What if you could profit from inflation rather than suffer from it?

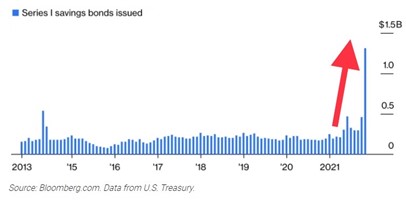

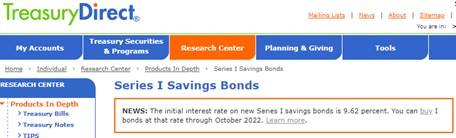

While interest rates on most traditional bond investments remain near historical lows, there currently are bonds to invest in that are AAA rated and yielding 9.62% (as of 7.1.2022)! They are called I Bonds, and they have gained in popularity and garnered significant attention over just the past year or so, paralleling inflation’s rapid ascent.

While on the surface the government guarantee and high interest rate may seem too good to be true, like most things in life (investing certainly included), there is more to I Bonds than initially meets the eye, and while they may be bonds to invest in for some people, there is lots to consider, and they do not come without risks.

Offered by the US Treasury and guaranteed by the full faith and credit of the United States government, Federal Series I Savings Bonds, commonly known as “I Bonds,” have become an increasingly popular investment. The way I Bonds accrue interest is somewhat unique: the actual rate of interest, or yield, for I bonds is determined with an equation using the ”Fixed Rate” + the “Inflation Rate.” This total “Composite Rate” is then re-established every six months.

With inflation soaring this year, the rate for I Bonds is now 9.62% (as of 7.1.2022).

This high (yet potentially temporary, depending on what inflation does throughout 2022 and into next year) interest rate for I Bonds, and the security of the full faith and credit of the United States government, are two reasons people are focusing more of their attention on this place to invest their money.

Two additional reasons why I Bonds may be good bonds to invest in include:

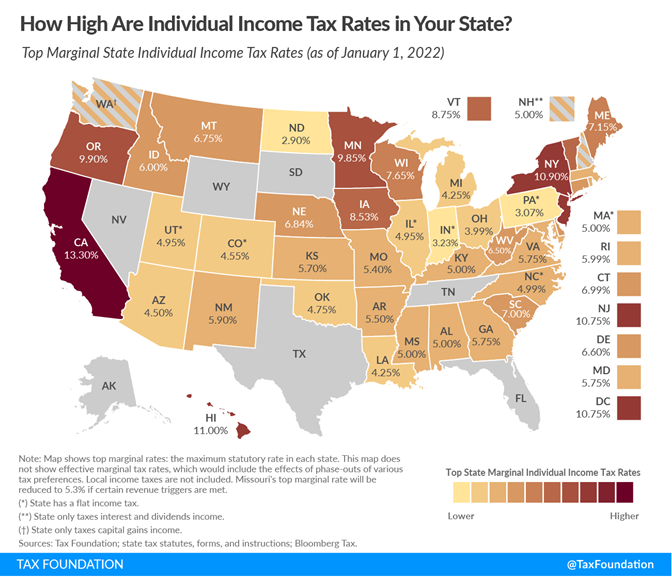

1. The interest that I Bonds pay is federally taxable (but deferrable!), but not taxable on a state level.

While federal taxes are owed on I Bond interest, you have the choice to defer reporting the interest until you cash the bond in (or the bond stops earning interest because it has reached final maturity). You also can report the interest every year on your tax return, but we typically would advise against that.

Additionally, because no state taxes are owed on I Bond interest, this makes the rate for I Bonds even more attractive for residents of high tax states like California, New York, and Oregon.

2. They provide inflation protection for your cash.

Want to create a small but direct inflation-adjusted rainy-day fund that is virtually risk free? Owning I Bonds and leveraging the current 9.62% interest rate (as of 7.1.2022) may be worth considering.

The security of the US government guarantee, coupled with the attractiveness of the current 9.62% rate for I bonds, give them great “curb appeal.” However, the drawbacks and downsides of I Bonds may mean they are not the best bonds to invest in.

