“Is investing in cryptocurrency good?” will be a question that many investors ask themselves as we head into 2024.

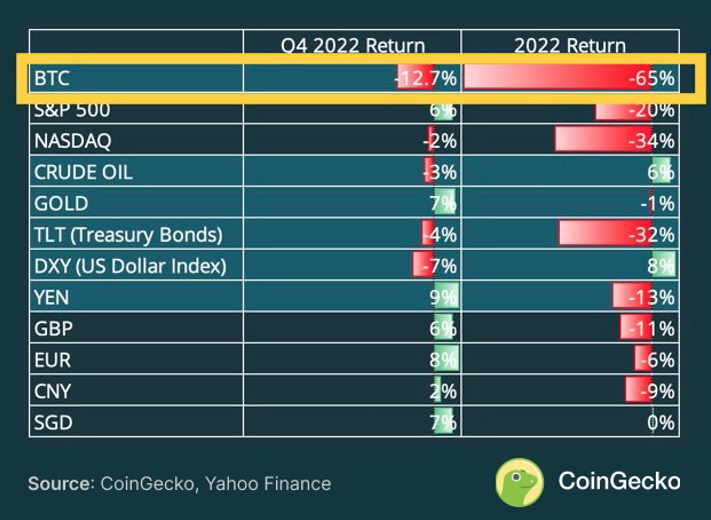

Understanding the importance of not getting too excited – nor too worried – about the inevitable year-to-year price movements that occur throughout virtually all major investment and asset classes, 2022 was a trainwreck for crypto! Ethereum (ETH) dropped 66%, and Bitcoin (BTC), the world’s largest cryptocurrency, declined 65%.

However, for as much of a trainwreck 2022 was, crypto investors have seemingly had a veritable blank check throughout most of 2023, as BTC has increased from $16,602 to $44,000 (+165%), and ETH has increased from $1,202 to $2,275 (+90%), both as of 12.21.2023!

Is investing in cryptocurrency good? Do you believe that 2024 will be another action-packed year for crypto and digital assets? If so, will it be action-packed in a good or bad way? And is there any logic in even attempting to make a crypto price prediction?

At Towerpoint Wealth, we are humble about our ability to accurately predict the future, and graciously but firmly refrain from staring into our translucent (at best) crystal ball and prophesize about the price of BTC and ETH at the end of 2024. However, while we believe that making a crypto price prediction is sketchy at best, we do believe, for those with the “intestinal fortitude” to tolerate large price swings and continued near-term uncertainty, that the odds of a blank check are higher than the odds of a trainwreck when considering a longer-term investment in digital assets, and that now may be an opportune time to be invested in and own digital assets and crypto as part of a properly-diversified investment portfolio. Why? Below are four specific reasons.

The pending approval of a new crypto ETF

Is this the biggest development to happen on Wall Street in the last 30years?

Blackrock, the world’s largest asset manager, believes the answer to the question “Is investing in cryptocurrency good?” is “Yes!”

The investment company expects the SEC to approve its application to launch a new bitcoin exchange traded fund (ETF) on or around January 10, 2024, with trading to begin six to eight weeks later. The launch of a BTC ETF has been in the works for more than ten years, and is expected to “open the crypto door” to mainstream investors. This new bitcoin ETF is expected to bring a whole new group of crypto investors into the fold, should help to increase overall flows into and demand for digital assets, and underpin a wave of institutional interest in the crypto market.

The Bitcoin halving event

Scheduled for April, 2024, the Bitcoin halving is a significant event in the cryptocurrency ecosystem that occurs roughly every four years. During this process, the economic reward that Bitcoin miners receive is cut in half. This deliberate reduction is embedded in the Bitcoin network, and designed to control the issuance of new bitcoins and enforce a maximum cap of 21 million bitcoins, ensuring scarcity.

The economic principle of reduced supply, coupled with sustained demand, often leads to increased value for Bitcoin, making “halving” a closely watched and influential aspect of the cryptocurrency's monetary policy.

A more “dovish” Federal Reserve and looser economic conditions

Analogous to Chicago’s NFL franchise right now, the “bears” (those who are pessimistic about the state of the economy and stock market) are currently on their heels. Inflation has moderated and is generally tamer, and the stock market has experienced a large advance since late October. Many investors feel that the litany of interest rate increases we experienced in 2023 are now behind us, and that the Fed may actually consider cutting rates in 2024.

Lower interest rates, a more stable economy, and “accommodative” monetary policy from the Fed can diminish the appeal of traditional currencies, prompting investors to explore digital assets with perceived scarcity, like Bitcoin. In such conditions, cryptocurrencies can emerge as a store of value and an attractive diversification strategy, gaining favor among those looking for alternatives in times of “economic looseness.”

US and global banks will embrace tokenized payments

Tokenization of payments is a security method substituting sensitive payment details, like credit card numbers, with a distinct and random character set known as a "token." This practice enhances the security of payment data in transactions, as the original card information is neither utilized nor retained.

Tokenization is poised to drive increased demand for cryptocurrency by enhancing the security and efficiency of transactions. As traditional financial systems adopt tokenization for various assets, the appeal of cryptocurrencies as inherently tokenized forms of value becomes more evident. The trust and security associated with tokenized transactions may attract individuals and institutions seeking alternatives to traditional financial instruments. Furthermore, the seamless integration of tokenized assets within blockchain ecosystems provides a compelling narrative for the broader adoption of cryptocurrencies, positioning digital assets as integral components of the future financial landscape.

