Bitcoin launched back in 2009. Thirteen years have since gone by, there now exist more than 10,000 new cryptocurrencies, and the global crypto market capitalization tops $2 trillion!

However, as modeled by Larry David’s character in FTX’s hilarious Super Bowl commercial last weekend (look for a link to it later in this newsletter!), there are still plenty of no-coiners who continue to ask “Will crypto crash again?”

Even with the explosive growth referenced above, a healthy amount of skepticism and a fair amount of ignorance about digital assets and cryptocurrencies remain, informally correlated to one’s age and level of interest in technology. What’s keeping people from “buying in” to cryptocurrencies?

- "Blockchain technology seems to be a solution looking for a problem.”

- "Crypto is too complicated for me.”

- "The adoption of crypto has been insufficient.”

- "Using crypto will increase my transaction costs.”

Some people even believe crypto is a trojan horse, sent by radical libertarians to undermine the global financial system! While that last reason may be a bit alarmist, there continue to be those who argue blockchain and crypto may be too disruptive for their own good.

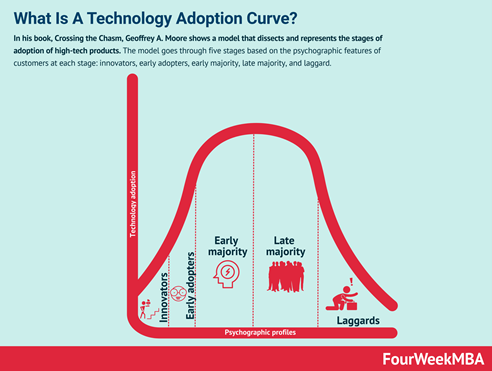

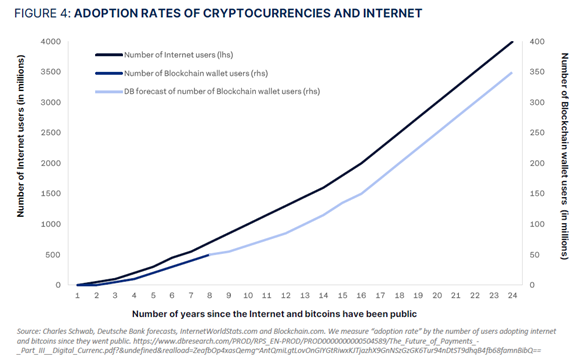

We disagree, and believe that while the journey to mass acceptance may continue to be wild and schizophrenic, that distrust of blockchain technology will ultimately prove to be unwarranted. We believe that the adoption of cryptocurrency will be much like the adoption of any other technology: The rate at which adoption occurs grows gradually, then generally explodes upwards.

Consider the internet thirty years ago. In 1990, only a handful of governments, universities, businesses, and individuals were using the internet. But by the year 2000, everyone had a website. In 2021, consumers spent more than $871 billion online, a 44% increase from 2019, and almost triple the 15.1% increase the previous year.

Remember when the iPhone was invented back in 2007? Smart phones were scarce then. Only a few short years later, and just about everyone had the internet available to them in their pockets and at their fingertips.

We are not doubting that the feel of a crisp $100 bill in your hand is unduplicable, and there will always be demand for fiat currency as long as there are governments. However, we firmly believe that the movement towards a global financial system that removes the control that banks have on money is inevitable. While this evolution will almost assuredly be met with many impediments, obstacles, and outright deterrents (such as the most recent cryptocurrency pullback, that began in early November and ended in late January, causing folks to ask “will crypto crash again?”), global finance is moving away from being centralized (money being held by banks, which have the goal of earning profits) to being decentralized, where blockchain technology eliminates the need to use profit-seeking intermediaries and third-parties to lend, spend, trade, and borrow.

DeFi, as decentralized finance is commonly known, is disruptive. And when something is disruptive, it is confusing, and causes disorder.

Please do not mistake our belief and confidence in the future of crypto, blockchain, and DeFi as being willfully ignorant, as we fully recognize the risks, uncertainties, and pitfalls that exist and will persist for some time. After all, is there anyone who does not believe that centralized financial institutions will fight tooth and nail to protect their primary means of earning profits? There seems to never be a dull moment with crypto!

However, understanding the advancements that need to be made, and the myriad of questions that still need to be answered before crypto is commonly accepted and DeFi trends towards becoming the norm, we believe it is not an if, but a when, finance becomes decentralized.

