As markets, regulations, and technologies continue to advance, embracing innovative financial tools becomes not only a choice, but a strategic imperative for those aspiring to build and protect wealth and to achieve and sustain financial success.

Like using a typewriter in a smartphone world, utilizing old technology instead of new wealth management tools may be quaint, but won’t do a great job of helping you navigate the fast-paced world of modern finance.

Understanding, accepting, and perhaps even adopting these new financial tools not only will empower you with real-time insights and automation, but also position you to better adapt to swiftly moving market changes, fostering a proactive and informed approach to financial decision-making.

Tax Optimization Software

Along with costs and expenses, income taxes can represent a significant drag on your portfolio. Fortunately, taxes are a “necessary evil” that we do have some control over, especially if we use the right financial tools.

At Towerpoint Wealth, we utilize Bloomberg BNA Income Tax Planner to generate and compare multiple economic, investment, and tax scenarios, helping us help our clients align their financial moves with tax efficiency, and showcase the most advantageous tax minimization strategies available.

Tax optimization software also transforms the labyrinthine tax code into a navigable roadmap, identifying strategic deductions, credits, and exemptions that might otherwise slip through the cracks. This financial tool helps us help clients swiftly adapt to changes in tax laws, and enables us to stay ahead of regulatory shifts and capitalize on new opportunities, all while saving time and reducing the risk of costly errors.

Fully Customized ESG and Socially-Responsible Portfolios

Most investors are familiar with ESG (environmental, social, & governance) and socially-responsible investment vehicles such as mutual funds and exchange-traded funds (ETFs). However, unlike the one-size fits all approach of these products, Towerpoint Wealth utilizes a customized separately managed account (SMA) via our partnership with Ethic Investments, helping us provide our clients with a more tailored socially-responsible and ESG portfolio via direct ownership of individual companies that qualify as ESG-friendly based on customized screening criteria.

This ESG SMA financial tool grants us greater control and customization over client portfolios, as this level of specificity allows investors to align their values with their investments more precisely. How? They have the ability to exclude or include specific companies (read: stocks) based on their custom ESG criteria.

Digital Assets/Cryptocurrency Separately Managed Accounts

Similar to the ESG SMAs discussed above, a digital asset/crypto SMA is a wealth management tool that affords you the ability to directly own either or both Bitcoin and Ethereum, and to securely hold these crypto positions in cold storage. At Towerpoint Wealth, we have partnered with Eaglebrook Advisors to help us help our clients gain direct access to the digital asset and crypto markets. Unlike a Bitcoin ETF or private fund, Eaglebrook’s tax optimization financial tools and strategies find opportunities to reduce or defer capital gains tax liability, provide higher levels of customization, and also incorporate cutting-edge security measures, addressing one of the primary concerns in the digital asset space, instilling confidence in an environment often plagued by security uncertainties.

Personal Finance Dashboards with Real-Time Portfolio Analytics

Personal financial dashboards, exemplified by platforms like Black Diamond utilized by Towerpoint Wealth clients, are financial tools that have helped to revolutionize the way investors oversee and manage their comprehensive financial landscapes. These dashboards consolidate an array of financial information, providing users with a comprehensive view of their assets, liabilities, investments, and spending patterns in one centralized interface.

Beyond mere aggregation, personal financial dashboards such as Black Diamond offer advanced analytical tools, allowing users to delve into the many nuances and details of their investment portfolios. Investors can track performance metrics, assess risk exposure, and simulate various scenarios to gauge the potential impact on their financial goals. The 24/7 real-time nature of these dashboards enhances financial agility, enabling users to monitor and adapt swiftly to market and economic changes, and make proactive adjustments to their strategies.

Financial News Aggregators

Financial news aggregators are indispensable wealth management tools for the information age, consolidating a myriad of financial news sources into a single, easily digestible platform. These platforms, like Harkster, PiQSuite.com, The Fly On the Wall, and even Yahoo Finance, curate breaking news, market trends, and economic analyses, offering users a comprehensive snapshot of the financial landscape. By amalgamating information from diverse sources, financial news aggregators provide a holistic understanding of market dynamics, allowing for more informed decision-making.

One of the key advantages of financial news aggregators lies in their ability to save time and streamline information consumption. Instead of navigating multiple websites or sifting through various publications, users can access a centralized hub that organizes news based on relevance and importance. These platforms often include customizable features, that enable users to tailor their news feeds to specific industries, companies, or market segments, further enhancing efficiency.

At Towerpoint Wealth, we believe that embracing innovative financial tools and wealth management tools is not just a choice but a strategic imperative in the ever-evolving landscape of personal finance. These tools serve as your ally as you work and plan to properly coordinate all of your financial affairs, not merely keeping pace but leading the way toward smarter, more informed, and ultimately more successful financial decisions.