- For instance, I Bonds have a 30-year maturity, and are not redeemable for at least 12 months.

Put differently, you will have no access to your funds for one full year. For some, that is not a big deal, but for others, it could be an important consideration.

- Also, investors will forfeit the last three months of interest if they redeem an I Bond between one year and five years after issue.

- In addition, I Bonds are not marketable securities, and the maximum investment amount for an I Bond is “only” $10,000 annually.

You cannot buy and sell I Bonds at will like you can with regular stocks, bonds, and most mutual funds.

At Towerpoint Wealth we believe that for some investors, the $10K investment ceiling limits the I Bond “payoff” and may make it not worth the time and energy required to open and fund an account directly with TreasuryDirect. Additionally, many investors are looking to streamline their financial situations and not complicate them, and the additional hassle of having another account custodian and 1099 come tax time may not be worthwhile.

We believe the I Bond $10K annual investment limitation makes it difficult for some investors to accumulate enough to truly move the needle. However, for smaller accounts focused on wealth preservation, I Bonds may make a lot of sense.

- All of this to say, I Bonds are less-than-easy to purchase through TreasuryDirect’s antiquated website, and cannot be purchased through an independent financial advisor or broker.

Quoting a CNBC article from Wednesday, “It’s like going to the DMV online.”

Add extra account numbers to your list, as well as extra passwords TreasuryDirect also may require additional identity verifications and account authorization forms, not to mention signature guarantee requirements and additional paperwork for simple bank account changes.

- Finally, the rate for I Bonds is variable, changes every six months, and could easily adjust downwards depending on the rate of inflation.

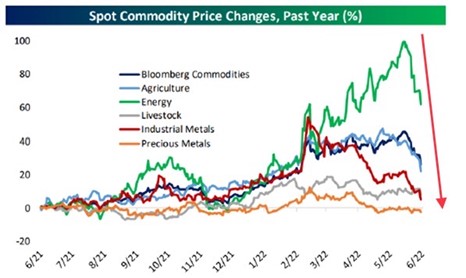

While recency bias may lead us to believe that inflation will continue to surge, there are already signs that it may be moderating. The stock market strongly rebounded last week due in part to plunging commodity prices, a positive sign for potentially slowing inflation:

If, or more likely when inflation calms, the rate for I bonds are apt to decline.

Does the full faith and credit of the United States government, coupled with the 9.62% rate for I Bonds, make them attractive enough to explore further? After reading this newsletter, are you thinking about passing on them, or are you considering them as an investment? Click the thumbnail image below if you want to check out the official I Bond Treasury Direct website, and hopefully your experience won't be as “DMV-ish” as mentioned above!

Click the Wealth Management Philosophy thumbnail image below to learn more

about how we help our clients build and protect their net worth

What's Happening at TPW?

Two excellent and long-time TPW clients, Kristi and Dan Spector, connected with our President, Joseph Eschleman, CIMA®, for a comprehensive financial review meeting at our downtown headquarters this past Friday.

From the looks of their smiles, it appears that Dan and Kristi appreciate our commitment to the TPW mission statement:

At Towerpoint Wealth, we do everything we can to defend our clients against fraud and cybersecurity threats, have implemented a strong cybersecurity plan which we regularly update, and consistently conduct employee education efforts aimed at identifying and stopping fraud attempts.

It can be difficult to protect our clients from scams they may encounter through channels such as email, social media, and even dating apps, all of which have been used by criminals to steal data and assets. So just last month, the TPW team participated in an interactive presentation from Charles Schwab where we learned about different types of scams that may target our clients. We also absorbed a few tips for helping clients identify and avoid them, as well as how to respond in the event that they fall victim to a scam.

What else is happening with the Towerpoint Wealth family?