Will crypto and blockchain adoption perfectly mirror the two aforementioned examples? Probably not, but the similarities are noteworthy and should not be discounted. Will crypto crash again? It’s certainly possible, arguably even probable. But for those who understand, embrace, and adopt cryptocurrency and blockchain as an innovative new financial technology, we believe there are rewards to be had. Will the ride continue to be wild? Absolutely, but we believe it will become less and less wild as adoption increases, skepticism wanes, and use cases increase.

Below are five reasons why we believe crypto is here to stay and not going away!

1. Mainstream awareness: It wasn’t the Super Bowl, it was the Crypto Bowl!

A few short years ago, a number of media outlets including Facebook, Twitter, and Google banned advertisements that had anything to do with digital assets.

Last Sunday, an estimated 112 million viewers tuned in to watch the Rams defeat the Bengals in Super Bowl LVI. And a healthy number of them tuned in more for the halftime show and the commercials than for the game itself. And leading the advertising pack were Binance, FTX, Coinbase, Crypto.com, eToro, and Bitbuy – all cryptocurrency exchanges. And one of the best and funniest commercials of the entire Super Bowl featured the curmudgeonly Larry David, and his dismissal of history’s greatest inventions, including crypto. Click below to watch it!

The overlying point of these advertisers? Play into FOMO (fear of missing out), and don’t listen to Larry! The messaging continues to be clear - we are real companies, real advertisers, we’re here to stay, and we’re mainstream.

2. Rapid growth in mainstream adoption

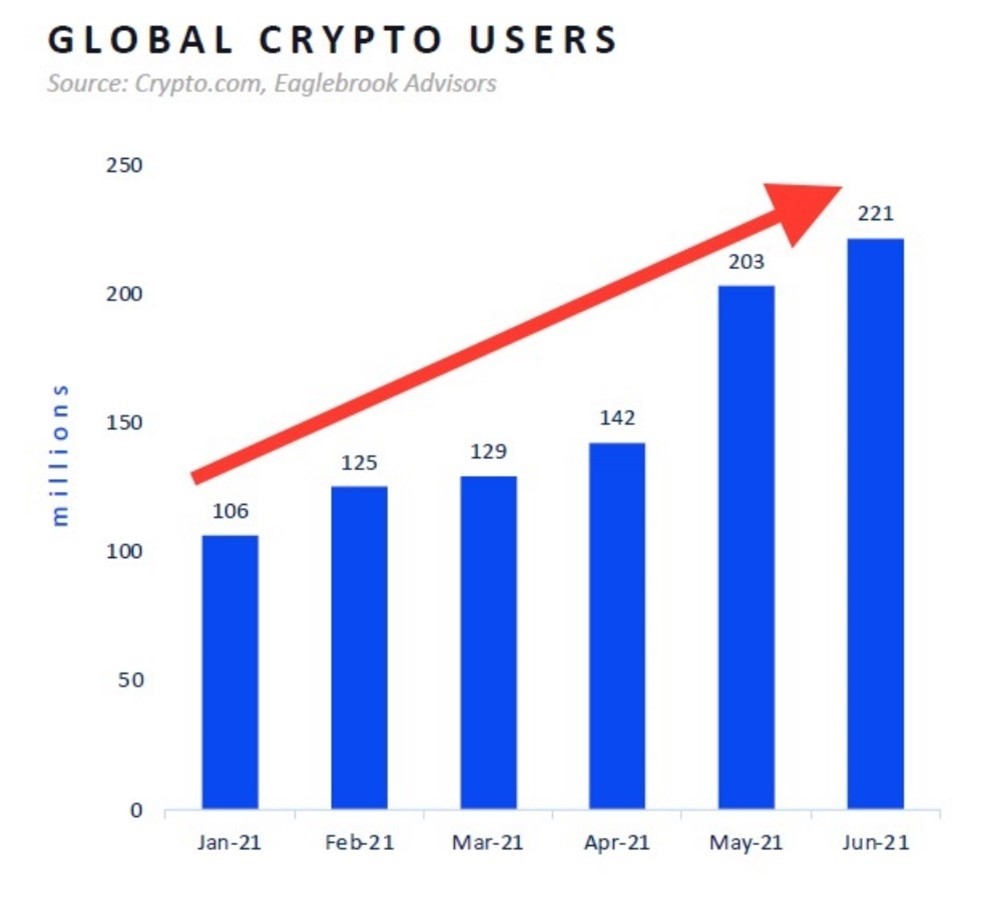

More than 220 million people now own digital assets, as of June of last year. By some measures, this growth is rising faster than the internet did in its early stages. Trends firmly point to more users, longer holding periods, and growing institutional investment.