So, IS investing in cryptocurrency good? To paraphrase Eaglebrook Advisors recent 4Q, 2023 commentary, now is an optimal time to understand the investment thesis for crypto, and to source ways to securely invest in digital assets. And while accurate crypto price prediction is a virtual impossibility, both Bitcoin and Ethereum have continued to be quite resilient in the face of adversity, and the growth and adoption of both have demonstrated that digital assets are a compelling emerging asset class. The narrative continues to change, as both retail investors and institutions continue to participate in the adoption of BTC and ETH, driving demand for these major cryptocurrencies.

Would you like to discuss your own situation further with us, or learn more about our wealth management philosophy and how we help clients build and protect their wealth? Curious how we utilize and integrate digital assets for some of our clients as part of a properly-diversified investment portfolio?

We encourage you to schedule an initial 20-minute discovery call with us, as we welcome learning more about you and your unique circumstances and beginning to get to know you.

Thank you and Merry Christmas, Ascent Builders!

In the spirit of enduring partnership, Scott Kelly and Patty McElwain stopped by the Towerpoint Wealth headquarters yesterday to drop off their MUCH-anticipated Christmas wreath! This emblematic gesture not only reflects the holiday spirit, but also underscores the strength of our business relationship.

The wonderful aroma of pine trees that now engulfs our office serves as a pleasant reminder of the shared values, mutual respect, and seamless cooperation we share with Ascent. Here’s to continued success and shared triumphs in 2024!

Do you believe that crypto is here to stay and not going away?

Cryptocurrency has established itself as a legitimate new investment category and a formidable player in the financial landscape, and we firmly believe its persistence is not a passing trend.

The decentralized nature, borderless transactions, and blockchain technology underpinning cryptocurrencies address key inefficiencies in traditional financial systems. Beyond speculation, the growing acceptance and adoption of digital assets by major institutions and retail investors underscores their longevity. While skeptics may dismiss crypto as volatile, its adaptability and its path towards revolutionizing financial transactions, contracts, and even governance is undeniable.

In an era of technological evolution, we believe that dismissing the staying power of cryptocurrencies is shortsighted, and encourage you to click the thumbnail image below to learn about why we hold this belief.

We are hopeful you will enjoy this educational video, and encourage you to share it with any colleagues or friends of yours who would benefit from watching it.

Browse our robust library of other wealth-building and wealth-protecting educational videos.

IRA Qualified Charitable Distributions (QCDs)

Did you know there is a way to take money out of a “Traditional” pre-tax IRA without paying income taxes?

IRA Qualified Charitable Distributions (QCDs) offer a savvy strategy for individuals looking to align their retirement savings with their charitable giving. For those aged 70½ or older, the IRS allows direct transfers of up to $100,000 annually from an IRA to qualified charities, excluding this amount from the individual's taxable income. This tax-efficient approach enables retirees to fulfill their philanthropic goals while leveraging the tax benefits associated with Qualified Charitable Distributions. It's a strategic move, allowing individuals to contribute to causes they care about while minimizing their tax liability. Understanding the nuances of IRA QCDs is pivotal for those seeking to optimize their retirement assets and make a positive impact on the charitable organizations they support.

CLICK HERE or the thumbnail image below for an excellent resource discussing QCDs and other IRA required minimum distribution strategies.

Have questions about your upcoming 2023 tax return?

Would you like to review an old tax return for missed opportunities?

Click the banner below to message Steve Pitchford, Steve Pitchford, Certified Financial Planner.

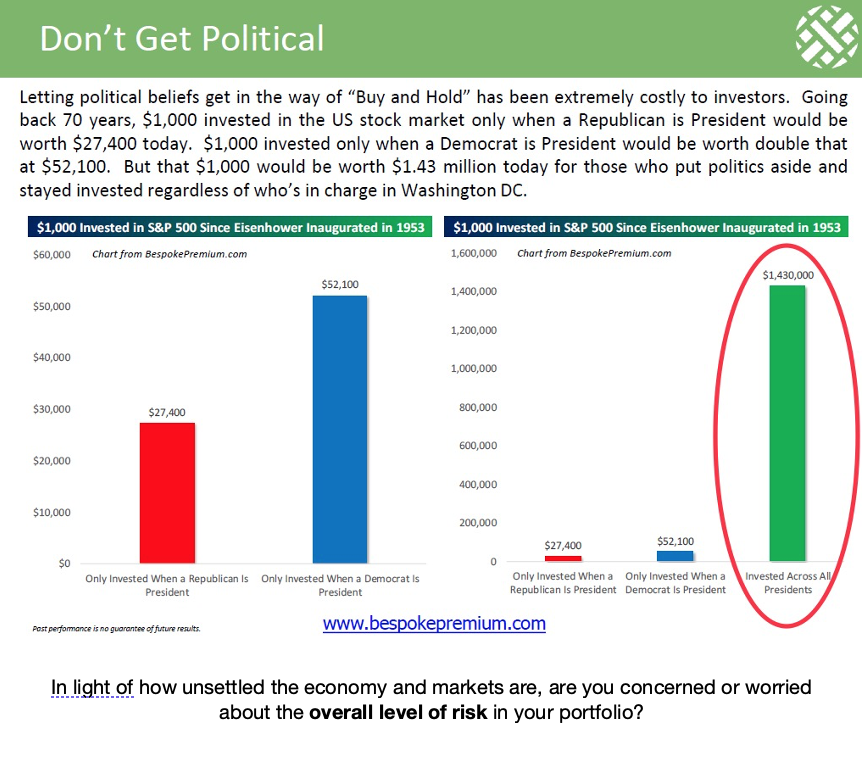

Don’t Get Political!

Politics and investing do not mix very well - great illustration below (especially the GREEN bar that we circled) from Bespoke Investment Group.

Key takeaway - stay invested, and be disciplined, no matter who’s in charge in Washington DC, and no matter who wins the 2024 election.

Message us to discuss your circumstances.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast