Tax season is here, and if you’re an investor, that means there’s something that should be on your radar — 1099 forms. Whether you’ve earned interest from bonds, dividends from stocks, or capital gains from your trading activity, the IRS wants to know about it.

But, when done strategically, tax reporting isn’t just about compliance; it’s an opportunity to optimize your investment strategy and minimize unnecessary tax burdens.

Understanding what is on a 1099 tax form and how to use it to your advantage is key to protecting your wealth. Misreporting gains, overlooking deductions, or misunderstanding tax rates could leave you paying more than you need to — or worse, trigger unwanted IRS scrutiny.

For investors managing complex portfolios, tax planning isn’t something to think about once a year. It’s a year-round strategy that can help preserve more of your returns and keep your portfolio working efficiently.

In this article, we’ll walk through:

- The different types of 1099 forms investors receive and what they mean for your taxes.

- How to interpret your brokerage 1099 and avoid common tax pitfalls.

- Key strategies to reduce tax liability and improve portfolio efficiency.

The U.S. tax code is complicated, but navigating it doesn’t have to be. With the right knowledge, the right financial and tax advisor, and a proactive plan, you can make tax season another opportunity to strengthen your longer-term financial strategy.

What is a 1099 Tax Form?

If you’ve earned investment income in a non-retirement, “taxable” account, you may be wondering: What is a 1099, and how does it impact my tax return?

A 1099 tax form is one of the most common documents investors receive during tax season. It’s how brokerage firms, banks, and other financial institutions report taxable income to both you and the IRS.

Unlike a traditional W-2, which reports income from an employer, a 1099 tracks investment-related income — including dividends, interest, and capital gains — that isn’t subject to automatic withholding.

For investors, understanding what’s on a 1099 is essential. If you’ve earned interest from a high-yield savings account, received dividends from stocks, or sold assets for a gain, these transactions need to be reported correctly to avoid unnecessary tax liabilities.

Types of 1099 Forms Investors Need to Know

If you’re an investor, chances are you’ll receive at least one 1099 tax form during tax season. Depending on the types of investments you hold and the transactions you’ve made throughout the year, your brokerage firm may issue multiple forms, each reporting a different type of income.

Investors must understand the different types of 1099 forms because not all 1099 income is taxed the same way.

Qualified dividends, for example, may be taxed at a lower federal rate (usually 15%) than ordinary income, while short-term capital gains (from assets held less than a year) are taxed at a higher rate than long-term capital gains. Understanding these distinctions is critical to properly managing your tax liability and ensuring your investment strategy is as tax-efficient as possible.

Failing to report 1099 income accurately can lead to IRS penalties or an unexpected tax bill. Since your brokerage firm sends a copy of your 1099 to the IRS, any discrepancies could raise red flags and result in additional scrutiny.

Understanding these forms — and how they impact your tax liability — is essential for effective tax planning and portfolio efficiency.

1099-INT: Reporting Interest Income

The IRS 1099-INT form is issued when you earn more than $10 in interest income from bank accounts, bonds, or money market funds. While this may seem straightforward, the tax treatment of interest income varies depending on the source.

- Taxable Interest – Interest earned from savings accounts, corporate bonds, and certificates of deposit (CDs) is taxed as ordinary income, meaning it is subject to your highest marginal tax rate.

- Tax-Exempt Interest – Interest earned from municipal bonds is generally exempt from federal taxes and may also be exempt from state and local taxes, depending on where the bond was issued.

- U.S. Treasury Interest – Interest from Treasury bonds, bills, and notes is exempt from state and local taxes but still subject to federal taxes.

For investors who hold fixed-income securities, understanding how 1099-INT income is taxed is key to structuring a tax-efficient portfolio and preparing for tax season.

1099-DIV: Reporting Dividend Income

If you received $10 or more in dividends, your brokerage will issue a 1099-DIV form. This form reports dividends and capital gain distributions from stocks, ETFs, and mutual funds. However, not all dividends are taxed the same way.

- Qualified Dividends – These dividends are taxed at long-term capital gains rates (0%, 15%, or 20%, depending on your taxable income). To qualify for this favorable tax treatment, the stock must meet specific requirements, as determined by the IRS.

- Nonqualified Dividends – Also known as ordinary dividends, these are taxed as ordinary income, meaning they could push you into a higher tax bracket.

- Capital Gains Distributions – If you own mutual funds or ETFs, you may receive capital gains distributions, which occur when the fund manager sells securities within the fund. These are taxed based on whether they are short-term or long-term gains, even if you didn’t sell shares yourself.

For investors looking to manage their tax liability, placing dividend-generating investments in tax-advantaged accounts such as IRAs or Roth IRAs can help reduce tax exposure over time.

1099-B: Reporting Stock and Asset Sales

If you sold investments — such as stocks, bonds, mutual funds, or ETFs — you’ll receive a 1099-B from your brokerage. This form reports:

- Proceeds from sales.