Bitcoin is also disrupting traditional payment processes, and is now one of the largest settlement networks in the world. By the end of 2021, the Bitcoin network settled over $13.1 trillion in transactions, up 470% from 2020, representing over half of the US’s GDP for the year, and MORE than what Visa, one of the largest payment processors in the world, settled last year!

3. Demographics – The Great Wealth Transfer

Over $68 trillion (yes, you read that right, trillion) is set to be transferred from the Baby Boomers to Millennials and Gen Xers over the next 25 years. Both Millennials and Gen Xers have a higher level of interest in innovation (read: decentralized finance) and a lower level of trust in traditional institutions (read: centralized finance). Supporting this perspective, 83% of millennial millionaires already own digital assets, a trend we believe is likely to continue as this demographic reaches peak earning and spending years.

Click the video below to learn more:

4. “We’ll just print more (money)”

Governments and central banks around the globe have clearly demonstrated a willingness to provide economic stimulus in the form of bailouts, social spending, and quantitative easing. In the past two years alone, 29% of the current US money supply was created.

The unsurprising result? Monetary, price, and asset INFLATION.

Conversely, bitcoin has programmed scarcity – its supply cannot be manipulated or devalued by fiscal or monetary policy, and provides direct protection from global fiat currency debasement.

5. Bitcoin is sound money

What qualities and characteristics about traditional money and fiat currency are important to us as users? The same ones that bitcoin and other cryptocurrencies exhibit: Portability, security, storability, durability, acceptability, scarcity, divisibility, and fungibility.

All of these qualities allow bitcoin to be used as both a medium of exchange and a store of value.

Throughout history civilizations have used many different mediums of money, including cattle, leather, rocks, squirrels, jewels, wine, and seashells. And before sovereign currencies took hold, gold was the medium of trade for many nations (and to this day still is a very good store of value). As with any new currency, it will take time for cryptocurrency adoption to grow.

Bitcoin is only 12 years old, and many other cryptocurrencies are still in their infancy. However, each day crypto remains accepted, active, secure, and continues to grow in popularity and usage, it will become more and more mainstream. To be clear, bank notes and credit cards were not made for the internet and the digital age we are clearly in – crypto was!

Interested in learning more? Click the image below to read a well-assembled report from Eaglebrook Advisors about the bitcoin market cycle.

And while we don’t expect for you know, understand, and adopt all 10,000 cryptocurrencies, we couldn’t resist sharing the below “primer” with you.

Have you thought but are unsure about integrating crypto into your longer-term investment portfolio? Click HERE to message us, as we welcome opening an objective dialogue with you about the many advantages, disadvantages, risks, and considerations involved.

What is Happening at TPW

Kings win!

