It's Tax Time | What is the Form 1099?

What exactly is a Form 1099, why can they be so frustrating to process, and how do you manage the problem of receiving an amended one? Read on to find out!

What is the Form 1099?

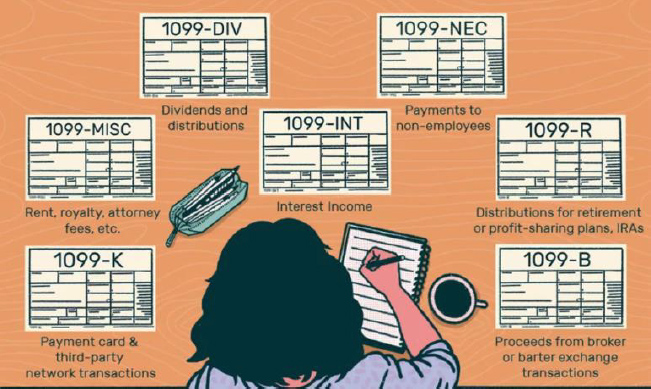

A Form 1099 is any one of a series of documents that contains information on all transactions that occurred inside of a “taxable” account1 during a given tax year. Reporting this information on a taxpayer’s annual federal individual income tax return is required. Most investment custodians (e.g. Charles Schwab, Fidelity, Merrill Lynch, etc.) will consolidate the various Form 1099s into one consolidated document, known as a Composite Form 1099.

The most common transactions represented on a Form 1099 are:

• Dividends and Distributions (Form 1099-DIV): Typically generated by owning a stock/equity investment product.

• Interest Income

(Form 1099-INT): Typically generated by owning a bond/fixed-income investment product.

• Capital Transactions (Form 1099-B): Reflects gains/(losses) from the sale of a capital asset.

Towerpoint Tip:

A Form 1099 is not the same as a Form 1099-R. The latter form reports annual distributions from tax-advantaged retirement accounts, such as “regular” pre-tax IRAs, Roth IRAs, SEP IRAs, and 401(k)s.

What do I do with a Form 1099?

If you work with a CPA/tax advisor, you should provide this tax form to them for inclusion on your federal individual income tax return.

If you prepare your own tax returns, be sure to utilize the import function that many tax preparation software programs now provide. This will ensure accurate reporting to the IRS, which is particularly important for Form 1099s, as any reporting discrepancies in the information you input versus the information the Internal Revenue Service (IRS) receives from your custodian automatically “flags” your federal tax return for additional scrutiny.

Why do I receive my Form 1099 late or even worse, receive an amended Form 1099?

Generally, investment custodians have until February 15 to provide taxpayers with their Form 1099s, although more recently, custodians are requesting exceptions and extensions to, or even flat-out missing, this issuance deadline, so be aware that you may be waiting past this date to receive yours.

Why? Before completing Form 1099s, custodians must first receive and collect taxable income information from each of the underlying investments all of their clients were invested in during the prior year; and more often than not, 1099 issuance delays originate with the underlying companies themselves.

It is also common for custodians to have to restate the originally issued Form 1099, and reissue what are known as amended Form 1099s, when one or more of the underlying investment companies revise, update, or correct an error made in their initial reporting.

What do I do if I receive an amended Form 1099, and are there any steps I can take to make this less of a headache?

if you receive an amended Form 1099 after already filing your tax return, you may need to file an amended tax return. You should speak with your CPA/tax professional for guidance on this important consideration.

To put yourself in the best position to avoid this hassle, we recommend that taxpayers work with their CPA/tax professional to prepare their tax returns in full as early as possible in the filing season, but wait until later in March to actually file them. While we fully understand the desire for some of you to finish and file your tax return as soon as possible, waiting to file minimizes the likelihood that you’ll have to file an amended tax return after receiving an amended Form 1099. Additionally, this gives your tax professional adequate time to properly prepare and file your return should you receive amended 1099s.

Towerpoint Tip:

If the difference between the original Form 1099 and the amended Form 1099 is slight, and can be considered in your favor, the cost of amending the tax returns may outweigh doing nothing. However, we advise you file an amended return when the amended Form 1099 results in additional taxes owed.

How Can We Help?

Director of Tax and Financial Planning

At Towerpoint Wealth, we are a legal fiduciary to you, and embrace the professional obligation we have to work 100% in your best interests. If you would like to speak with us regarding any other tax questions you may have, we encourage you to call (916-405-9166) or email (spitchford@towerpointwealth.com) to open an objective dialogue.

Towerpoint Wealth, LLC is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Towerpoint Wealth, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Towerpoint Wealth, LLC unless a client service agreement is in place.