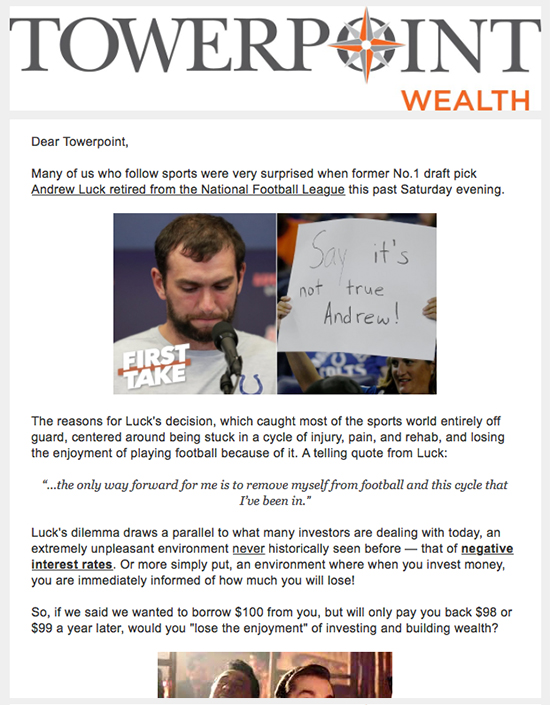

Many of us who follow sports were very surprised when former No.1 draft pick Andrew Luck retired from the National Football League this past Saturday evening.

The reasons for Luck's decision, which caught most of the sports world entirely off guard, centered around being stuck in a cycle of injury, pain, and rehab, and losing the enjoyment of playing football because of it. A telling quote from Luck:

“…the only way forward for me is to remove myself from football and this cycle that I’ve been in.”

Luck's dilemma draws a parallel to what many investors are dealing with today, an extremely unpleasant environment never historically seen before — that of negative interest rates. Or more simply put, an environment where when you invest money, you are immediately informed of how much you will lose!

So, if we said we wanted to borrow $100 from you, but will only pay you back $98 or $99 a year later, would you "lose the enjoyment" of investing and building wealth?

Don't laugh — while it sounds absurd (to us at Towerpoint Wealth, downright offensive), increasingly this is now the global bond market. A rising share of government and corporate bonds are trading at negative interest yields — a financial twilight zone that took hold after the '07-'08 financial crisis, and has accelerated on fears that a fragile global economy will be further damaged by the U.S.-China trade war.

A headline from a Business Insider article written almost three years ago sums up this new and perplexing environment:

Unlike Andrew Luck, who was simply able to extricate himself from his bad circumstances and rigors of being an NFL quarterback, most retail and institutional investors cannot just turn their backs on this perplexing investment environment. Investors have to find a home somewhere for their capital. So while a scenario in which interest rates in the U.S. turn negative is no longer unthinkable, it does not mean there are not ways to build wealth in this type of environment. Regardless of what may happen, at Towerpoint Wealth we stand ready to help you, and encourage you to call or email us to discuss your circumstances further.

Towerpoint Wealth at Schwab's SOLUTIONS® conference

Our Director of Client Services, Lori Heppner, Client Service Specialist, Raquel Jackson, and Director of Research and Analytics, Nathan Billigmeier, spent a full day out of the office in San Francisco last week attending the 2019 Charles Schwab SOLUTIONS® conference.

In the interests of maximizing operational efficiencies, learning more about cybersecurity protection, as well as leveraging Schwab's research, trading, and innovations in financial technology (FinTech) capabilities, Nate, Lori, and Raquel sharpened their professional saws and took a deep dive into SOLUTIONS®, learning more about how the myriad of Schwab's tools and resources can help us better and more efficiently serve our clients at Towerpoint Wealth.

* Click the Solutions tile below to view the SOLUTIONS® agenda and session details *

In addition to the aforementioned interest rate and FinTech developments, a number of trending and notable events have occurred over the past two weeks:

- Amazon rainforest fires continue

- Billionaire industrialist and conservative donor, David Koch, dead at 79

- Andrew Luck stuns the NFL, announces his retirement

- National Dog Day 2019

- Hurricane Dorian threatens to broadside Florida over the Labor Day weekend

- Sacramento restaurant icon, Biba Caggiano, dead at 82

Lastly, please take three or four minutes to review the curated content found below, highlighted by:

- What might Andrew Luck do next, after his surprise retirement from the NFL? Click below to find out.

- A well-written article discussing whether a recession in the United States will follow the now-inverted yield curve.

- Have a dog? Pinched for time and unable to walk poor Fido? The Wag! app may be the perfect solution for you!

As always, we encourage you to reach out to us (info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely complicated place. We are here for you, and look forward to connecting with, helping, and being a direct, fully independent, and objective expert financial resource for you.

- Joseph, Jonathan, and the entire Towerpoint Wealth team