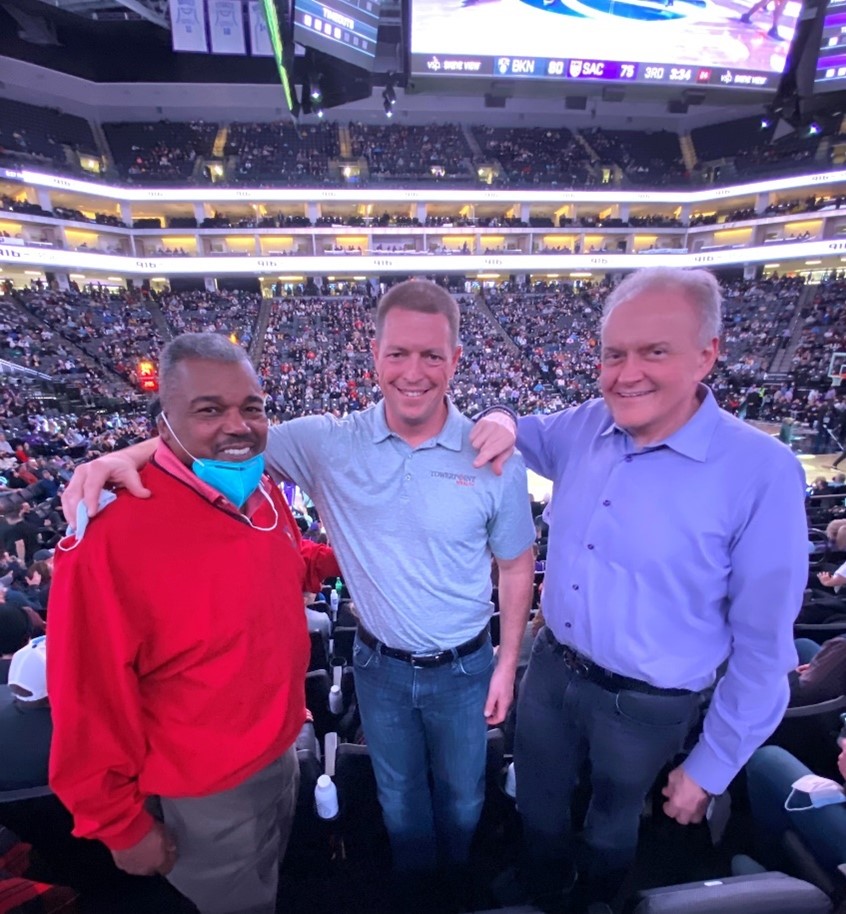

Our President, Joseph Eschleman, spent an enjoyable, action-packed, and productive evening last Wednesday at the Golden1 Center, soaking in an upset Kings victory over the Brooklyn Nets, 112-101.

As usual, Joseph mixed some business with pleasure during the game – flanking him in the photo is District 7 Sacramento Councilmember and Super Bowl XIchampion, Rick Jennings II, and one of the top estate planning attorneys in Northern California, Mark Drobny, CEO of Drobny Law Offices.

The entire TPW family was rocking their new company-branded winter vests yesterday at the office.

Everyone is excited at how warm and chic their new Towerpoint Wealth gear is, and a big thanks to FnD Embroidery for helping with the customization and finishing touches!

TPW Taxes - 2022

January 24 marked the official beginning of the 2022 tax season, when the IRS will begin accepting and processing 2021 tax returns. Taxpayers and tax advisors are beginning to clamor for tax information, with the April 18 tax filing deadline only two short months away.

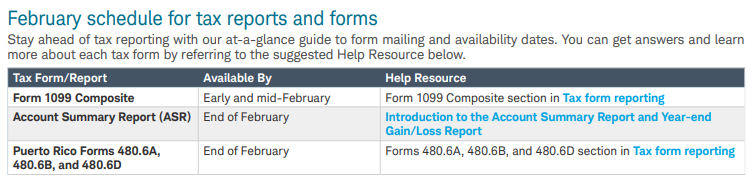

If you are a Towerpoint Wealth client, please expect your Form 1099 Composite any day now, as Charles Schwab has indicated that by mid-February you should have these important tax forms.

TPW News You Can Use

Useful and interesting content we read the past two weeks:

1. Looking for Evidence? Trust Us, Biden Administration Says – Associated Press – 2.5.2022

When President Biden’s administration was asked for evidence to back up dramatic claims about national security developments last week, it demurred with a simple rejoinder: You’ll have to trust us on that.

No, they would not reveal what led them to say they knew that Russia was plotting a false flag operation as a pretext to invade Ukraine. No, they would not explain their confidence that civilian casualties were caused by a suicide bombing rather than U.S. special forces during a raid in Syria.

The lack of transparency strained already depleted reserves of credibility in Washington, a critical resource diminished over the decades by instances of lies, falsehoods, and mistakes on everything from extramarital affairs to the lack of weapons of mass destruction in Iraq.

2. The Craziest Ways Wall Street is Spending This Year’s Record-Setting Bonuses – NY Post – 2.8.2022

Flush Wall Street hotshots blow their record-setting bonuses on cars and caviar.

3. How a Secret Assault Allegation Against an Anchor Upended CNN and Jeff Zucker – NY Times – 2.16.2022

The network’s top-rated host and its president were forced out following ethical lapses, an office romance, and a letter from a lawyer for “Jane Doe.”

