A turnover in football. A double-fault in tennis. A personal foul in basketball. A penalty in hockey. A fielding error in baseball. Everybody makes mistakes. And, just as these slip-ups can impede winning and success in sports, committing common investing mistakes can interfere with getting your money’s best performance.

Put differently, minimizing common investing mistakes can be just as important as optimizing performance when it comes to building and protecting your wealth and net worth!

Understanding that the world of investing and wealth-building is filled with pitfalls, potential blunders, and common missteps, at Towerpoint Wealth we believe that raising awareness and helping our clients and friends to AVOID the most common investing mistakes will help you to not only be more self-aware, but also to chart a stronger course toward a more prosperous financial future.

As any athlete knows, the only way to avoid mistakes completely is to not be in the game, and that’s the worst mistake of all!

Found below are 20 common investing mistakes to learn about the top 20 most common investing mistakes to watch out for, as identified by the CFA Institute.

Avoid Common Investing Mistakes

Just like winning in sports, building and protecting net worth requires careful consideration, discipline, guts, strategic planning, and sometime even a little luck. Additionally, never taking your eye off the ball and avoiding the most common investing mistakes plays a huge part in the success you enjoy throughout your longer-term wealth-building journey.

From making emotionally-driven decisions to neglecting due diligence, there are a myriad of common investing mistakes that can hinder the growth of your portfolio. Below, we delve into the top 20 to avoid, with each “pitfall” serving a valuable lesson serving a valuable lesson about how to go the distance with your portfolio. Whether you're a seasoned investor or just starting out, understanding and sidestepping these common investing mistakes can make a significant difference in achieving your longer-term financial goals.

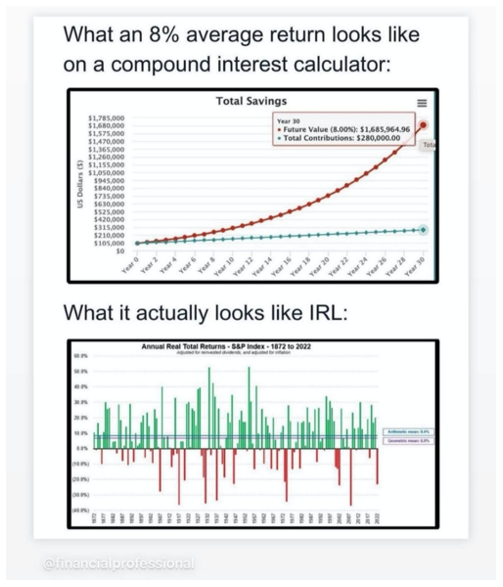

1. Impractical Expectations: Having realistic return expectations is essential. Measured expectations act as goalposts guiding you toward longer-term stability and avoiding emotional turbulence.

2. Absence of Investment Goals: Rather than being influenced by shorter-term trends and headlines, investors must remain grounded by their vision of their future and their longer-term financial aspirations, from one season to the next.

3. A Dearth of Diversification: Owning a myriad of different investments, and embracing diversification, helps to fortify your portfolio against the possibility that any individual stock, or any singular portfolio component, will shatter its foundation.

4. Short-Sighted Focus: The allure of a home run or long bomb pass is akin to the pursuit of shorter-term gains, but steadfastness to your initial strategy will keep you on course. Shorter-term market fluctuations should never impact a longer-term investment thesis.

5. High Buys, Low Sells: We obviously want to buy low and sell high, but with regular market gyrations and volatility, it's easy to falter. Selling low and buying high can send your overall performance into the gutter. As Warren Buffett said:

6. Excessive Trading: Pioneering research from The Journal of Finance reveals that the most active traders trail the U.S. stock market by an average of 6.5% annually. As Jesse Lauriston Livermore said:

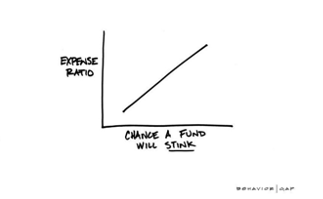

7. Fee Avalanche: Investment costs, expenses, and fees have the potential to erode your investments significantly, ruining the “gas mileage” of your portfolio, particularly over the long haul.

8. Tax-Centric Tunnel Vision: While minimizing income taxes is crucial, financial and investment decisions should not be solely tax-driven. Consider taxes only within a more comprehensive economic framework when making financial and portfolio-specific decisions.

9. Infrequent Portfolio Checkups: Review your portfolio, and overall financial, investment, and retirement plan at least semi-annually to ensure you are covering all the bases and adjusting your stance when needed. Don’t micromanage, but don’t fall asleep on the bench either.

