It is this investment advice from Warren Buffett that has been ubiquitous throughout his storied career:

1. Accurately predicting the stock market is a fool’s game, and

2. Never bet against America!

After two remote pandemic years, an estimated 25,000 Berkshire Hathaway shareholders flocked to Omaha, Nebraska last weekend for the in-person return of the Berkshire Hathaway annual shareholder’s meeting, featuring the omnipresent, dynamic, and larger-than-life 91-year-old Warren Buffett.

Along with his 98-year-old right hand man and long-time sidekick Charlie Munger, the “Oracle of Omaha” presided over a spirited, intellectual, and oftentimes jovial congregation of investors from around the globe. Live-streamed by CNBC, the event had a festival feel to it, and was described as an “opportunity to learn from the masters.” Whitney Tilson, the CEO of Empire Financial Research who has been going to Berkshire’s shareholder meeting for the past 25 years, said that the event is always “intellectually, physically, and emotionally fulfilling.”

Want some investment advice from Warren Buffett? Here are four excellent takeaways from the Berkshire shareholders meeting:

Investment Advice from Warren Buffett

1. Both Buffett and Munger see market volatility and speculative behavior as an opportunity.

Buffett lambasted Wall Street for encouraging speculative behavior in the stock market and effectively turning it into a gambling parlor.

“Wall Street makes money, one way or another, catching the crumbs that fall off of the table of capitalism… They make a lot more money when people are gambling than when they are investing” Buffett said.

However, he then went on to say that the situation can create market dislocations that give Berkshire Hathaway an opportunity. “That’s why markets do crazy things, and occasionally Berkshire gets a chance to do something.”

2. Buffett’s trick for getting his money’s worth out of the stock market? Not obsessing about finding a perfect time to invest in a stock.

Go ahead and invest, and then observe the market over time to see if you should buy more of that company’s stock. Buffett says that this strategy has a higher chance of return, and it alleviates some of the pressure of predicting the stock market.

If the value of the stock dips after you buy it, and you still believe in the company, he suggests that the shares have become less expensive, so buy more. This is where Warren Buffett invests.

Another billionaire appears to feel the same way:

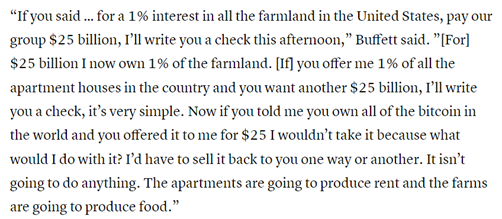

3. Buffett prefers “assets with value” over bitcoin.

While bitcoin has steadily been gaining acceptance from the traditional finance and investment world, Buffett is sticking to his skeptical stance on the cryptocurrency.

When asked about bitcoin, Warren Buffett said it is not a productive asset and doesn’t produce anything tangible. He then elaborated and gave a hypothetical answer:

In short, bitcoin will not be where Warren Buffett invests.

4. Inflation swindles almost everybody.

From stock and bond investors, to people who stash cash under their couch, inflation hurts many different kinds of investors.

“You print loads of money, and money is going to be worth less,” Warren Buffett said.

Additionally, while he said that he couldn’t, and wouldn’t, predict the trajectory of inflation over the coming months or years (just like he avoids predicting the stock market), he did say that the best protection against inflation is your own personal “earning bar,” as a person’s skills, unlike currency, won’t be taken away and are inflation-proof.

Buffett then summarized: “The best investment by far is anything that develops yourself – and it’s not taxed at all.”

Buffett, Munger, and Berkshire appear to be doing something right, as the S&P 500 has dropped more than almost 14% this year so far, while Berkshire’s stock is up almost 6% year-to-date! We do believe that investment advice from Warren Buffett is worthy of our attention.

Click the image below to watch any part (or all!) of the BRK annual shareholder’s meeting.

What's Happening at TPW

It’s a family affair at Towerpoint Wealth!

It felt a little like a Billigmeier family reunion earlier this week, as Marc and Glenda, two good Towerpoint Wealth clients, flanked their son and our Director of Research and Analytics, Nathan Billigmeier, prior to their comprehensive financial, investment, and retirement review meeting.

Both Marc and Glenda are well-versed in Warren Buffett’s philosophies, and know that accurately predicting the stock market is next to impossible. A key factor in their longer-term success is most certainly their humility and their discipline, which are also two foundational TPW wealth-building and wealth-protection ideals.