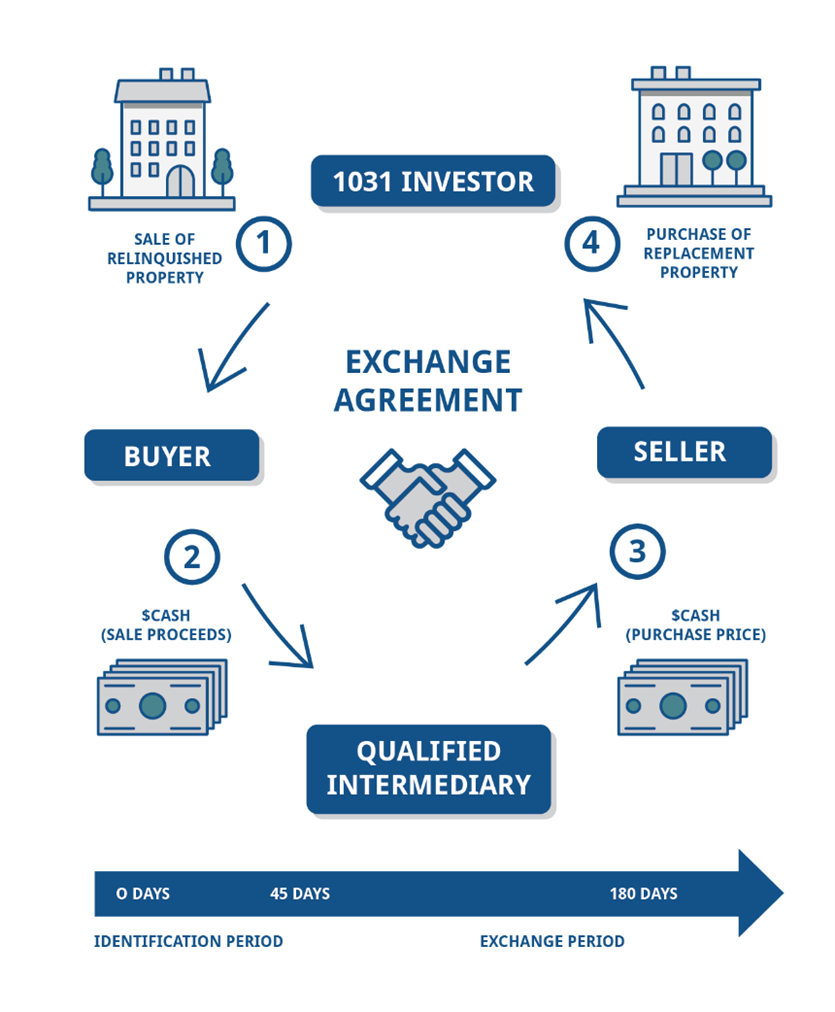

TPW Taxes - Section 1031 Exchanges

Do you own appreciated investment real estate? Torn between doing a 1031 and deferring all of the taxes, or selling and paying all of the taxes now?

A global pandemic and swiftly increasing interest rates have not (yet?) hampered the positive outlook of the residential and commercial real estate markets. In 2021, there was more than $100 billion in tax-free 1031 exchange volume, and transactions have been strong in 2022 as well. If you are considering the sale of investment property, rather than pay a tax liability of up to 40%, you may utilize a 1031 exchange to defer the following taxes:

1. Capital Gains Tax – Your rate will vary based on your taxable income. For 2022, your long-term Federal capital gains rate may be as high as 20% if your taxable income exceeds $459,750 (filing single) or $517,200 (married filing jointly).

2. Net Investment Income Tax (NIIT) – If you have income from investments, including capital gains, you may be subject to an additional 8% net investment income tax on your adjusted gross income in excess of $200,000 ($250,000 if married filing jointly) in 2022.

3. State tax –You will probably also be subject to state and/or local income taxes. State tax rates are quite variable, from 0% in some states to as high as 3% in California.

4. Tax on unrecaptured section 1250 gains – An IRS tax provision where previously recognized depreciation is recaptured into income when a gain is realized on the sale of depreciable real estate property.