10. Risk Misjudgment: Striking the equilibrium between too much and too little risk is the keystone to financial success. Risk is not a bad thing, as you need to take some amount of risk in order to achieve your goals. However, risk should always be justified, quantified, and properly managed.

11. Performance Blindness: Many investors don’t know the actual performance of their portfolio and investments. Evaluating gross and net (inclusive of fees and inflation) returns is an ever-important consideration.

12. Media-Driven Overreactions: Bad news and big headlines sell. While shorter-term bouts of negative news may trigger fear and emotional discomfort, it is important to remember that having a strategy, and being steadfast in sticking to it, should vastly increase your odds of longer-term investment success.

13. Inflation Oversight: Historically, inflation has averaged around 4% annually, slowly gnawing at your nest-egg. Be acutely aware of inflation, and account for it when developing and managing your financial, retirement, and investment plan and strategy.

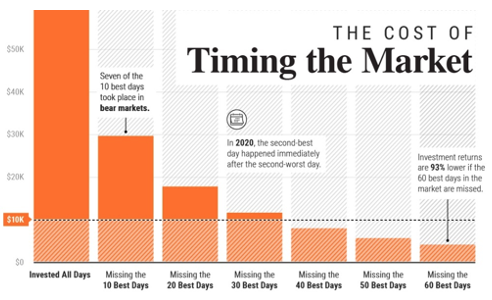

14. The Illusion of Market Timing: Even a broken clock is right twice a day. Consistently (and accurately) timing the market is akin to chasing a mirage. Remain fully invested, be disciplined, and don’t give in to the temptation to jump around.

15. Neglecting Financial Advisor Due Diligence: Verify your advisor's credentials and employment history through resources like BrokerCheck. If they have complaints or compliance issues on their record, ask them what happened and why.

16. Advisor Misalignment: Partnering with the right financial advisor is crucial, as they play a pivotal role in shaping your financial journey. A well-matched advisor not only provides sound guidance based on your goals and risk tolerance, but also ensures a collaborative and trusting relationship, fostering a path to and increasing your odds of having longer-term financial success.

17. Emotional Investing: Market, political, and economic events will inevitably stir our stomachs, but investing rationally is the creed during market squalls. As Warren Buffett said:

18. Yield Chasing: High-yielding, high-income investments often have the highest risk; a juicy dividend or lofty interest rate does not automatically make an investment a “good” one.

19. Procrastination: Time is a critical factor in wealth accumulation and compounding returns. Delaying investment decisions and putting off saving and investing can result in missed opportunities for growth, and limit the potential benefits of positive longer-term market trends.

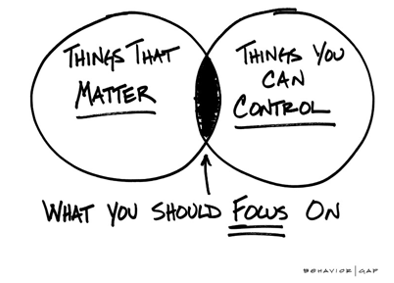

20. Focusing on Things Out of Your Control: Market and economic shifts will always be unpredictable, but investors can increase their odds of success by managing their emotions, consistently saving and investing their money, minimizing expenses and taxes, and only taking as much risk as is necessary.

Steering clear of the 20 common investing mistakes outlined above is paramount for those seeking financial and investment success in the dynamic and unsettled world we live in. From setting realistic goals and maintaining a diversified portfolio, to resisting the allure of market timing and not chasing yield, these lessons serve as a playbook for increasing your odds of successfully building and protecting your net worth and wealth over time.

Fostering the long-term trust and confidence of our clients oftentimes extends outside of the office, and it’s wonderful when important clients become important friends!

Our President, Joseph Eschleman, enjoyed a delicious sushi dinner at Kru earlier this week with two great TPW clients, Craig Richardson and Kelli Richardson.

Here’s to wonderful company, financial peace of mind, great food, trusted partnerships, and growing and protecting wealth.

A replay of our latest webinar, AI Decoded: Unlocking the Secrets of Artificial Intelligence!, is now available – click the thumbnail image below to watch it!

Thanks to our esteemed panel of guests, Linda Duessel from Federated Hermes, Inc, Chris Gannatti, CFA® from Wisdom Tree, and Michael Grant from Calamos, the AI webinar was an absolute hit, as we covered a lot of material:

What is artificial intelligence?

