Contrary to popular belief, estate planning is NOT just about what happens after you’re gone. It’s about making sure your wealth, values, and intentions are both documented and protected — now and for generations to come.

Yet far too often, even smart, financially successful individuals unknowingly leave gaps in their estate plan.

Maybe they assume they don’t need one yet. Or they’ve created a will or trust, but never reviewed their beneficiary designations. Or they’ve worked with an attorney — but haven’t coordinated with their financial advisor to ensure the plan works in practice, not just on paper.

OR, they have an estate plan, and haven’t reviewed or updated it in years!

That’s why we’ve created this estate planning checklist.

At Towerpoint Wealth, we believe estate planning is a team effort. And while attorneys help draft legal documents, a fiduciary financial advisor plays a crucial role in making sure your financial picture is fully coordinated, from how your accounts are titled to how your assets are managed, distributed, and protected.

In this article, we’re walking through 10 of the most common estate planning pitfalls we see — and how to avoid them with a well-orchestrated strategy.

If you’re starting to think about your legacy or want to double-check that your plan is up to date, this checklist is designed to help you approach estate planning with greater clarity, confidence, and coordination.

Why Estate Planning Is Important… and Why So Many Get It Wrong

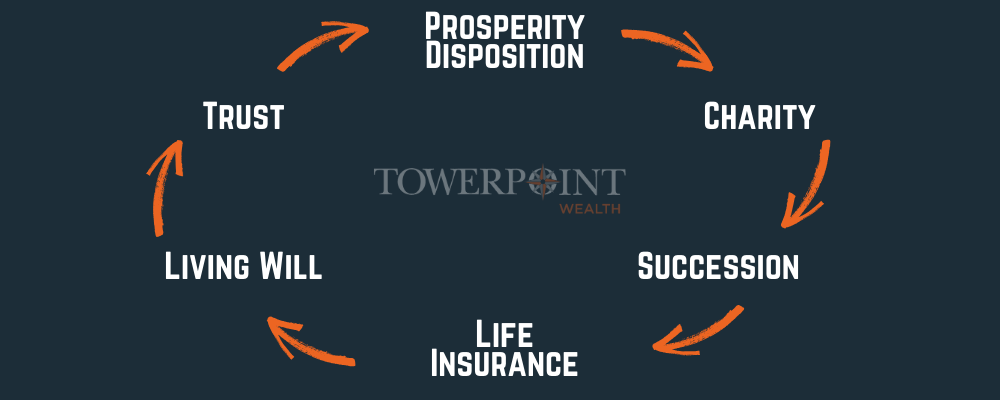

Estate planning is about much more than simply writing a will or deciding who gets what after you’re gone. At its core, estate planning is about maintaining control over your wealth, your wishes, and your legacy.

It’s the process of organizing your financial life in a way that protects the people and causes you care about, provides clarity during difficult times, and helps ensure your assets are handled according to your values, not just the default rules of the state.

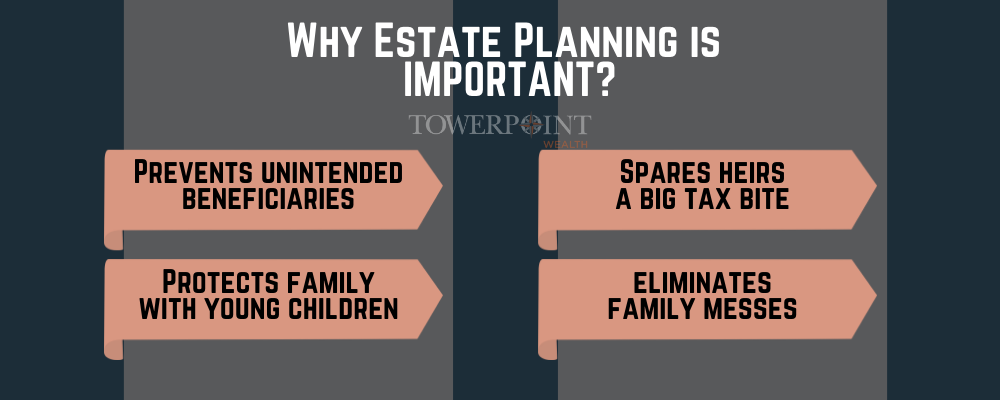

So, why is estate planning important if you already have a spouse or adult children who know your preferences?