TPW News You Can Use

Useful and interesting content we read the past two weeks:

1. Could This Be an Antebellum Age? – The Wall Street Journal – 6.23.2022

In John Milton’s “Paradise Lost,” Lucifer—who only yesterday had been God’s favorite—consoles himself with this thought: “The mind is its own place and in itself / Can make a Heav’n of Hell, a Hell of Heav’n.” The United States of America, another of God’s erstwhile favorites, now and then performs the same trick of the mind.

At the moment, the country seems committed to the second option, as if united in a natural preference for hell.

2. A Turning Point in Cancer – Eric Topol / Substack – 6.10.2022

Scientists have released an unprecedented series of breakthroughs related to cancer treatment, covering a wide range of therapies and types of cancer which could have huge impacts on overall mortality and quality of life.

3. The Vanishing Moderate Democrat – The NY Times – 6.29.2022

Is there an existential crisis among moderate Democrats? While some of them remain reluctant to publicly concede the reality that the Democratic Party has indeed shifted left — either out of fear of angering their fellow Democrats or validating Republican attacks — they will readily acknowledge that voters perceive the party as having drifted out of the mainstream. And they are convinced that this is threatening their political survival.

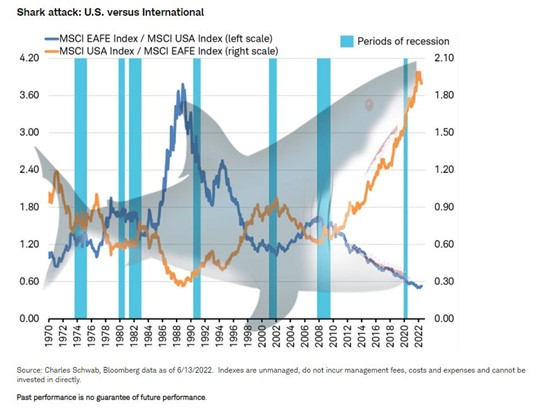

TPW Chart of the Week

Shark attack!

The chart below from Charles Schwab shows what stock market *shark attacks* look like, using the relative performance of 1.) U.S. stocks vs. 2.) international stocks.

The two lines are just the ratio of one index divided by the other.

- When the blue line is rising, international stocks are outperforming U.S. stocks.

- When the orange line is rising, U.S. stocks are outperforming international stocks.

Do you think U.S. stocks appear to be overvalued vs. international stocks right now?

What does this U.S. vs. international stock dichotomy mean?

Should you should care?

TPW Educational Video : Feeling Naive About Your Social Security Benefits?

Do you feel naïve about your Social Security benefits?

- Are you confused about when to take Social Security?

- Is it best to take your Social Security early or wait?

- Are you concerned about the solvency of the Social Security system, and how that might affect your benefit?

- Have you heard about Social Security spousal benefits but not sure you understand how they work?

Click the thumbnail image below to watch our President, Joseph Eschleman, answer each of these questions, and more! And if you enjoy the video, please subscribe to our YouTube channel, give us a thumbs up, and click on the bell if you want to be notified when we release our next one!

Have questions about how exactly to optimize your Social Security benefit?

Quote of the Week

Consistent with Towerpoint Wealth’s theme of evaluating and managing risk, but not avoiding it altogether, is William Shedd’s quote below.

Its meaning is clear, and its applicability to building and protecting wealth, and to investing in general, cannot be ignored: It's better to get out, take intelligent risks, and act, than to sit and do nothing.

Trending Today

As the 24/7 news cycle churns, twists, and turns, a number of trending and notable events have occurred over the past few weeks:

- Making good on his "super bad feeling," Elon Musk's layoffs at Tesla reflect his concerns about the economy

- Battles over abortion have now shifted from the Supreme Court to state courts

- The most popular social media platforms have hidden some posts that mention abortion in any context

- Don't plan to party at your rented Air B&B. It’s now banned

- LEGO puts its first US manufacturing plant in Virginia

- Ukrainian President Volodymyr Zelensky addresses NATO, demands more arms, money, and support

- The whispers of Hillary Clinton 2024 have started

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140,info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph, Jonathan, Steve, Lori, Nathan, Michelle, and Luis

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity.

We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on Twitter