- What does #machinelearning mean?

- -AI’s ancient connection with Socrates.

- -Commercial uses for AI.

- The AI user experience started in 1950.

- How smart is AI? It can pass the bar exam!

- Bias is built into the AI user experience.

- Is AI going to take my job?

- Will AI replace financial advisers?

- Will creativity suffer with AI?

- The AI user experience helps financial advisors help their clients.

- How do we prevent AI being used for evil purposes?

- How to invest in AI.

- Embracing the AI user experience!

We are confident you will enjoy this webinar, and encourage you to share the video link with any colleagues or friends who would enjoy this AI information.

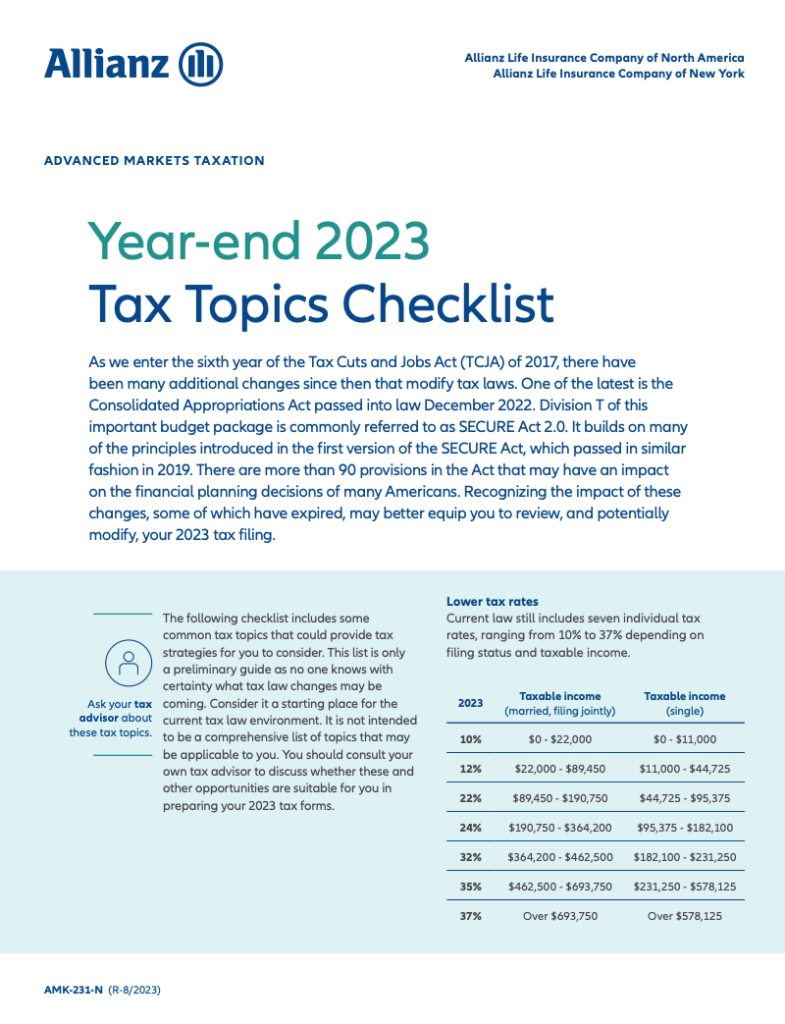

CLICK HERE or the thumbnail image below for an excellent checklist that includes some common tax topics that could provide tax planning strategies to consider. While the list is only a preliminary guide, as no one knows with certainty what tax law changes may be coming, consider it a valuable starting place for the current tax law environment.

Click the image below to complete our short form and download Towerpoint Wealth’s 2023 Tax Reference Guide, an excellent resource and tax “cheat sheet” that was designed to help you take advantage of the many tax deductions and opportunities there are to help shave to help shave money off of your tax bill!

Have questions about your upcoming 2023 tax return? Would you like to review an old tax return for missed opportunities?

Click the banner below to message Steve Pitchford, Steve Pitchford, Certified Financial Planner.

“As we express our gratitude, we must never forget that the highest appreciation is not to utter words, but to live by them.”

- John F. Kennedy

Are you a veteran? If so, CLICK HERE for an excellent guide itemizing the abundant benefits available to servicemembers.

Obtaining linear, straight-line growth in your investment portfolio is generally a very unreasonable expectation.

In light of how unsettled the economy and markets are, are you concerned or worried about the bonds in your portfolio, and/or the overall level of risk you are taking in your portfolio? Message us to discuss your circumstances.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast