why it’s important to have an up-to-date and properly coordinated estate plan at the bottom of this page.

Below are descriptions of the most fundamental estate planning documents, as well as other important estate planning considerations.

Estate Planning and Wills

Estate Planning | Trust

An Advance Health Care Directive

A Financial Power of Attorney

Beneficiary Forms

Life Insurance

Owning a Business

Four Ways to Maximize Your Beneficiary’s Inheritance

Keeping Your Estate Planning Documents Organized

How can we help?

Estate Planning and Wills

A will is the most well-known and widely used estate planning document. A will is a legally binding blueprint that dictates how an individual would like their assets to be handled upon their death.

Specifically, a will can direct

- who the beneficiaries of an estate should be

- who to leave property to (property may include bank accounts, investment accounts, real estate, or any other assets you own at the time of your death)

- who should be named a guardian for minor children

- who should be chosen as an executor of the estate

- who should plan personal affairs (such as burial arrangements, gifts, and donations) and hurdle other legal challenges.

Should everyone have a will? Yes. We believe everyone should have a will. A will is essential even for individuals with a very simple estate, or who have already established a revocable trust (see next section).

What if someone dies without a will? If an individual dies without a will, they have died “intestate.” When this occurs, the law of their state of residence determines how their property is distributed upon death. Dying intestate virtually guarantees a costlier, longer, and more stressful probate process, especially when compared to an individual who had a properly drafted will.

Probate is the legal process through which a deceased person's estate is distributed to heirs and designated beneficiaries and any debt owed to creditors is paid off. In general, probate property is distributed according to the decedent's will (if there is one) or according to state law if no will exists.

You can visit the following website to review the intestate rules for California.

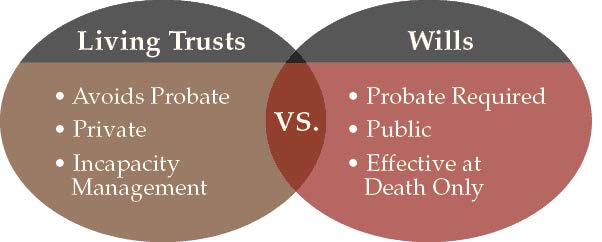

Does a will have any shortcomings? A will, unlike a properly funded revocable trust, will still be subject to probate. It is almost always preferable to avoid probate given the costs associated with the process (which include attorney’s fees, court costs, and appraiser’s fees). Also, the probate process is public record, which limits the privacy surrounding an individual’s estate and heirs.

Even with its limitations, a properly drafted and administered will is an essential estate planning document for almost all individuals. And, any shortcomings of a will can be mitigated by adding a revocable trust.

Estate Planning | Trust

A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. Trusts are extremely flexible, with the ability to specify how and under exactly what conditions the assets held “in trust” pass to beneficiaries.

The most common and widely applicable form is a revocable trust (also known as an inter vivos, or, living trust). Revocable trusts are funded during the lifetime of the grantor—the individual that creates the trust—and can be altered, changed, modified, or revoked entirely during the grantor’s life. Revocable trusts are unique in that the grantor and the trustee are the same person.

What are some advantages of a revocable trust? Advantages of a revocable trust include: flexibility, avoiding the cost, delay, and publicity of probate, protection from court challenges, and the ability to control one’s assets after they have died.

Why do I need a will if I have a revocable trust? A revocable trust only deals with the specific assets titled or held within the trust, such as life insurance, real property, and investment portfolios. Even with a revocable trust, most attorneys still recommend a pour-over will to account for those items not specifically placed, or titled, in the name of the trust.

Should everyone have a revocable trust? Not necessarily. Individuals (or couples with no children) who have a very simple estate and/or do not have significant assets may only need a will.

Anthoor Law Group, Plan Your Living Trust Now, digital image, Anthoor Law Group, accessed October 22, 2018 - Estate Planning | Living Trust and Estate Planning and Wills

An Advance Health Care Directive

An Advance Health Care Directive is a document that allows an individual to select a person or persons they trust to make decisions regarding their health care in the event they are mentally or physically unable to make decisions for themselves. An Advance Health Care Directive allows for specificity by identifying many different mental and physical impairments and the desired actions for each.

An Advance Health Care Directive is the terminology used in California. In other states, the same document may be known as a durable power of attorney for health care, a medical power of attorney, or a health care proxy.

Do I need an Advance Health Care Directive if I am in good health? Though an Advance Health Care Directive is particularly essential for someone with a family history of poor mental or physical health, or for someone whose health is rapidly declining, we believe everyone should have one.

A Financial Power of Attorney

A Financial Power of Attorney allows an individual to give a trusted person authority to handle their financial affairs if they become unable or unwilling to do so by incapacitation or other means. A financial power of attorney can be as simple as allowing this trusted person to pay the incapacitated individual’s bills, or can be as involved as operating their business.

When creating a financial power of attorney, we recommend making the power durable.

A durable power of attorney will last for the entire individual’s life. So, if the individual becomes incapacitated more than once in their life, the durable power of attorney will continue to serve its purpose. If durability is not added, the trusted person’s power will lapse when/if the individual recovers from an incapacitation.

Should everyone have an Advance Health Care Directive and Financial Power of Attorney in their estate planning documents? We believe everyone over the age of 18 should have a properly executed Advance Health Care Directive and Financial Power of Attorney.