Chart / Infographic of the Week

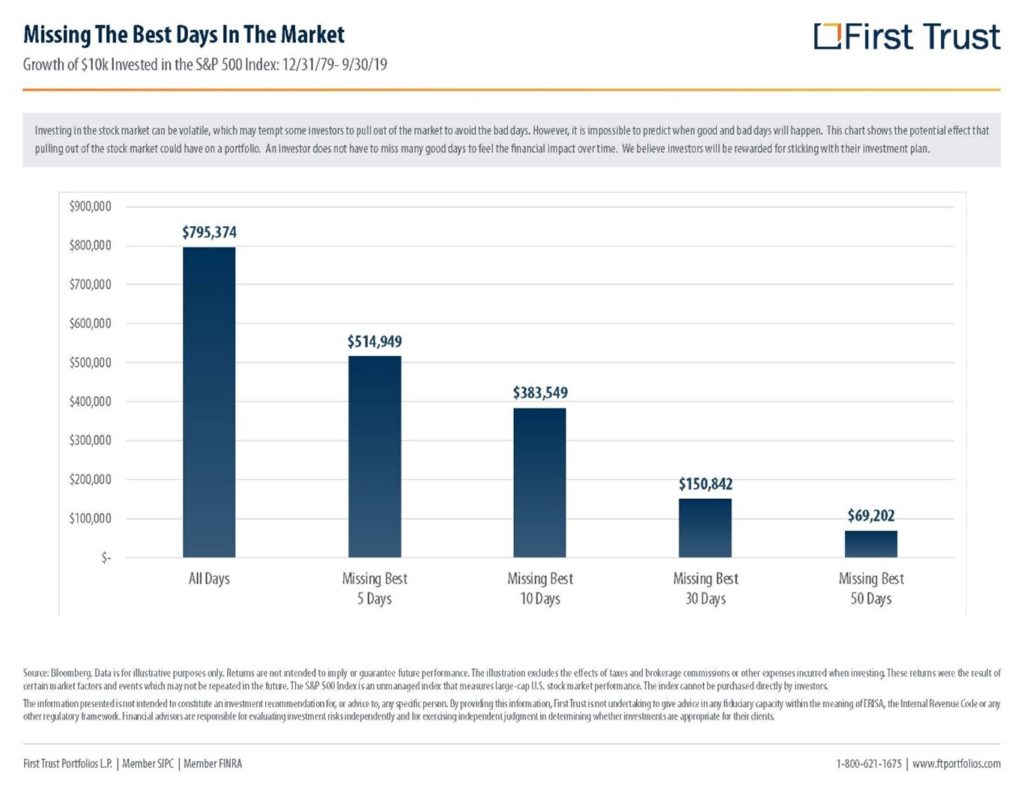

The below illustration from First Trust is an “oldie but goodie.”

While we generally believe that the stock market is very efficient, we also believe that the markets can be quite irrational in certain situations. Of course there are booms and busts.

Accurately predicting the exact days to “go all in” or “go all out” is next to impossible, and if you MISS the best days because you are out, you will pay a steep price! As evidenced by the chart below, we strongly encourage you to be humble when considering the binary decision of “going all in” or “getting completely out,” as the consequences can be devastating if you are wrong!

Quote of Week

If (when?) anyone tries to push or drag you down, just think about this quote from Denzel Washington!

TPW Washington Watch

Congress returned to Washington in 2022 facing a difficult legislative environment. The narrow margins in both chambers were already a huge impediment to passing legislation, but the fact that 2022 is a midterm election year only exacerbates the political tensions.

As a result, 2022 is expected to be relatively light on big legislative initiatives—though the atmosphere could be right for a dormant retirement savings bill to be rekindled. It is also expected to be a big year for regulations, as the administration seeks to use the regulatory process to accomplish some of its priorities away from the gridlock on Capitol Hill.

Click below for an excellent commentary from Charles Schwab that summarizes many of the key issues in Washington that could impact you in the year ahead.

Trending Today

As the 24/7 news cycle churns, twists, and turns, a number of trending and notable events have occurred over the past few weeks:

- Clouded by doping scandals, human rights abuses, and a boycott by US diplomats, record-low ratings for NBC’s coverage of the Beijing Winter Olympics

- Scientists may have cured HIV in a woman for the first time

- Judiciary under the microscope as Congress weighs stock trading ban

- California schools will still require masks inside classrooms, even as mandate ends elsewhere

- NYC Mayor Adams fires 1,430 workers who refused to get a COVD vaccination

- The first free at home COVID tests are arriving from the U.S. government – every home in the US is eligible for four tests

- Former President Trump says filing by Justice Dept. special counsel John Durham proves he was spied on in 2016

- Intel Corp set to acquire Tower Semiconductor Ltd. for $5.4 billion

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph, Jonathan, Steve, Lori, Nathan, and Michelle

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity. We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on Twitter