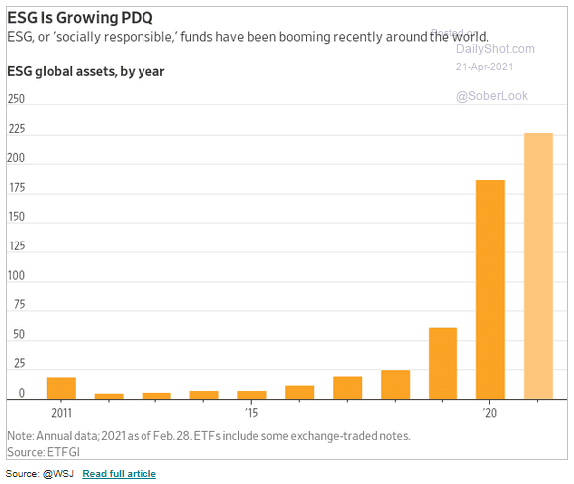

ESG (Environmental, Social, and Governance), sustainable, and responsible investing have evolved from a peripheral and misunderstood investment concept to a mainstream philosophy that now includes more than 500 sustainability-focused index funds amounting to more than $250 billion of U.S. investment assets. As more and more retail investors begin to understand and recognize their ability to have their investments and portfolio mirror their personal values, ESG and sustainable investing is no longer a “trend,” and instead can now be classified as a full-blown movement.

At Towerpoint Wealth, we embrace our responsibility to continually refine and improve how we serve our clients, and have cultivated a comprehensive firmwide ESG and sustainable investing initiative that has expanded in lockstep with the expansion of sustainable and responsible investing. At the forefront of this initiative is our partnership with Ethic Investments, a technology-driven asset manager that powers the creation of sustainable investment portfolios, building ESG-customized separately managed accounts (SMAs) for Towerpoint Wealth clients that are optimized to 1.) track the market, 2.) align with our clients’ strategic investment allocations, and 3.) align with a specific set of sustainability and ESG criteria.

Click HERE to review Towerpoint Wealth’s sustainability pillars, and click below to watch a succinct 15 minute conversation between our President, Joseph Eschleman, and Ethic co-founder Jay Lipman, as they discuss:

- What is ESG, sustainable, and responsible investing

- Why demand for ESG, sustainable, and responsible investing has exploded over just the past 18 months

- Why returns and growth no longer need to be sacrificed when utilizing and implementing an ESG and sustainable investment philosophy

- Why utilizing a customized SMA is a much more effective way to develop and implement a inclusionary and exclusionary ESG-focused portfolio, as opposed to an ESG ETF or open-end mutual fund

- How the pandemic and COVID-19 accelerated the growth and focus on ESG investing

- What the future of ESG, sustainable, and responsible investing looks like

Click HERE to request our free white paper on sustainable investing, or to begin a conversation with us about how to align your portfolio with your personal values.