Well, verbal wishes don’t necessarily carry legal weight, a trust that isn’t properly funded won’t do what you intended, and the administrative, emotional, and financial costs of estate planning mistakes often fall hardest on your loved ones.

At Towerpoint Wealth, we often see people assume that estate planning is a legal task to “check off” with an attorney.

But an effective estate plan requires significant strategizing and coordination. Your financial advisor plays a central role in that process: titling accounts properly, reviewing beneficiary designations, funding trusts, managing tax exposure, and aligning the plan with your overall financial strategy.

Unfortunately, too many people delay it altogether.

According to a survey conducted by Caring.com, approximately two-thirds (!) of Americans don’t have a complete estate plan — and among high-income households, many have outdated estate planning documents or incomplete implementation. That procrastination often results in unnecessary estate taxes, court delays, family disputes, or confusion during a crisis.

What does this mean? Without a proactive, collaborative approach, even the most well-intended estate plans can fall short. A clear plan is one of the most powerful gifts you can leave behind, and one of the smartest steps you can take while you’re here.

So, where do most people go wrong — and how can you avoid those missteps? That’s where our estate planning checklist comes in.

Towerpoint’s Estate Planning Checklist: 10 Questions to Help You Build a Stronger, More Coordinated Estate Plan

Even the most well-drafted legal estate planning documents can fall short if the financial side of your plan isn’t aligned.

That’s why we created this estate planning checklist. Not just to help you get organized, but to help you avoid the real estate planning cost — the cost of often overlooked mistakes that derail even the best intentions.

Each item in this checklist reflects a common pitfall we see and, more importantly, the proactive steps you can take to avoid them. It’s designed to help you approach your estate plan with clarity, coordination, and confidence.

Let’s work through the essentials.

1. Do You Have a Plan — or Just a Will?

Checklist Tip: Make sure your plan includes more than just a will.

Many people think having a will is an estate plan — but a true plan is much more comprehensive. It includes clear instructions for how your assets are owned, managed, and transferred both during your lifetime and after you’re gone.

That means coordinating how accounts are titled, how beneficiary designations are handled, and what happens in the event of incapacity, not just death.

This is exactly why we work with your attorney to help you build coordinated estate strategies that go beyond just the documents, and work with your life.

2. Are Your Beneficiaries Up to Date?

Checklist Tip: Review and update beneficiaries on retirement accounts, life insurance, TOD/POD accounts, and other key assets.

Outdated beneficiaries are one of the most common estate planning mistakes — and one of the easiest to fix. Keep in mind: beneficiary designations override what’s in your will or trust, so if they’re not aligned, your wishes may not be honored.

We recommend reviewing these designations at least every two to three years, or after any major life event.

3. Have You Funded Your Trust?

Checklist Tip: Ensure your trust actually holds your assets.

Creating a trust isn’t enough — you have to fund it. That means retitling assets or designating the trust as a beneficiary where appropriate. A trust with no assets won’t accomplish your goals, and you may unintentionally send your estate through probate.

This is where working with your advisor plays a critical role in helping you coordinate and track what belongs where.

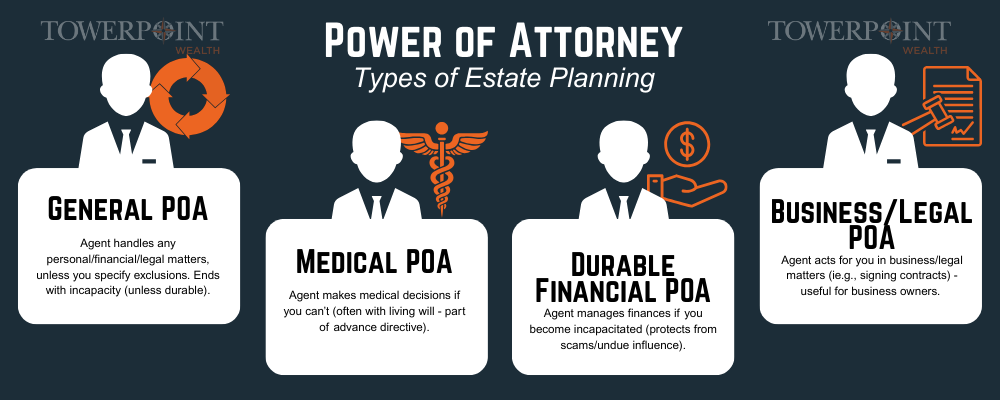

4. Are You Protected if You’re Incapacitated?

Checklist Tip: Create powers of attorney and healthcare directives.

Estate planning isn’t just about what happens after death — it’s also about planning for the unexpected. Make sure you’ve named trusted individuals to make financial, business, and medical decisions on your behalf, and documented your wishes clearly.

Without these documents, your loved ones may face difficult decisions with no guidance.

5. Have You Considered Inheritance Taxes?

Checklist Tip: Understand estate and inheritance tax exposure.

While many families aren’t subject to federal estate tax, higher-net-worth households may still face significant exposure. While there’s no state inheritance tax in California, for example, there may be other tax implications based on where assets are located.

A coordinated team of advisors, CPAs, and attorneys can help minimize unnecessary tax burdens.

6. Are You Keeping Family in the Loop?

Checklist Tip: Talk to your loved ones about your estate plan.

Clear communication prevents confusion, resentment, and conflict. You don’t have to share every detail, but discussing your intentions with key individuals — especially those who may have roles in your plan — can make a major difference down the road.

Many times, we will work with our clients in joint family meetings to help facilitate these conversations and reduce the stress in these conversations.

7. Do You Have a Team in Place?

Checklist Tip: Work with both an estate attorney and a fiduciary financial advisor.

An attorney helps you draft the right legal documents, while your advisor ensures the strategy is implemented, updated, and aligned with your financial goals. Estate planning works best when both professionals collaborate with you to create a cohesive and effective plan.

Our team helps clients organize, simplify, and maintain their plans over time. We strive to ensure that we work as a unit with attorneys, CPAs, and other professionals to create plans with the most accurate and up-to-date information.

8. Is Your Plan Built to Evolve?

Checklist Tip: Review your plan every 3–5 years or after major life events.

Births, deaths, marriages, divorces, moving, business changes — all of these can affect your estate plan. Too often, documents are created and forgotten. A good plan should be built to grow with you.

9. Are Your Documents Organized and Accessible?

Checklist Tip: Store and share your estate planning documents securely.

Even the most well-thought-out plan can fall apart if no one knows where the documents are or if the originals are locked away in an inaccessible file cabinet. Make sure your power of attorney, trust, will, and healthcare directives are stored securely and shared with those who need access.

We often use secure digital vaults to help clients centralize and share this information.

10. Have You Defined What You Want Your Legacy to Be?

Checklist Tip: Think beyond logistics — clarify your values, goals, and charitable wishes.

Estate planning isn’t just technical, but also deeply personal. Whether it’s passing along values to your children, supporting a cause you care about, or creating a lasting philanthropic legacy, this step ties it all together.

If you’re unsure where to start, a trusted financial advisor can help you reflect on what legacy really means to you and build a plan that reflects it.

Bottom Line

Estate planning is far beyond a simple legal task — it’s a personal, emotional, and financial one.

At Towerpoint Wealth, we’ve seen firsthand how even the most well-intended plans can fall short without proper coordination and follow-through. That’s why we created this Estate Planning Checklist — not just to help you get organized, but to help you avoid common (and costly) missteps.

Whether you’re just starting out or reviewing an existing plan, this checklist is designed to help you ask the right questions, involve the right professionals, and ensure your wishes are actually carried out, not just written down.

And remember: estate planning is NOT a one-time task. Life changes, and your plan should evolve with it.

If you’re unsure whether your plan is up to date — or if you’re just getting started — we invite you to schedule a 20-minute “Ask Anything” call. Our goal is to make sure you walk away with more clarity and confidence about what’s working… and what might need attention.