- Cost basis (what you originally paid for the investment).

- Short-term vs. long-term classification.

The difference between the sale price and your cost basis determines whether you have a capital gain or loss. Short-term capital gains (held less than one year) are taxed at ordinary income rates, which can be as high as 37%, depending on your income.

On the other hand, long-term capital gains (held more than one year) are taxed at the more favorable capital gains tax rates (0%, 15%, or 20%).

Key Tax Considerations for Investors:

- Wash Sale Rules – If you sell a security at a loss and repurchase a “substantially identical” asset within 30 days, you cannot claim the loss for tax purposes. This can impact tax-loss harvesting strategies.

- Missing Cost Basis – Some brokerage firms may not provide cost basis details for older investments. If the cost basis is not included, you may be taxed on the full proceeds of a sale unless you have accurate records.

1099-MISC: Reporting Miscellaneous Investment Income

A 1099-MISC is less common for stock market investors, but may apply if you earned:

- Rental income from investment properties.

- Royalties from intellectual property or mineral rights.

- Certain alternative investment earnings.

Unlike other investment-related 1099 forms, a 1099-MISC reports miscellaneous income, such as rental earnings or royalties. Investors receiving this form should follow the IRS 1099-MISC form instructions carefully to ensure they properly report income and avoid self-employment tax surprises.

1099-R: Reporting Retirement Account Distributions

If you have taken withdrawals from a 401(k), IRA, pension, or annuity, your financial institution will issue a 1099-R to report the distribution. A 1099-R can be issued regardless of whether the distribution is taxable. For example, when you roll over retirement assets directly from a 401(k) to an IRA, you will receive a 1099-R for the rollover — even though this is not a taxable event.

- Traditional IRA and 401(k) withdrawals are taxed as ordinary income.

- Roth IRA withdrawals are tax-free, provided you meet the IRS’s eligibility requirements.

- Early withdrawals (before age 59½) may trigger a 10% penalty in addition to ordinary income taxes unless an exception applies.

- Required Minimum Distributions (RMDs) from tax-deferred accounts begin at age 73 and must be reported on your tax return.

- Direct rollovers or rollovers processed within 60 days from one qualified account to another qualified account are non-taxable events.

What is on a 1099 Tax Form?

A brokerage 1099 tax form consolidates all taxable transactions related to your investments. While these forms may seem straightforward, overlooking key details can lead to misreporting income, overpaying taxes, or triggering IRS scrutiny.

Key Sections of a 1099 Form for Investors

- Payer and Recipient Information – Your name, address, and Social Security number should match your tax records. Errors here can lead to reporting mismatches with the IRS.

- Income Details – Different sections report interest, dividends, capital gains, and other taxable income separately.

- Federal and State Tax Withholding – If you requested tax withholding on investment income, this section will show the amount withheld.

- Cost Basis Reporting – Cost basis reporting is crucial for 1099-B forms, as cost basis helps you report gains and losses on your tax return.

Common Mistakes to Avoid

- Missing Cost Basis Adjustments

- Some brokers may not report cost basis for older investments, leading to inaccurate capital gains calculations if you do not maintain accurate records.

- Overlooking Reinvested Dividends

- Even if dividends are reinvested, they are still taxable in the year they were distributed.

- Ignoring State Tax Implications

- Municipal bond interest may be federal tax-exempt but taxable at the state level, depending on where the bonds were issued.

Failing to double-check 1099 details before filing your return can result in unnecessary tax liabilities or red flags for an IRS audit. It is important to work with a trusted tax professional to be sure you’re not missing any key information for your tax return.

Potential IRS Red Flags

To avoid unnecessary IRS audits and remain compliant, it’s important to remain vigilant. Common red flags for the IRS include:

- Discrepancies between your reported income and the IRS copy of your 1099.

- Failing to account for capital gains distributions from mutual funds.

- Forgetting to report small dividends or interest, which could trigger an IRS audit.

Strategies to Minimize Tax Liability on 1099 Income

Once you understand how investment income is taxed, the next step is optimizing your portfolio for tax efficiency.

Here are key strategies investors can use to reduce their tax burden:

1. Hold Interest and Dividend-Paying Investments in Tax-Advantaged Accounts

Interest and dividends from stocks, ETFs, and mutual funds are taxable, but where you hold these investments matters in the long run.

- Qualified dividends and interest income are subject to taxes annually, but holding these assets in IRAs or 401(k)s allows the income to grow tax-deferred and go untaxed until withdrawn.

- Consider keeping high-yield bonds, REITs, actively-traded mutual funds and ETFs, and dividend-paying stocks in retirement accounts to reduce annual tax exposure.

2. Utilize Tax-Loss Harvesting

- Selling underperforming investments to offset capital gains can significantly reduce taxable income.

- Be aware of wash sale rules, which prevent investors from claiming a loss if they repurchase the same, or a very similar, security within 30 days.