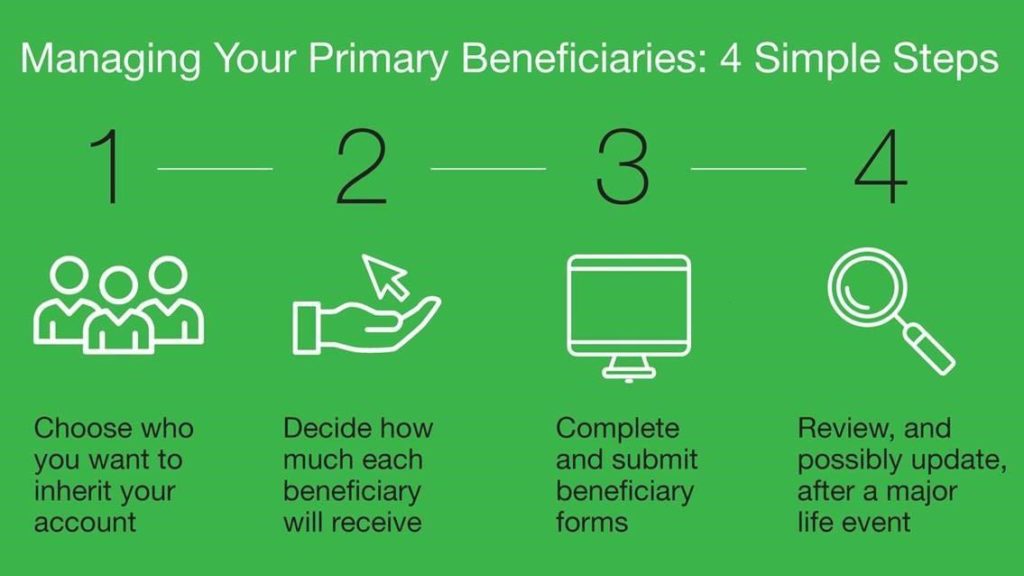

Beneficiary Forms

For certain assets, an individual can designate a beneficiary or beneficiaries to automatically receive the property upon their death. For example, an individual can establish a Transfer on Death (TOD) account or a Payable on Death (POD) account, titled outside of their trust, designating specific beneficiaries for these types of accounts. All retirement accounts such as IRAs, 401(k)s, 403(b), 457s, TSPs, and even annuities are subject to beneficiary designation rules as well.

Naming a beneficiary for these types of accounts is often very easy to do and should not be overlooked. If you do not name a beneficiary for these accounts, the assets may go through probate and/or be subject to problematic tax consequences. The intestate rules then dictate the beneficiary to receive these assets and this may be inconsistent with your intended wishes.

Life Insurance

One way to ensure that all of your debts are paid in the event of your death (or disability) is through having adequate life insurance coverage. A life insurance trust can purchase a life insurance policy so the death benefit that is paid isn’t included in your taxable estate.

While a detailed discussion on life insurance is outside the scope of this checklist for estate planning, the two most common types are term and whole life.

Owning a Business

If an individual also owns a business, their estate planning and trust becomes more complicated and more important. Not only do they need to consider their family’s best interests, but also their business partners, co-owners, heirs, and employees, and customers’ best interests. Here are some tools to help business owners address the interests of these other people:

Management succession plans specify who will take over their role.

Buy/sell agreements help to assure business continuation for the surviving partner(s) or co-owner(s).

Family limited partnerships help directly engage heirs and survivors.

Four Ways to Maximize Your Beneficiary’s Inheritance

When most individuals are thinking about estate planning and wills and assembling their estate planning documents, they generally only think about the tax consequences to themselves. But a truly comprehensive estate plan takes estate planning a step further and considers the tax consequences the beneficiaries of the estate may face. When creating an estate plan, it is important to understand and properly plan for these taxes. This will help to reduce your obligation to Uncle Sam, and ensure your beneficiaries get the largest inheritance possible.

1. Consider the taxes on Inherited Pre-Tax Retirement Accounts. Understand the different distribution rules for eligible beneficiaries and non-eligible beneficiaries.

2. Consider Gifts to family and friends as a way to lower the value of your estate. Give less than $18,000 annually to your children and grandchildren, or contribute to a tax-free Section 529 plan. They won’t pay taxes on the cash gift.

3. Consider philanthropy as a way to lower the value of your estate. If you are charitably inclined, you can make gifts of any size at any time while alive directly to qualifying 501(c)(3) charities, or to a Donor Advised Fund.

4. Take advantage of a step-up in cost basis. Instead of gifting appreciated stock or property before your death, have your beneficiaries inherit it after your death, so they won’t have to pay capital gains when he or she sells the asset.

We discuss minimizing taxes to maximize your beneficiary’s inheritance, in our comprehensive estate planning article.

Keeping Your Estate Planning Documents Organized

We believe estate planning documents should be kept in three separate places: the individual(s) should maintain the originals, their attorney should also have a copy, and their wealth manager should have a copy as well.

For personal safekeeping, while we continue to recommend keeping a physical copy of your documents, you should also consider utilizing a website to store these documents in the cloud. Reputable websites to store these documents include:

We also recommend visiting the following webpage to read a complete guide to keeping and maintaining your personal financial records.

For every American adult, it’s never too early to start thinking about estate planning and trust creation.

If you’re still not convinced all this is necessary, please read our article, Six Reasons Why Estate Planning is Important.

How can we help?

The Towerpoint Wealth team collaborates closely and in tandem with our clients’ estate planning attorneys and tax advisors, and supports our clients as their estates grow and evolve. To help you with estate planning, our financial and wealth advisors can counsel you on legacy planning and coordination.

Download your estate planning checklist today!

Learn more about estate planning and estate planning documents on our YouTube Channel:

- Estate planning with a 401 k and other retirement accounts

- Estate planning young families

- Term life insurance

Towerpoint Wealth, LLC is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Towerpoint Wealth, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Towerpoint Wealth, LLC unless a client service agreement is in place.