Our President, Joseph F. Eschleman, CIMA®, and friend of Towerpoint Wealth, John Palombi, put some work in last weekend at the Fair Oaks Sun Run, clocking a quick five miles. Nice work, gentlemen!

TPW Taxes - 2022

Is it full steam ahead for Secure 2.0?

After passing the House in late March by a 414-5 vote, the bipartisan Securing a Strong Retirement Act of 2021 is now awaiting approval by the Senate, with Congress expected to vote on a final measure before the end of 2022.

Providing even more and arguably better opportunities to save for retirement, the passage of Secure 2.0 appears to be more of a ‘when’ than an ‘if’, and as we wait for this legislation to hopefully become law, click the image below to read an excellent overview from Wealth Management.com that discusses five key provisions of the bill:

TPW News You Can Use

Useful and interesting content we read the past two weeks:

1. What Was the Strategy Behind the Supreme Court Leak? – NY Times – 5.4.2022 The leak of a draft Supreme Court decision that would overturn Roe v. Wade is not a surprise, but it is something of a mystery. The mystery: The logic of and strategy behind the leak.

2. The Bottom Line in Ohio? Trump Wins – Washington Post – 5.4.2022

Most one-term presidents recede from the political scene, with their party’s voters happy to see them go. But Donald Trump continues to dominate the Republican Party a year and a half after he lost re-election. Tuesday’s Republican Senate primary in Ohio confirmed Trump’s influence, as a Trump-endorsed J.D. Vance won the nomination, with 32 percent of the vote, in a primary that included four other major candidates.

3. A ‘Haven for Criminals’ – NY Post – 5.4.2022 A NYC subway conductor outraged about attacks on transit riders and his fellow transit workers confronted MTA CEO Janno Lieber during a live radio interview on Wednesday.

TPW Chart of the Week

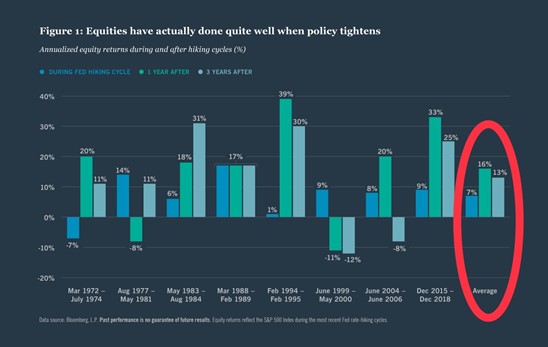

Rising interest rates are bad for the stock market, right? Not so fast…

While it may have felt that way in April, the illustration below from Nuveen indicates the opposite is actually true!

Note the Average column on the far right: equities have historically performed well through tightening cycles, albeit not without volatility.

Do you enjoy predicting the stock market? Do you believe rising interest rates will cause the market to go up, or go down?

Send us a quick message and let us know what you think!

Quote of the Week

“During this time of reopening, we are likely to see some upward pressure on prices… But those pressures are *likely to be temporary* as they are associated with the reopening process.”

Jerome Powell, Chairman of the Federal Reserve April, 2021

The sardonic truth? Almost a year later, the consumer price index (CPI) is +8.5%, and accelerating.

Here’s the point: predicting the stock market, or inflation, or any future economic occurrence, is next to impossible to consistently (and accurately) do. Be aware but wary of the accuracy of expert predictions, understanding that today’s forgone conclusions are often hindsight’s most embarrassing moments. Those who can mix knowledge with humility are often at a longer-term competitive advantage.

Want further testimony? From August of last year: Why Fed’s Powell Still Thinks High Inflation is ‘Temporary’

Trending Today

As the 24/7 news cycle churns, twists, and turns, a number of trending and notable events have occurred over the past few weeks:

- Law enforcement prepares for potential violence, unrest surrounding Roe v. Wade decision

- Netflix is responding to its loss of customers by making some production cuts, including Megan Markle’s animated show, “Pearl”

- Munich Mayor Dieter Reiter announced Oktoberfest plans with no COVID restrictions this year

- The low level of Lake Powell, the second largest U.S. reservoir, threatens the production of electricity for millions of people

- AOC attacks Kyrsten Sinema over filibuster after SCOTUS leak

- Is that an outlaw lawn? Las Vegas has a new approach to saving water

- Following pandemic-era losses, oil companies are now seeing record-breaking profits (while we’re paying more and more at the pump)

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph, Jonathan, Steve, Lori, Nathan, and Michelle

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity. We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on Twitter