Would you like to discuss your own situation further with us, or learn more about our wealth management philosophy and how we help clients build and protect their wealth? Curious how we utilize and integrate digital assets for some of our clients as part of a properly-diversified investment portfolio?

We encourage you to schedule an initial 20-minute discovery call with us, as we welcome learning more about you and your unique circumstances and beginning to get to know you.

Click the Wealth Management Philosophy banner image below to learn more about how we help our clients grow and protect their net worth.

It is a Boy!!!

Happy New Year and a big congratulations go out to our Director of Research and Analytics, Nathan Billigmeier, and his wife, Jessica Billigmeier, on their new baby boy, Caleb!

Caleb was born 1/3/2024 at 4:20AM, 6lbs., 15oz., 19 in. Everyone is doing great, and Caleb’s brothers, Ethan and Grayson, are loving having a new baby brother!

What is happening with the Towerpoint Wealth family? Click the banner below to find out!

Minimizing Common Investing Mistakes

Minimizing common investing mistakes is extremely important when working to build and protect your wealth and net worth and get your money’s best performance. Do you know what the 20 most common investing mistakes are?

Click the thumbnail image below for Part 1 of our series!

We are hopeful you will enjoy these educational videos, and encourage you to share this valuable information / share the video links with any colleagues or friends who would benefit from watching them.

Click the image below to browse our robust library of other wealth-building and wealth-protecting educational videos.

2023 Form 1099s

What exactly is a Form 1099, why can they be so frustrating to process, and how do you manage the problem of receiving an amended 1099 in March or April (Hint – don’t file your taxes too soon!)?

CLICK HERE or the thumbnail image below to read an excellent guide written by Steve Pitchford, our Director of Tax and Financial Planning, about to handle the frustrations of Form 1099 with aplomb and alacrity!

Have questions about your upcoming 2023 tax return?

Would you like to review an old tax return for missed opportunities?

Click the banner below to message Steve Pitchford, Steve Pitchford, Certified Financial Planner.

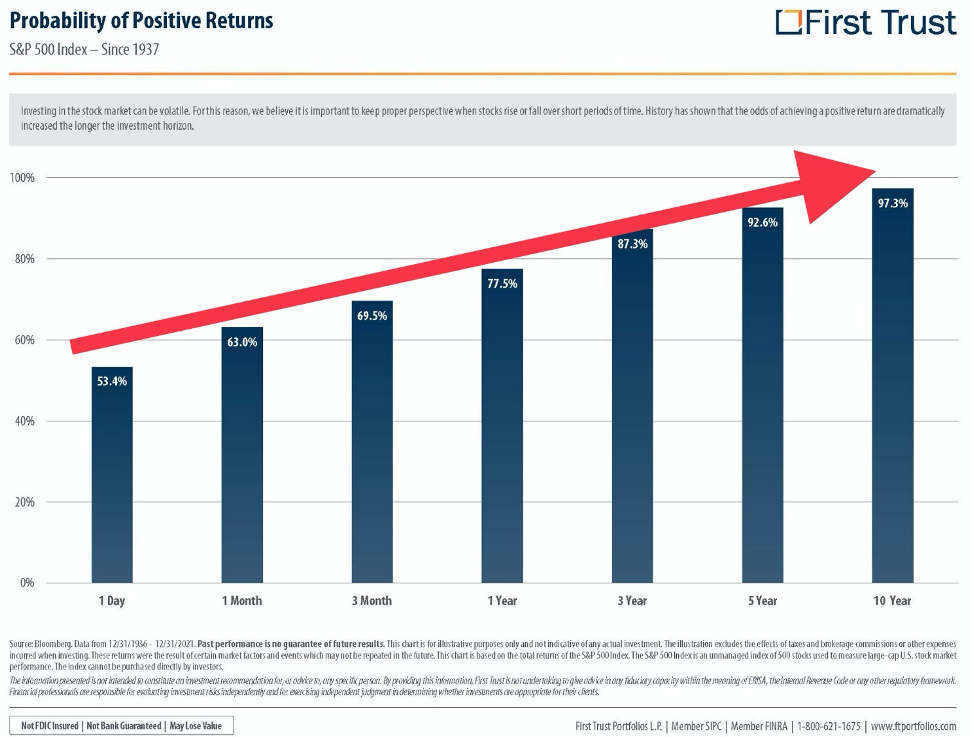

Increasing the Probability of Positive Returns

Investing in the stock market can be volatile. For this reason, we believe it is important to keep proper perspective when stocks rise and fall over shorter periods of time. History has repeatedly shown that the odds of achieving a positive return are dramatically increased the longer the investment time horizon. Thanks to First Trust for the caption and the illustration!

In light of how unsettled the economy and markets are, are you concerned or worried about the bonds in your portfolio, and/or the overall level of risk you are taking in your portfolio?

Message us to discuss your circumstances.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity. We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on YouTube

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on X

Click HERE to follow TPW Podcast : A Wealth of Knowledge