3. Time Your Asset Sales Strategically

- Holding an investment for more than one year qualifies it for lower long-term capital gains tax rates.

- Consider deferring sales into the next tax year if it helps lower your taxable income.

4. Donate Appreciated Securities Instead of Selling

- Instead of selling stocks and paying capital gains tax, donate appreciated assets to a qualified charity.

- This allows you to deduct the full fair market value of the securities while avoiding capital gains taxes.

5. Optimize Retirement Withdrawals

- Coordinate withdrawals from taxable, tax-deferred, and Roth accounts to manage tax brackets.

- Avoid early withdrawals to prevent penalties and unnecessary taxes.

- Consider partial Roth conversions to move taxable IRA assets into tax-free accounts at lower tax rates.

- Consider Charitable Qualified Distributions for your Required Minimum Distributions to exclude otherwise taxable RMDs from taxation if donated to charity.

Final Thoughts

While reporting taxes can come with some stress, for investors, tax reporting is an opportunity to align your financial decisions with a tax-efficient investment strategy.

The 1099 forms you receive each year provide a snapshot of your portfolio’s taxable activity, but understanding how to interpret and report them correctly is key to minimizing your tax liability and keeping more of your hard-earned returns.

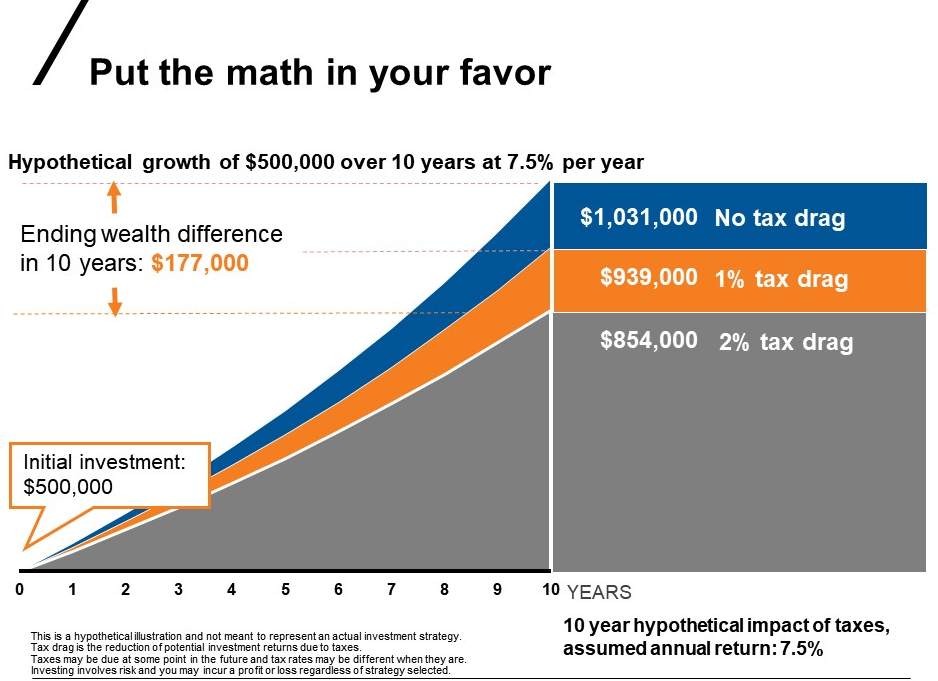

Managing tax implications on investments isn’t a once-a-year task. It requires proactive planning, careful portfolio management, and a longer-term strategy. From knowing how dividends and interest income are taxed to strategically timing asset sales and utilizing tax-loss harvesting, small adjustments can make a significant impact on your overall financial picture.

This is where working with a fiduciary financial advisor can be invaluable. A well-structured financial plan doesn’t just focus on market returns, but considers tax implications, risk management, and wealth preservation strategies.

A trusted advisor can help you:

- Ensure accurate tax reporting by reviewing your 1099 forms and spotting potential errors before you file.

- Develop a tax-efficient investment strategy that considers asset location, withdrawal timing, and portfolio rebalancing.

- Reduce capital gains tax exposure by implementing tax-loss harvesting and charitable giving strategies.

- Navigate changing tax laws to optimize your portfolio while staying compliant with IRS regulations.

- Work in tandem with your tax advisor or CPA to ensure you are receiving coordinated tax-minimization counsel.

Tax planning helps take you from reacting to what happened last year to preparing for what’s ahead. The decisions you make today can help reduce your tax burden in the future and position you for greater financial success.

At Towerpoint Wealth, we specialize in helping investors build tax-efficient portfolios that align with their long-term financial goals.

If you want to ensure your investments are working as efficiently as possible — both in terms of growth and tax savings — we invite you to schedule a 20-minute “Ask Anything” conversation today. We’ll help you take a strategic approach to your investments so you can maximize returns and minimize tax surprises.